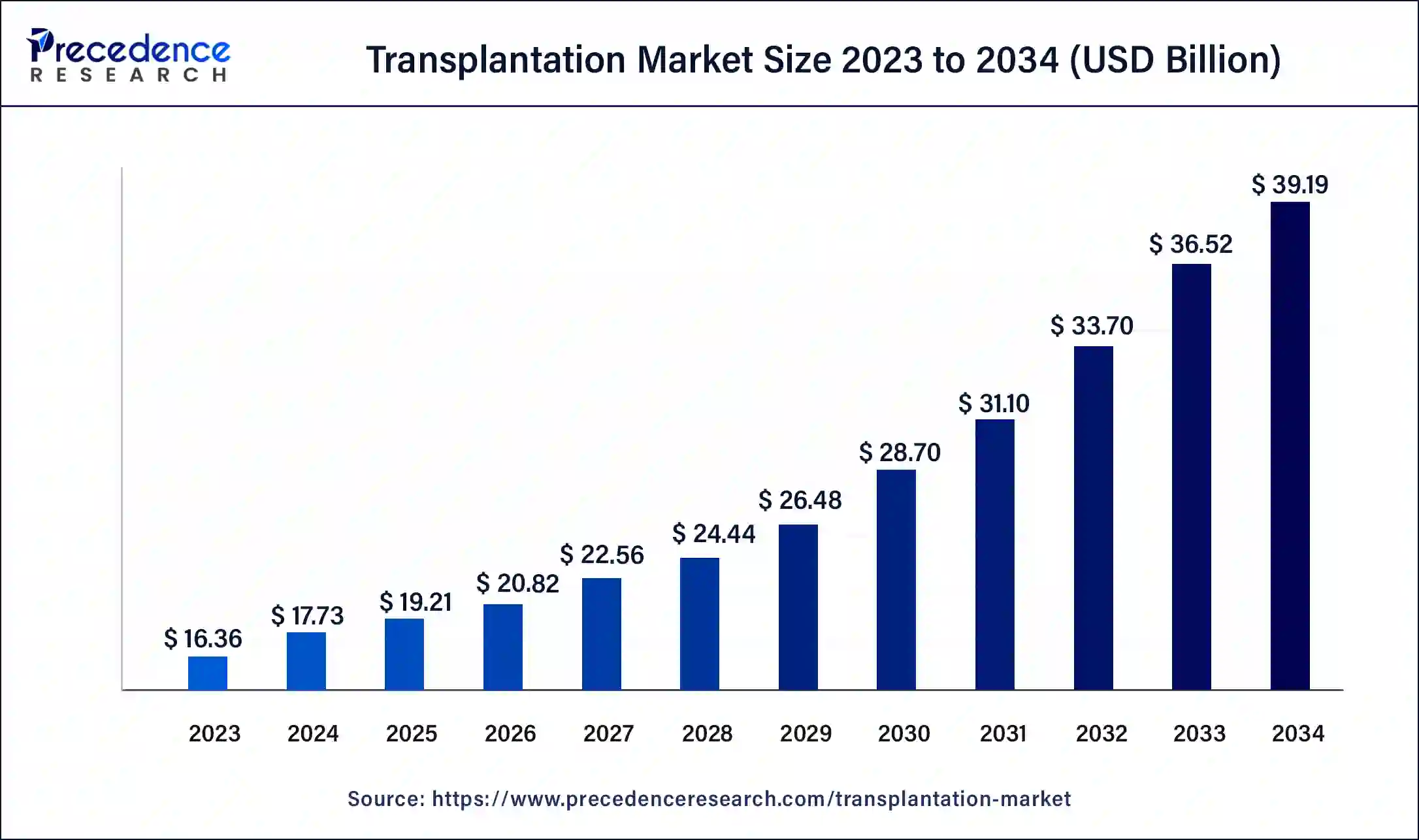

The global transplantation market size is calculated at USD 19.21 billion in 2025 and is predicted to reach around USD 39.19 billion by 2034, accelerating at a CAGR of 8% from 2025 to 2034. The North America transplantation market size surpassed USD 7.45 billion in 2024 and is expanding at a CAGR of 8.24% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global transplantation market size was estimated at USD 17.73 billion in 2024 and is predicted to increase from USD 19.21 billion in 2025 to approximately USD 39.19 billion by 2034, expanding at a CAGR of 8% from 2025 to 2034.

