September 2024

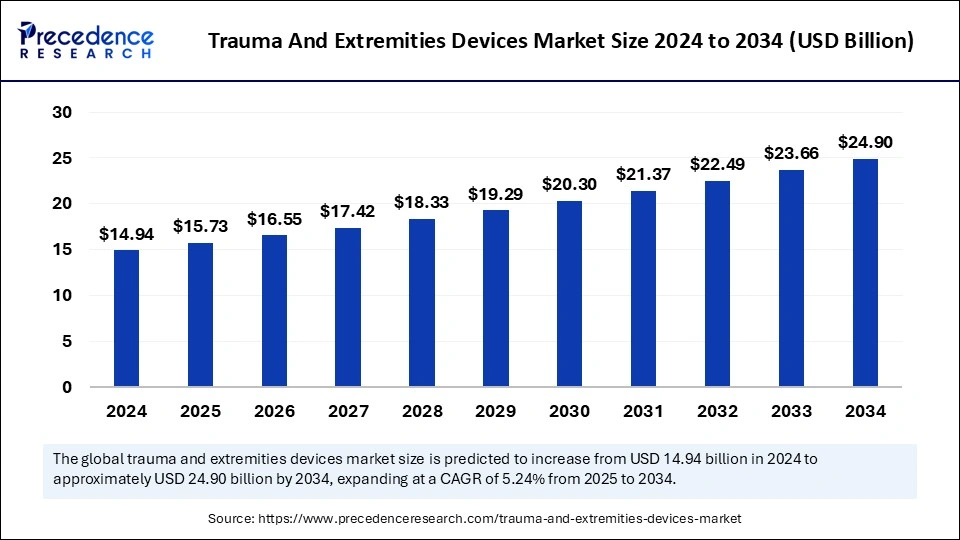

The global trauma and extremities devices market size is calculated at USD 15.73 billion in 2025 and is forecasted to reach around USD 24.90 billion by 2034, accelerating at a CAGR of 5.24% from 2025 to 2034. The North America market size surpassed USD 7.02 billion in 2024 and is expanding at a CAGR of 5.36% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global trauma and extremities devices market size was estimated at USD 14.94 billion in 2024 and is predicted to increase from USD 15.73 billion in 2025 to approximately USD 24.90 billion by 2034, expanding at a CAGR of 5.24% from 2025 to 2034. Increased prevalence of orthopaedic disorders in the geriatric population driving the growth of the global market. Increased incidence of sports injuries has raised the need for trauma and extremities devices. Additionally, rising demand for minimally invasive procedures is emerging in the market.

Artificial Intelligence has become a crucial player in the development of cutting-edge and customized trauma and extreme devices. The rising incidence of trauma cases is driving the rapid adoption of AI in the trauma and extremities devices market. The growing need for effective and fast procedures is encouraging this adoption. The ability of AI to provide virtual testing to reduce the need for physical prototypes is another key factor for this growth.

The ability of AI to deliver efficient and precise technology advancements is making them popular for diagnostic tools and surgeries to improve patient outcomes in the trauma and extremities devices market. AI is enabled to help make customized implants according to indivisible patient needs and anatomy. The predictive analytics of AI is also helpful for the development of personalized medicines. The need for post-operative care, real-time guidelines, and support for patients suffering from trauma and extremities is seeking further utilization of automation to improve the infrastructure.

The U.S. trauma and extremities devices market size was exhibited at USD 6.32 billion in 2024 and is projected to be worth around USD 10.70 billion by 2034, growing at a CAGR of 5.41% from 2025 to 2034.

Adoption of developed technologies: to boost the market in North America

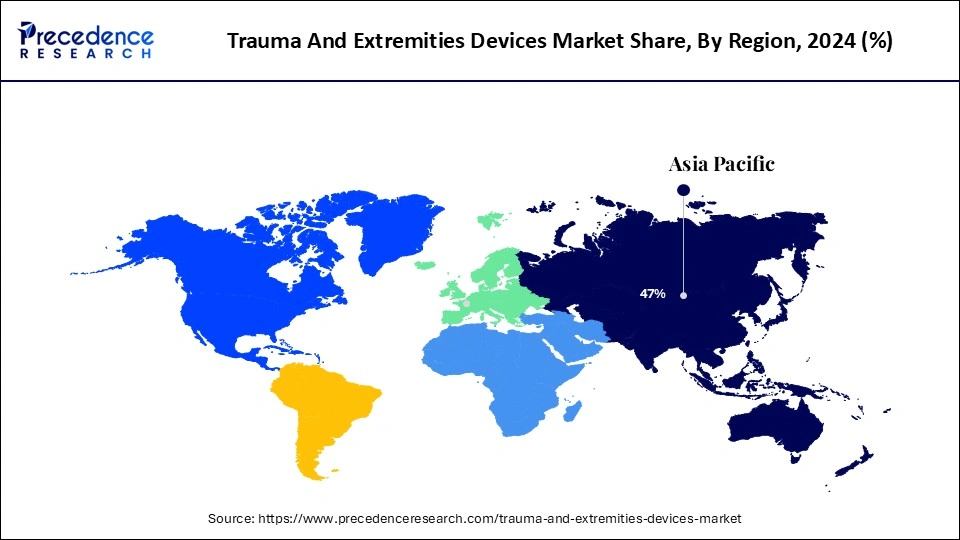

North America accounted as the dominant region of the trauma and extremities devices market due to regional early adoption of the cutting-edge technologies and well-established healthcare infrastructure. The advanced healthcare infrastructure of North America allows for the adoption of novel technologies. Government focus and initiatives for research and development firms are also contributing to the regional market.

