January 2025

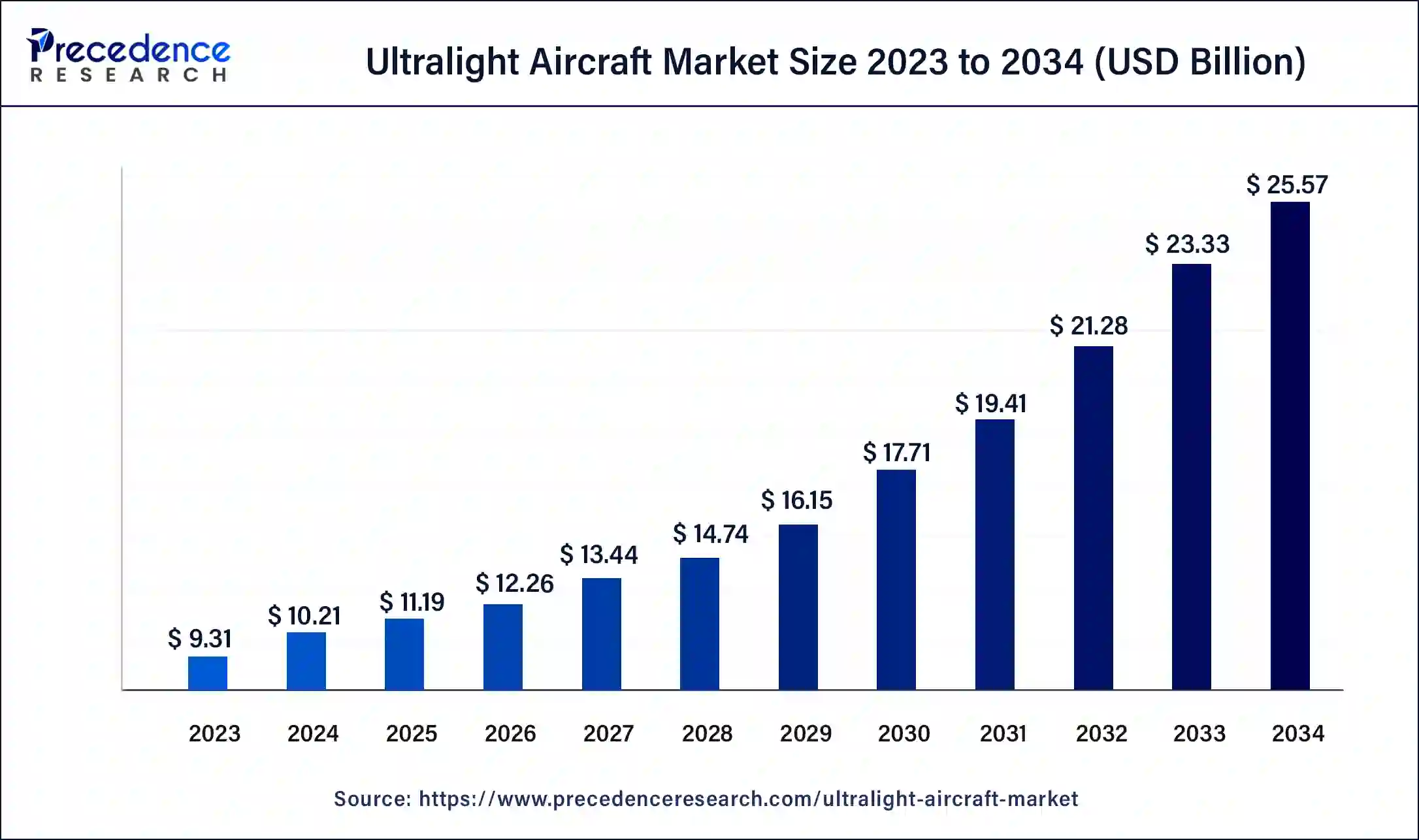

The global ultralight aircraft market size surpassed USD 9.31 billion in 2023 and is estimated to increase from USD 10.21 billion in 2024 to approximately USD 25.57 billion by 2034. It is projected to grow at a CAGR of 9.62% from 2024 to 2034.