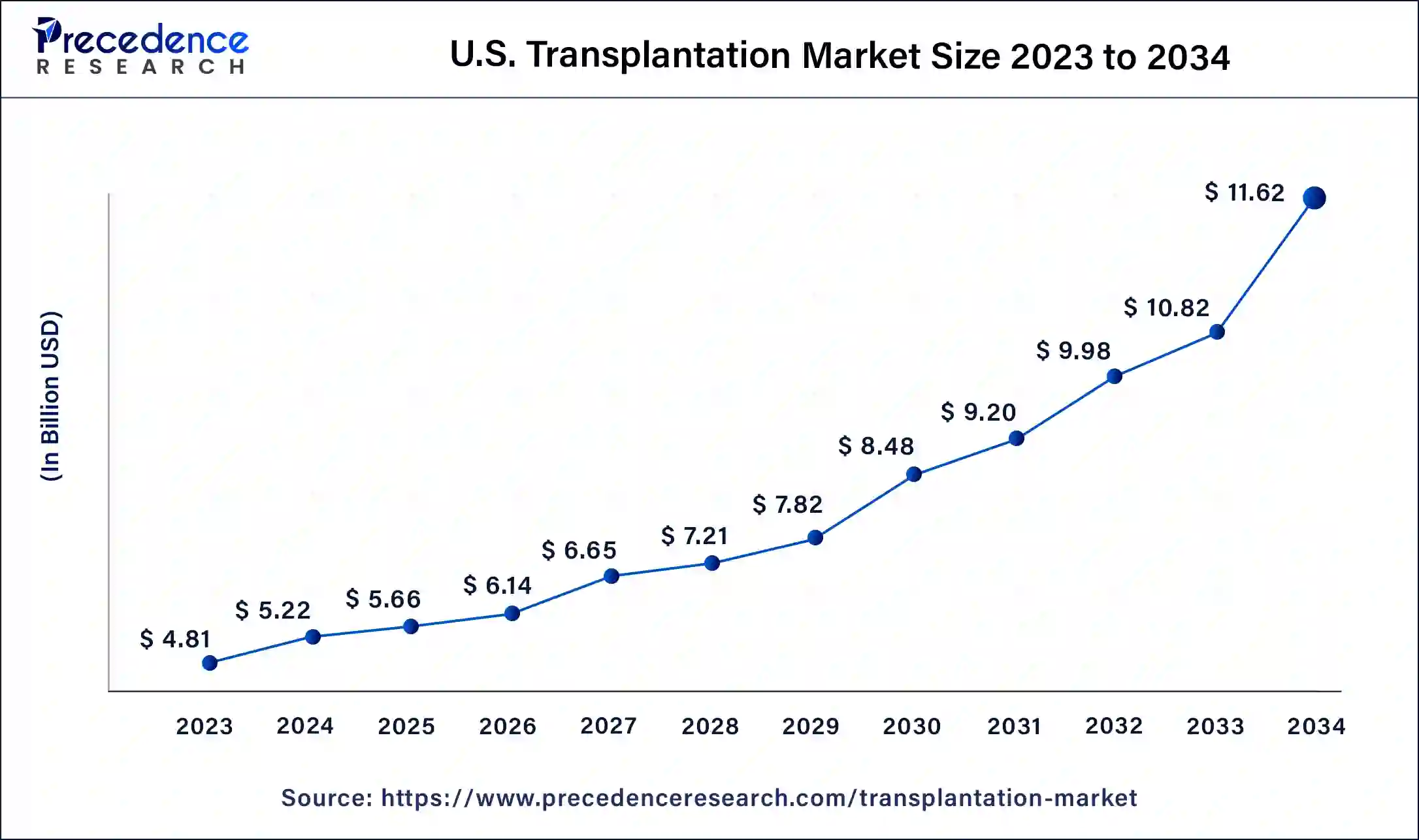

The U.S. transplantation market size was valued at USD 4.81 billion in 2024 and is expected to be worth around USD 11.62 billion by 2034, at a CAGR of 8.34% from 2025 to 2034.

