January 2025

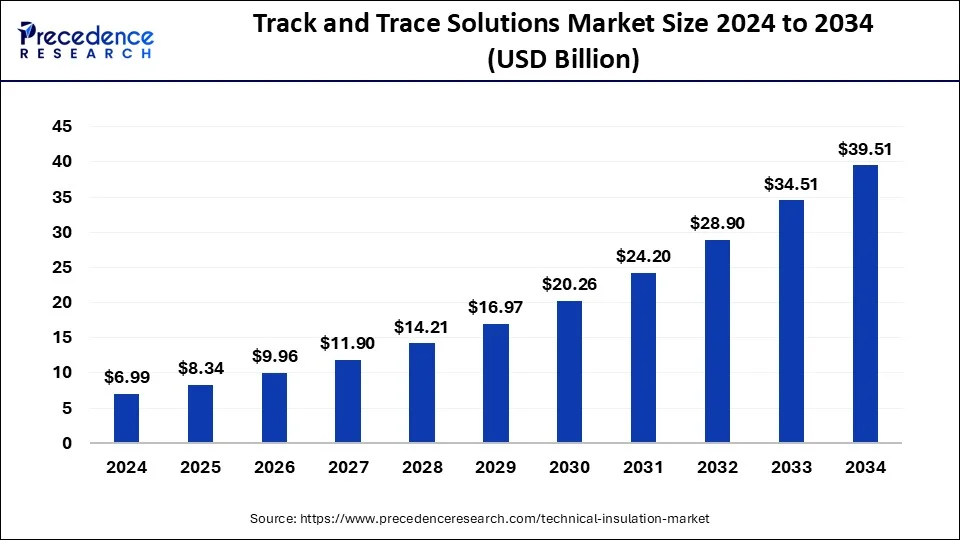

The global track and trace solutions market size is calculated at USD 8.34 billion in 2025 and is forecasted to reach around USD 39.51 billion by 2034, accelerating at a CAGR of 18.91% from 2025 to 2034. The North America market size was estimated at USD 3.43 billion in 2024. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global track and trace solutions market size was estimated at USD 6.99 billion in 2024 and is predicted to increase from USD 8.34 billion in 2025 to approximately USD 39.51 billion by 2034, expanding at a CAGR of 18.91% from 2025 to 2034.

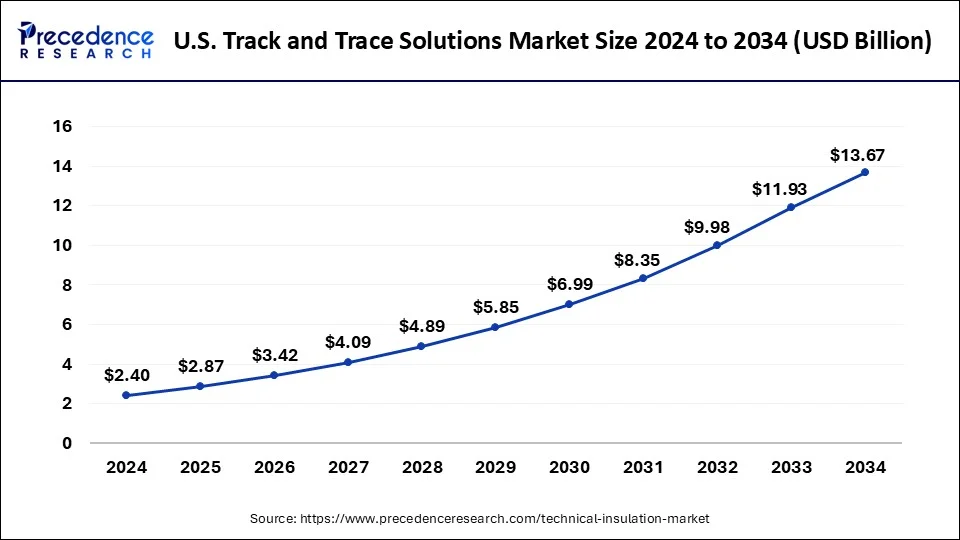

The U.S. track and trace solutions market size was valued at USD 2.40 billion in 2024 and is expected to be worth around USD 13.67 billion by 2034, at a CAGR of 19% from 2025 to 2034.

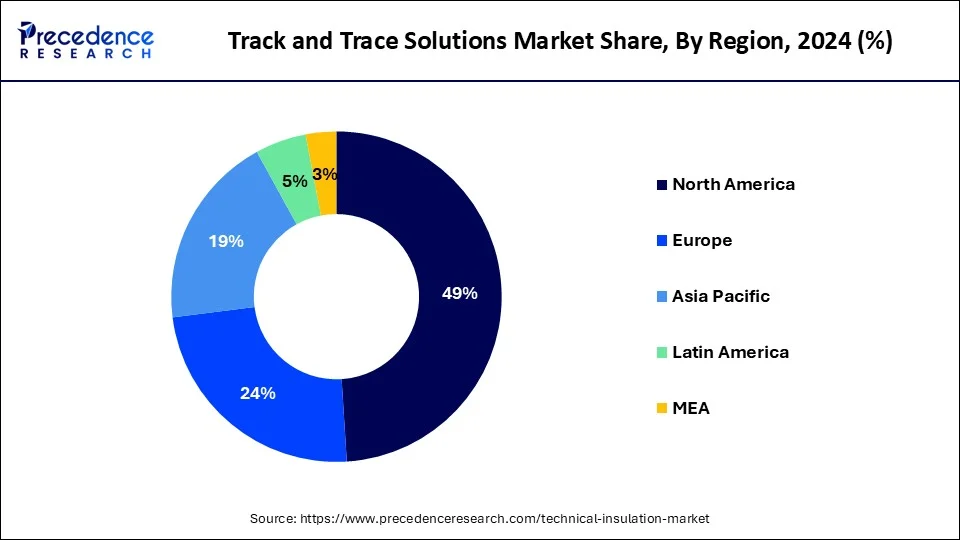

North America dominated the global track and trace solutions market in 2024 with significant revenue share, trailed by Europe. Causes including the existence of a huge number of biotechnology and pharmaceutical corporations and medical device producers, strict regulations concerning serialization, and the increasing medical devices market, are driving the growth of the track and trace solutions market growth in this region.