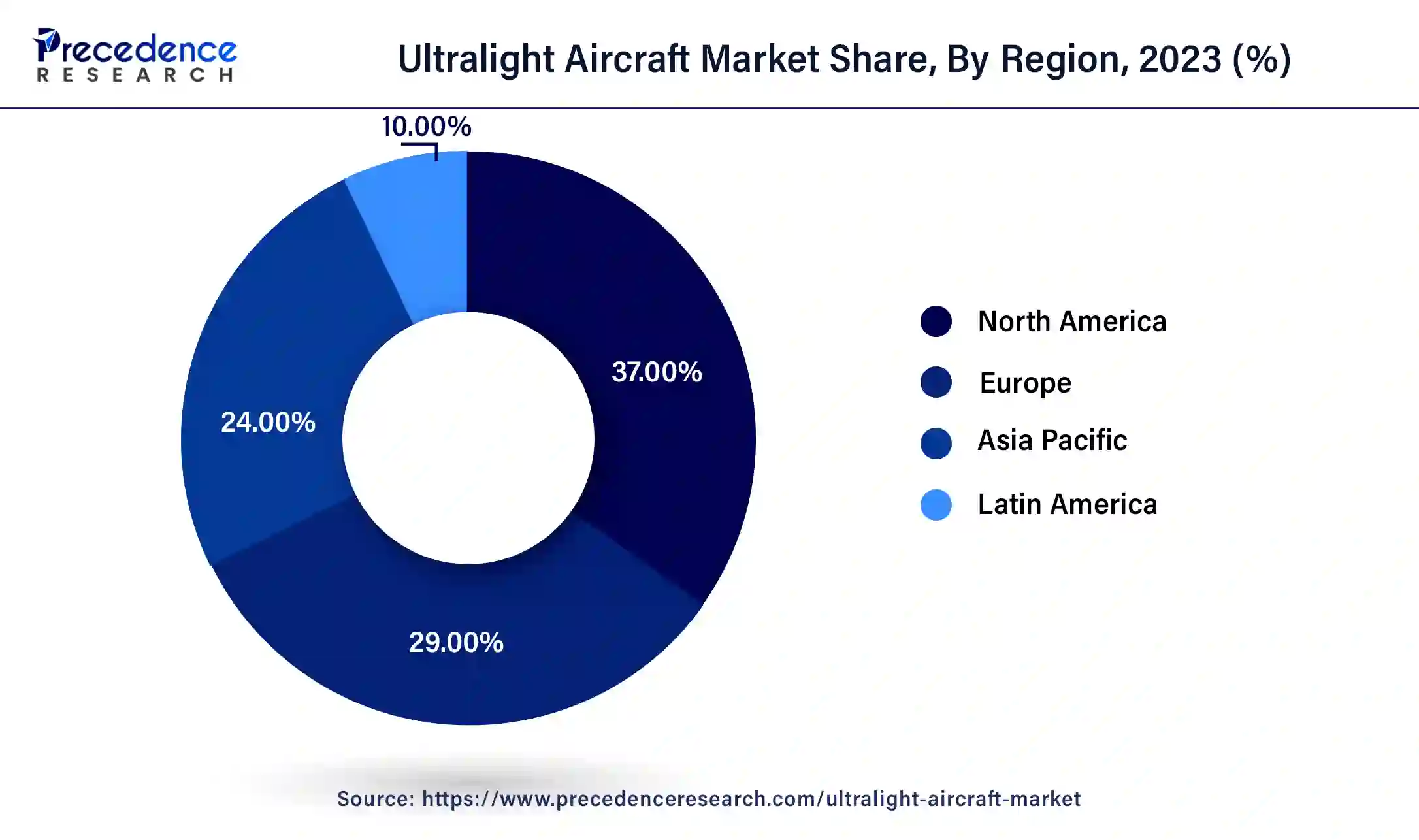

The global ultralight aircraft market size is projected to be worth around USD 25.57 billion by 2034 from USD 10.21 billion in 2024, at a CAGR of 9.62% from 2024 to 2034. The North America ultralight aircraft market size reached USD 3.44 billion in 2023. The growing demand for recreational aviation along with liberal regulatory control and rules around ultralight aircraft has led to growth in the ultralight aircraft market.

