February 2025

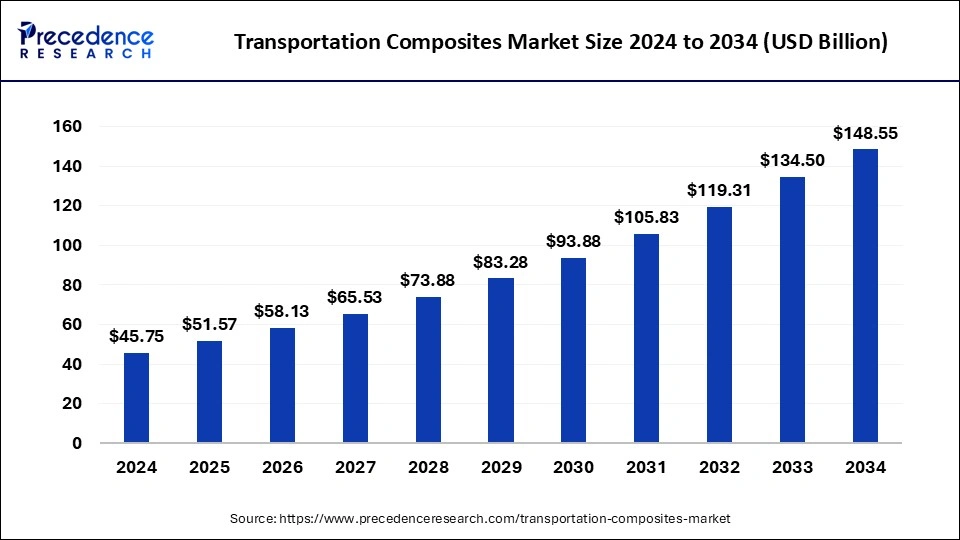

The global transportation composites market size is accounted at USD 51.57 billion in 2025 and is forecasted to hit around USD 148.55 billion by 2034, representing a CAGR of 12.50% from 2025 to 2034. The Asia Pacific market size was estimated at USD 21.05 billion in 2024 and is expanding at a CAGR of 12.64% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global transportation composites market size accounted for USD 45.75 billion in 2024 and is predicted to increase from USD 51.57 billion in 2025 to approximately USD 148.55 billion by 2034, expanding at a CAGR of 12.50% from 2025 to 2034.. The rising developments in the railway network across the world are driving the growth of the transportation composites market.

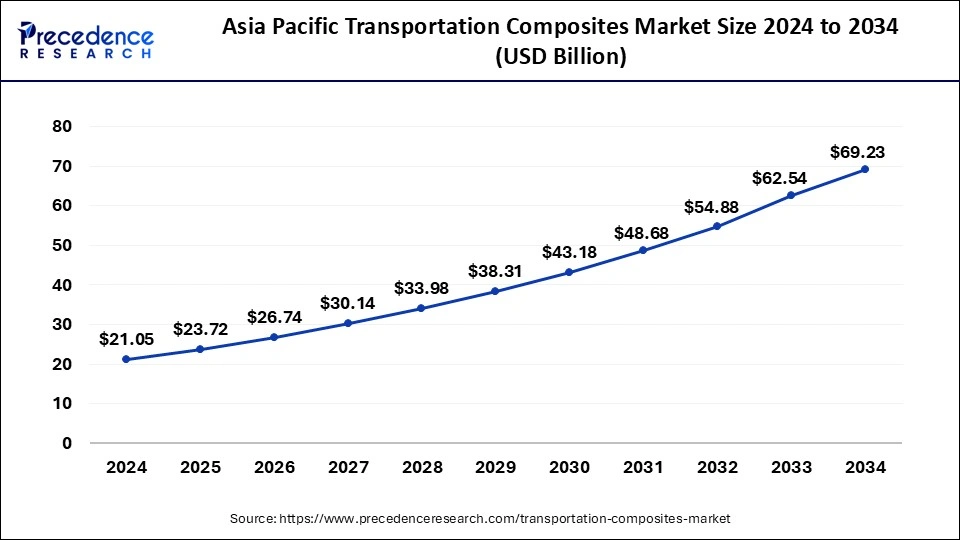

The Asia Pacific transportation composites market size was exhibited at USD 21.05 billion in 2024 and is projected to be worth around USD 69.23 billion by 2034, growing at a CAGR of 12.64% from 2025 to 2034.