The presence of key manufacturers is facilitating the development and adoption of novel, cutting-edge technologies. The rising incidence of trauma injuries has led the region to develop advanced materials and design devices with titanium and bioabsorbable materials. The rising trauma cases are shifting the government's focus on trauma and extremities care facilities. In recent years, the government has been empowering research institutes to develop advanced trauma and extremities care in the region.

The United States is leading the North American trauma and extremities devices market due to the presence of key companies, R&D capabilities, and increased demands for minimally invasive surgical procedures. The rapidly growing aging population in the United States is increasing demands for arthroscopy and endoscopy procedures that are rising in adoption for minimally invasive procedures. Growing government and non-government initiatives and investment in trauma care facilities and awareness are playing crucial roles in the market expansion in the U.S.

Growing patient populations are driving government initiatives to boost the Asian market

Asia Pacific is projected to witness significant growth in the trauma and extremities devices market due to the rising geriatric population in the region. The increased aging population has led to a rising prevalence of hip-related conditions, such as osteoarthritis and hip fractures, leading to enhanced demands for advanced surgical procedures. Factors like growing urbanization and expanding healthcare infrastructure are also playing a significant role in the market growth. Rapidly growing urbanization and developing cities have increased the risks of road accidents. Additionally, investments in pharmaceutical companies by government and private bodies are contributing to the market growth. Rising government and regulatory focus on increasing awareness of trauma and developments of facility care in rural and developing areas are expected to highlight the regional market growth in the forecast period.

Trauma and extremities devices are the medical devices utilized to treat traumatic injuries and disorders affecting the extremities, like fractures, osteoporosis, and degenerative conditions. The growing aging population is raising demands for cutting-edge technologies in healthcare. Rapidly growing urbanization and infrastructures are leading to the risks of accidents. The incidence of sports injuries has increased due to rapid enrollments in sports. These factors are contributing to the increasing prevalence of orthopedic disorders. The factor majorly fueling the market growth is the government and non-government organization initiatives. Their focus on increasing awareness of trauma and extremities care, and investments in the development of well-established healthcare infrastructures are emerging in the market.

The rising availability of hospitals, ambulatory surgery centers, and outpatient facilities is making it easy for patients to gain prior care. The rising prevalence of bone disorders among the aging population has witnessed spectacular empowerment for the development of novel, cutting-edge technologies. With ongoing developments and adoption of advanced technologies like imaging, 3D printing, minimally invasive devices, and customized devices, the market is projected to generate great revenue in the upcoming period.

| Report Coverage | Details |

| Market Size by 2034 | USD 24.90 Billion |

| Market Size in 2025 | USD 15.73 Billion |

| Market Size in 2024 | USD 14.94 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End-Use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Technology advancements and innovations

The ongoing developments of less invasive surgical techniques like intramedullary nails and locking plate systems for faster healing and reducing soft tissue trauma are enhancing the market expansions. Additionally, the developments of cutting-edge materials like titanium and bioabsorbable materials are improving the durability and biocompatibility of internal trauma fixation devices. The adoption of 3D printing allows customized implants and helps to reduce the need for bone grafts and enhance patient outcomes.

Advancements in biologics and tissue engineering technologies are helping to reduce the need for allografts or autografts and allowing implants for customized tissue-engineered products. The adoption of automation like computer-assisted navigation and robotic-assisted surgeries is allowing more precise and less invasive surgeries, making it easy for healthcare professionals to handle procedures and convenient for patients to reduce healing time and improve the results.

Automation is advancing patient outcomes by reducing complications and errors in treatments. The integration of advanced technologies in the healthcare sector is enhancing the adoption rate for trauma and extremities devices. Additionally, ongoing government and non-government organization investments in the development of innovative technologies are projected to continue to drive market expansion.

Lack of skilled professionals and materials

The trauma and extremities devices require proper and accurate handling; the lack of skilled professionals is likely to hamper the market growth. Also, the limited availability of materials like titanium and bioabsorbable materials can limit the growth of the market. Most trauma and extremities devices are designed with metals, which can cause allergies or infections in metal-sensitive patients.

