March 2025

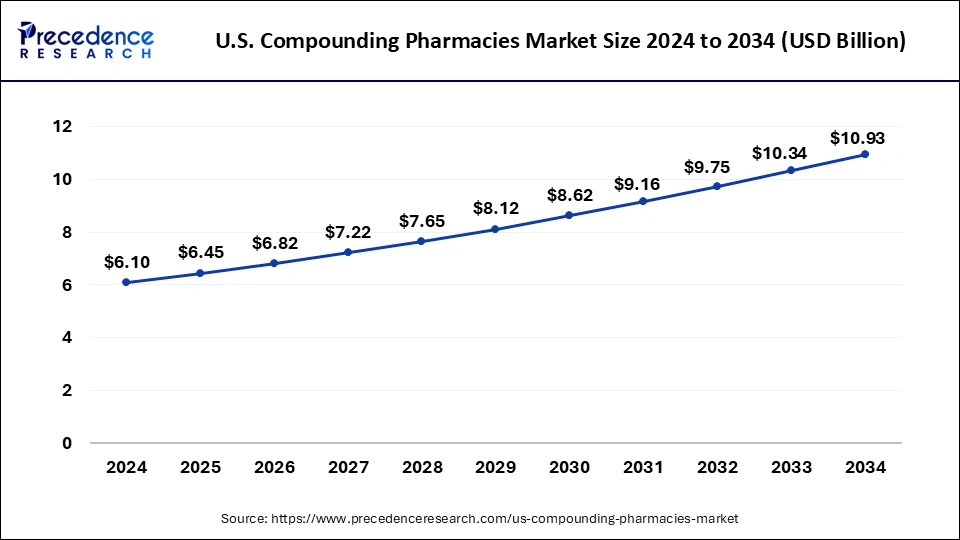

The U.S. compounding pharmacies market size is calculated at USD 6.45 billion in 2025 and is forecasted to reach around USD 10.93 billion by 2034, accelerating at a CAGR of 6.04% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. compounding pharmacies market size was calculated at USD 6.10 billion in 2024 and is predicted to increase from USD 6.45 billion in 2025 to approximately USD 10.93 billion by 2034, expanding at a CAGR of 6.04% from 2025 to 2034.

The surging investments by the key market players in the research and development to innovate and customize the formulations to effectively treat various diseases are expected to boost the growth of the US compounding pharmacies market. The growing prevalence of cancer among the US population is significantly augmenting the market growth.

According to the National Cancer Institute, in 2020, approximately 1,806,590 new cancer cases were estimated to be diagnosed and about 606,520 cancer deaths were estimated in US. The most diagnosed type of cancer included breast cancer, lungs cancer, prostate cancer, and colon and rectum cancer. The lungs, prostate, and colorectal cancer collectively accounted for 43% of the total new cancer cases diagnosed in men, while in women, the breast, lungs, and colorectal cancer accounted for 50% in 2020. The cancer incidence or rate of new cancer cases in men is 442.4 per 100,000. The cancer death rate is 158.3 per 100,000 per year. It was estimated that around 16,850 adolescents and children aged 0 to 19 years would be diagnosed with cancer and around 1,730 would die out of it in 2020. US$150.8 billion was estimated to be the national cancer care expenditure in US in 2018.

Therefore, the surging cases of cancer in US are expected to significantly boost the growth of the US compounding pharmacies market in the forthcoming years. There has been a shortage of drugs owing to the longer lead times, lack of adequate raw materials, increased drug failure, and delayed production, which is a prominent factor behind the growth of the US compounding market. Furthermore, growing geriatric population base in US along with the better longevity is accelerating the market growth significantly. According to the Population Reference Bureau, by 2060, the geriatric population in US will constitute around 24% of the total US population.

