July 2024

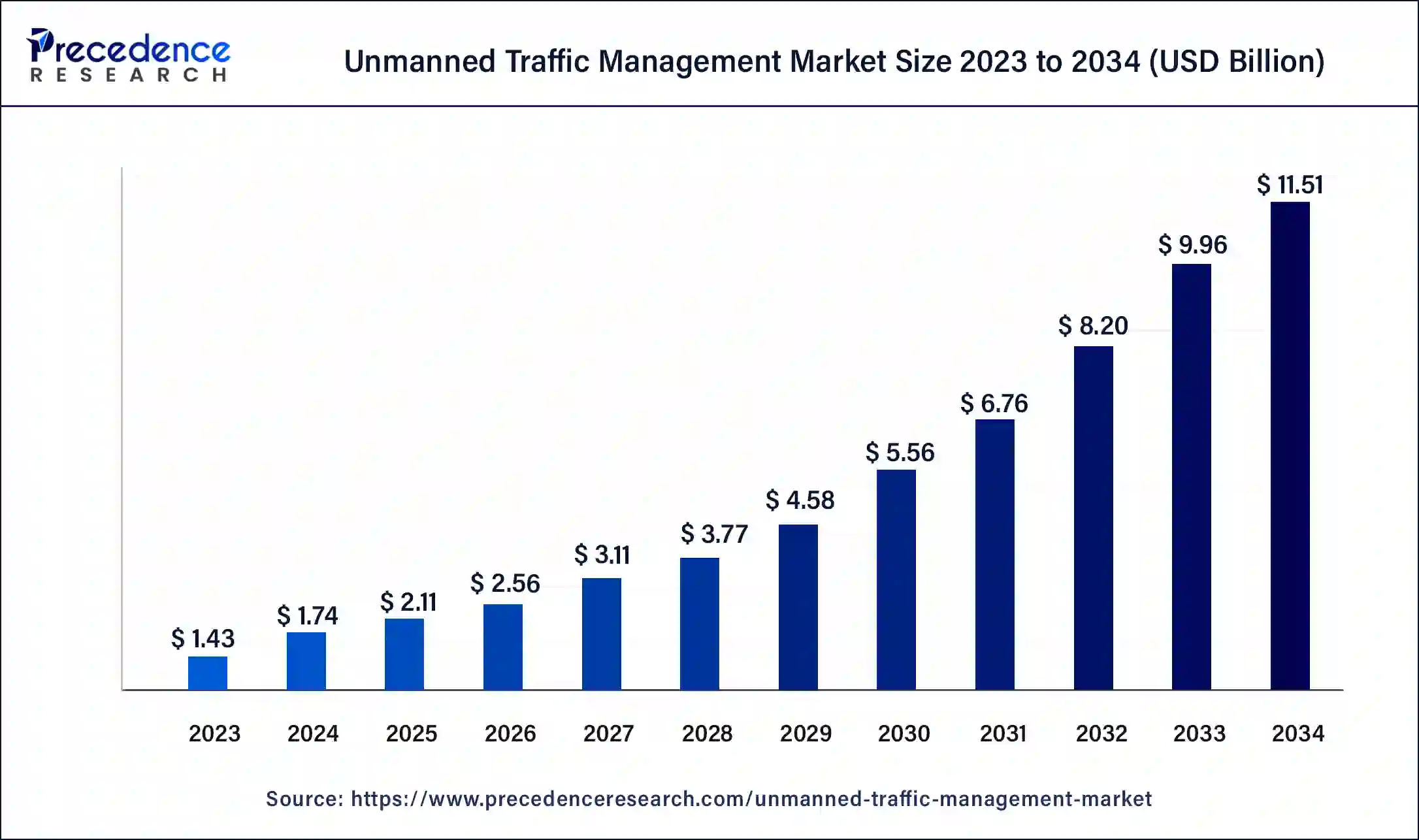

The global unmanned traffic management market size was USD 1.43 billion in 2023, estimated at USD 1.74 billion in 2024 and is anticipated to reach around USD 11.51 billion by 2034, expanding at a CAGR of 20.79% from 2024 to 2034.

