January 2025

Unified Communication as a Service Market (By Industry Vertical: Automotive, Education, Healthcare, BFSI, Hospitality, Real Estate, Legal, IT & Telecom, Others; By Deployment: Public Cloud, Private Cloud) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

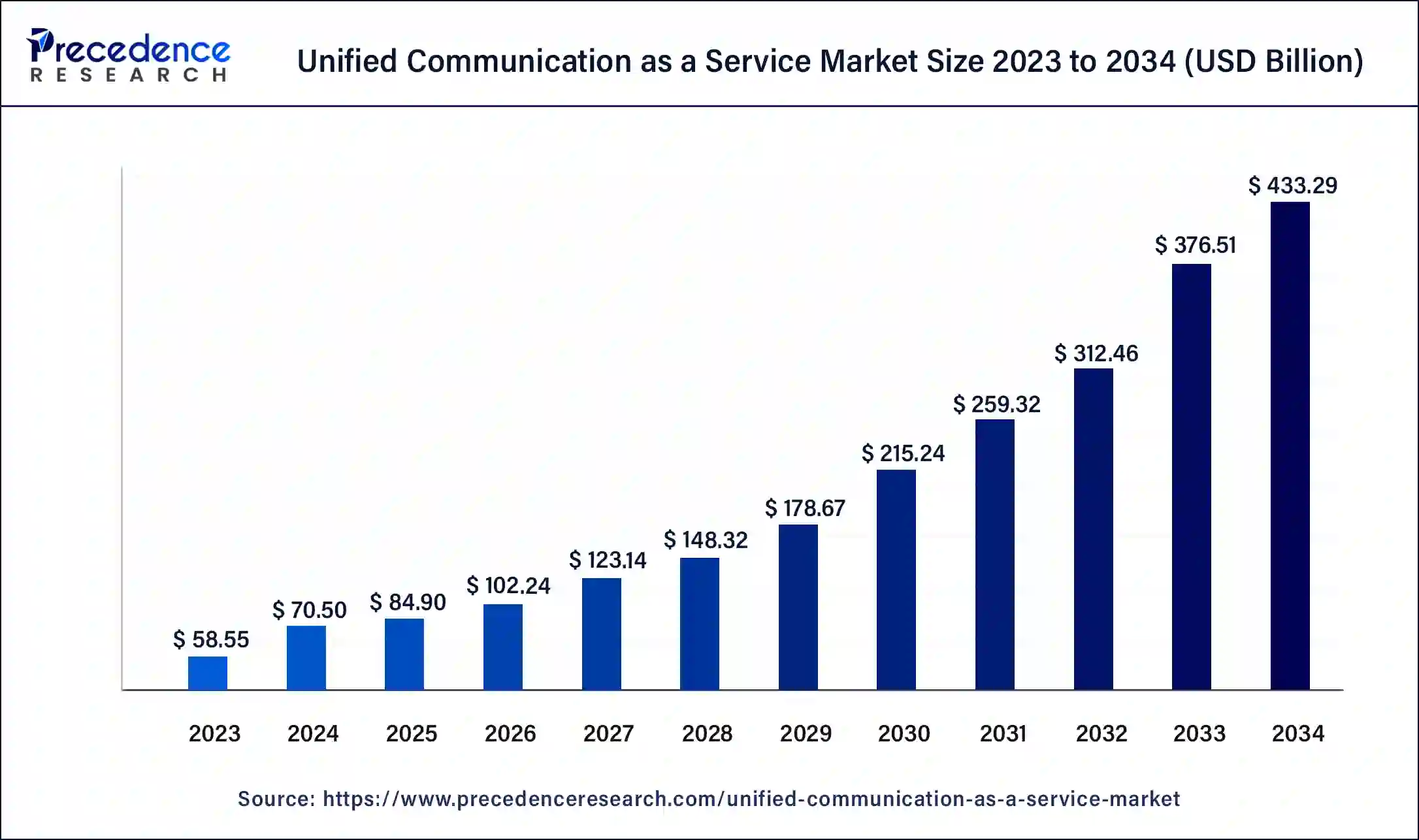

The global unified communication as a service market size was USD 58.55 billion in 2023, calculated at USD 70.50 billion in 2024 and is expected to reach around USD 433.29 billion by 2034, expanding at a CAGR of 18% from 2024 to 2034.