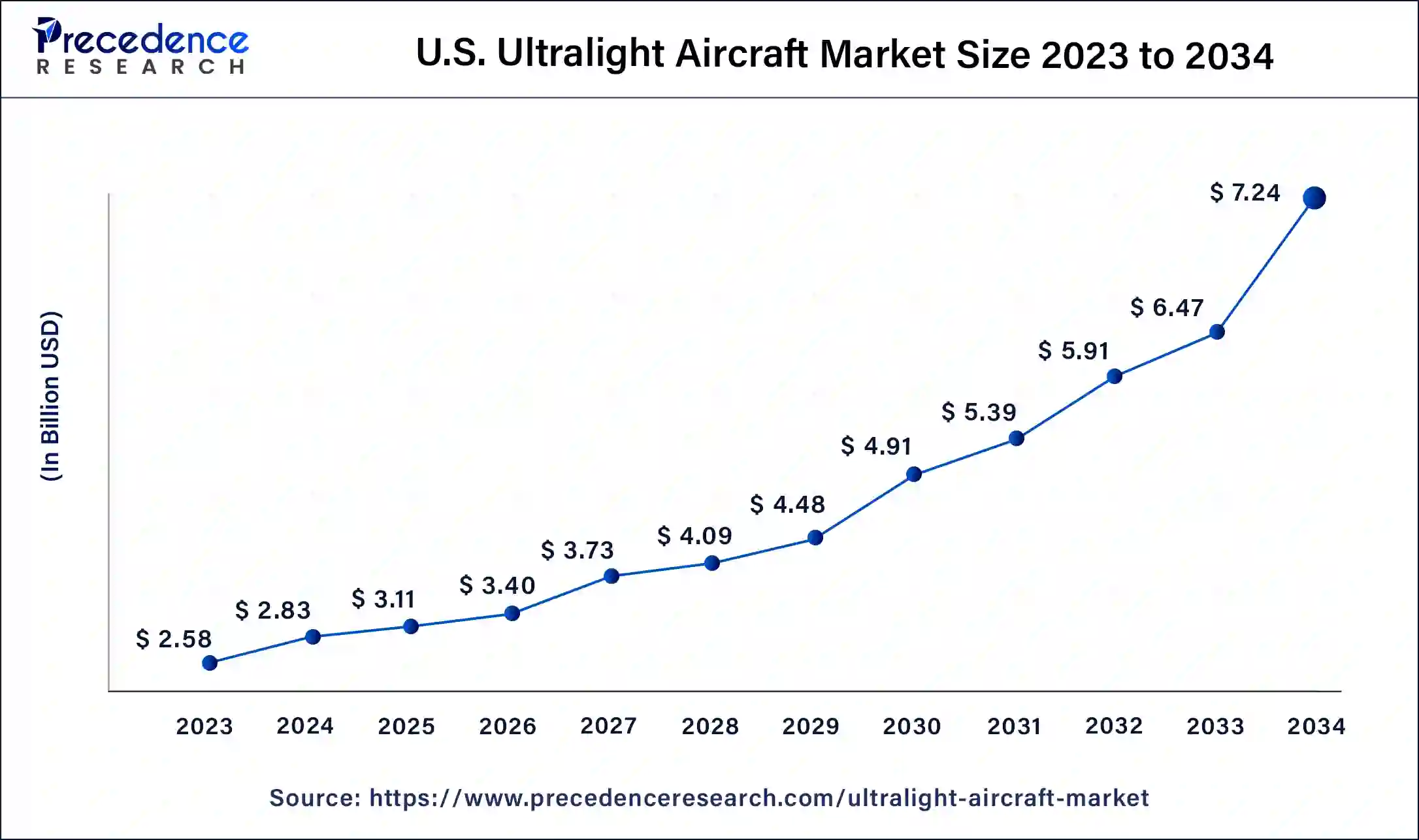

The U.S. ultralight aircraft market size was exhibited at USD 2.58 billion in 2023 and is projected to be worth around USD 7.24 billion by 2034, poised to grow at a CAGR of 9.83% from 2024 to 2034.

North America dominated the ultralight aircraft market in 2023. The region has liberal regulations when it comes to ultralight aircraft, which has led to their popularity. The United States Federal Aviation Administration leverages very few restrictions on the operation of such planes. These aircraft do not require certifications and are not required to meet the airworthiness certification standards specified for aircraft.

Individuals piloting these crafts are not required to meet any aeronautical knowledge, age, or experience requirements or to have airman or medical certificates, and the vehicles do not need to be registered or carry any registration markings. These lax restrictions, coupled with the growing popularity of recreational aviation in the region, have led to high demand in the market.

Asia Pacific is set to host the fastest-growing ultralight aircraft market during the forecast period. Countries such as India and China are rapidly developing aircraft infrastructure for tourism, connectivity, and healthcare purposes. China also plans to incorporate short-distance general aviation transportation into the national transportation system by the end of 2025 to meet the needs of air traffic in small and medium-sized cities, as well as remote areas.

Ultralight aircraft refers to lightweight airplanes with very low power consumption, which are flown for sports and recreational purposes. However, advanced models are being used for pilot training and patrolling and are being explored in a limited combat role. Ultralight aircraft started as hang gliders modified for power by installing small engines. Newer ultralight aircraft are designed with light, modern materials, such as Nanocomposites, and come equipped with relatively powerful but light engines.

