January 2025

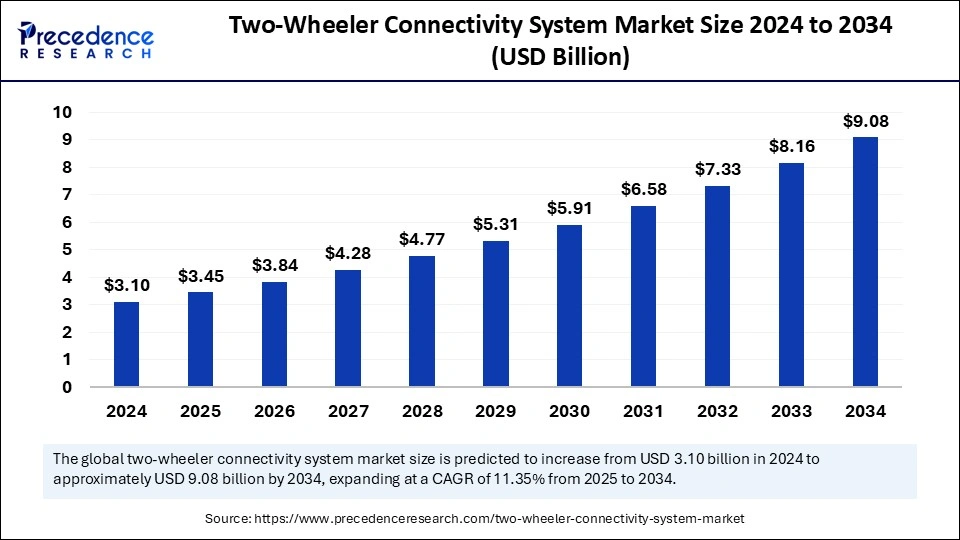

The global two-wheeler connectivity system market size is calculated at USD 3.45 billion in 2025 and is forecasted to reach around USD 9.08 billion by 2034, accelerating at a CAGR of 11.35% from 2025 to 2034.The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global two-wheeler connectivity system market size accounted for USD 3.10 billion in 2024 and is predicted to increase from USD 3.45 billion in 2025 to approximately USD 9.08 billion by 2034, expanding at a CAGR of 11.35% from 2025 to 2034.The increasing demand for electric vehicles and growing concerns about rider safety and security are major factors boosting the growth of the two-wheeler connectivity system market. Moreover, the integration of advanced technologies and smart devices is fueling market expansion.

Artificial Intelligence has been acting as a game changer for the two-wheeler connectivity system market. The increased demand for advanced featured vehicles is leveraging the implementation of artificial intelligence with the existing system to advanced safety standards, personalized riding experiences, and enhanced vehicle management. AI is not only able to reduce cost and improve the efficiency of two-wheelers but also helps to enable seamless communications between two-wheelers and infrastructures. The ability of AI algorithms to deliver quick responses to real-time road conditions and rider behaviors makes them ideal for urban areas. The information on rider behavior and preference conducted through AI algorithms is significant for manufacturers to develop better customized and personalized expertise.

The two-wheeler connectivity system refers to the integration of connectivity solutions and technologies with two-wheelers to improve safety, security, vehicle diagnostics, emergency responses, and navigation. The two-wheeler connectivity system market provides insights into technological advancements and innovations to transform the two-wheeler vehicle industry. The growing reliability of smart devices, including smartphones and smartwatches, is the major factor driving the integration of advanced technologies in two-wheelers to improve overall efficiency, performance, and rider experiences. Implementing advanced technologies like advanced rider assistance systems and shared mobility services emphasizes the two-wheeler connectivity system. The increasing demand for advanced featured scooters, motorcycles, and electric bikes is contributing to market growth. Additionally, factors like government initiatives and support for innovation and development of advanced electric vehicles and investment in manufacturing infrastructure are enabling access to cutting-edge technologies.

| Report Coverage | Details |

| Market Size by 2034 | USD 9.08 Billion |

| Market Size by 2025 | USD 3.45 Billion |

| Market Size in 2024 | USD 3.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.35 % |

| Dominated Region | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Demand for enhanced safety and convenience

The increased demand for safety and convenient features in two-wheelers is driving the global two-wheeler connectivity system market. Due to the rising safety concerns, the implementation of anti-theft systems, emergency response systems, collision warning systems, navigation and route optimization, infotainment systems, voice assistance, vehicle maintenance alerts, and smartphone integrations have increased. The integration of smartphones and voice assistance allows vehicle owners to keep track of their vehicles from remote locations. In addition, rising traffic congestion contributes to market growth. GPS navigation helps riders navigate traffic more efficiently and provides convenient riding experiences. Additionally, integrating smart devices with two-wheelers improves safety, vehicle management, and convenience.

Lack of connectivity standards

Lack of standardization in connectivity systems leads to compatibility issues between two-wheelers and smart devices. This, in turn, reduces the adoption of connectivity systems. High costs, security concerns, limited data sharing, and limited interpretability between systems are major market restraints. Additionally, stringent regulations regarding vehicle safety and inadequate infrastructure for supporting the connectivity system hinder the growth of the two-wheeler connectivity system market.