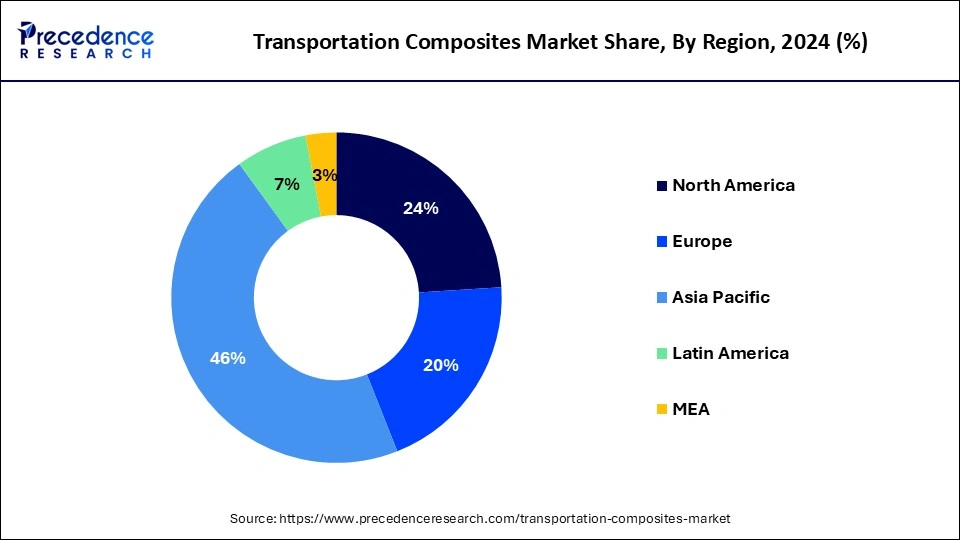

Asia Pacific held the largest market share in 2024 and is expected to maintain its dominance throughout the forecast period. The growth of this region is mainly driven by rising government initiatives in countries such as India, China, South Korea, Japan, and others to strengthen the chemical sector. The rising developments in the railway sector, along with the presence of well-established waterways in India and China, drive the market growth. Also, the rising advancements in science and technology, along with the easy availability of raw materials, are likely to drive market growth.

Moreover, the presence of several market players such as Mitsubishi Chemical Holdings Corporation, Jushi Group, Toray Group, Teijin Ltd, and some others are constantly engaged in developing high-quality composite materials and adopting several strategies such as launches, collaborations, and acquisitions, which in turn drives the growth of the transportation composites market in this region.

Europe is expected to be the fastest-growing region during the forecast period. The growth of this segment is mainly driven by the rising demand for electric vehicles in this region. For instance, in June 2024, Hyundai launched a new IONIQ model in Europe. IONIQ is an advanced electric car that delivers a driving range of around 630 km on a single charge. Also, rising investments by public and private sector entities in developing the automotive sector are boosting market growth. Moreover, the presence of well-established aerospace and automotive industries in Germany and France has increased the demand for composite materials, which in turn is driving the market growth.

Moreover, the presence of several local manufacturers of composites materials, such as Solvay S.A., Royal DSM, Gurit Holdings, and some others, are engaged in manufacturing superior transportation composites materials and adopting several strategies such as launches, collaborations, and acquisitions, which in turn drives the growth of the transportation composites market in this region.

The transportation composites market has grown rapidly with the developments in manufacturing industries. This industry mainly deals with the development, manufacturing, and supply of composite materials for the transportation industry. There are several types of resin that are used in the production of composite materials, which mainly include thermoset and thermoplastic resins. The composite materials are manufactured using several processes, such as compression molding, injection molding, resin transfer molding, and others. There are different types of fibers that are used in the production of composite materials, which mainly include glass fiber, carbon fiber, natural fiber, and some others.

The composite materials are used in the production of interior and exterior components of automobiles. It finds application in several transportation categories, including railways, roadways, waterways, and airways. This industry is expected to grow exponentially with the development of transportation industries.

| Report Coverage | Details |

| Market Size by 2034 | USD 148.55 Billion |

| Market Size in 2025 | USD 51.57 Billion |

| Market Size in 2024 | USD 45.75 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.50% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Resin, Manufacturing Process, Fiber, Transportation Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for electric vehicles

The adoption of electric vehicles (EVs) has increased in recent times due to growing awareness of reducing emissions. Also, the governments of several countries are launching initiatives for the adoption of EVs along with rising developments in EV infrastructure across the world. Moreover, growing development in private and semi-public EV charging, along with rising prices of gasoline, has also increased the demand for EVs. Thus, the rising demand for EVs has increased the demand for transportation composite materials as these materials are used for several applications, such as weight reduction, improved braking battery efficiency, and acceleration. Also, several composite material companies are developing various lightweight components for EVs, which in turn is expected to drive the growth of the transportation composites market.