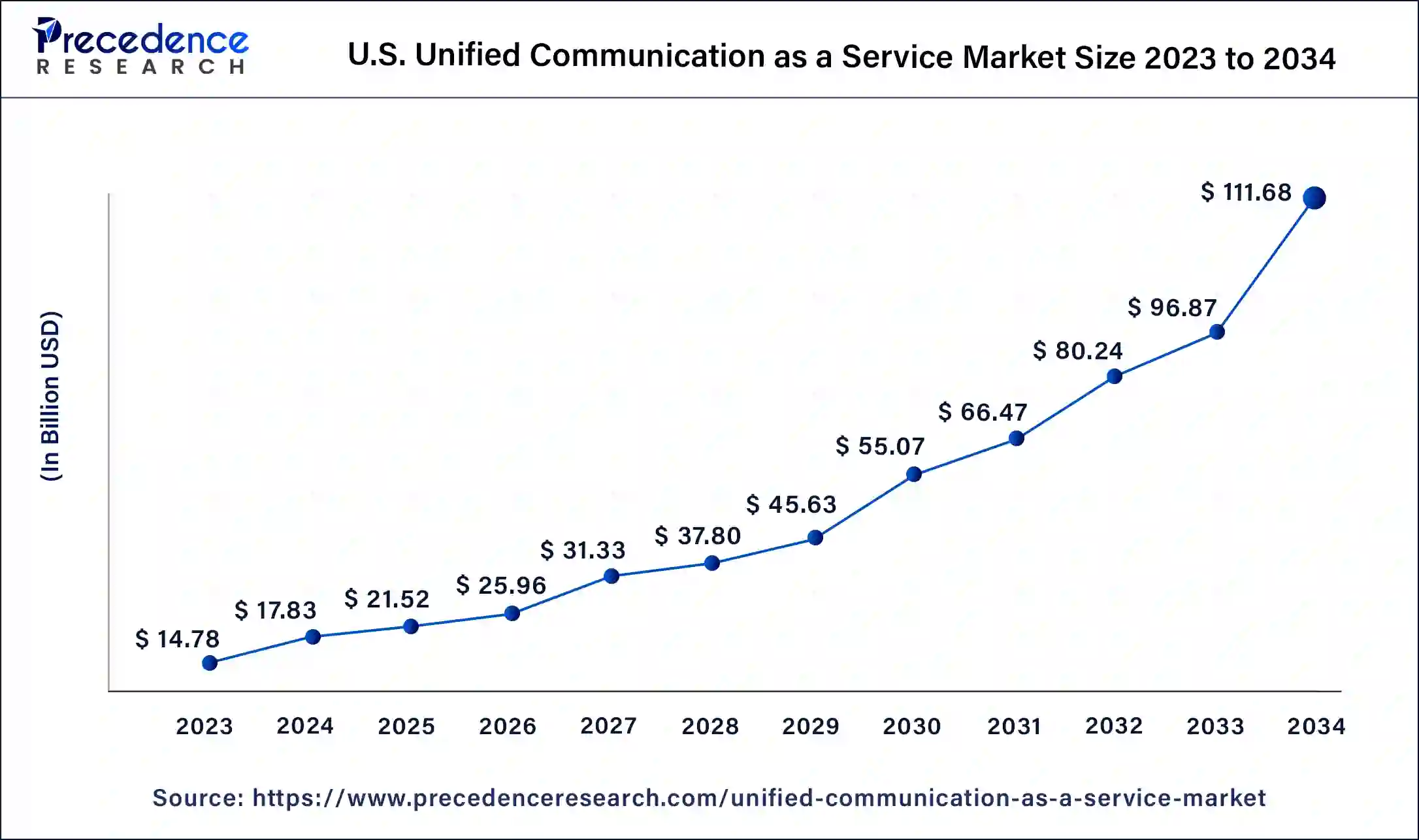

The U.S. unified communication as a service market size was valued at USD 14.75 billion in 2023 and is expected to reach around USD 111.68 billion by 2034, poised to grow at a CAGR of 20.14% from 2024 to 2033.