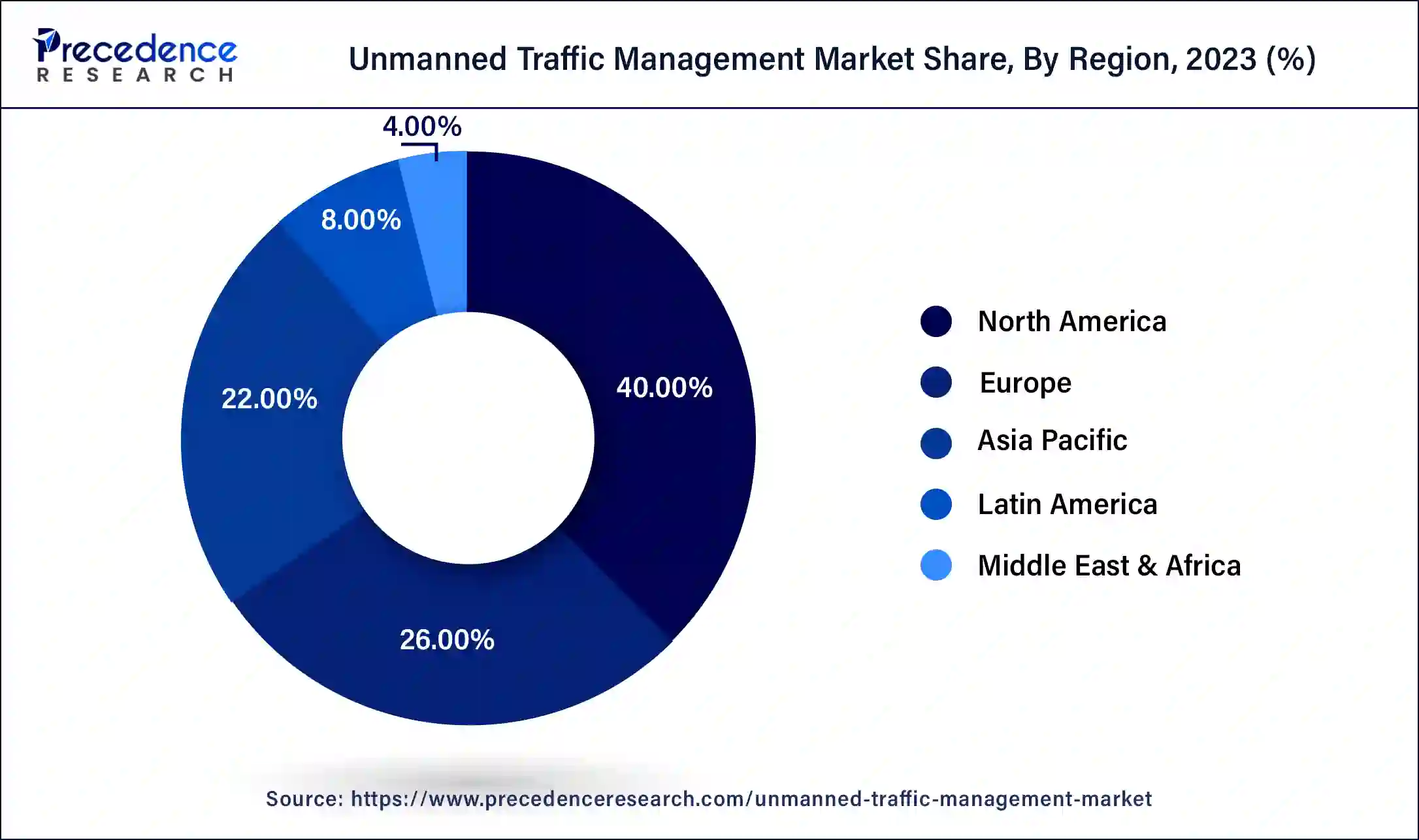

The global unmanned traffic management market size accounted for USD 1.74 billion in 2024 and is predicted to reach around USD 11.51 billion by 2034, growing at a CAGR of 20.79% from 2024 to 2034. The North America unmanned traffic management market size reached USD 700 million in 2023. The growing demand for improved surveillance can grow the market.