Different aviation bodies across the globe have varied definitions of what is considered an ultralight aircraft and, thus, slightly altered regulatory requirements. Definitions vary according to the maximum permitted weight of the craft, altitude restrictions, and the presence of parachutes. The ultralight aircraft market encompass a wide category of crafts, including lighter-than-air powered airships, powered fixed-wing crafts, powered parachutes, powered and unpowered gliders, and trikes.

Demand in the ultralight aircraft market is driven by high disposable incomes, especially in established economies, and a growing interest in recreational aviation. Technological advances such as innovations in material science and the development of sustainable ultralight aircraft with hybrid and electric power options are opportunities for growth in space. However, high initial costs and disruptions in the global aviation supply chains hinder the market.

How artificial intelligence is transforming the ultralight aircraft market

Artificial intelligence is bringing technological breakthroughs across industries, including aerospace and defense, robotics, metals and mining, navigation, and material fabrication. Nanotechnology has led to the creation of several new lightweight materials that are being adopted into the aerospace industry, including the production of ultralight aircraft. The integration of AI with nanotechnology in the ultralight aircraft market has led to several benefits in material design, the development of new products, and optimization of the fabrication process.

Nanotechnology offers unprecedented precision in fabrication and unique properties to materials, including exceptional strength, electrical conductivity, mechanical and thermal stability, and resistance, making them apt for applications in aerospace engineering. AI-based technologies, such as generative design algorithms, are also used to create innovative and lightweight models for the ultralight aircraft market.

| Report Coverage | Details |

| Market Size by 2034 | USD 25.57 Billion |

| Market Size in 2023 | USD 9.31 Billion |

| Market Size in 2024 | USD 10.21 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.62% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Propulsion, Takeoff, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing income and interest in recreational aviation