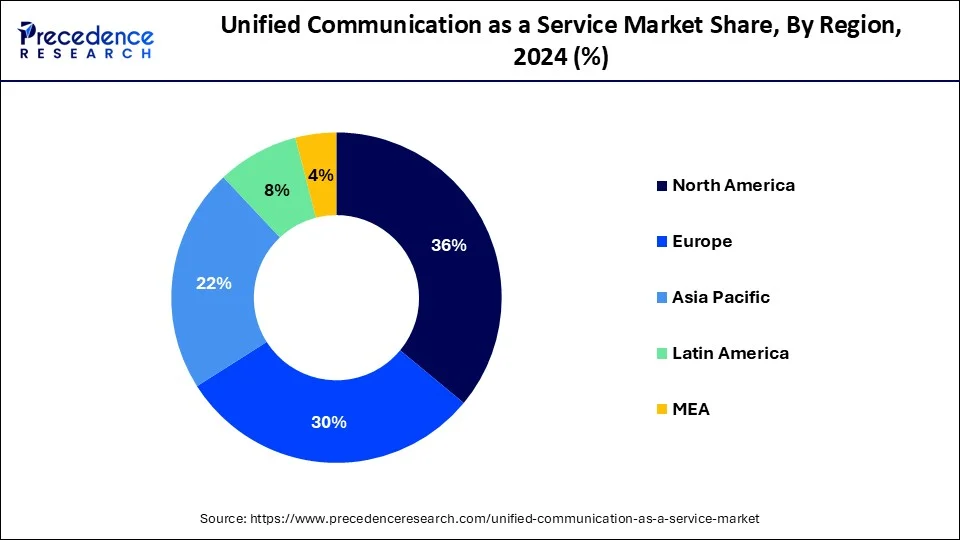

North America holds a share of 36% in 2023 of the unified communication as a service market due to its early and widespread adoption of cloud-based communication solutions. The region's robust technological infrastructure, high internet penetration, and the presence of key market players contribute to its major share. Additionally, a proactive approach to remote work and the constant need for advanced communication tools in enterprises further drive the demand for UCaaS. The well-established corporate landscape, combined with a strong emphasis on technological innovation, positions North America as a significant leader in the UCaaS market.

Asia-Pacific is set for rapid growth in the unified communication as a service (UCaaS) market due to increasing digitization, expanding internet connectivity, and a surge in remote work. As businesses in the region embrace cloud-based communication solutions to enhance collaboration, UCaaS offers a scalable and cost-effective approach. The rising demand for flexible communication tools, coupled with the region's economic development, positions the Asia-Pacific market as a key player in the global UCaaS landscape, poised for substantial expansion.

Meanwhile, Europe is experiencing notable growth in the unified communication as a service (UCaaS) market due to the increasing adoption of flexible work models, digital transformation initiatives, and the demand for streamlined communication tools. The region's businesses are recognizing the benefits of cloud-based UCaaS solutions in fostering collaboration and productivity. Additionally, the emphasis on data security and compliance aligns with the advanced features offered by UCaaS providers. As a result, the market is witnessing significant traction, with organizations across Europe leveraging UCaaS to enhance communication and adapt to evolving workplace dynamics.

Unified communication as a service (UCaaS) is a cloud-based communication solution that integrates various tools and services into a single platform, streamlining collaboration and enhancing efficiency for businesses. It combines features like voice and video calling, instant messaging, email, and conferencing, allowing users to communicate seamlessly across different devices. UCaaS eliminates the need for on-premise hardware and offers a scalable, flexible, and cost-effective alternative. Users can access communication tools through the internet, facilitating remote work and increasing overall productivity. This service promotes a unified and cohesive communication experience, breaking down silos between different channels and simplifying the way teams connect and collaborate.

Unified Communication as a Service Market Data and Statistics

| Report Coverage | Details |

| Global Market Size by 2034 | USD 433.29 Billion |

| Global Market Size in 2023 | USD 58.55 Billion |

| Global Market Size in 2024 | USD 70.50 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 18% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Industry Vertical, Deployment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cost savings

Cost savings play a pivotal role in driving the increasing demand for unified communication as a service (UCaaS) solutions. Businesses are drawn to UCaaS because it offers a cost-effective alternative to traditional communication systems. By adopting cloud-based UCaaS, companies can significantly reduce capital expenditure associated with maintaining on-premise hardware, upgrading infrastructure, and managing complex communication networks. Moreover, UCaaS eliminates the need for extensive IT support, reducing operational costs and freeing up resources for other critical business functions.