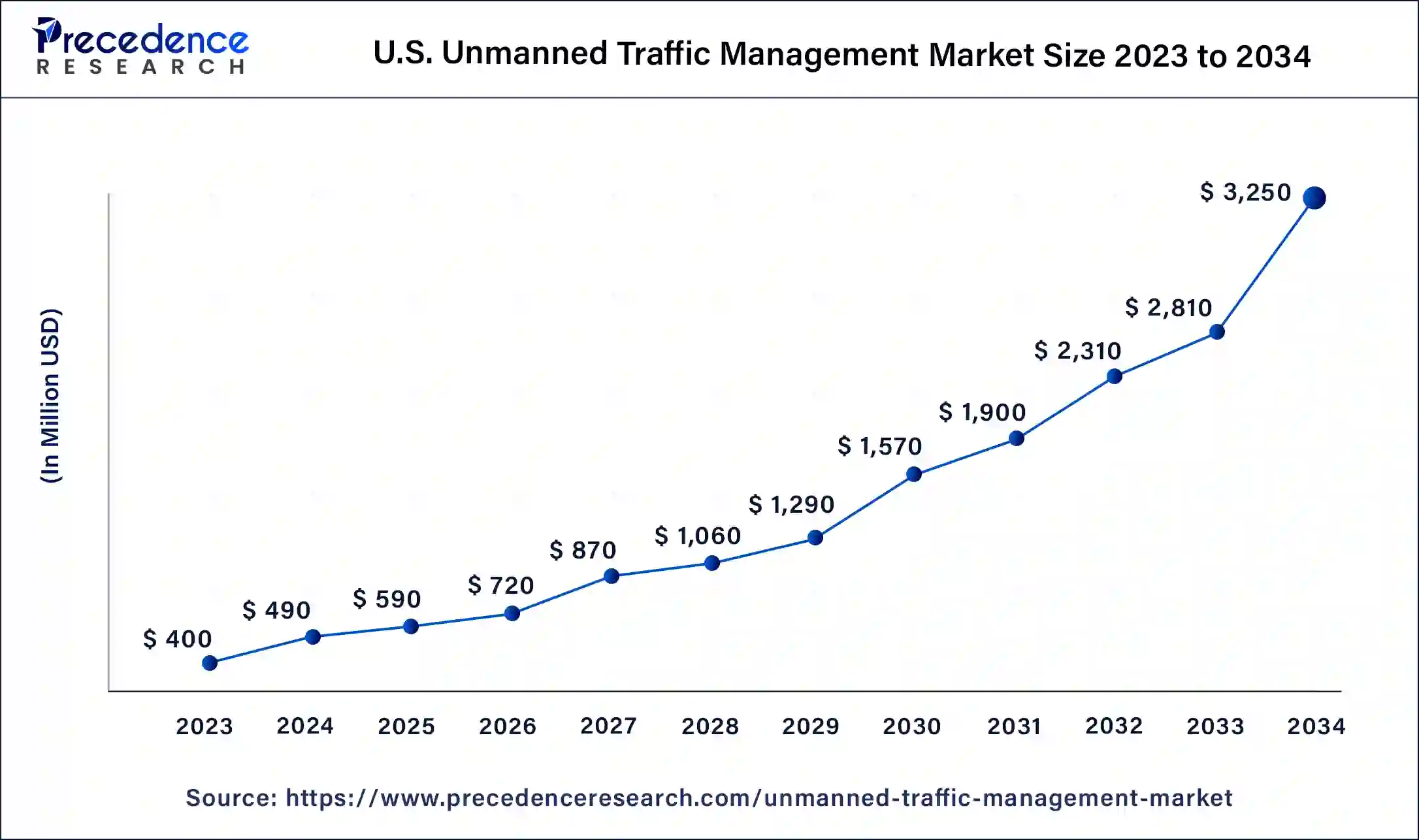

The U.S. unmanned traffic management market size was estimated at USD 400 million in 2023 and is expected to be worth around USD 3,250 million by 2034 expanding at a CAGR of 20.89% from 2024 to 2034.

North America dominated the unmanned traffic management market in 2023. With numerous businesses focusing on software development, telecommunication, and aerospace, the area is home to a booming technology sector. This innovation ecosystem draws talent and investment to the area by promoting the creation of state-of-the-art unmanned traffic management solutions. The drone applications span a wide range of industries in North America, from agricultural and public safety to infrastructure inspection and delivery service. In order to support the expanding drone industry, this demand drives investment in the unmanned traffic management infrastructure and service.