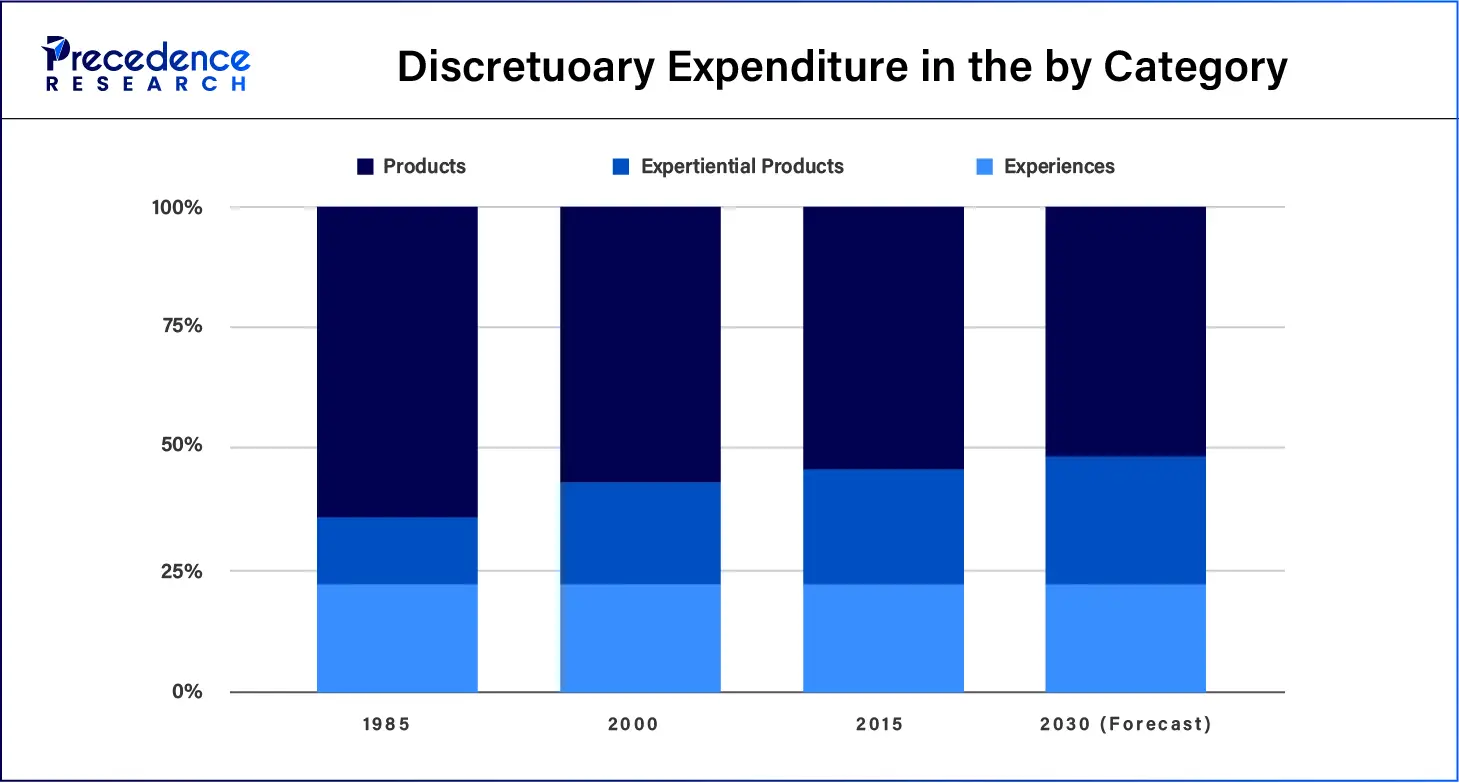

Rising disposable income is driving higher leisure spend throughout established economies such as the United States and European countries. Similarly, in the ultralight aircraft market, emerging macro drivers in the leisure economy include valuing experiences above things, widespread use of social media, and expanding free time.

A rise in recreation spending was also reflected in emerging economies such as India and China. According to the International Trade Administration, growth prospects in China remain strong in aviation segments, including short-distance commuting, tourism, leisure and sports, and pilot training. A rise in leisure spending across the world coupled with increased awareness about recreational aviation and access to training has led to consumers increasingly using smaller, personal ultralight and light aircraft in the ultralight aircraft market.

Regulatory support in several countries

The rules and regulations surrounding ultralight aircraft tend to be quite relaxed in several countries, including Australia, the Philippines, the United States, and the United Kingdom. In the United States, one of the biggest ultralight aircraft markets, a user is not required to register their craft, nor is the pilot required to have a pilot's certificate. The United States Federal Aviation Administration has put minimal restrictions on the operation of ultralight aircraft, including limiting flights to the daytime, a maximum of five gallons of fuel, yielding right-of-way to all other aircraft, and restricting flight over controlled airspace.

High initial costs and safety concerns

In countries with regulations around flying ultralight aircraft, individuals need to invest a substantial amount of time and money in pilot training and obtaining a license. The cost of the ultralight aircraft market products also tends to be prohibitive, with the cheapest options available at an up-front cost of USD 8,000 to USD 15,000. The crafts also need to be maintained regularly, adding further to the price tag.

