August 2024

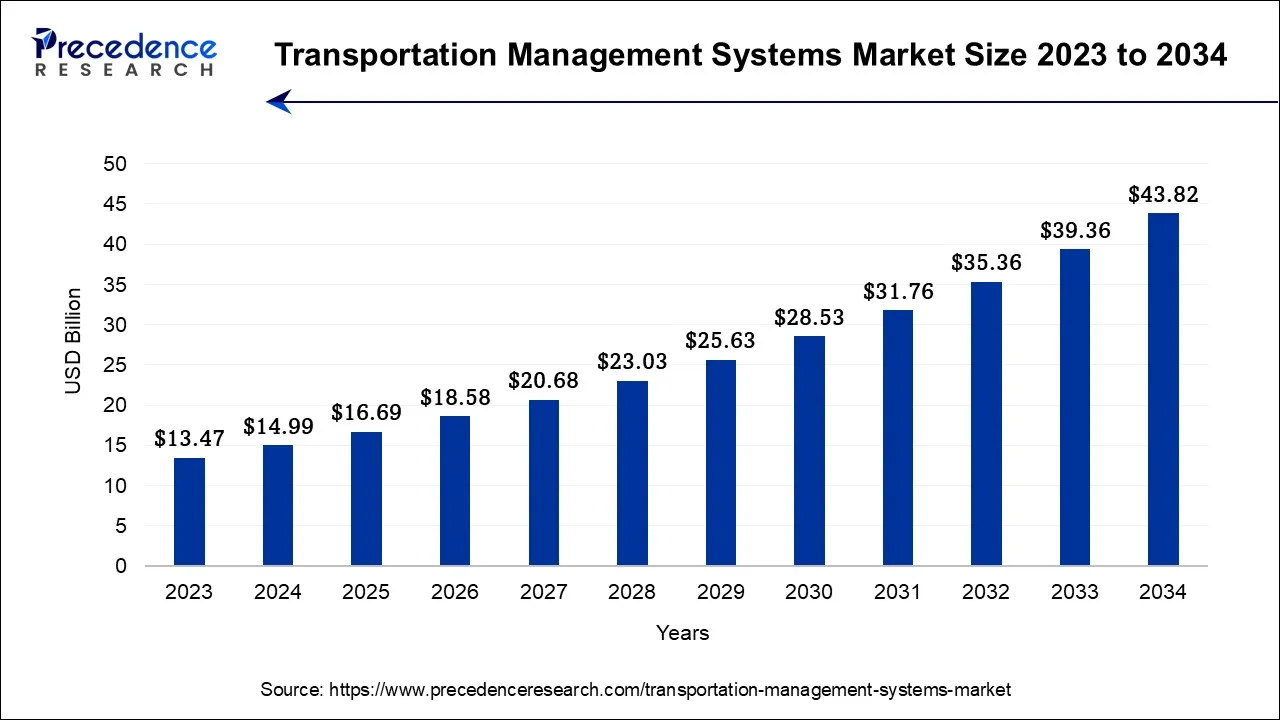

The global transportation management systems market size is calculated at USD 14.99 billion in 2024, grew to USD 16.69 billion in 2025, and is predicted to hit around USD 43.82 billion by 2034, poised to grow at a CAGR of 11.3% between 2024 and 2034. The North America transportation management systems market size accounted for USD 5.40 billion in 2024 and is anticipated to grow at the fastest CAGR of 11.46% during the forecast year.

The global transportation management systems market size is expected to be valued at USD 14.99 billion in 2024 and is anticipated to reach around USD 43.82 billion by 2034, expanding at a CAGR of 11.3% over the forecast period from 2024 to 2034.

