January 2025

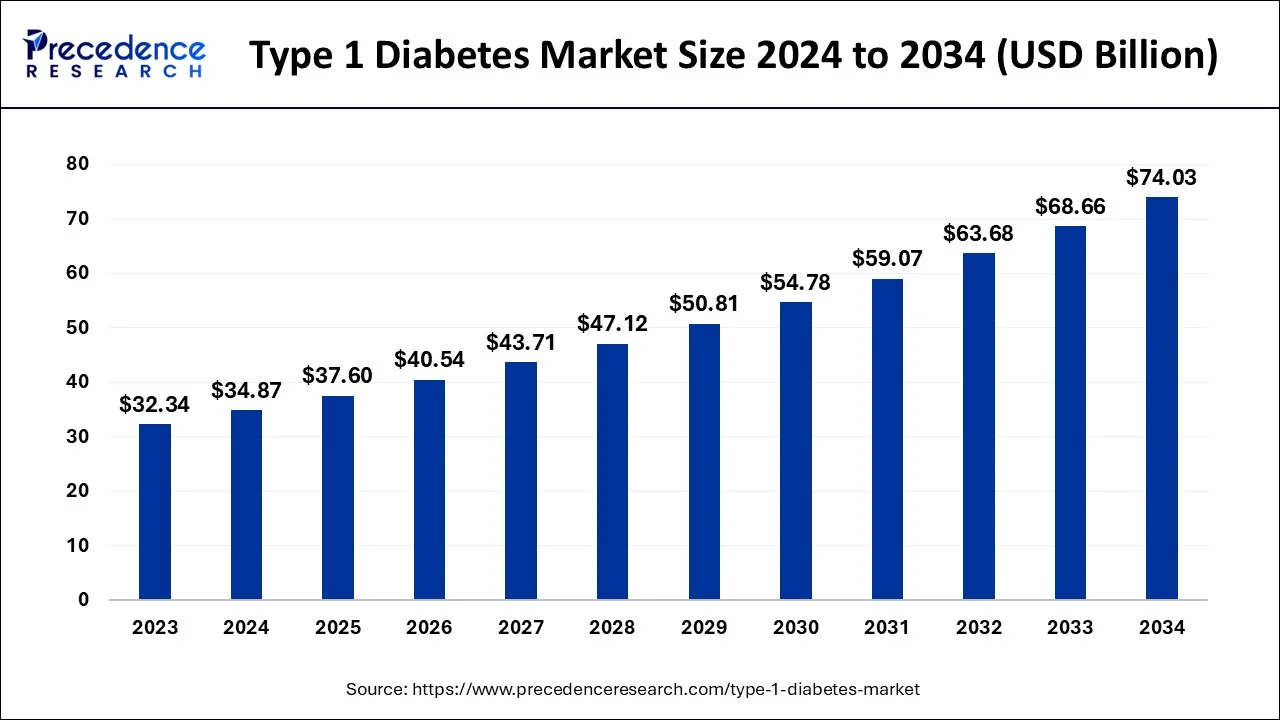

The global type 1 diabetes market size accounted for USD 34.87 billion in 2024, grew to USD 37.6 billion in 2025 and is expected to be worth around USD 74.03 billion by 2034, registering a healthy CAGR of 7.82% between 2024 and 2034. The North America type 1 diabetes market size is predicted to increase from USD 16.04 billion in 2024 and is estimated to grow at a fastest CAGR of 7.92% during the forecast year.

The global type 1 diabetes market size is calculated at USD 34.87 billion in 2024 and is anticipated to reach around USD 74.03 billion by 2034, expanding at a CAGR of 7.82% between 2024 and 2034.