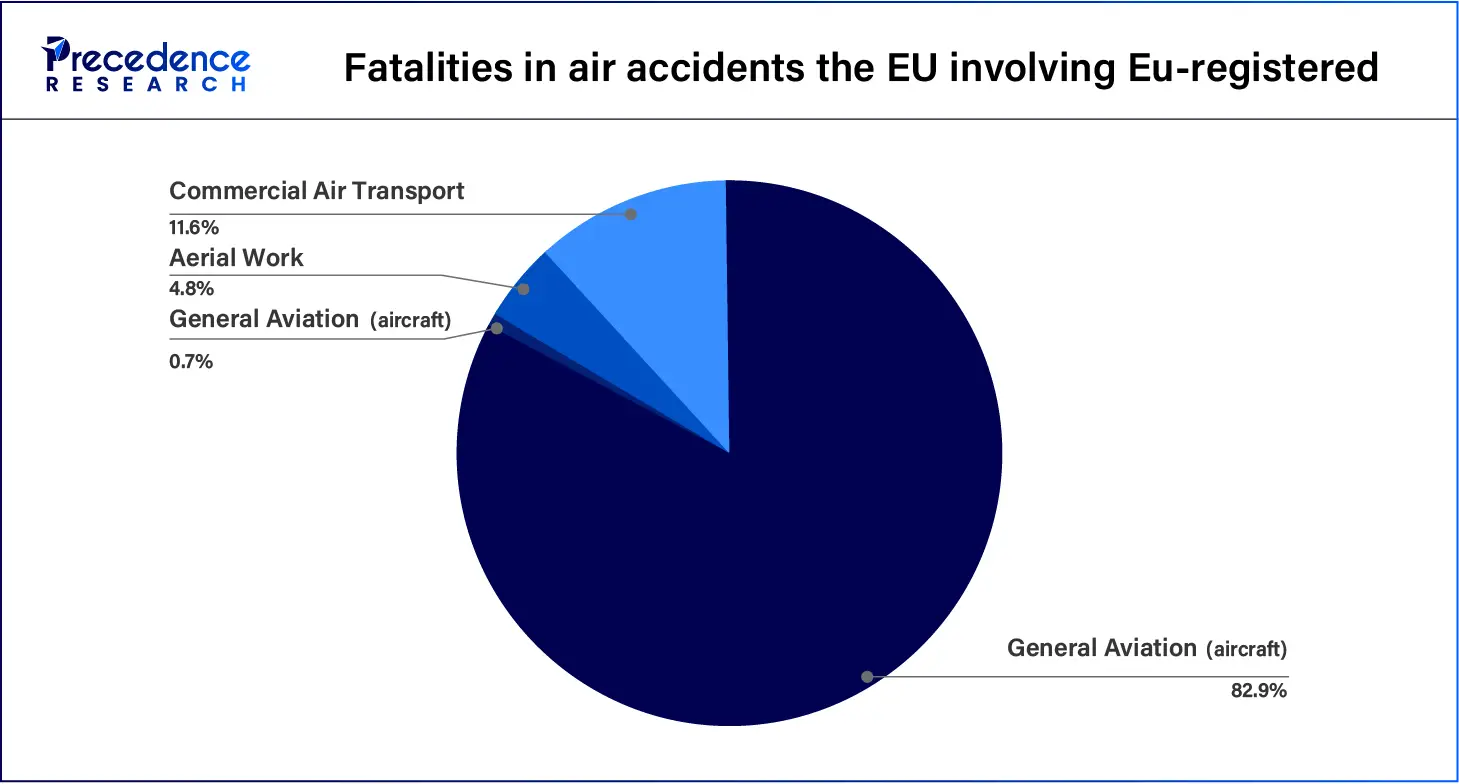

The high time and monetary cost of engaging in recreational aviation using these crafts poses a restriction on growth in the ultralight aircraft market. In countries where regulations on ultralight aircraft are relaxed and individuals do not require a license or prior training to operate these craft, there are concerns about safety and security.

Disruptions in global supply chains

Just as the global aviation industry is recovering from a massive slowdown during the COVID-19 pandemic, supply chain disruptions continue in the sector, and suppliers to aerospace manufacturers face uncertainties with parts suppliers. Major plane producers and original equipment manufacturers, responsible for a sizeable portion of spare parts, decreased their output due to lower demand.

Manufacturers currently do not have enough spare parts to fulfill their existing commitments, so the number ending up in the aftermarket remains limited. Over 85% of the disruptions originated at third-party factories, plants, and warehouses, feeding into the supply chains. Recovery will depend on granting licenses to create more capacity in the system.

Technological developments in terms of materials like nanoparticles

Innovations in aircraft design, propulsion, and manufacturing will drive down the costs of purchasing and operating ultralight aircraft. Technological advancements like the developments in autonomous aircraft improved flight pathing, cloud services, and digital tools would further boost the reliability of these crafts. For instance, increasing the use of precision GPS over traditional instruments and landing systems will allow access to smaller airstrips and airports, increasing the overall accessibility of these crafts. Nanotechnology-based materials like this have the potential to revolutionize the ultralight aircraft market.

Rising sustainability via hybrid and electric-power aircraft

The aviation industry is notorious for its high environmental cost, with a 4% share in anthropogenic global warming. Green initiatives and policies across the world look to lower the climate impact of the industry with regulations around fuel use and mandates on emission reductions. The increasing emphasis on sustainable aviation will lead to rising demand in the ultralight aircraft market. Their lightweight design aligns well with reducing fuel emissions and lowering the environmental impact of aviation, attracting environmentally conscious individuals who partake in recreational aviation.

Developments like hydrogen-powered, electric, and hybrid ultralight aircraft are some of the sustainability initiatives in this industry. According to a position paper by Europe Air Sports, fuel consumption for powered flying has improved significantly over the past date, especially in ultralight aircraft (up to two seats).