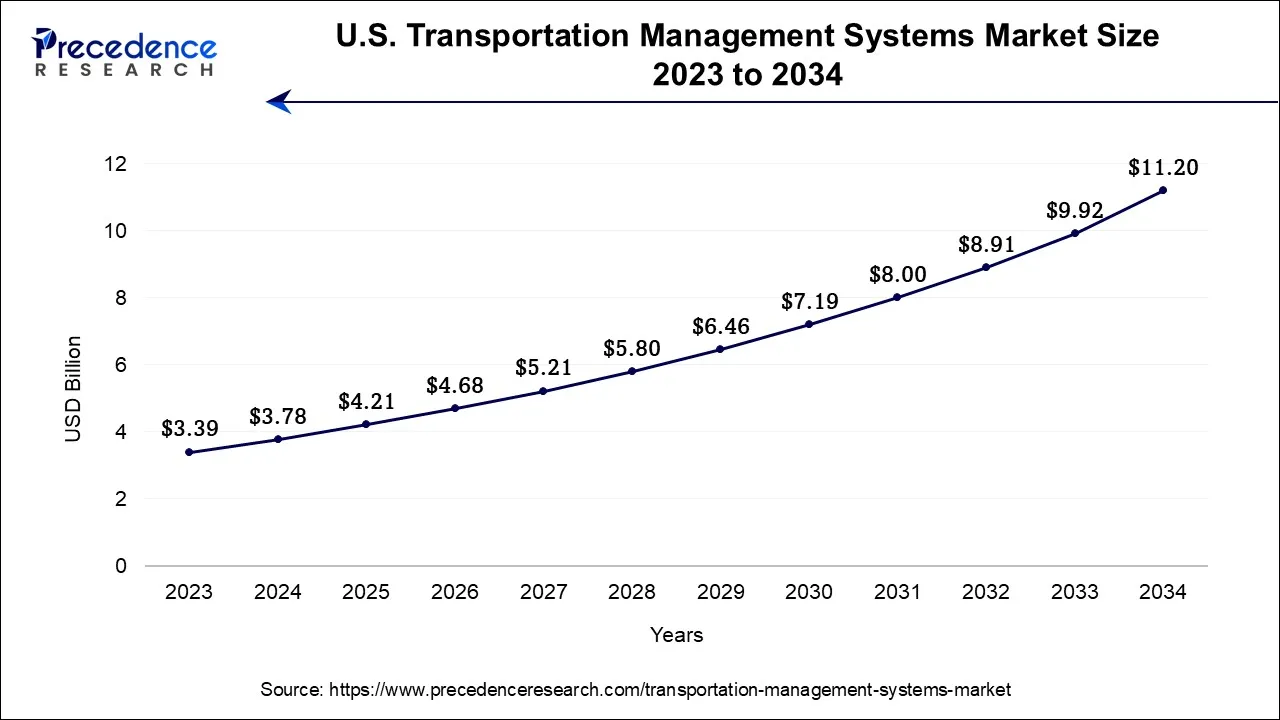

The U.S. transportation management systems market size is accounted for USD 3.78 billion in 2024 and is projected to be worth around USD 11.20 billion by 2034, poised to grow at a CAGR of 11.47% from 2024 to 2034.