The increasing acceptance of compounding pharmacies and the presence of favorable government policies pertaining to reimbursements is driving the growth of the US compounding pharmacies market. Further, the rising technological advancements is leading to the growth of the effective compounding pharmacies. The presence of leading market players coupled with the presence of strong healthcare infrastructure in US is augmenting the growth of the US compounding pharmacies market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.04% |

| Market Size in 2025 | USD 6.45 Billion |

| Market Size by 2034 | USD 10.93 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Pharmacy Type, Product, Sterility, Compounding Type, Therapeutic Area, and End-User |

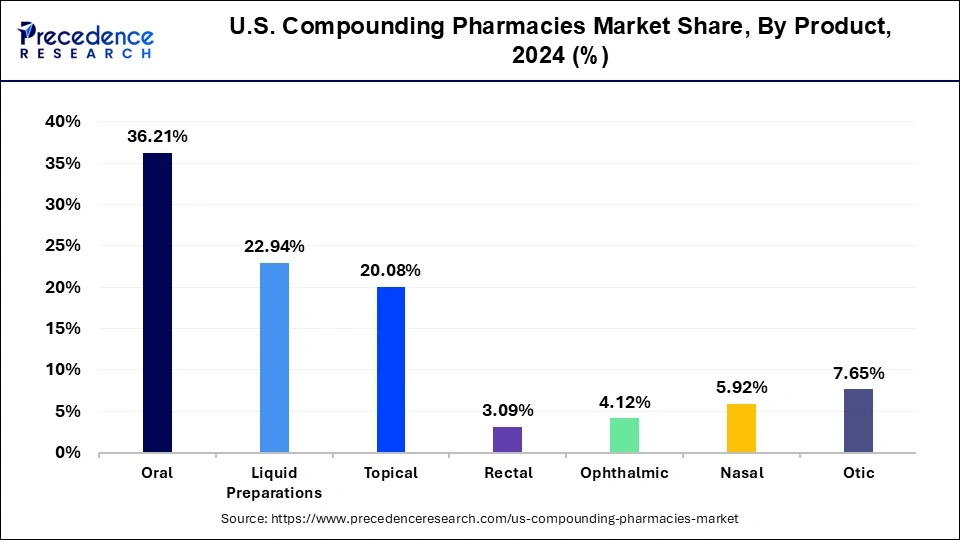

Based on product, the oral medications segment dominated the US compounding pharmacies market, accounting for around 36.21% of the market share in 2024. The rising prevalence of various chronic diseases and increased preference for oral medications owing to their ease of use and easy storage have boosted the growth of this segment. The availability of various oral medications in the form of tablets, capsules, powder, and granules are some of the major and most preferred traditional forms of oral medications. The increasing demand for personalized medications among the various age groups is expected to foster the growth of the market in the upcoming years.

Liquid Preparations segment accounted for around 22.94% of the US compounding pharmacies market share in 2024 and is expected to be the fastest-growing segment during the forecast period. For doctors looking for a substitution for the more popular oral solid dose type, oral liquid solutions offer a versatile option. Compounding pharmacies may be required to manufacture oral liquids if an oral solid dose form is incorrect for a particular patient or if providing the patient's desired dosage is difficult. Tablets and prescriptions are typically difficult to swallow for children and the elderly. Due to liquid pharmaceuticals offering a more pleasant formulation & an easier delivery mechanism, these patient populations are able to consume their medications more readily. Patients occasionally require prescriptions that are not available over the counter, as well as certain drug combinations. Compounding chemists may develop these unique mixtures in liquid form to meet the needs of the patient.