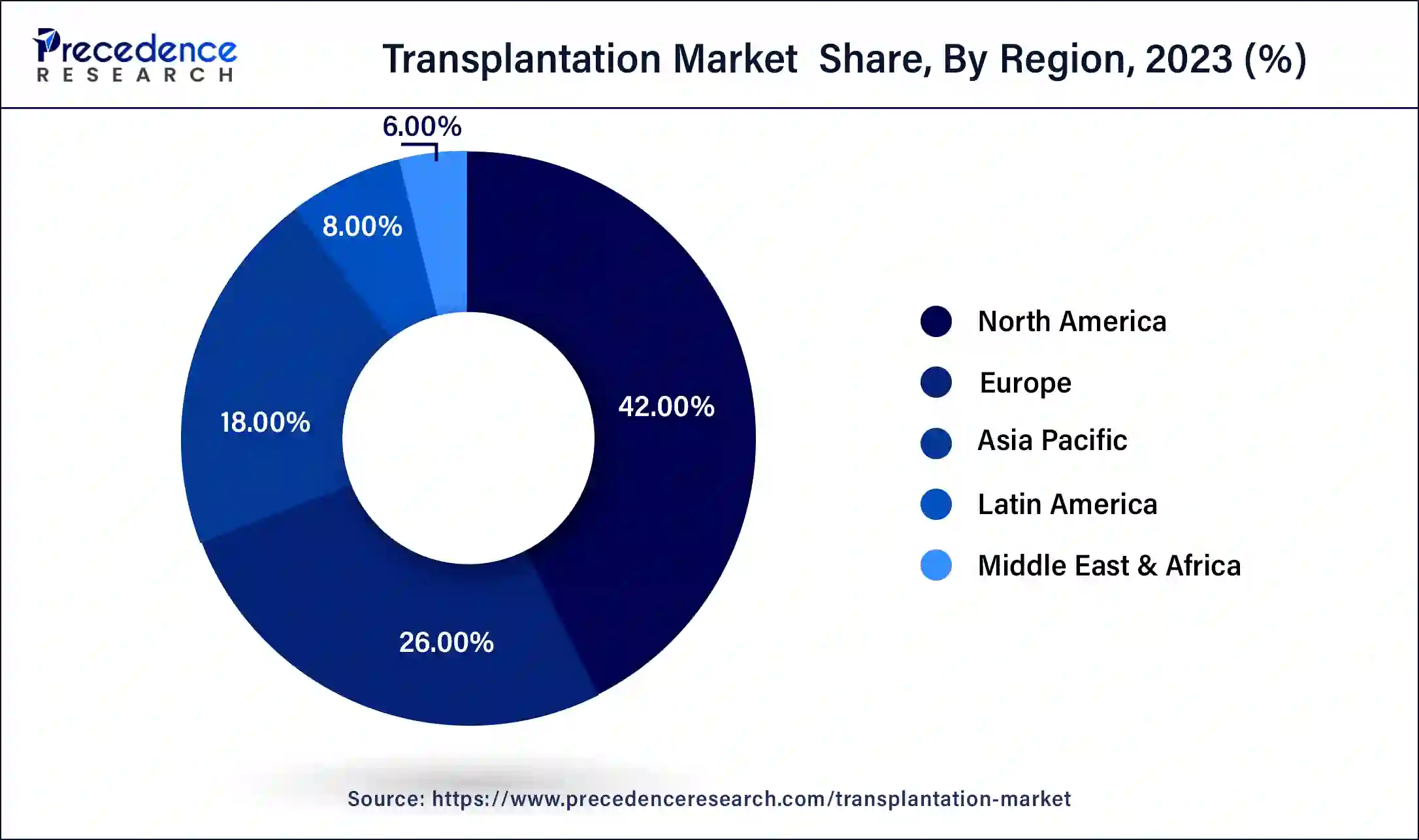

North America encountered as the most prominent region leading the global transplantation market with significant revenue share of nearly 42% in 2024 and projected to maintain its dominance throughout the analysis period. Well-developed health treatment facilities along with the presence of several major medical devices as well as biotechnologies manufacturing companies such as Zimmer Biomet, Arthrex, Inc., Novartis AG, Medtronic, and Stryker supports the market growth.

Asia Pacific is anticipated to grow notably in the market during the forecast period. The region has a robust healthcare infrastructure, facilitating ongoing research on stem cells to develop in vitro tissue and organs in various Asian Pacific countries such as Japan, China, South Korea, India, the Philippines, Indonesia, and others. The rising gap between demand and supply of organs, including kidneys, liver, and heart, for transplantation has significantly increased due to a rise in chronic disorders such as lupus, COPD, cancer, kidney failure, and others. Other factors such as increasing healthcare expenditure, growing awareness about organ donation, a supportive government framework, an increasing incidence of organ failures, an increasing geriatric population, and rapid technological advancement have led to the growth of the transplantation market in the region during the forecast period. The governments and NGOs of various countries in the region are actively participating in encouraging people to donate organs to save precious lives. For instance, MOHAN Foundation, Mumbai, was proud to be a part of the organ donation awareness campaign organized by ROTTO SOTTO, Mumbai, in collaboration with the Indian Army on 6th April 2025. They started the day with door-to-door awareness in the army quarters, set up an informative stall near the army canteen, and concluded with a public outreach drive at the iconic Gateway of India. Over 21097 people across the country pledged to donate their organs in the journey of saving precious lives.