Asia Pacific market for track and trace solutions offer great potential and projected to register fastest growth rate throughout the forecast period. The intensifying pharmaceutical market and the enactment of rigorous regulations to improve the consistency and quality of pharmaceutical medicine are the important factors for market growth in this region. Additionally, escalating pressure to limit high occurrence of fake drugs in emerging Asian nations such as China and India further drives the market growth. China’s track and trace regulations and laws authorized serialization and tracking during the supply chain and vital compliance reporting to the China Food and Drug Administration for whole pharmaceuticals. These rigorous regulations are anticipated to lift the growth of the market in these nations in the nearby future.

The global track and trace solutions market is estimated to experience momentous growth during the estimate period owing to aspects such as upsurge in adoption of track and trace solutions by pharmaceutical and medical device manufacturers to resolve the problem of drug counterfeit and organized regulatory framework & execution of standards. Though these influences develop the growth of the track and trace solutions market, great installation cost related with aggregation and serialization solutions greatly obstruct the market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 39.51 Billion |

| Market Size in 2025 | USD 8.34 Billion |

| Market Size in 2024 | USD 6.99 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.91% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, Application, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Emphasis on counterfeit prevention Counterfeit products can tarnish a company's reputation and erode consumer trust. By implementing track and trace solutions, companies can authenticate their products and assure customers of their authenticity, thereby safeguarding their brand reputation. Many industries, such as pharmaceuticals, food and beverage, and electronics, are subject to stringent regulations mandating the serialization and traceability of products. Failure to comply with these regulations can result in legal penalties and market access restrictions. Track and trace solutions help companies meet these regulatory requirements by providing visibility into product movements and ensuring compliance with serialization standards. Thereby, the rising focus of counterfeit prevention acts as a major driver for the track and trace solutions market.

Complexity in integration

Different industries have unique processes, systems, and standards. Implementing track and trace solutions across these diverse ecosystems can be complex. Integrating the technology with existing systems and workflows without disrupting operations can be challenging. Track and trace solutions often involve collecting and managing vast amounts of data from various sources. Ensuring compatibility and consistency of data formats across different systems and stakeholders can be difficult. Mismatched data formats or incompatible systems can hinder seamless integration and data sharing.

Integration of advanced technologies

Track and trace solutions can integrate with emerging technologies such as artificial intelligence (AI), machine learning (ML), and augmented reality (AR) to further enhance their capabilities. For example, AI and ML algorithms can analyze supply chain data to predict demand, optimize routing, and detect anomalies, while AR technology can provide interactive visualizations of product information and instructions. New technologies enable greater visibility and transparency across the supply chain, allowing companies to track the movement of goods from production facilities to end consumers. This increased visibility helps companies identify inefficiencies, mitigate risks, and respond more effectively to disruptions.

As of 2024 serialization solutions occupied major share in terms of revenue in the global track and trace solutions marketplace. This is attributed to the growing focus of regulatory bodies and execution of the same. Country governments, federal agencies, and the healthcare sector are taking actions to reduce product diversion and drug forging. Serialization is a major step to obey with new ePedigree regulations that are mandatory for product traceability throughout the supply chain. Furthermore, augmented focus on patient security and brand safety by producers is anticipated to push segment growth throughout the study period.

Among different product type, software solutions dominated market with huge share of track and trace solutions market revenue in 2024. This is on account of mounting adoption in healthcare companies, such as biopharmaceuticals, pharmaceuticals, and medical devices corporations. These software solutions are employed for uninterrupted management of product lines, manufacturing facilities, case, and warehousing, bundle tracking, and shipping. Establishments developing this software are capitalizing in R&D for improved product improvement, which is anticipated to thrust market growth during years to come.

Among technology segmentation of the market, as of 2024, barcodes technology garnered major share of the total revenue in the track and trace solutions market. 2D barcode has appeared as leading sub-segment and is anticipated to uphold its position during the estimate period. Augmented application of 2D barcodes in biopharmaceutical and pharmaceutical product packaging is a main aspect that backed to the great revenue share. Furthermore, plenty data storage capacity of 2D barcodes above linear barcodes plus its greater popularity in the market, lifts the sale of 2D barcode-based track and trace solutions.

In 2024, out of different end users of the market pharmaceutical companies lead the market with significant revenue share. Guaranteeing safe product track and trace abilities through several entities during the supply chain by employing serialization is a decisive step to meet the issues confronted by pharmaceutical firms. Presently, it is binding for pharmaceutical producers to obey with state and federal regulations for track and trace solutions, which is further flourishing the demand for these solutions.

Rising numbers of companies are facing frequent issues on account of the increasing diversity and complexity in serialization necessities, mostly in the pharmaceutical business. Disparities in regulations and standards across nations along with the management of accumulated complex data makes it tough for companies to implement serialization in track and trace. Nevertheless, cumulative rate of forging of pharmaceuticals and other healthcare produces pushes the acceptance of serialization in the supply chain.

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the track and trace solutions market. This report offers breakdown of market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend at global, regional, and country from 2020 to 2032. This report includes market segmentation and its revenue estimation by classifying it on the basis of various parameters including product type, application, technology, end user, and region as follows:

By Technology

By Product

By Application

End-User

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

January 2025