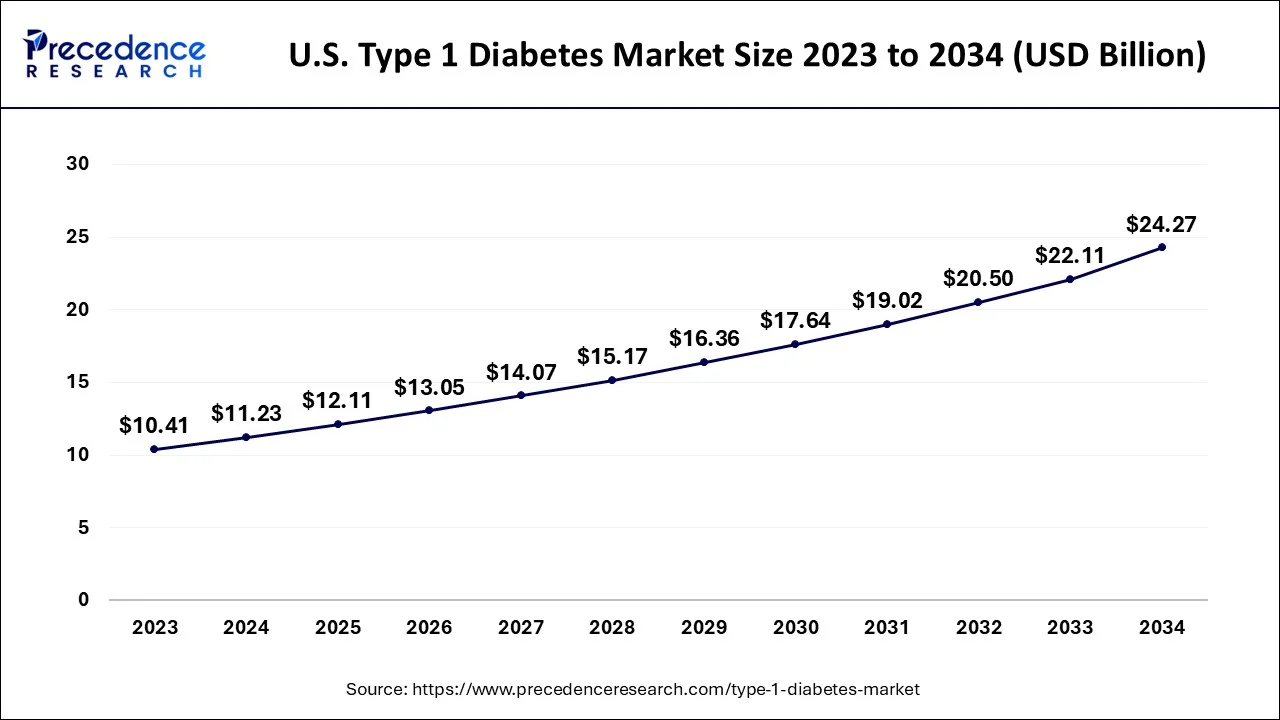

The U.S. type 1 diabetes market size accounted for USD 11.23 billion in 2024 and is anticipated to reach around USD 24.27 billion by 2034, growing at a CAGR of 8% between 2024 and 2034.

