January 2025

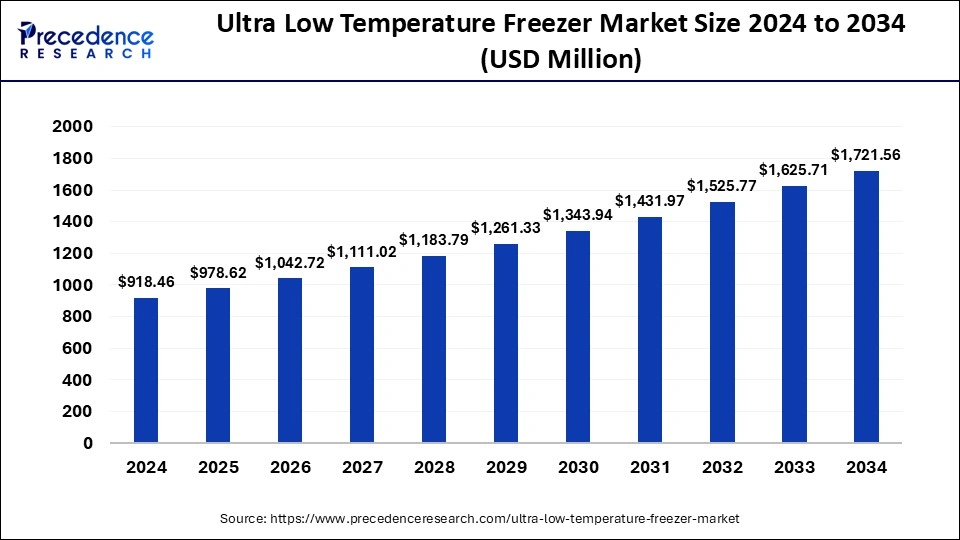

The global ultra low temperature freezer market size accounted for USD 978.62 million in 2025 and is forecasted to hit around USD 1,721.56 million by 2034, representing a CAGR of 6.48% from 2025 to 2034. The North America market size was estimated at USD 413.31 million in 2024 and is expanding at a CAGR of 6.61% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global ultra low temperature freezer market size accounted for USD 918.46 million in 2024 and is predicted to increase from USD 978.62 million in 2025 to approximately USD 1,721.56 million by 2034, expanding at a CAGR of 6.48% from 2025 to 2034.

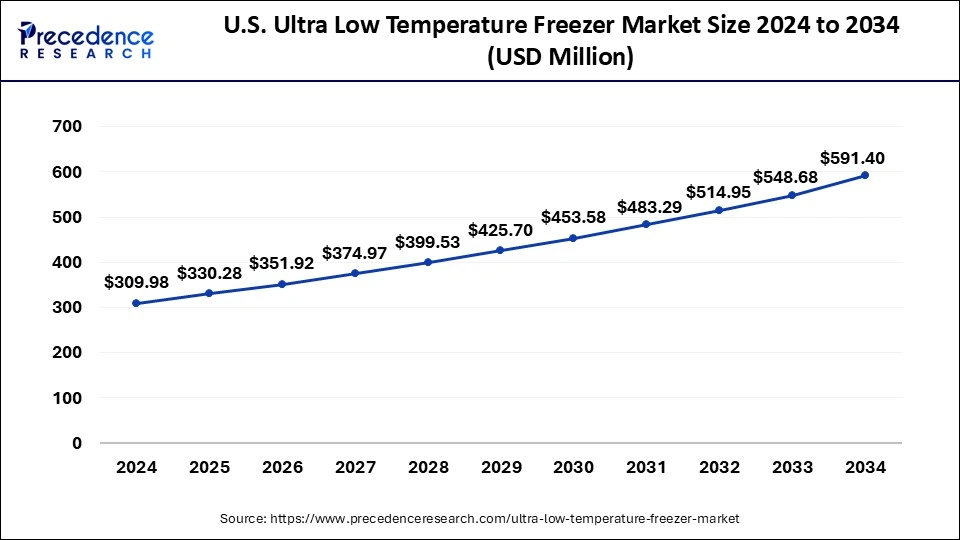

The U.S. ultra low temperature freezer market size was exhibited at USD 309.98 million in 2024 and is projected to be worth around USD 591.40 million by 2034, growing at a CAGR of 6.69% from 2025 to 2034.

