March 2025

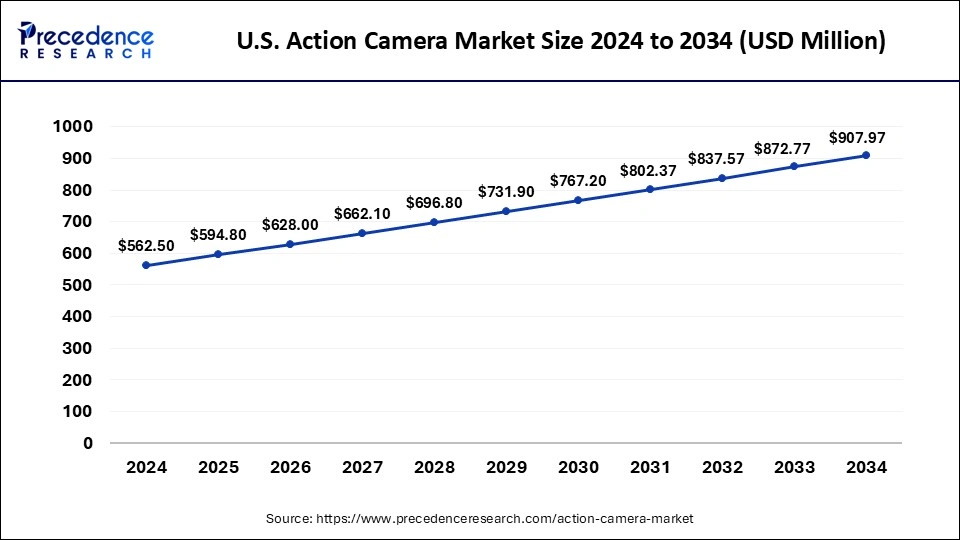

The U.S. action camera market size is evaluated at USD 594.80 million in 2025 and is forecasted to hit around USD 907.97 million by 2034, growing at a CAGR of 4.80% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. action camera market size accounted for USD 562.50 million in 2024 and is predicted to increase from USD 594.80 million in 2025 to approximately USD 907.97 million by 2034, expanding at a CAGR of 4.80% from 2025 to 2034.

The U.S. action camera market offers compact and ruggedized camera that are designed for capturing dynamic activities and extreme sports. These cameras are typically small, lightweight, and feature a wide field of view. They are popular for activities such as biking, skiing, surfing, skydiving, and other high-motion adventures. The design of action cameras focuses on durability, portability, and ease of use in challenging environments.

According to the data published by OBERLO, U.S. e-commerce sales are estimated to be around USD 1.04 trillion in 2022, an increase of 8.5% compared to that in 2022.

| Report Coverage | Details |

| Market Size in 2025 | USD 594.80 Million |

| Market Size by 2034 | USD 907.97 Million |

| Growth Rate from 2025 to 2034 | CAGR of 4.80% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End Use, Application, Resolution, and Distribution Channel |

The increasing acceptance of online shopping

Action camera manufacturers, including the market leaders now rely heavily on online retail and e-commerce platforms as their primary sales channels. These sites include Amazon.com. This internet channel turns out to be quite profitable, enabling manufacturers to provide competitive prices free from major regional restrictions. Additionally, by eliminating the need for customers to visit actual establishments, it improves convenience. Strong advertising chances are also provided by online retail, which uses ad analytics and SEO tools to promote effectively.

Prominent producers of cameras and accessories, like Canon, Nikon, Samsung Electronics, and Panasonic, have embraced online distribution via their platforms or joint ventures with Amazon, eBay, and Alibaba. Action camera usage, accessibility, and affordability are all on the rise in the United States, and these factors, together with increased internet access, make the online retail channel one of the key trends propelling the growth of the U.S. action camera market.

Rising competition in the industry

Sellers of action cameras are finding that their profit margins are shrinking. The main cause of this is the rise in raw material costs. Many new suppliers have joined the industry as a result of the enormous growth potential. The goal of vendors is to provide action cameras that are within the reach of the average user, particularly in developing nations. This reduces the potential for sales and revenue for current vendors. To draw customers and set their items apart, suppliers also constantly add new features.

Rising partnership

The increasing partnership in the U.S. action camera market industry is expected to propel revenue growth. Such collaboration and ventures are inspired by the increasing interest of investors in the industry's potential combined with steady growth in the recent decade.

The professional segment held the largest share of the U.S. action camera market in 2024. Professionals in the sports and entertainment industry, including athletes, coaches, and filmmakers, use action cameras to capture immersive and dynamic footage. In sports, action cameras can provide unique perspectives and angles for training analysis and highlight reels.

In certain situations, action cameras are used by filmmakers and videographers to get shots that are hard or impossible to get with traditional cameras. Action cameras are useful tools for recording behind-the-scenes footage, action sequences, and unusual angles in film and television production because of their small size and versatile mounting options. Thus, this is expected to drive the segment growth over the forecast period.

The sports segment dominated the U.S. action camera market in 2024. This is attributable to the growth in the number of adventure sports and strong exposure from the media. The market is being driven further by the rise in the number of people who enjoy sports like racing, riding, skydiving, surfing, skiing, skateboarding, climbing, and other sports. Additionally, using digital technology with its sophisticated lens and resolution greatly aids in taking high-quality action photos and films. The expansion of sports leagues and activities in the nation is also contributing to the segment's growth.

The recreational activities segment is observed to grow at the fastest rate in the U.S. action camera market during the forecast period. The rise in popularity of extreme sports such as surfing, snowboarding, mountain biking, and skydiving has fueled the demand for action cameras. Enthusiasts in these recreational activities seek compact, rugged cameras that can capture their adventures in high-definition quality, driving the growth of the market.

The proliferation of social media platforms and the growing trend of content creation have contributed to the increased demand for action cameras among recreational users. Individuals engage in various outdoor activities to capture breathtaking footage and share their experiences with friends, family, and followers on social media platforms, boosting the adoption of action cameras.

The high definition (HD) segment held the dominating share of the U.S. action camera market in 2024. HD footage provides viewers with a more immersive and engaging experience, whether they are watching action sports, travel adventures, or everyday moments. The crispness and clarity of HD videos make them more captivating and enjoyable to watch, driving demand for HD action cameras. As high-definition displays become increasingly prevalent in TVs, monitors, and mobile devices, there is a growing demand for content captured in HD format. HD action cameras are compatible with these displays, allowing users to enjoy their footage on large screens with stunning clarity and detail.

The ultra HD (UHD) segment is expected to grow at a significant rate in the U.S. action camera market during the forecast period, as it provides the consumer with several benefits. UHD filming offers versatility in both high definition and normal definition. Demand is being driven mostly by sophisticated devices with UHD features being commercially accessible. The trend of consumers choosing to shoot in 4K/UHD rather than 1080p or 720p significantly fuels the segment's expansion.

The offline segment held the largest share of the U.S. action camera market in 2024. Customers would rather inspect the device and its characteristics in person. A significant influence on the company may be seen in the growing requirement for channel partners to simplify sales strategy. Additionally, because aftermarket service is available for a small fee, retail businesses have a high customer retention rate. Additionally, the retail channels could deal only in one of the two divisions or provide a combination of accessories and cameras.

By End Use

By Application

By Resolution

By Distribution Channel

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

November 2024

January 2025

February 2025