November 2024

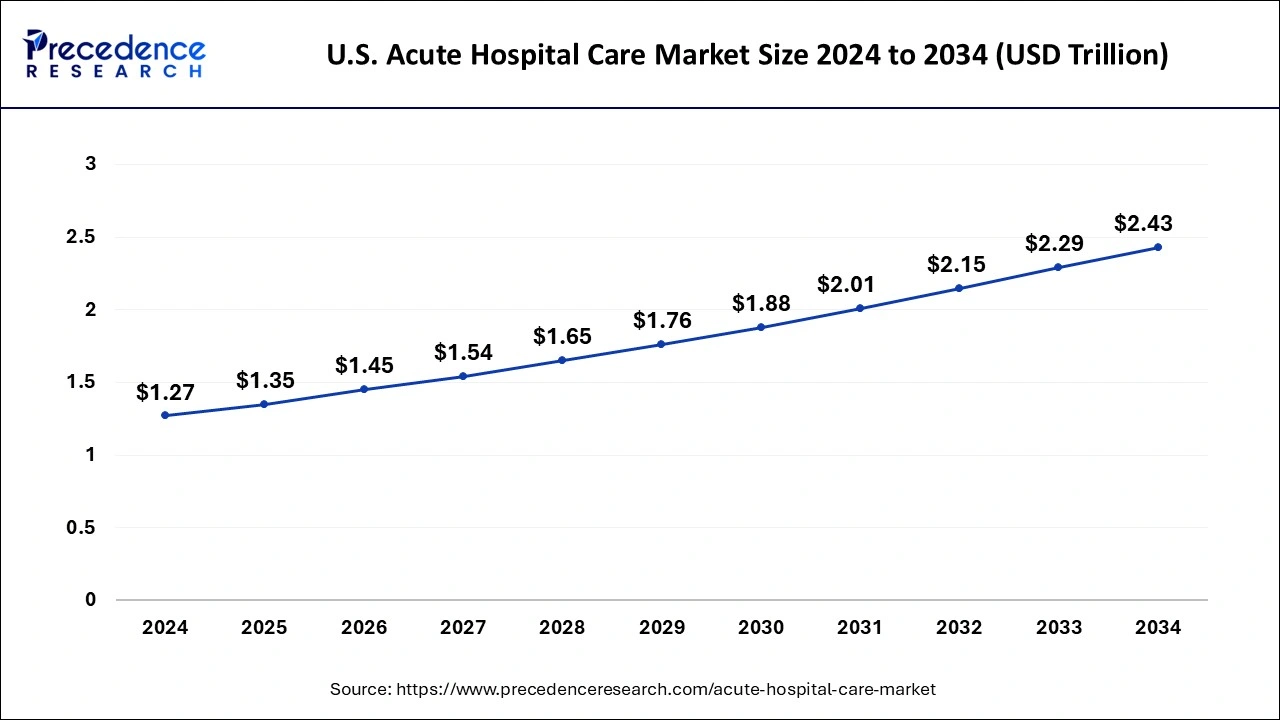

The U.S. acute hospital care market size is calculated at USD 1.35 trillion in 2025 and is forecasted to reach around USD 2.43 trillion by 2034, accelerating at a CAGR of 6.70% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Trillion/Billion), with 2024 as the base year.

The U.S. acute hospital care market size was estimated at USD 1.27 trillion in 2024 and is predicted to increase from USD 1.35 trillion in 2025 to approximately USD 2.43 trillion by 2034, expanding at a CAGR of 6.70% from 2025 to 2034. The rising investment in healthcare infrastructure by the government is driving the growth of the U.S. acute hospital care market.