The scalability and flexibility of UCaaS solutions further contribute to cost savings, allowing organizations to pay for only the services they need, especially beneficial for businesses experiencing fluctuations in demand. This emphasis on cost efficiency not only attracts enterprises looking to optimize their budgets but also opens the door for smaller businesses to access advanced communication tools that were once financially challenging to implement, thereby fostering a surge in the market demand for UCaaS.

Employee resistance to change

Employee resistance to change serves as a notable restraint in the unified communication as a service (UCaaS) market. The introduction of new communication tools and the shift to cloud-based collaboration platforms often face opposition from employees accustomed to traditional methods. This resistance can stem from a lack of familiarity, fear of the unknown, or concerns about disruptions to established workflows. As a result, businesses may encounter challenges in achieving widespread adoption of UCaaS solutions within their workforce.

Overcoming employee resistance requires effective change management strategies, including comprehensive training programs, clear communication about the benefits of UCaaS, and addressing concerns transparently. Without successful change management, organizations may struggle to harness the full potential of UCaaS, limiting its market demand. Recognizing and addressing employee concerns early in the implementation process is crucial for fostering a positive attitude toward the adoption of UCaaS and ensuring that the technology aligns seamlessly with the needs and preferences of the workforce.

Integration with emerging technologies

Integration with emerging technologies is a key driver of opportunities in the unified communication as a service (UCaaS) market. The infusion of artificial intelligence (AI) and the Internet of Things (IoT) into UCaaS platforms enhances communication experiences and functionality. AI-powered features, such as intelligent chatbots and automated workflows, streamline communication processes, increasing efficiency and reducing response times. Additionally, IoT integration allows for the incorporation of smart devices into communication networks, creating a more connected and dynamic environment.

These technological advancements not only improve the user experience but also open new avenues for innovation. For instance, AI-driven analytics can provide valuable insights into communication patterns, enabling organizations to make data-driven decisions. As businesses increasingly recognize the potential of these integrated solutions to optimize operations and enhance collaboration, the demand for UCaaS is expected to grow. This presents a significant opportunity for providers to stay at the forefront of the market by continually advancing and integrating emerging technologies into their UCaaS offerings.

The healthcare segment held the highest market share of 19% in 2023. In the unified communication as a service (UCaaS) market, the healthcare segment focuses on providing seamless communication solutions tailored to the unique needs of the healthcare industry. This includes secure and compliant messaging, telehealth support, and collaborative tools for healthcare professionals. The trend in the healthcare segment of UCaaS involves a growing emphasis on virtual care and remote collaboration, aiming to enhance patient care delivery, improve operational efficiency, and ensure secure communication in compliance with healthcare regulations such as HIPAA. As the healthcare sector embraces digital transformation, the demand for specialized UCaaS solutions continues to rise.

The hospitality segment is anticipated to witness rapid growth at a significant CAGR of 22.12% during the projected period. In the hospitality segment, unified communication as a service (UCaaS) refers to cloud-based communication solutions tailored for the unique needs of the hospitality industry. This includes integrated communication tools like voice, video, and messaging services, enhancing guest experiences and optimizing staff collaboration. Trends in this sector involve the increasing adoption of UCaaS to facilitate seamless guest interactions, streamline internal communications, and leverage features like virtual concierge services. As the hospitality industry evolves, UCaaS proves instrumental in delivering efficient and personalized communication solutions to meet the demands of modern travelers and hotel operations.

