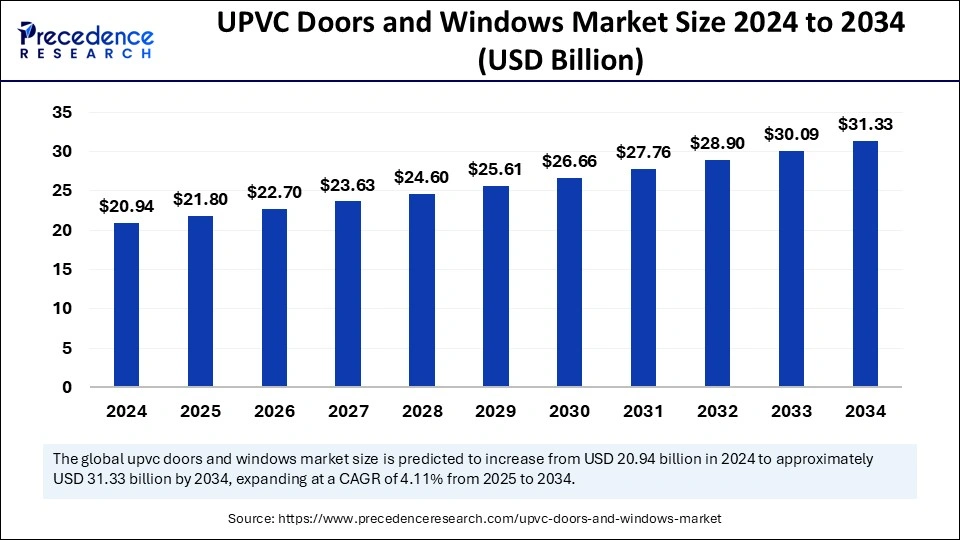

The global UPVC doors and windows market size is calculated at USD 21.80 billion in 2025 and is forecasted to reach around USD 31.33 billion by 2034, accelerating at a CAGR of 4.11% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global UPVC doors and windows market size accounted for USD 20.94 billion in 2024 and is predicted to increase from USD 21.80 billion in 2025 to approximately USD 31.33 billion by 2034, expanding at a CAGR of 4.11% from 2025 to 2034. The market growth is attributed to the increasing adoption of durable, energy-efficient, and low-maintenance fenestration solutions in residential and commercial construction.

Artificial intelligence technology facilitates enhancements to UPVC doors and windows market manufacturing through efficiency enhancement. The input of advanced algorithms leads to optimized design precision, which reduces both material waste and production costs. AI automation technologies increase manufacturing efficiency by ensuring production quality standards along with reducing the duration of manufacturing processes. Manufacturers use smart analytics to analyze customer preferences for developing customized solutions that fulfill exact aesthetic and functional requirements.

The UPVC doors and windows market continues towards rapid expansion as people seek more efficient building solutions to reduce energy consumption. Building structures powered by UPVC (Unplasticized Polyvinyl Chloride) technology maintains better heat insulation that minimizes energy usage in structures. UPVC windows, together with other energy-efficient window solutions, allow homeowners to reduce their utility expenses and greenhouse gas emissions, according to the Energy Saving Trust 2025 report. UPVC presents low costs due to its durability, low maintenance requirements, and resistance to weathering, so it works well in both residential and commercial use. Furthermore, the UPVC doors and windows experience increased market adoption in the future, as they help extend energy efficiency and promote sustainability goals.

| Report Coverage | Details |

| Market Size by 2034 | USD 31.33 Billion |

| Market Size in 2025 | USD 21.80 Billion |

| Market Size in 2024 | USD 20.94 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.11% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End user, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Impact of urbanization and infrastructure growth

Growing urbanization and infrastructure development are anticipated to boost the UPVC doors and windows market demand in the coming years. The increasing speed of construction operations in developing nations has produced a requirement for long-lasting and value-effective building materials. The market prefers UPVC doors and windows, as they offer long lifespans and minimal care requirements with strong resilience against external conditions.

Modern fenestration solutions enter residential projects and smart city programs since these building plans need to comply with sustainable building standards. These products have gained acceptance in the rising commercial sector and retail facilities as they enhance quality alongside looks. The modern urban development scene demonstrates the essential position that UPVC doors and windows play in this sector.

| Country | Urbanization Rate (%) | Year |

| Australia | 86.62 | 2023 |

| United States | 83.3 | 2023 |

| United Kingdom | 84.64 | 2023 |

| China | 64.57 | 2023 |

| India | 36.36 | 2023 |

Environmental concerns and recycling challenges

Environmental concerns and recycling challenges the UPVC doors and windows market. Environmental issues become serious due to the non-degradable nature of UPVC products, thus making their disposal problematic. Regions lacking proper waste management systems do not possess specialized recycling facilities needed for UPVC disposal.