Organ failure occurs because of various factors that include loss of blood, serious trauma, drug of abuse testing, poisoning, sepsis, leukemia, and other acute diseases. Demand for organ and tissue transplantation mainly heart, kidney, lungs, and liver is very high. Alcohol consumption, unhealthy dietary habits, drug abuse, and lack of exercise are some of the major causes of organ failure. This expected to trigger the demand for transplantation products in the coming years. Additionally, increasing number of acute diseases has also resulted in the rising cases of organ failure.

However, customary and religious belief along with lack of awareness related to organ donation prevents large number of people from donating organs. Thus, shortage of organs for the treatment of organ transplantation is likely to hinder the market growth. There is a massive gap between the supply and demand of organ for the treatment of organ failure. As per the U.S. Department of Health & Human Services report in 2019, total number of patients for kidney transplantation was 43,201, yet only 23,401 procedures for kidney transplantation were performed.

With the increasing cases of chronic diseases and the growing old-age population across the globe, the demand for organ transplantation is rising at a rapid pace. Diabetes, heart attacks, liver cirrhosis, and other diseases have become very common, which often lead to organ failure. As a result, the cases of organ transplants have increased in the past few years. Moreover, the increasing prevalence of chronic kidney disease (CKD) is expected to contribute to market expansion, as it is the most common cause of kidney failure.

| Report Highlights | Details |

| Market Size by 2034 | USD 39.19 Billion |

| Market Size in 2025 | USD 19.21 Billion |

| Market Size in 2024 | USD 17.73 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application Type, End User Type, Region Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing incidence of organ failure