Non-biodegradable and unavailability of raw materials

The application of transportation composites has gained immense attention in recent times. Although there are several applications of composite materials, there are several problems associated with them. Firstly, most composite materials are non-biodegradable in nature and are not subject to recycling. Secondly, this industry faces problems due to a shortage of raw materials along with the high prices associated with it. Thus, the non-availability of raw materials and non-recyclability of composite materials is expected to restrain the transportation composites market growth.

Rise in a number of racing events across the globe

The attraction towards car and bike racing has increased rapidly among people around the world. Several organizations, such as Formula 1, Nascar, Motorsport Australia, IMSA, and some others, are arranging car racing events to gain popularity among audiences. Thus, with the growing number of racing events, the demand for racing cars has increased rapidly. These racing cars are manufactured using composite materials to deliver superior performance. Hence, rising demand for racing cars is expected to create ample growth opportunities for the transportation composites market players in the future.

The thermoset segment held the largest market share in 2024 and is expected to continue its dominance during the forecast period. The growth of this segment is generally driven by the rising applications of thermoset resin composites in several industries, including robotics, biomedical, construction, and infrastructure. Also, the growing demand for thermoset composites due to their cross-linking property, high-temperature resistance, and superior dimensional stability drives the market growth. Moreover, the increasing usage of polyvinyl chloride and PET in transportation composites is likely to drive the growth of the transportation composites market.

The thermoplastic segment is the fastest-growing segment during the forecast period. This segment is generally driven by the rising demand for recyclable materials around the world. Also, the growing use of thermoplastic composites in aerospace and construction industries due to superior chemical resistance and reshaping capabilities is driving the market growth. Moreover, the growing demand for thermoplastic resin in the automotive industry for manufacturing lightweight vehicles is likely to boost the growth of the transportation composites market.

The compression molding segment dominated the market in 2024. The growth of this segment is generally driven by the growing demand for composite materials in the transportation sector. Also, the growing application of compression molding for producing complex shapes of composite materials boosts the market growth. Moreover, the compression molding process is the most affordable manufacturing process involved in the production of composite materials, which in turn drives the growth of the transportation composites market.

The resin transfer molding segment is expected to be the fastest-growing segment during the forecast period. This segment is generally driven by rising developments in the composite materials industry. Also, the rising application of resin transfer molding for manufacturing intricate parts with sharp edges boosts the market growth. Moreover, the rising usage of the resin transfer molding process for the production of fiber–plastic composites for automotive and aerospace industries is likely to drive the growth of the transportation composites market.

The carbon fiber segment held the largest share of the transportation composites industry and is expected to continue its dominance during the forecast period. The growth of this segment is driven by rising demand for lightweight vehicles across the globe. Also, the growing use of carbon fiber as a prominent raw material for the fabrication of advanced composite materials is driving the market growth. Moreover, government agencies of spacecraft and aircraft, such as the U.S.

Air Force and NASA, are also using carbon fiber to derive maximum performance, which in turn is expected to boost the growth of the transportation composites market. Furthermore, the properties of carbon fibers, such as long service life, corrosion resistance, lightweight, superior abrasion and wear resistance, and some others, are likely to drive the market growth.

The glass fiber segment is the fastest-growing segment during the forecast period. This segment is generally driven by the growing demand for glass fiber in the automotive sector for manufacturing interior and exterior parts. Also, the rising demand for glass fiber by the boat-making industry for the production of hulls, liners, decks, and some other components of boats drives the market growth. Moreover, the growing application of glass fiber in the aerospace sector for manufacturing gaskets, cargo liners, and other interior components of aircraft is expected to drive the growth of the transportation composites market.

The airways segment held the largest share of the market in 2024. This segment is generally driven by the rise in a number of aerospace companies across the world. Also, the growing use of composite materials in the aerospace sector for manufacturing engine blades, nacelles, propellers/rotors, brackets, interiors, single aisle wings, and wide-body wings has boosted the market growth. Moreover, several composite material companies are launching several products that find application in the aerospace industry, which further propels the growth of the transportation composites market.

The exterior segment held the largest market share in the genome editing market in 2024. The growth of this segment is generally driven by the growing demand for luxury cars around the world. Also, the rising application of composite materials in the automotive industry for manufacturing fenders and radiators in cars is driving the market growth. Moreover, the increase in the use of composite materials for producing doors and bumpers of cars due to their high strength and lightweight properties is likely to drive the growth of the transportation composites market during the forecast period.

The interior segment is expected to be the fastest-growing segment during the forecast period. The growth of this segment is generally driven by the rising demand for electric vehicles around the world. Moreover, the growing demand for composite materials in the automotive and aerospace sectors for manufacturing engines and other interior components due to properties such as superior flexibility, increased strength, lightweight design, and high durability is likely to drive the growth of the transportation market.

By Resin

By Manufacturing Process

By Fiber

By Transportation Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

September 2024

April 2025

May 2024