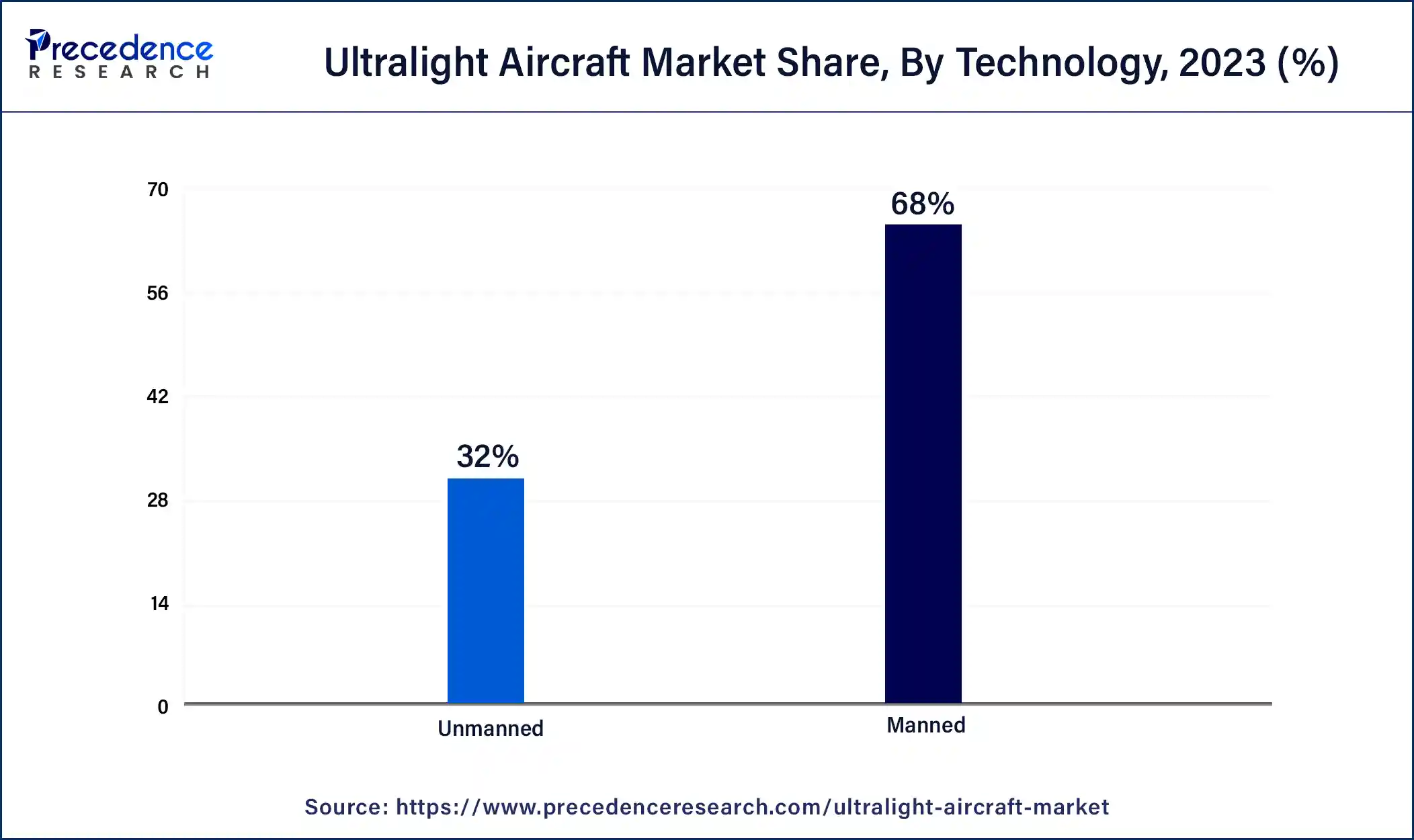

The manned segment dominated the ultralight aircraft market in 2023. Manned ultralight aircraft have a human pilot controlling the craft. Manned aircraft are most widely used today, especially in ultralight aircraft, where command and control are important and policy restrictions exist. The popularity of manned aircraft is attributed to the demand for recreational flying, pilot training, and some agricultural applications that require human control.

The unmanned segment is expected to grow at the fastest rate in the ultralight aircraft market during the forecast period of 2024 to 2033. Unmanned aircraft have seen significant adoption in agriculture, defense, surveying mapping, and surveillance. Unmanned crafts are popularly used in the military, especially in areas where there is a threat to human safety. Advances in autonomous vehicle technology and AI will likely lead to the advent of fully functional autonomous aircraft in a few years. As of 2024, U.S.-based aerospace manufacturer Wisk Aero has made significant headway towards the first fully autonomous flight with its Generation 6 eVTOL. The company is working towards certification of autonomous aircraft by the end of the decade.

The conventional propulsion segment made up the largest share of the ultralight aircraft market in 2023. Most ultralight aircraft in operation currently use conventional propulsion. Ultralight aircraft tend to have small engines to fit within the weight restrictions in countries of operation. With hybrid and electric engines currently in a nascent stage of development, conventional engines still dominate the ultralight aircraft market.

The electric & hybrid segment is projected to expand rapidly in the ultralight aircraft market in the coming years. Growth in the segment is driven by a demand for environmentally friendly aircraft and technological advances in the development of electric VTOLs and UAVs.