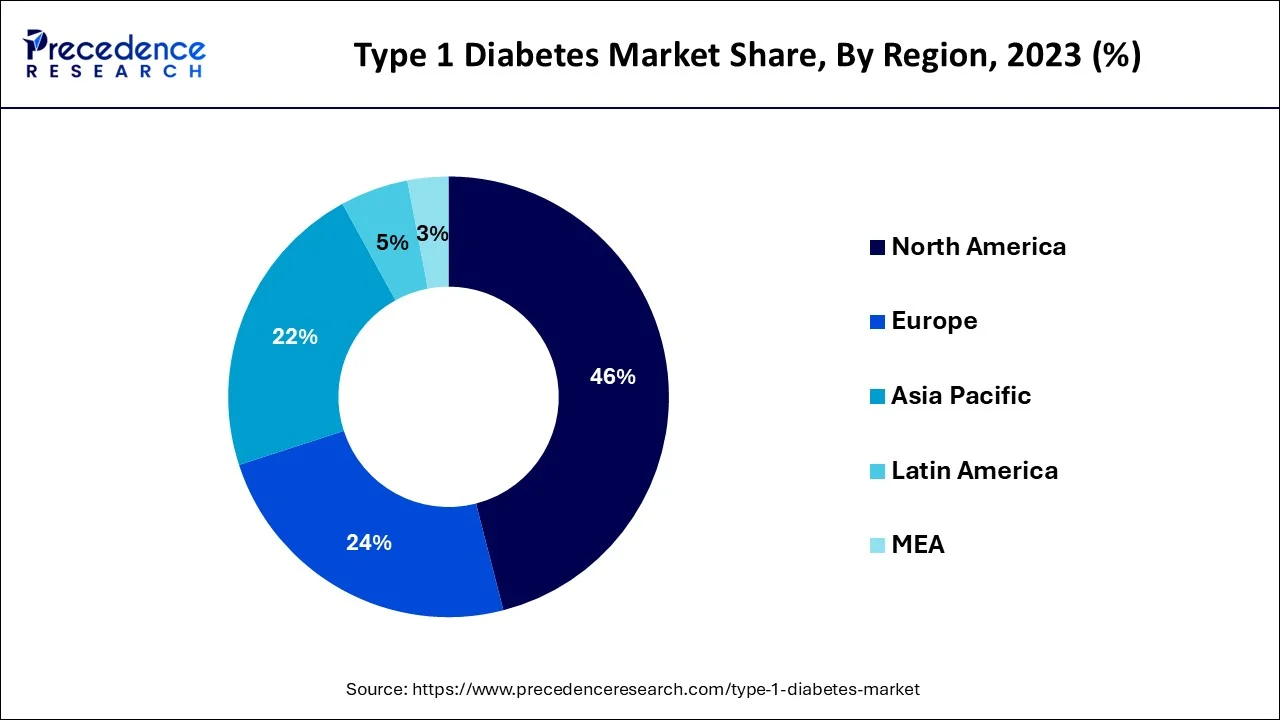

Geographically, North America accounted for the largest revenue share in the global type 1 diabetes market. Increasing patients of type 1 diabetes, including children and adolescents, is a major driving factor for the market in North America. Along with this, the rising participation of major key players in the research and development activities for the invention of new diabetes cures has accelerated the growth of the type 1 diabetes market in North America. Asia Pacific is the fastest growing region in the global type 1 diabetes market owing to the reduced cost of treatment for diabetes.

The rise in consumer spending on healthcare and technological advancements in the healthcare sector has fuelled the growth of the type 1 diabetes market in Europe. Germany is the fastest-growing country in Europe for the type 1 diabetes market due to increasing early checkups for diabetes. The technological advancements in insulin delivery options for type 1 and type 2 diabetic patients have boosted the growth of the type 1 diabetes market in Latin America. Moreover, the developing healthcare infrastructure will likely increase the market's growth during the forecasted period of 2023-2032.

Countries in the Middle East and Africa are experiencing increased type 1 diabetes patients. The oral anti-diabetic drug segment holds the largest revenue share of the type 1 diabetes market in Middle East countries. Along with this, the developing healthcare infrastructure will likely boost the growth of the type 1 diabetes market in Africa.

When a pancreas fails to produce insulin or significantly less insulin, the type of diabetes is considered type 1 diabetes. Type 1 diabetes is a genetic condition known as insulin-dependent diabetes. Type 1 diabetes requires daily corrections to maintain the ideal blood glucose level in the body. Patients with type 1 diabetes are usually provided with insulin. Although type 1 diabetes is less common than type 2 diabetes, nearly 10% of diabetic patients have type 1 diabetes. Type 1 diabetes is mainly diagnosed in children and teenagers.

Frequent urination, extreme thirst, rapid weight loss, and upset stomach are a few significant symptoms of type 1 diabetes. The primary treatment for curing or controlling risks associated with type 1 diabetes is injecting insulin, and the oral route of administration is not applicable for treating type 1 diabetes. The high dependency of type 1 diabetes patients on daily injectable insulin has shown significant growth in the global type 1 diabetes market. The global type 1 diabetes market comprises various vital players, treatments for type 1 diabetes, several end-users, advancements in drugs, and many other factors that propel the growth of the global type 1 diabetes market.

| Report Coverage | Details |

| Market Size in 2024 | USD 34.87 Billion |

| Market Size in 2034 | USD 74.03 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.82% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Largest Revenue Share | North America |

| Segments Covered | By Insulin Analog, By Devices, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The global type 1 diabetes market is projected to grow during the forecast period of 2023-2032, owing to the increasing demand for measures to treat type 1 diabetes. Technological advancement in remote blood glucose monitoring devices is likely to accelerate the growth of the global type 1 diabetes market. Moreover, acquisitions, strategic partnerships, and collaborations by prominent players in the type 1 diabetes market are seen as another driver for the growth of the global type 1 diabetes market. For instance, in July 2021, Eli Lilly & Company announced the acquisition of Promoter Technologies, Inc. This acquisition aims to help Eli Lilly & Company to focus on the advancement of its glucose-responsive insulins. Research & development activities, investments in the innovation of new insulin drugs to treat type 1 diabetes, increased number of license agreements, and approvals for the use of new drugs by administrative bodies are considered driving factors for the market.

The increased risk of type 1 diabetes in children and teenagers rapidly increases the demand for advanced insulin delivery options in the healthcare sector. This factor is a significant driver for the global type 1 diabetes market. Along with this, the rapid adoption of advanced tools and techniques in treating diabetes is likely to propel the growth of the type 1 diabetes market. The global type 1 diabetes market is driven by factors such as the growing adoption of home-care settings by diabetic patients for convenient healthcare, growing funds for drug development, and growing awareness of early checkups for diabetes to prevent risks in the future.

Strict guidelines and regulations for approvals of new insulin/drugs to treat type 1 diabetes hold the market's growth and are seen as a major restraining factor. Potentially dangerous side effects caused by medications for type 1 diabetes hamper the development of the global type 1 diabetes market. The high cost associated with the diagnosis and treatment of type 1 diabetes is a restraining factor for the global type 1 diabetes market.