Some of the causes of organ failure are serious trauma, sepsis, loss of blood, poisoning, drug abuse, leukemia, and other acute illnesses. Serious organ failure is associated with acute illnesses that are associated with degradation of organ functioning. Glomerular diseases, diabetes, hypertensive nephrosclerosis may result in kidney failure. Similarly, cirrhosis leads to liver failure and likewise coronary heart disease may lead to heart failure. Obesity, alcohol & drug abuse, and smoking may lead to such conditions, which could ultimately result in organ failure. Thus, global demand for tissue and organ transplantation, mainly for bone marrow, heart, liver, kidney, and lungs is very high. According to the U.S. Government Information on Organ Donation and Transplantation, about 112,000 candidates were registered on the U.S. national transplant waiting list by March 2020. Increase in the number of geriatric population due to improved & advanced healthcare facilities have also contributed to the high demand for organ transplantation. Thus, increase in number of acute illnesses and rise in the number of geriatric population are factors leading to an increase in number of organ failures globally, therefore driving demand for organ transplantation procedures.

Technological advancements in organ transplant methods

Technological advancements in the field of 3D bioprinting are also boosting the adoption of organ transplantation. Developments in PCR technique, such as improvements in system design and advanced assays, provide high precision and effectiveness in tissue typing. The development of a new technique by John Hopkins University School of Medicine called desensitization has made it possible to allowing transplanting kidney from any donor. Therapeutic hypothermia has become crucial in organ transplantation utilizing targeted temperature management, which is used to protect neurological functions in patients with cardiac arrest, asphyxia, and stroke. Thus, introduction of such advanced techniques has led to growth of the transplantation market driving the number of organ transplant procedures globally.

Developed tissue banks

There are instances where tissue banks have stored biomedical tissues under cryogenic conditions. With increase in demand for tissue transplantation, demand for tissue banks providing services like assessment of donor suitability, processing, recovery, storage, labeling, and delivery of tissues has increased considerably. Tissue banks primarily use low temperature storage to maintain and store tissues at ideal conditions. Increase in the number of burn injuries has resulted in high demand for tissue banks that retrieve skin and store them in aseptic conditions for donation. Also, advances in technology and instruments including centrifuge, and cryopreservation systems facilitate efficient preservation of the tissue. In addition, computerized support systems with advanced hardware and software allow maintenance of the tissues more easily with high efficiency. Thus, with these developments seen in tissue banks, the storage and retrieval of organs has become relatively easier, thereby propelling the growth of the market.

Transplant rejection

Transplant rejection is a process in which the receiver’s immune system attacks the transplanted organ or tissue, identifying the transplanted organ or tissue to be foreign. Typically, three types of rejections are reported—hyper-acute rejection, acute rejection, and chronic rejection. Despite donor matching, tissue typing, and usage of immunosuppressants, there are instances where transplants are rejected by an individual’s body resulting in failure of the organ transplanted. Not adhering to immunosuppressive drugs is one of the major reasons that results in transplant rejection. Possible complications that may arise due to transplant rejection are certain types of cancers, infections, loss of function in transplanted tissue or organ, and severe side effects due to inappropriate medicinal dosages. According to the Organ Procurement and Transplantation Network, failure of transplanted kidney is reported in about 4% of deceased donor kidney transplants within a period of 1 year. In living donor kidney transplant recipients, failure rates are 14% at 5 years after transplant. Thus, with such factors causing transplant rejection, the growth of the market is expected to be hindered.

Shortage of organ donors

According to the Living Kidney Donors Network, there were more than 90,000 kidney transplant receivers globally in 2017 and the number is estimated to increase in the near future. Typically, organs are harvested from deceased patients that have suffered a brain injury or stroke. With an increase in smoking, alcohol consumption, drug abuse, there is a huge decrease in the number of healthy patients suitable for organ donation. Unavailability of organ donors and the shortage of suitable organs for transplantation have resulted in an increased number of patients on transplant waiting lists. Lack of awareness about organ donation has also been a major factor limiting the market growth. Thus, the growth of the transplantation market is expected to be hindered over the forecast period.