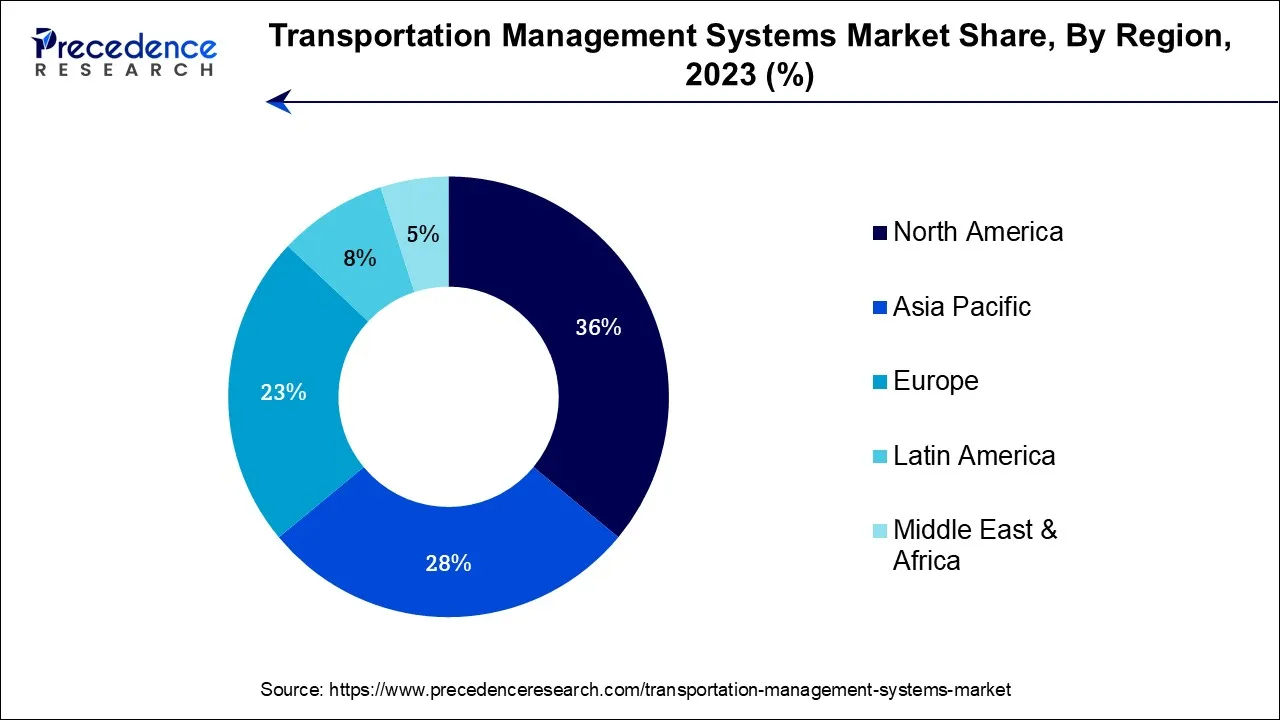

North America has held the largest revenue share 36% in 2023. The region is experiencing a strong emphasis on sustainability, with TMS solutions increasingly integrating eco-friendly features to reduce carbon footprints. The adoption of cloud based TMS systems is growing, offering scalability and remote access. Moreover, there is a notable focus on enhancing last-mile delivery capabilities to meet the demands of the booming e-commerce sector. Overall, North America's TMS market is evolving to meet the changing logistics landscape and sustainability.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, the transportation management systems market is witnessing robust growth driven by expanding e-commerce, increasing urbanization, and a focus on improving supply chain efficiencies. Countries like China and India are experiencing a surge in TMS adoption due to their massive logistics demands. Additionally, the integration of AI and IoT technologies into TMS solutions is a prominent trend, enabling businesses to optimize their transportation networks and handle the region's diverse and complex logistics challenges efficiently.

The transportation management systems market encompasses software and technology solutions designed to optimize and streamline the management of transportation and logistics operations for businesses. TMS platforms offer functionalities like route planning, shipment tracking, and cost optimization.

The transportation management systems market is dynamic, driven by the need for efficient supply chain management, cost reduction, and sustainability. With the increasing complexity of global logistics, TMS solutions continue to evolve, integrating AI and analytics for enhanced decision-making, making it a pivotal segment within the broader transportation and logistics industry.

The transportation management systems market is a rapidly evolving sector within the logistics and supply chain management industry. TMS solutions encompass a range of software and technology tools that assist businesses in optimizing and orchestrating their transportation operations. Several key trends and growth drivers are shaping the TMS market.

Firstly, the increasing globalization of supply chains has heightened the need for efficient transportation management, as businesses seek to navigate complex international logistics. The incorporation of artificial intelligence (AI) and machine learning into TMS solutions stands out as a prominent trend. This integration empowers businesses with predictive analytics and data-driven decision-making capabilities, ultimately leading to the optimization of routing and scheduling processes.

Furthermore, the surge in e-commerce activities and the escalating demand for swift and dependable shipping choices have played a pivotal role in driving the widespread adoption of TMS. Moreover, sustainability concerns have driven the incorporation of eco-friendly transportation options and practices within TMS solutions.

Moreover, TMS providers can capitalize on the growing demand for cloud-based and software-as-a-service (SaaS) solutions, which offer scalability and flexibility. Offering user-friendly interfaces and simplified implementation processes can make TMS systems more accessible to a broader range of businesses.

Furthermore, addressing sustainability concerns by developing eco-friendly features and promoting green logistics can set TMS providers apart in a competitive market. Collaboration with other stakeholders in the supply chain, such as carriers and shippers, also presents opportunities to create integrated, end-to-end solutions.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 11.3% |

| Market Size in 2024 | USD 14.99 Billion |

| Market Size by 2034 | USD 43.82 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Deployment, By Mode of Transportation, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The globalization of supply chains has surged the demand for transportation management systems (TMS) as businesses expand their operations across borders. TMS solutions have become essential for efficiently coordinating the movement of goods internationally. These systems offer advanced features like cross-border compliance, optimized routing, and real-time tracking, addressing the complexities of global logistics. As companies seek to streamline their supply chain operations and ensure timely deliveries across diverse geographic regions, the TMS market experiences increased demand, making it a critical tool for managing globalized supply chains effectively.