The United States, in particular, has taken the initiative to create legislation that would make it easier for drones to be integrated into the airspace. In order to create a favorable environment for businesses to develop and implement unmanned traffic management solutions, the Federal Aviation Administration (FAA) has been actively involved in the creation of rules and standards for the unmanned traffic management system.

Europe is expected to grow at the highest CAGR in the unmanned traffic management market during the forecast period. Europe’s airspace management systems and strong legislative framework make it easy to integrate unmanned aerial vehicles into the airspace. Additionally, a substantial amount of money is spent on research and development, which promotes creativity and the uptake of unmanned traffic management solutions.

The unmanned traffic management market refers to systems and services created to control the growing complexity of drone activities in the airspace, which are referred to as the market. It contains technology for managing airspace, controlling drone traffic, communicating, and integrating with the current ATC system. Unmanned traffic management (UTM) systems are becoming more important in guaranteeing safe and effective drone operations as the number of drone applications grows.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 21.42% |

| Market Size in 2023 | USD 1.43 Billion |

| Market Size in 2024 | USD 1.74 Billion |

| Market Size by 2033 | USD 9.97 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Component, Solution, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Development of smart cities

The development of smart cities boosts the unmanned traffic management market. There is an intriguing relationship between unmanned traffic management and smart cities. Consequently, smart cities use a variety of technologies to improve productivity, sustainability, and the standard of living for citizens. This frequently incorporates sophisticated infrastructure management, communication, and transportation systems. The smart city infrastructure is essential for UTM, which is controlling drones and other unmanned aerial vehicles (UAVs) in low-altitude airspace.

High cost and low return on investment

The high cost and low return on investment of unmanned traffic management slow down the unmanned traffic management market. A large infrastructure investment is necessary to implement a reliable UTM system. This investment includes systems for surveillance, ground control stations, communication networks, and regulatory compliance. For many parties involved, particularly smaller businesses or towns with tighter resources, these expenses may be unaffordable. UTM service providers occasionally could find it difficult to bring in enough money to cover their expensive overhead. This is especially true in areas where the need for UTM services is still developing or where the reach of UAV operations is restricted by regulations.

Collaboration between software and drone manufacturing companies

The collaboration between software and drone manufacturing companies can be the opportunity to grow the unmanned traffic management market. By combining cutting-edge software with manufacturing know-how to create cutting-edge unmanned traffic management systems, cooperation between software and manufacturing firms may propel the expansion of the unmanned traffic management industry. This partnership can improve unmanned aerial vehicle safety, effectiveness, and scalability by fusing state-of-the-art software for airspace management, navigation, and communication with the capacity to manufacture dependable hardware components.

In the unmanned traffic management market, collaboration can also result in the development of comprehensive unmanned traffic management platforms that address a range of industrial requirements, including public safety, infrastructure inspection, logistics, and transportation. Software and manufacturing businesses may take advantage of the growing need for UTM solutions and propel market progress by utilizing each other's advantages.

The persistent segment dominated the unmanned traffic management market in 2023. There is a growing need for unmanned aerial vehicles or drone management for dependable and continuous communication. The constant and dependable communication that persistent unmanned traffic management systems provide is essential for the real-time monitoring, control, and coordination of UAVs in a variety of applications, including infrastructure inspection, delivery, surveillance, and agriculture.

The increased use of UAVs in many businesses and sectors makes this dependability even more crucial. The development of the persistent category within the market may also have been aided by technological developments, such as better network infrastructure, improved data processing algorithms, and greater satellite communication capabilities. Persistent UTM systems can now handle large-scale UAV operations and are more effective and economical thanks to technological advancements.

The non-persistent segment is expected to grow rapidly in the unmanned traffic management market during the forecast period. When compared to persistent systems, non-persistent unmanned traffic management solutions frequently require less infrastructure investment. They can lower implementation costs for companies and organizations wishing to adopt unmanned traffic management capabilities by utilizing already-existing communication networks and technologies, such as Wi-Fi and cellular networks. Since non-persistent unmanned traffic management systems are frequently more adaptable and scalable, integrating them with various UAV kinds and operating conditions is made simpler. Industries and sectors that need dynamic and flexible unmanned traffic management solutions to match their changing demands find this flexibility appealing.