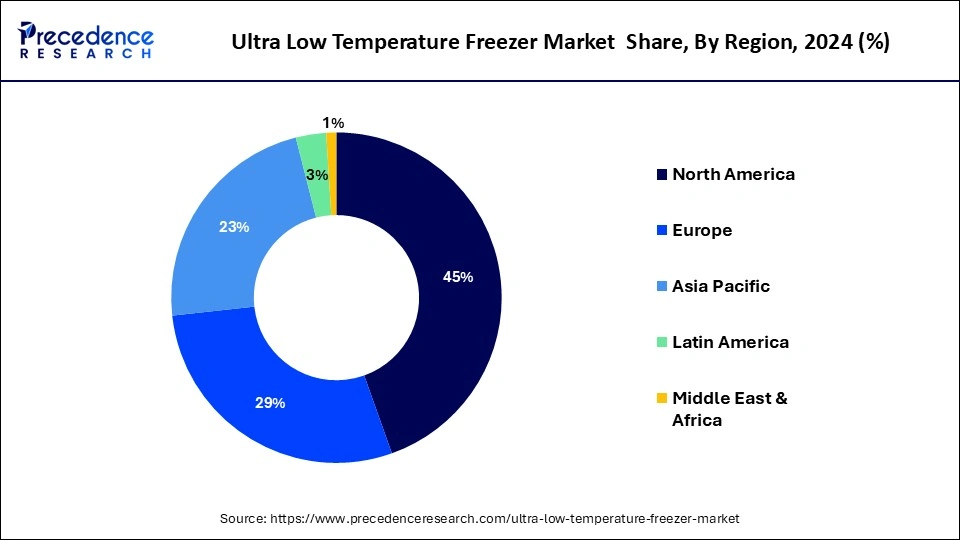

North America held the largest share of 45% in 2024, the ultra low temperature freezer market due to advanced healthcare infrastructure, robust research and development activities, and a high prevalence of biopharmaceutical companies. The region's strong focus on biopharmaceutical research, especially in the United States and Canada, drives the demand for ultra low temperature Freezers. Additionally, the presence of key market players, strategic investments in healthcare, and a proactive approach to adopting innovative technologies contribute to North America's dominance in this market.

Asia-Pacific is poised for rapid growth in the ultra low temperature freezer market due to expanding healthcare infrastructure, rising biopharmaceutical research, and increasing awareness of the importance of precise sample storage. The region's growing investment in research and development, coupled with rising demand for vaccines and biologics, fuels the need for advanced cold storage solutions. Additionally, the escalating prevalence of chronic diseases and infectious outbreaks further amplifies the demand for Ultra Low Temperature Freezers in the Asia-Pacific region, making it a key area for market expansion.

Meanwhile, Europe is experiencing notable growth in the ultra low temperature freezer market due to several factors. The region's increasing focus on advanced medical research, particularly in vaccine development and personalized medicine, has led to a rising demand for these freezers. Additionally, stringent regulations regarding the storage and transportation of biological materials have propelled the adoption of Ultra Low Temperature Freezers. The region's commitment to healthcare infrastructure development, coupled with the ongoing COVID-19 vaccination efforts, has further intensified the need for reliable storage solutions, contributing to the market's significant growth in Europe.

The ultra low temperature freezer market offers specialized devices designed to maintain extremely low temperatures, typically ranging from -40°C to -86°C or even lower. It is widely used in various scientific and medical settings to store sensitive biological materials such as vaccines, enzymes, and genetic samples. These freezers play a crucial role in preserving the integrity of these substances by preventing any degradation or loss of activity. The ultra-low temperatures slow down molecular and chemical processes, ensuring the long-term stability of stored samples. Researchers, healthcare professionals, and laboratories rely on these freezers to safeguard valuable specimens, allowing for extended storage durations without compromising the quality of the materials. The precise temperature control and reliable performance of ultra low temperature freezers make them indispensable tools in industries where maintaining the viability and functionality of biological samples is of utmost importance.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,721.56 Million |

| Market Size in 2025 | USD 918.46 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.48% |

| Leading Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expanding biobanking activities

The Integrated Biorepository of H3Africa Uganda (IBRH3AU) equipped with 20 ultra-low temperature freezers reflects the expanding biobanking infrastructure.

The surge in expanding biobanking activities significantly boosts the growth of the ultra low temperature freezer market. Biobanks, which store and manage various biological samples like tissues, blood, and DNA, play a pivotal role in advancing medical and genetic research. As biobanking activities expand globally, the need for reliable preservation of these sensitive biological materials also grows. Ultra low temperature freezers provide the necessary conditions to maintain the long-term viability and integrity of stored samples. With the increasing emphasis on genomic and personalized medicine research, biobanks require ultra-low temperature storage to ensure the stability of specimens. The heightened demand for ULT freezers is, therefore, a direct result of the expanding biobanking landscape, as researchers and healthcare professionals rely on these specialized freezers to safeguard and maintain the quality of crucial biological samples for ongoing and future studies.

Alternative storage solutions

The ultra low temperature freezer market faces restraints due to the emergence of alternative storage solutions. Advances in cryopreservation and the use of dry ice present cost-effective alternatives for specific applications, challenging the dominance of ULT freezers. These alternatives, often considered more economical, can restrain market growth, particularly in sectors where budget constraints are a significant concern. Moreover, the adoption of alternative storage solutions is driven by environmental considerations. Cryopreservation methods, for example, may be viewed as more environmentally friendly compared to the high energy consumption associated with ULT freezers. As industries seek sustainable practices, the perceived environmental impact of ultra low temperature Freezers becomes a factor that restrains their market demand, prompting a shift towards alternative storage solutions that align with more eco-conscious practices.