Moreover, the imperative need for data security and efficiency has significantly boosted the demand for transportation management systems (TMS). With the rising volume of sensitive transportation data, businesses are turning to TMS solutions to centralize and secure information while improving operational efficiency. TMS platforms offer robust data security measures and streamlined processes, ensuring the protection of valuable data assets and reducing the risk of breaches. This heightened focus on data security and efficiency has become a key driver in the growing adoption of TMS systems across various industries.

Regulatory compliance imposes restraints on the transportation management systems market by necessitating adherence to a complex web of transportation laws and regulations. Meeting diverse compliance requirements across different regions and industries can be challenging, leading to increased operational costs and potential legal liabilities for non-compliance. Companies may hesitate to adopt TMS solutions due to concerns about managing and staying up to date with these intricate regulatory frameworks. This constraint underscores the importance of TMS systems that offer robust compliance features to alleviate these burdens and foster market adoption.

Moreover, Integration challenges restrain the market demand for transportation management systems (TMS) as they complicate the adoption process. TMS platforms must seamlessly integrate with existing enterprise systems, such as ERP and CRM software, to deliver their full benefits. The complexity of achieving this integration can deter businesses from investing in TMS solutions, particularly those with intricate legacy systems. Overcoming these challenges by offering user-friendly integration options and robust support is crucial for unlocking the potential of TMS and expanding its adoption across diverse industries.

The integration of artificial intelligence (AI) and the Internet of Things (IoT) advancements significantly enhances transportation efficiency, making AI-powered TMS solutions a sought-after asset in optimizing logistics operations and meeting the growing need for precision and agility in the industry. IoT devices, such as sensors on vehicles and goods, provide valuable real-time data for TMS platforms to optimize routing and scheduling. This synergy improves overall logistics performance, reduces costs, and meets the growing demand for agile and data-driven transportation solutions, thus spurring the adoption of TMS in the market.

Moreover, Collaborative logistics initiatives are surging the market demand for transportation management systems (TMS). TMS platforms enable seamless collaboration between various supply chain stakeholders, including shippers, carriers, and distributors. By providing real-time visibility and data-sharing capabilities, TMS fosters coordination and efficiency, reducing transportation costs and enhancing service levels. This collaborative approach aligns with the industry's need for end-to-end solutions and improved supply chain visibility, thereby driving greater adoption of TMS systems as businesses seek to optimize their logistics operations and strengthen their partnerships within the supply chain ecosystem.