Acute hospital care is responsible for giving the treatment for immediate and short-term treatment for any type of critical disease, injury, or illness. The acute care hospitals are used to improve the health of the patients. Acute hospital care includes emergency care, urgent care, trauma care, rehabilitative care centers, pediatric and neonatal care units, acute care surgery stations, and psychiatric acute care centers. The increasing prevalence of chronic illness in the population of the United States and the rising number of accidents in the country are driving the demand for emergency healthcare facilities or emergency rooms for treatment and diagnostics. Thus, all these factors are driving the growth of the U.S. acute hospital care market.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.43 Trillion |

| Market Size in 2025 | USD 1.35 Trillion |

| Growth Rate from 2025 to 2034 | CAGR of 6.70% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Medical Condition, Facility Type, Service |

Rising demand for emergency care units

Acute hospital care services include intensive care, emergency services, surgical services, specialized care units, and diagnostics services. It provides a standardized work environment and a process for admission and discharge. Thus, all these factors are driving the growth of the U.S. acute hospital care market.

Acute hospital care includes services like appropriate and on-time treatment, assessment, and diagnosis that minimize the time to stay in the hospital. The rising prevalence of chronic diseases and accidental cases like road accidents, burn cases, and others drives the demand for emergency care units for timely treatment. It enhances the management process, such as patient bed management and smoother patient flow. It also helps decrease the overflow of patients in the emergency department and avoids unnecessary admissions.

Unawareness and affordability issues

The unawareness about acute hospital care in underserved populations, including rural communities, ethnic and racial minorities, and lower-income populations, is restraining the growth of the U.S. acute hospital care market.

Technological advancements

The rising advancement in technology in the medical industry, the rising investment in the development of healthcare facilities, and technological adoption in the healthcare industry are further driving the growth of the U.S. acute hospital care market. The advancements in medical diagnostics tools, devices, surgical procedures, minimally invasive procedures, robotic surgery, personalized therapies, precision medicine, and treatment modalities are driving the growth opportunity for the market.

Additionally, with the rising awareness about the healthcare campaign for addressing population health management, healthcare facilities are collaborating with community partners to manage the preventive care program that helps in improving health outcomes and lower overall expenditure on healthcare and reducing healthcare disparities that, further contributing to the growth of the U.S. acute hospital care market.

The emergency care segment dominated the U.S. acute hospital care in 2024. The rising accidental cases, heart stroke, depression, dementia, and other age-related issues in the geriatric population are driving the demand for emergency care units. Emergency care units provide medication for patients with life-threatening medical conditions.

The demand for emergency care hospitals in the United States is driven by the increasing geriatric population and the prevalence of communicable diseases. Life-threatening conditions such as stroke, heart attack, severe bleeding, difficulty in breathing, poisoning, acute abdominal pain, severe allergic reactions, broken bones, and lacerations are further contributing to the demand for emergency care services in the U.S. acute hospital care market.

The general acute facilities segment held the largest share of the U.S. acute hospital care market in 2024. General acute care involves the short-term treatment of conditions like illness, injuries, emergency needs, and recovery after surgery requirements. Acute care hospitals are responsible for urgent healthcare support for any type of eventuality, including widespread illness, natural disasters, epidemics, and accidents. It actively helps in saving lives and prevents disabilities in patients.

There are several types of general acute care, including emergency care, urgent care, trauma and acute surgery, pre-hospital care, short-term stabilization, and critical intensive care. It is also considered secondary health care, and it is more advanced than primary care because it involves urgent care specialists, healthcare workers, trauma specialists, and other healthcare providers.

The ICU segment dominated the U.S. acute hospital care market in 2024. The increasing demand for intensive, round-the-clock monitoring of patients is driving the demand for the ICU segment. ICU units are well-equipped with life-saving medical equipment, surgical processes, and well-trained professionals.

The ICU segments provide the benefits of shorter ICU stay, reduced mortality rates, shorter duration of mechanical ventilation, decreased incidence of renal failure, reduced arrhythmias and hypotensive episodes, increased cases of central venous and pulmonary artery catheterizations, less consultation required, and reduced number of arterial blood-gas analyses.

By Medical Condition

By Facility Type

By Service

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

September 2024

January 2024

February 2025