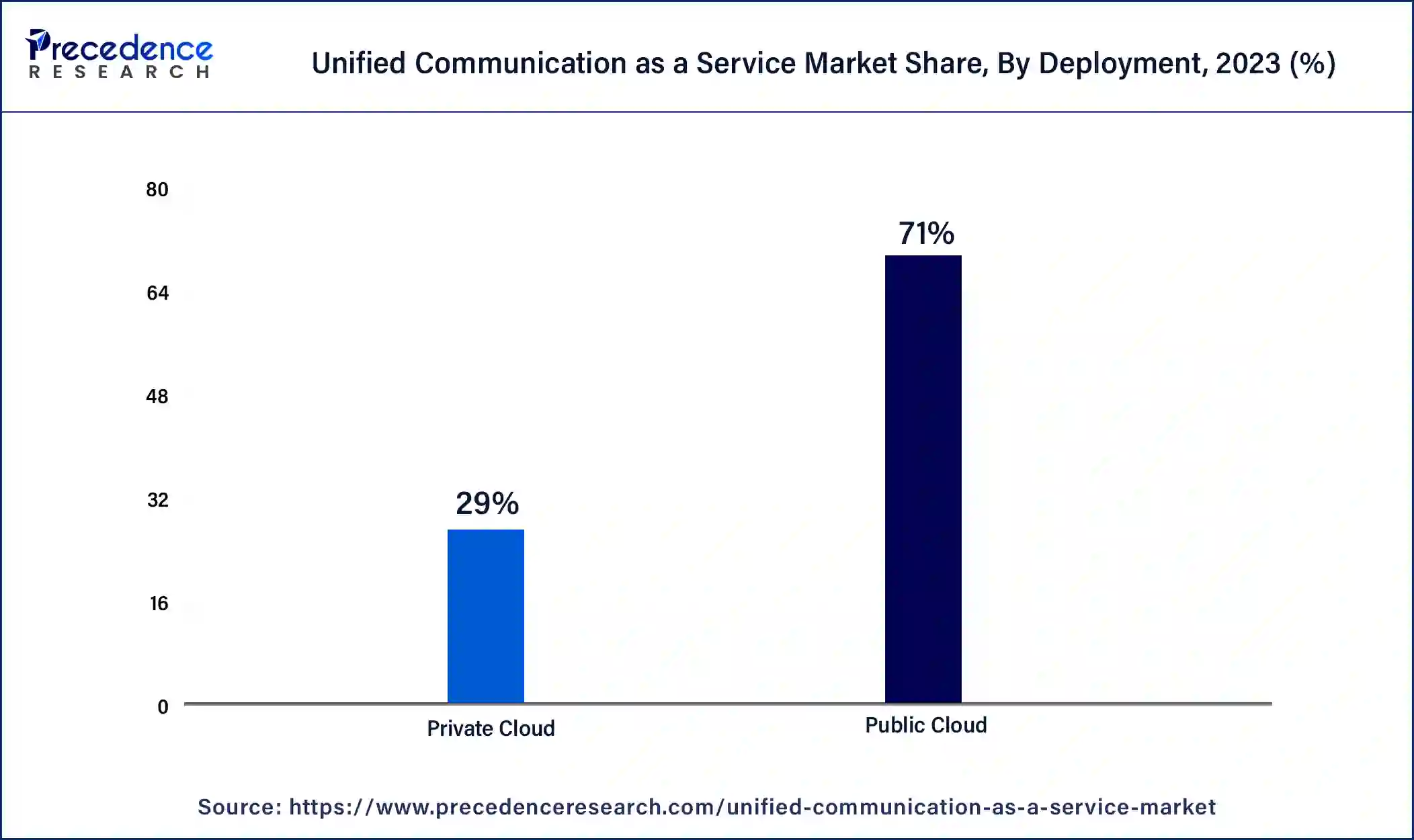

The public cloud segment has held a 71% market share in 2023. In the unified communication as a service (UCaaS) market, the public cloud deployment segment involves delivering communication services over a shared cloud infrastructure accessible to multiple users. This approach offers scalability, cost-effectiveness, and flexibility, allowing organizations to access UCaaS solutions without the need for extensive on-premise infrastructure. A notable trend in this segment is the increasing adoption of public cloud UCaaS due to its ease of implementation, reduced upfront costs, and the ability to support remote work, aligning with the growing trend of flexible work environments.

The private cloud segment is anticipated to witness rapid growth over the projected period. In the unified communication as a service (UCaaS) market, the private cloud segment refers to the deployment of communication services on a dedicated, secure cloud infrastructure exclusively for a single organization. This approach ensures greater control over data, security, and customization. A current trend in the private cloud segment of UCaaS is the increasing adoption among enterprises with specific security and compliance requirements. Businesses prioritize private cloud solutions to maintain a high level of data protection, making this deployment option a growing preference in the evolving UCaaS landscape.

Segments Covered in the Report

By Industry Vertical

By Deployment

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

February 2025

February 2025