Global health security initiatives

Global health security initiatives are creating significant opportunities for the ultra low temperature freezer market. As the world grapples with the challenges posed by pandemics and infectious diseases, governments and organizations are prioritizing the development of robust vaccine distribution networks. ultra low temperature freezers play a crucial role in this landscape by providing the necessary infrastructure for storing vaccines at extremely low temperatures, ensuring their efficacy and safety.

The demand for ultra low temperature freezers has surged as a result of these initiatives, leading to increased investments in healthcare infrastructure. Governments worldwide are focusing on enhancing their cold chain capabilities to respond effectively to health emergencies. This presents a substantial opportunity for manufacturers and suppliers in the ultra low temperature freezer market to contribute to global health security efforts by providing reliable and efficient storage solutions, fostering growth and market expansion in the process.

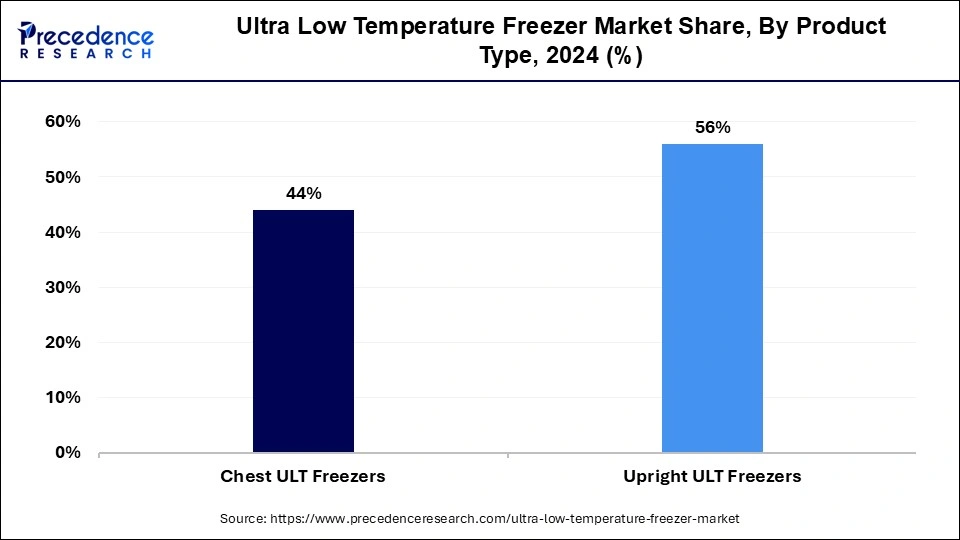

The upright ULT freezers segment held the highest market share of 56% in 2024. Upright Ultra Low Temperature (ULT) Freezers, a segment in the ultra low temperature freezer market, are vertically oriented units designed for efficient storage of temperature-sensitive materials. These freezers offer easy access to samples and are commonly used in laboratories and healthcare settings. A trend in this segment includes advancements in technology, such as improved insulation and energy efficiency, ensuring precise temperature control. The demand for upright ULT freezers is driven by their convenient design, making them a preferred choice for organizations involved in biopharmaceutical research and storage of valuable biological specimens.

The chest ULT freezers segment is anticipated to witness rapid growth at a significant CAGR of 7.9% during the projected period. Chest ultra low temperature (ULT) freezers are a type of storage equipment characterized by a horizontal configuration. These freezers are designed to reach and maintain extremely low temperatures, typically ranging from -40°C to -86°C, ensuring the preservation of temperature-sensitive biological materials. In the ultra low temperature freezer market, the chest ULT freezer segment is witnessing a trend towards increased adoption due to its efficient use of space and improved insulation properties. These freezers are favored for their low heat emission and energy efficiency, contributing to their growing popularity in various research and healthcare settings.

According to the end-user, the academic and research laboratories segment has held a 35% market share in 2024. The academic and research laboratories segment in the ultra low temperature freezer market refers to educational institutions and research facilities using these freezers to preserve biological samples. A key trend in this segment is the increasing demand for ultra low temperature freezers to support diverse research activities, including genomics, drug discovery, and vaccine development. As academic and research laboratories continuously expand their studies, the need for reliable and efficient storage solutions is driving the adoption of ultra low temperature freezers in this dynamic and growing market segment.

The bio-banks segment is anticipated to witness rapid growth over the projected period. In the ultra low temperature freezer market, the biobanks segment refers to institutions responsible for storing and managing various biological samples, including tissues, blood, and DNA, for research purposes. A key trend in this segment is the increasing adoption of ultra low temperature Freezers to preserve the integrity of these sensitive biological materials. As biobanking activities expand globally, the demand for reliable and precise storage solutions grows, driving the market's focus on delivering advanced ultra low temperature freezers tailored to the unique requirements of biobanks.

By Product Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

August 2024

August 2024