The technological developments in communication, including edge computing, 5G networks, and Internet of Things (IoT) devices, have greatly enhanced the dependability and performance of non-persistent unmanned traffic management systems. Non-persistent solutions have become more acceptable to consumers as a result of these technical improvements that increase data transfer speeds, decrease latency, and improve overall system responsiveness.

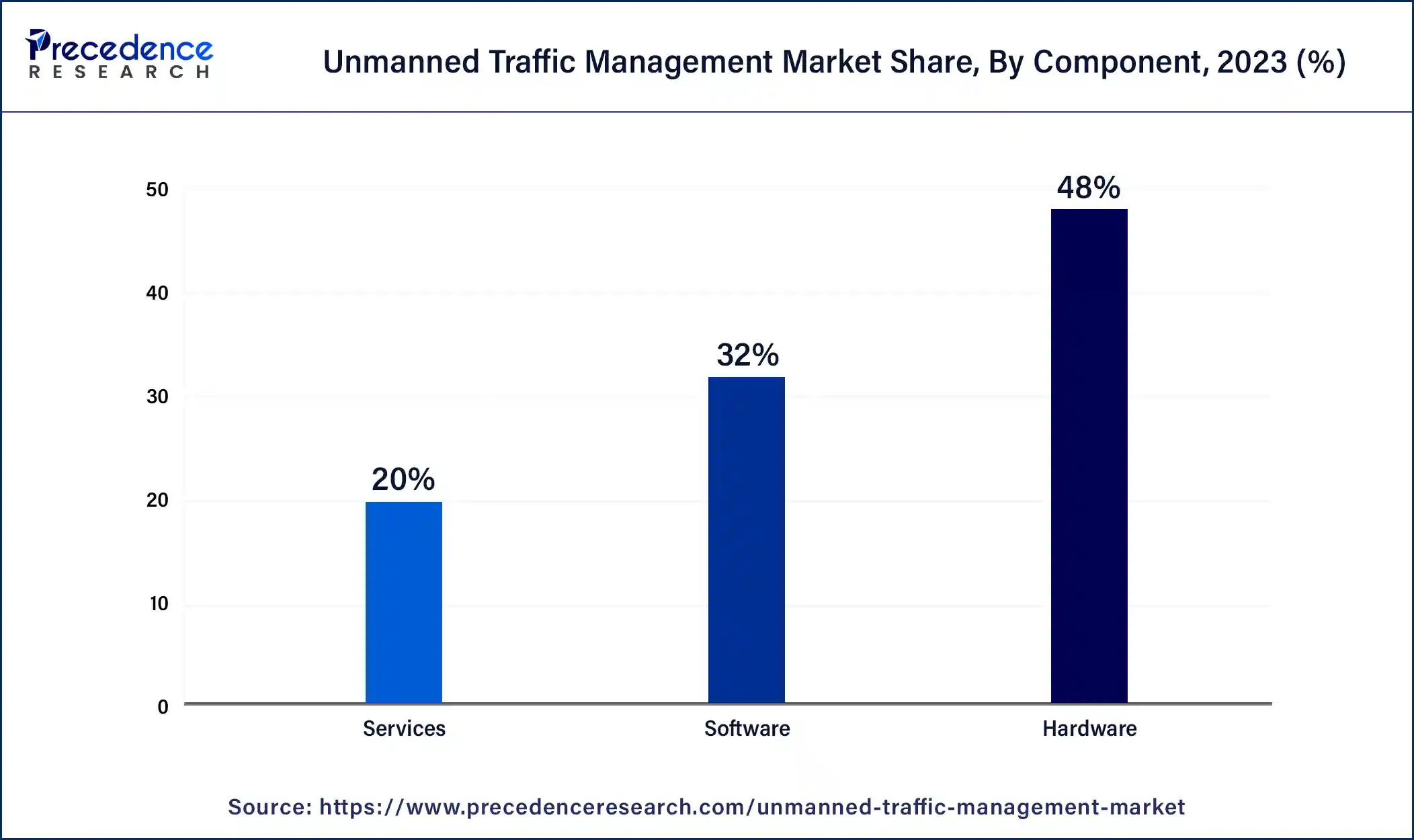

The hardware segment dominated the unmanned traffic management market in 2023. The unmanned traffic management systems are based on hardware, which includes physical devices, including sensors, ground control stations, communication equipment, and collision avoidance systems. Enabling communication, navigation, and surveillance capabilities is crucial for controlling drones, also known as unmanned aerial vehicles. The need for unmanned traffic management hardware components has increased as a result of the growing use of UAVs in a variety of fields and businesses, including public safety, construction, logistics, and agriculture.

Robust hardware solutions are required to enable safe and effective UAV control as more companies and organizations incorporate drones into their operations. To guarantee that unmanned traffic management systems adhere to safety standards and airspace laws, regulatory bodies and aviation authorities frequently impose certain hardware requirements. This entails fitting UAVs with transponders, navigational aids, and communication gear.

The software segment is expected to expand at a significant pace in the unmanned traffic management market during the forecast period. In order to meet the demands of different industries, operational sizes, and complexity, unmanned traffic management software may be made both scalable and configurable. Unmanned traffic management software may be customized to maximize performance, scalability, and flexibility in various use cases, whether it is assisting a small-scale drone delivery business or overseeing a large-scale UAV fleet for industrial inspections.

The unmanned traffic management software generates actionable insights and optimizes decision-making processes by utilizing data from sensors, UAVs, weather predictions, airspace conditions, and previous flight data. Unmanned traffic management system performance, risk management, and operational efficiency are all aided by the capacity to analyze massive volumes of data in real time, spot trends, find anomalies, and offer predictive analytics. From mobile devices or centralized command centers, unmanned traffic management software allows for the management, control, and observation of UAV activities remotely.