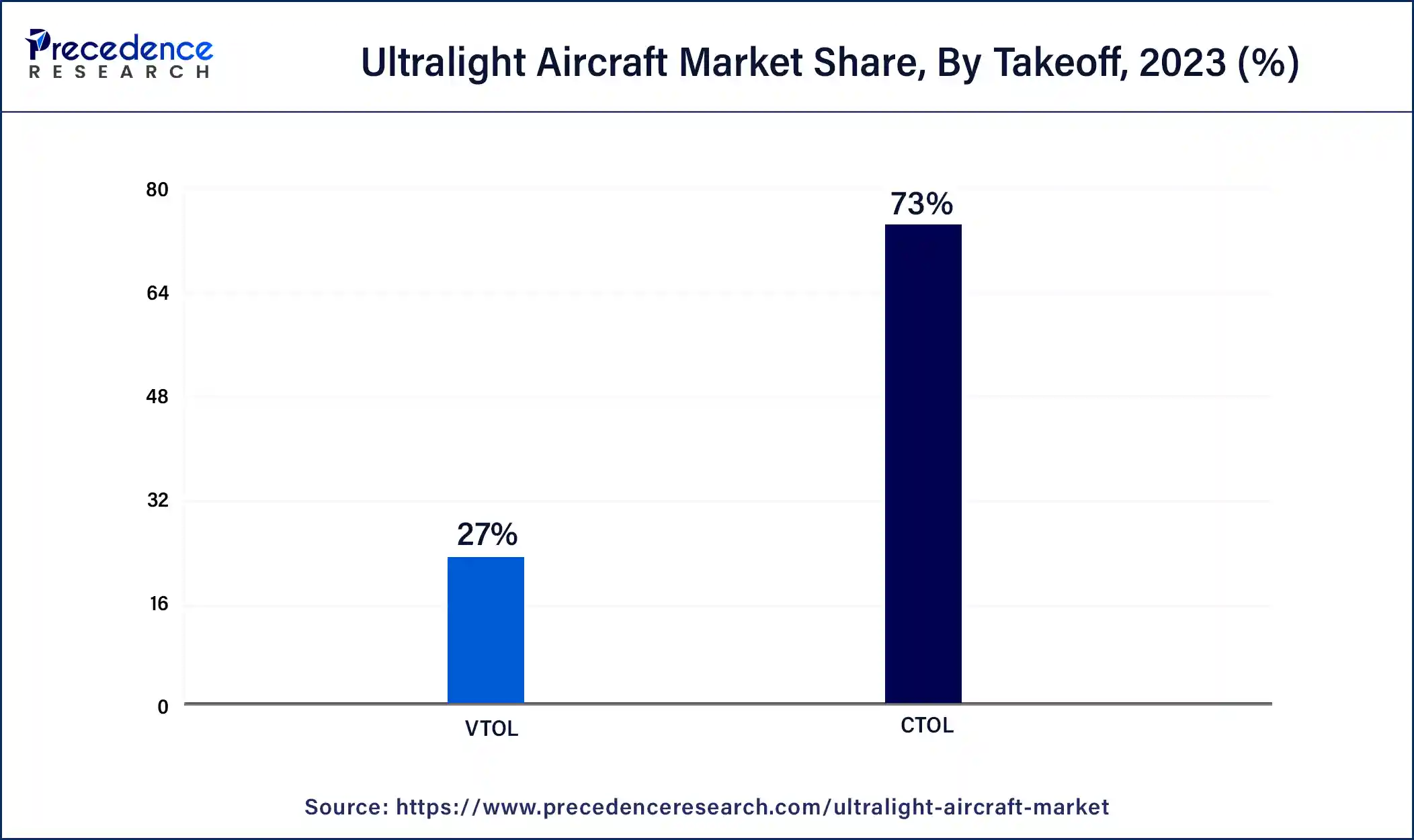

The CTOL segment led the global ultralight aircraft market in 2023. CTOLs are fixed-wing aircraft that need some sort of airstrip or runway to take off. CTOL aircraft are energy efficient, can attain higher altitudes, and cover significant distances compared to their counterparts. These characteristics make CTOLs popular in the market.

The VTOL segment is set to register significant growth in the ultralight aircraft market during the forecast period. VTOLs are rotary-wing aircraft that do not require runways to take off. They can hover and have high maneuverability. Despite these advantages, their high energy consumption, limited speed, and altitude make them less popular than CTOLs. However, new developments in the eVTOLs segment are propelling growth in the market.

The civil & commercial segment registered its dominance over the global ultralight aircraft market in 2023. Ultralight aircraft have the capacity for one or two people and are used to fly short distances, making them popular for sports and recreational activities. Their characteristics, especially short-flying distances, make them popular in the tourism industry.

The military segment will gain a significant share of the ultralight aircraft market over the studied period of 2023 to 2033. Ultralight aircraft are used in both urban and open warfare in the defense sector. In countries like the United States, the military has been taking an interest in eVTOLs.

Segments Covered in the Report

By Technology

By Propulsion

By Takeoff

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

January 2025

January 2025