Government measures support the adoption of aluminum and wood materials as eco-friendly alternatives for reducing environmental impacts. Canada will advance its Green Building Strategy in 2024 through a sustainable construction materials focus, which boosts both energy efficiency along resilience. Moreover, the combination of environmental regulations and standards acts as a barrier hindering the large-scale usage of UPVC construction materials in the market.

Smart home integration for UPVC doors and windows

Rising advancements in smart home technology are likely to create new growth opportunities for the UPVC doors and windows market in the coming years. UPVC products now link to automation features through sensors, which enable ventilation along with devices for remote access locking systems for improved performance and marketability. Smart glass technologies consisting of electrochromic and self-cleaning variants provide superior enhancements to contemporary fenestration systems.

The UPVC windows segment held a dominant presence in the UPVC doors and windows market in 2024, as they provide better energy efficiency than both wooden and metal window frames. Building insulation enhances through UPVC windows as they decrease energy requirements that support worldwide sustainability targets. The material properties of UPVC windows include strong resistance to chemical destruction, which results in extended product life and reduced maintenance needs. Furthermore, the growing demand for durable, cost-efficient fenestration solutions for their multiple benefits further fuels the market in the coming years.

The UPVC doors segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034. UPVC window industry professionals expect rising demand for energy-efficient sustainable housing solutions, driving the segment. The residential market selects UPVC products, as these materials combine longevity with charming looks and heat-retention features. The growth of contemporary home architecture that uses extended windows and moving doors strengthens the market for UPVC solutions.

The residential segment accounted for a considerable share of the UPVC doors and windows market in 2024. Residential homeowners choose UPVC products because these materials provide both cost-effectiveness and durability with energy-efficient properties. The Swindon Borough Council in the UK started their UPVC Windows and Doors Replacement Programme for 2023-2026 to demonstrate residential market expansion. Global housing energy efficiency efforts connect with this Market pattern, as the U.S. Department of Energy runs its Weatherization Assistance Program to make low-income homes more energy efficient.

The commercial segment is anticipated to grow with the highest CAGR during the studied years, owing to the growing shift of businesses focusing more intensely on residential performance and sustainability across their commercial properties. UPVC products deliver outstanding insulation values along with long product life and operational efficiency targets of commercial facilities. Upvc windows and doors demonstrate flexibility in design, which enables businesses to create contemporary facades that match the latest architectural fashions within the commercial sector. The market outlook predicts increased UPVC solution usage in commercial applications since businesses focus on cost reduction and environmental compliance.

The offline store segment led the global UPVC doors and windows market. Consumers mostly prefer the opportunity to inspect UPVC products through offline distribution channels as a necessary step before making their buying decisions. The personal touch of offline retailers offers expert counseling and leads customers to convert purchases through their channels with their superior customer service.

The online store segment is projected to expand rapidly in the coming years, owing to the rising popularity of electronic commerce platforms and customer preference for online convenience. Online retailers draw escalating customer numbers through their wide assortment of products combined with competitive pricing options paired with effortless product comparison. The beneficial impact of digital technology advancements enables virtual product demonstrations and makes customization options available to enhance online shopping. Internet penetration growth, along with consumer comfort in online shopping, results in the online distribution channel gaining a substantial market share of UPVC doors and windows.

North America dominated the UPVC doors and windows market, as it emphasizes energy-efficient building solutions together with its demanding building regulations. According to the U.S. Department of Energy, matching and losing heat through windows uses twenty-five to thirty percent of residential heating and cooling energy, thus making energy-efficient windows critical for lowering utility bills. Increased acceptance of UPVC products occurred because these materials ensure outstanding thermal insulation abilities.

The market for UPVC doors and windows is demonstrating rapid growth throughout Canada at this moment. National emissions reduction efforts have triggered a change in building regulations that enforce energy-efficient construction. The government of Canada enacted the Pan-Canadian Framework on Clean Growth and Climate Change in 2022 to boost building energy efficiency, which strengthens the market for UPVC products. The extremely cold Canadian climate requires superior insulation from building materials, as builders and homeowners find UPVC doors and windows to be a particularly favorable choice.

Asia Pacific is projected to host the fastest-growing UPVC doors and windows market in the coming years, owing to the fast-paced industrial and urban developments in China alongside India's major construction works throughout residential, commercial, and industrial buildings. The growing middle class and increasing disposable income in Asia Pacific territories are fuelling the market demand for both modern building materials and energy-efficient doors and windows, which establishes Asia Pacific as a primary market distribution sector for UPVC products.

The Indian construction industry shows quick development through government programs on infrastructure development, along with affordable housing programs, which creates rising demand for UPVC doors and windows. Furthermore, the expanding demand signals that India is becoming a significant consumer base for UPVC products in the coming years.

By Product Type

By End User

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client