The communication infrastructure segment dominated the unmanned traffic management market in 2023. Communication infrastructure is essential for smooth communication between the many parties involved in the unmanned traffic management ecosystem, such as drones, ground control stations, regulatory agencies, and other pertinent parties. It would be difficult to carry out efficient unmanned traffic management operations without a strong communication infrastructure. The high levels of scalability and dependability were probably given by the communication infrastructure options available in 2023, which are essential for controlling several drones at once.

Scalable communication systems are necessary to provide continuous coordination and communication as drone operations grow, particularly in metropolitan areas. It's possible that communication infrastructure solutions and unmanned traffic management systems are well-integrated, enabling effective data interchange, real-time updates, and drone flight coordination. The smooth integration increases unmanned traffic management systems' overall efficacy and increases their appeal to users and regulatory bodies.

The surveillance infrastructure segment is expected to grow rapidly in the unmanned traffic management market during the forecast period. The increasing use of drones in airspace raises serious security and safety issues. Radar systems, sensors, cameras, and other surveillance technologies are essential for keeping an eye on drone activity, spotting any threats, and guaranteeing that airspace laws are followed. It is anticipated that the need for sophisticated monitoring technologies will increase dramatically if these worries worsen. In order to improve safety and security, regulatory agencies frequently require unmanned traffic management operations to employ surveillance systems.

The adoption of surveillance infrastructure solutions by drone operators and unmanned traffic management service providers is fueled by compliance with these rules, which propels market expansion. Airspace violations, unapproved drone operations, and collision avoidance are just a few of the dangers that surveillance infrastructure helps to reduce. Modern surveillance systems provide automatic reaction, threat detection, and real-time monitoring.

The logistics & transportation segment dominated the unmanned traffic management market in 2023. Because the market profits quickly and directly from efficient, economical operations. Unmanned traffic management lowers overhead costs and increases productivity for a variety of applications, including inventory management, delivery route optimization, and timely transportation. These sectors are leading the way in using technology that increases safety and accelerates operations since they mainly depend on smooth mobility and coordination.

The surveillance & monitoring segment is expected to grow at a substantial CAGR in the unmanned traffic management market during the forecast period. The necessity to keep a check for harmful or illegal activity in airspace has increased with the use of drones and other unmanned aerial vehicles.

Segments Covered in the Report

By Type

By Component

By Solution

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

August 2024

April 2025

September 2024