Ethical and cultural issues

Ethical and cultural issues are major restraint in the transplantation market. Developing and underdeveloped nations lack awareness about organ donation and thus potential organ donors also hesitate in donating organs. Majority of the times, families, due to cultural and social stigma, discourage organ donation. Religious and customary beliefs also prevent a large number of people from organ donation. Therefore, such factors are expected to restrain the growth of the market.

Technological advancements in organ transplant methods

Advancements in healthcare technology highly influenced the medical sector, ultimately resulting in the cutting-edge medical technology. Transplantation market is flooded with technologies like artificial organs, stem cell research, tissue engineering, and 3D printing. These technologies revolutionized the transplantation market. Technological advancements in the field of 3D bioprinting are also creating opportunities in the market. Developments in PCR technique, such as improvements in system design and advanced assays, provide high precision and effectiveness in tissue typing. The development of a new technique by John Hopkins University School of Medicine called desensitization has made it possible to allowing transplanting kidney from any donor. Therapeutic hypothermia has become crucial in organ transplantation utilizing targeted temperature management, which is used to protect neurological functions in patients with cardiac arrest, asphyxia, and stroke. Thus, introduction of such advanced techniques fuels the market.

Tissue product segment was the highest revenue contributor in the global transplantation market in 2022, accounting for a market value share of nearly 59%. Significant rise in the transplantation procedures such as heart valves, cochlear, orthopedic soft tissues, and bone marrow prominently drives the growth of the segment. Further, advancement and development of new transplantation products is the other most important factor that propels the market growth. For instance, in September 2015, Arthrex Inc. introduced ArthroFlexAcellular Dermal Matrix, an orthobiologic product that is generally used capsular reconstruction.

On the other hand, immunosuppressive drugs segment projected to exhibit the fastest growth during the forecast period. This is mainly attributed to the increasing use of these drugs to prevent the post-transplant organ or tissue rejection. Rising number of chronic diseases has significantly boosted the organ transplantation market, which in turn expected to fuel the growth for immunosuppressive drugs over the analysis period.