Technological advancements

Technological advances create immense opportunities in the two-wheeler connectivity system market. Innovations in technology, such as 5G connectivity, IoT sensors, GPS trackers, and IoT, are making connectivity systems more user-friendly. Additionally, the growing safety and security concerns are encouraging manufacturing companies to innovate and develop customized connectivity solutions. Government initiatives and funding to improve manufacturing infrastructure enable access to cutting-edge technologies. The rising implementation of cutting-edge technologies like cloud computing and cybersecurity systems will likely boost consumers' attraction toward two-wheelers in the future. Furthermore, the rising integration of seamless technologies in electric and internal combustion engine (ICE) two-wheelers holds future market potential.

The Bluetooth connectivity segment held the largest market share in 2024 due to the increased adoption of Bluetooth technology. Bluetooth technology requires low power consumption, is easier to pair, is cost-effective, and is compatible with smartphones, which makes them the preferred choice for riders. The ability of Bluetooth technology to adjust settings and preferences makes them a customized and personalized solution for two-wheelers. Bluetooth connectivity technologies allow seamless communication, hands-free calling, and music streaming. Advancements in Bluetooth technology, like GPS navigation and voice assistance, further support segmental growth.

The Wi-Fi connectivity segment is expected to expand at the fastest rate in the coming years. The increasing integration of two-wheelers with smart devices like smartphones and smartwatches is driving the need for Wi-Fi connectivity technology. Wi-Fi provides high-speed connectivity and easy integration with existing systems for two-wheelers. The cost-effectiveness of Wi-Fi makes it popular among riders as well as manufacturers.

The smartphone integration segment dominated the two-wheeler connectivity system market in 2024. This is mainly due to the increase in smartphone penetration. Smartphones allow seamless integration with their devices for navigation, route optimization, entertainment, voice assistance, as well as hands-free calling. Additionally, the convenience and cost-effectiveness of smartphones have increased their adoption, making them suitable for connectivity systems.

The cloud computing segment is projected to witness rapid growth during the forecast period due to the increased need for advanced technology integration with two-wheelers. The rise in concerns about vehicle and rider safety has increased the adoption of cloud computing. It provides real-time data about vehicles and enables remote monitoring, improving the flexibility and security of the riders. Cloud connectivity also facilitates real-time collaboration.

The motorcycle segment dominated the two-wheeler connectivity system market in 2024. This is mainly due to the increased popularity of motorcycles in urban or city areas. Motorcycles have a high adoption rate compared to scooters and electric bikes. The improved connectivity systems in motorcycles, including improved navigation, entertainment, safety features, and vehicle maintenance systems, attract many consumers. Advances in motorcycle features like GPS trackers, navigation, wi-fi connections, and advanced speed abilities make them more popular among younger populations. Connected motorcycles play a vital role in providing opportunities for OEMs and service providers.

The electric bikes segment is projected to grow at a significant rate in the coming years due to the rising production and adoption of electric bikes worldwide. The increasing demand for advanced features like GPS tracking, infotainment systems, vehicle diagnostics, mobile app integrations, and real-time battery status monitoring in electric bikes to enhance the rider experience further supports segmental growth. The growing environmental concerns are a major factor boosting the demand for electric bikes.

The private use segment led the two-wheeler connectivity system market in 2024. The segment growth is attributed to advanced features in motorcycles, electric bikes, and scooters to improve safety and convenience for riders. Additionally, concerns about safety and security have risen, boosting the demand for connectivity systems in two-wheelers. Manufacturers' ongoing innovations and developments to provide customized and personalized two-wheelers with advanced connective features further contribute to segmental dominance.

On the other hand, the commercial use segment is expected to witness rapid growth during the forecast period due to the rising demand for efficient logistics and delivery services. The connectivity systems optimize routes and improve fuel efficiency and vehicle maintenance, making them ideal for commercial users to reduce costs and improve efficiency. Additionally, the rising implementation of connectivity systems in ride-sharing and rental two-wheelers is significantly impacting segment growth.

Europe led the two-wheeler connectivity system market with the largest share in 2024. Europe is well known for its non-emission commitment, which has increased the adoption of sustainable transportation like electric vehicles. The government's emphasis on developing robust connected vehicle technology infrastructure is the key driver of the European two-wheeler connectivity system market.

Ongoing government focus on collaborating with the private sector, OEMs, and other stakeholders across sustainable two-wheeler bike ecosystems is fast-tracking market growth in Europe. e2W cargo bikes are gaining immense popularity in the European market. Government initiatives, supporting policies, and regulations for developing infrastructure for connectivity systems play a vital role in the market expansion. Countries like Germany, France, and Italy are leading the regional market because of their well-established motorcycle manufacturing infrastructure.

Asia Pacific is expected to witness significant growth in the near future due to the increasing demand for electric two-wheelers. Rising government funding and subsidies for electric vehicles are boosting the adoption of e2W in the region. Moreover, the rising proliferation of high-speed internet connectivity and increasing penetration of smartphones are contributing to market expansion.

Countries like China, India, and Japan are expected to lead the Asia Pacific two-wheeler connectivity system market. China is the world's largest producer of vehicles, including two-wheelers. The rapid expansion of the automotive industry in India further supports regional market growth. In addition, the rising concerns about traffic congestion in these countries have boosted the adoption of connectivity systems.

By Technology

By Connectivity Type

By Vehicle Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

April 2025

April 2025