Covid-19 Impacts

The Covid-19 pandemic forced industries to shut down and governments to impose prolonged lockdowns. The spread of the coronavirus impacted negatively on almost every sector. However, the healthcare sector showed significant growth due to increased admissions of Covid positive patients. Patients with diabetes or other chronic diseases were more vulnerable to coronavirus infection. There has been a substantial decrease in visitors to hospitals or research institutes as people prefer staying at home. Hence it became difficult for doctors to treat diabetes complications. The strictly imposed lockdown has adversely impacted the economy of the type 1 diabetes market in the initial phase due to the disrupted supply chain of drugs, medications, insulin, active pharmaceutical ingredients, and devices required for diabetes treatment. China is one of the biggest manufacturers of insulin pumps used to treat type 1 diabetes. The outbreak of the pandemic disease started in Wuhan, China, negatively affected the supply chain of insulin pumps.

On the other hand, hospital administration and patients with diabetes preferred remote glucose monitoring systems to manage their health data accurately during the lockdown period. The sudden outbreak of coronavirus forced the population to focus on self-health care, which increased the demand for diabetes control drugs, insulin, and tools. Manufacturers continued to develop diabetes control tools owing to the increased demand during the peak period, which offered a significant profit to the global diabetes market. For instance, in May 2020, Tandem company stated that the company is still on profit margin due to increased demand and positive feedback from diabetic patients for their slim x2 electronic insulin pump.

Along with this, during the Covid-19 pandemic, where the invention of a novel drug/vaccine became a need of the hour, the governmental bodies and administration boosted the number of approvals for research and development of new drugs. This helped the type 1 diabetes market grow as multiple prominent pharmaceutical companies got licenses for supplying drugs, insulin, and glucose monitoring systems to treat high-risk diabetic patients properly. For instance, the U.S. Food & Drug Administration, in April 2020, approved Dexcom and Abbott to provide continuous glucose monitoring systems to hospitals. Moreover, the rise in price for diabetes treatment post-Covid-19 pandemic will likely generate profit for the global type 1 diabetes market.

Based on insulin analogs, the type 1 diabetes market is segmented into rapid-acting, short-acting, and long-acting insulin. The rapid-acting insulin analog segment accounts for the highest revenue share in the global type 1 diabetes market. The rapid-acting insulin is widely used in the treatment of type 1 diabetes as compared to type 2 diabetes. The rapid-acting insulin prevents the sharp rise in glucose/sugar levels in the blood after a meal. Rapid-analog insulin is prescribed to be taken before meals to avoid diabetic complications such as ketoacidosis. Patients with type 1 diabetes require a continuous and fast-acting dose of insulin. Thus, in the global type 1 diabetes market, rapid-acting insulin is expected to grow during the forecast period.

Based on devices, the type 1 diabetes market is segmented into an insulin pumps, insulin pens, blood glucose meters, and others. Blood glucose meters are widely used by hospitals, specialty clinics, and home care segments as they provide accurate details of glucose/sugar amount present in the blood. A blood glucose meter comes with a strip and a device that indicates the amount of glucose. The blood glucose meter is the largest segment owing to its easy function and accurate determination of blood glucose targets. Blood glucose meters do not require any skilled professionals; thus, it is widely used by type 1 diabetic patients as a home health care device.

On the other hand, the insulin pump segment is experiencing significant growth in the global type 1 diabetes market. Insulin pumps relieve a diabetic patient by releasing insulin in the required amount and according to the instructions provided by the device. In the modern healthcare sector, insulin pumps are considered an alternative to injections as they offer a continuous stream of insulin with fewer needles. These pumps are programmed and do not require timely attention for insulin delivery. The benefits associated with insulin pumps are projected to grow in the segment in the upcoming years.

Based on end users, the type 1 diabetes market is segmented into hospitals, research institutes, and home care. The hospital segment is the fastest growing segment among all, owing to the increasing prevalence of types of diabetes. Hospitals offer special units for treating type 1 diabetes that ensure proper treatment. The hospital segment for the global type 1 diabetes market has accounted for the largest revenue share due to the advancement in treatment options for type 1 diabetes. Initiatives for accessible or affordable diabetes treatment by several governments implemented in government hospitals have propelled the growth of the type 1 diabetes market. For instance, the National Health Ministry of India has recently started a free drug service for diabetic patients in government hospitals. The free drugs service provides free insulin for poor/low-income populations suffering from diabetes. The reduced cost of treatment and medications in government hospitals has upheld the hospital segment.

Moreover, the home care segment is considered the fastest-growing segment in the global type 1 diabetes market during the post-Covid-19 pandemic. The Covid-19 pandemic accelerated the culture of remote glucose monitoring, which has helped patients and healthcare providers in monitoring patients' blood glucose levels remotely. Considering the cost and time-saving benefits associated with home care for type 1 diabetes, the segment will likely maintain growth from 2024 to 2034.

By Insulin Analog

By Devices

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

July 2024

January 2025