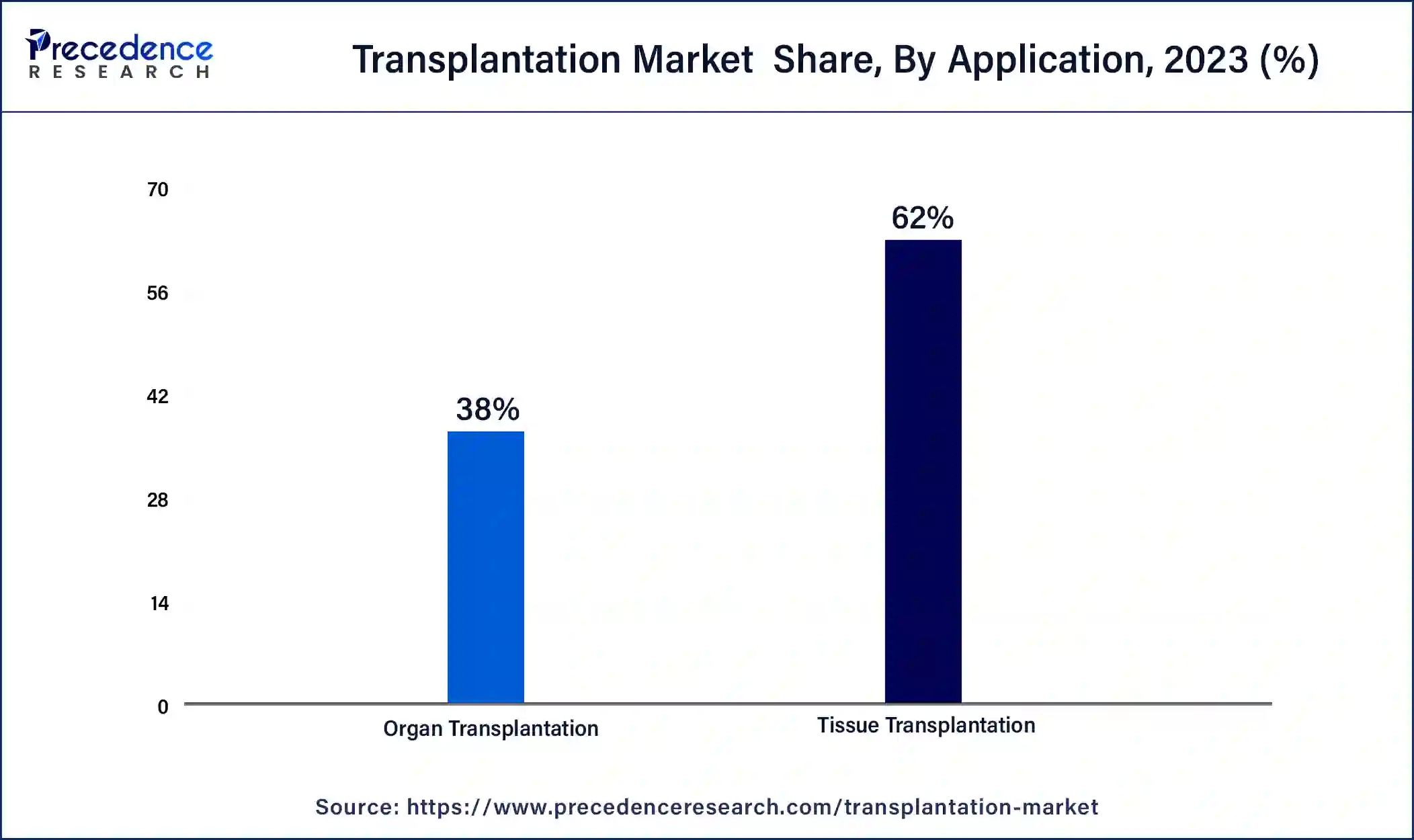

Tissue transplantation application segment emerged as the global leader in the global transplantation market, with a revenue share of around 62% in the year 2024 and projected to expand at the fastest rate during the forecast period. This is attributed to the fact that replacement of cornea, skin, heart valves, bones, nerves, tendons, and veinsare the most common procedures performed globally. Furthermore, the increasing cases of burn and accidents expected to fuel the demand for tissue products in the coming years.

Besides this, organ transplantation analyzed to exhibit significant growth over the forecast period. Increasing number of organ transplant procedures along with recurring sales of immunosuppressant drugs is likely to boost the segment growth. For instance, in 2017, there were nearly 90,306 kidney transplant procedures performed worldwide.

Hospital segment dominated the global transplantation market with value share of approximately 49.5% in the year 2024 and analyzed to retain its dominance over the forecast period. This is mainly due to increasing number of tissue and organ transplantation at hospitals as they are the primary health treatment centers. In addition, significant advancement along with rising investment for developing hospital Infrastructure equipped with advanced facilities attracts major audience.

On the contrary, transplant centers registered the highest growth rate during the forecast period. Increasing number of transplantations has triggered the need for large number of health centers to cater the patient requirement. Additionally, the rising government initiatives to encourage the public for organ donation again flourish the market growth.

The global transplantation market is highly fragmented with the presence of several small, medium, and large scale vendors. Major market players focus mainly on mergers & acquisitions, new product launch, and regional expansions to gain significant momentum in terms of revenue share in the industry. Mergers and acquisitions help vendors to expand their geographical reach and existing product portfolio.

This research study predicts market revenue and its growth rate at global, regional, and country levels and gives inclusive scrutiny of the newest industry drifts in all of the sub-segments from 2020 to 2032. This report categorizes global transplantation market report depending on product type, application, end-use, and region.

By Product Type

By Application

By End-use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client