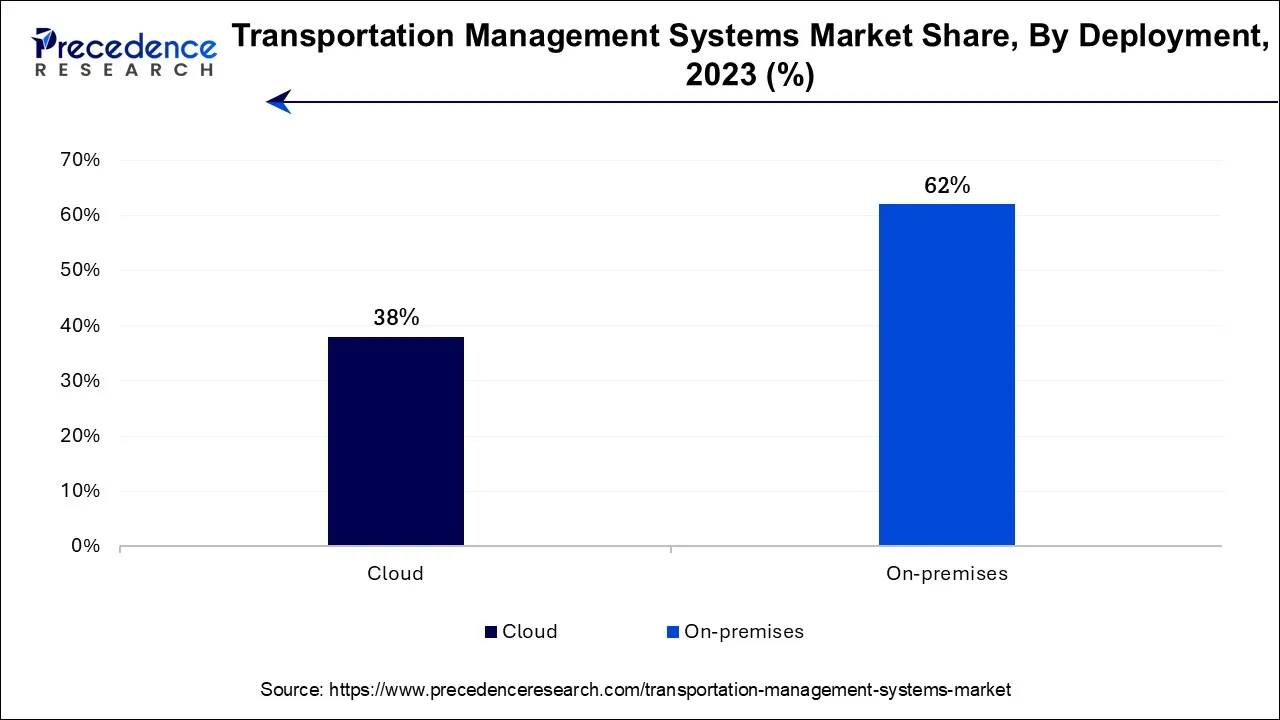

According to the Deployment, the on-premises segment held 62% revenue share in 2023. On-premises deployment in the transportation management systems market refers to the installation and operation of TMS software within a company's own physical infrastructure. This traditional approach offers greater control and security over data but is witnessing a shift towards cloud-based solutions. While some businesses still prefer on-premises TMS for data privacy and customization, the industry trend is moving towards cloud deployments due to their scalability, cost-effectiveness, and accessibility, enabling real-time collaboration and adaptability to evolve logistics needs.

The hardware sector is anticipated to expand at a significant CAGR of 17.8% during the projected period In the transportation management systems market, cloud deployment involves hosting TMS software and data on remote servers accessible over the internet. This approach offers scalability, cost-effectiveness, and flexibility. Cloud-based TMS solutions have witnessed growing adoption due to their ability to facilitate remote access, real-time updates, and reduced infrastructure costs. As businesses seek agile and scalable solutions, the trend towards cloud based TMS continues to rise, ensuring that companies can efficiently manage their transportation and logistics operations while adapting to evolving market needs.

Based on the mode of transportation, the roadways segment is anticipated to hold the largest market share of 39% in 2023. Roadways are a critical mode of transportation. In the transportation management systems market, the focus on roadways involves optimizing the management of trucking and shipping operations. Recent trends include increased adoption of TMS for last-mile delivery, route optimization, and real-time tracking, driven by the rise of e-commerce and the need for efficient, cost-effective transportation on road networks. Additionally, the integration of AI and IoT technologies into TMS solutions is enhancing decision-making and visibility, further enhancing the efficiency of road transportation logistics.

On the other hand, the waterways segment is projected to grow at the fastest rate over the projected period. Waterways, including rivers and oceans, are vital modes of transportation for cargo worldwide. In the transportation management systems market, a growing trend is the integration of TMS solutions with maritime logistics. These systems enhance efficiency in managing container shipping, port operations, and inland waterway transport. Real-time tracking, route optimization, and compliance management are becoming essential features in TMS to cater to the evolving needs of businesses relying on waterborne transportation.

In 2023, the manufacturing segment had the highest market share of 34.8% on the basis of the end user. The end-use segment encompasses businesses involved in the production of goods. Manufacturing companies utilize TMS solutions to optimize their supply chain operations, enhance inventory management, and streamline transportation processes. In the manufacturing segment prevailing trends involve a growing preference for cloud based TMS solutions. These cloud systems offer scalability, real-time tracking capabilities, and the incorporation of IoT and AI technologies. These trends are driving operational efficiency improvements, cost reductions, and heightened supply chain visibility, making them integral to modern manufacturing processes.

The retail and e-commerce segments are anticipated to expand at the fastest rate over the projected period. In the transportation management systems market, the retail and e-commerce sector refer to businesses specializing in the sale of goods directly to consumers. Recent trends in this segment include the increased adoption of TMS to streamline last-mile deliveries, enhance customer experience, and manage high shipment volumes. Retailers and e-commerce companies are leveraging TMS for real-time tracking, route optimization, and inventory management, ensuring timely deliveries and cost-efficiency in a competitive market.

Segments Covered in the Report

By Deployment

By Mode of Transportation

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

December 2024

December 2024

November 2024