Regulatory compliance and development costs

The regulatory requirements can increase the cost and time associated with the development of novel products, which can damage companies’ portfolio lines, profit margins, as well as reputations. The development of new products for the trauma and extremities devices market is expensive, which is likely to enhance the pricing pressures and hazard the adoption rate. Furthermore, challenges of product liability: the rising challenge of facing product liability risks for manufacturers can lead to financial loss.

Growing demand for less invasive surgeries

The rising demand for less invasive surgeries is generating spectacular opportunities for growth in the trauma and extremities devices market in the forecast period. The rising prevalence of road accidents, sports injuries, an aging population, and traumatic scenarios are seeking faster recovery by providing treatments. Less invasive surgeries have outcomes in less tissue damage and trauma. Less invasive surgeries also produce less scary processes and reduce the risk of infections.

Patients are continuously seeking minimally invasive surgeries to reduce hospitalization and cost pressures. The rising shift toward less invasive surgeries is surging the development of novel devices and technologies. With the rising need for such surgeries, the opportunities for innovations, expansion, and trends for the adoption of specialized devices are likely to increase.

The internal fixation segment accounted for the largest share of the trauma and extremities devices market. The growth of the segment is significantly driven by the increased prevalence of osteoarthritis and rheumatoid arthritis in aging populations. Internal fixation devices promote quick recovery and help to reduce soft tissue trauma. Internal fixation devices, including nails and plates, are small in size, and this occurs with less scarring to the patients. The technology advancements in internal fixations like bioabsorbable materials and titanium materials have increased the durability of the devices, making them more prior for healthcare professionals and patients. Additionally, increased sports-related injuries and road accidents are rising complex features that require effective and faster recovery devices like internal fixation.

On the other hand, the long bone stimulation segment is expected to witness significant growth in the forecast period due to the rise in the incidence of road accidents and sport-related injuries. The growing demands for less invasive procedures are also supporting the segment growth. The development of advanced technologies like ultrasound stimulation and electromagnetic stimulation is helping to improve the effectiveness of long-bone stimulation devices. With the rising elderly population and the need for specialized devices, we are expected to witness significant growth in this device adoption rate.

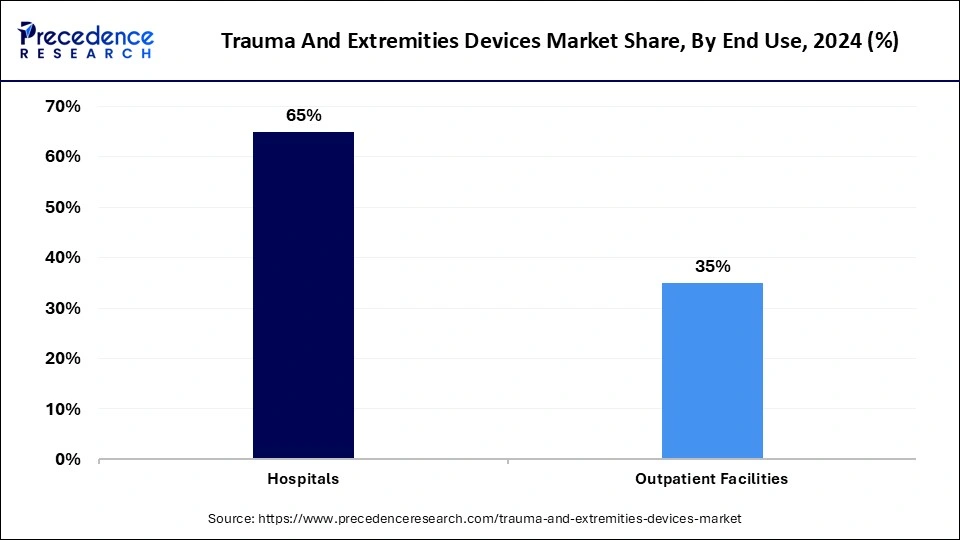

The hospital's segment dominated the trauma and extremities devices market in 2023. The segment growth is anticipated due to the expanding well-established hospital infrastructure, adoption of advanced medical facilities, and training of healthcare professionals. The expanding healthcare expenditure in developing and rural areas is providing easy access to medical care, making the hospital segment further dominant in the market. Increased trauma and accident cases are rising due to the growing geriatric population and rapidly growing urbanization and infrastructures, making hospitals the first priority to take care of care and treatment. Hospitals provide a high volume of elective and emergency surgeries. Additionally, the government and non-government organizations' rising investments and funding for the development of advanced hospital infrastructure have encouraged the adoption of specialized trauma centers in several hospitals.

However, the outpatient facilities, due to increased adoption of minimally invasive procedures and focus on cost-effectiveness and comfort, as the outpatient facilities don’t require overnight stays. Outpatient facilities are cost-effective compared to conventional hospitals. The easy accessibility of outpatient facilities and their convenience are making them more popular in the market. The ability to provide faster recovery time, making them prior to the patients. The developed advanced technologies like portable and compact devices and advanced imaging technologies are allowing outpatient facilities to provide advanced care facilities, which significantly impacts the segment’s growth.

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

February 2025

January 2025