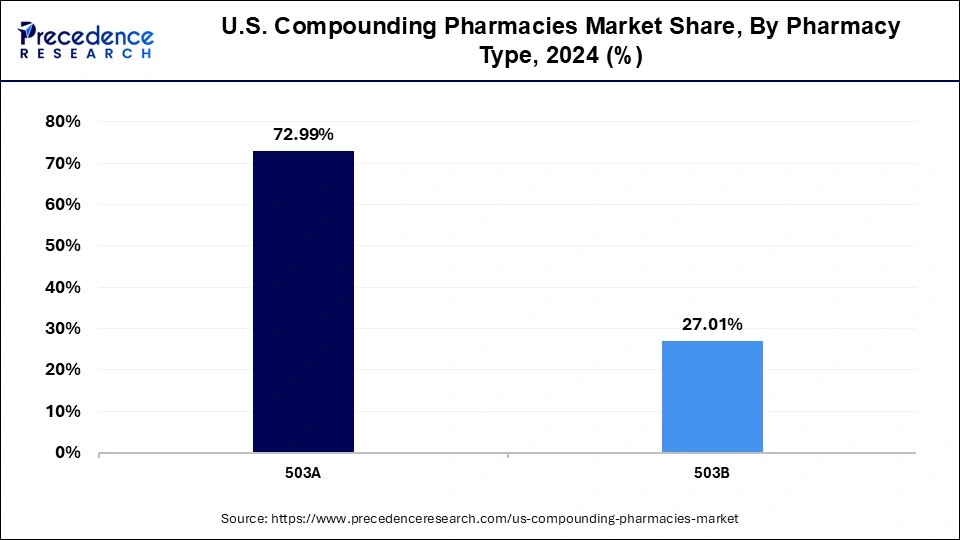

Based on the pharmacy type, the 503A segment dominated the US compounding market in 2024. This segment is estimated to grow at a CAGR of 6.08% during the forecast period. The government restrictions on drug production and requirements of medicine prescriptions have led to the growth of the 503A segment in the market. It is highly used for domestic consumption and hence dominates the US market. The strict regulations for biannual monitoring and audit ensure the safety and quality of this product.

U.S. Compounding Pharmacies Market Revenue, By Pharmacy Type, 2022-2024 (USD Billion)

| By Pharmacy Type | 2022 | 2023 | 2024 |

| 503A |

3.99 | 4.21 | 4.45 |

| 503B |

1.49 | 1.57 | 1.65 |

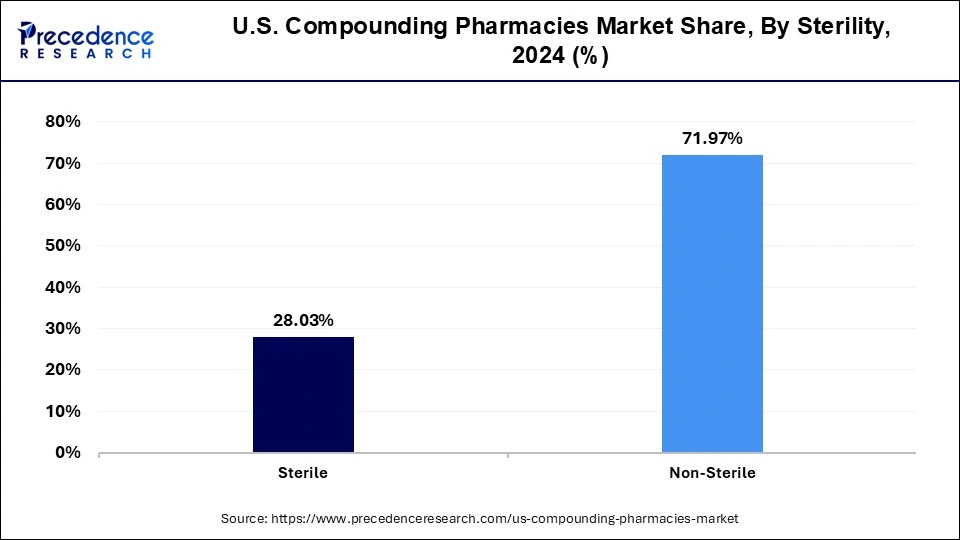

Depending on the sterility, the US compounding pharmacies market was dominated by the non-sterile segment that accounted for a market share of around 5.85% in 2024.

The sterile segment is expected to witness the highest growth rate during the forecast period. The rising incidences of chronic ailments like cancer and cardiovascular diseases are expected to significantly drive the growth of the sterile segment in the upcoming future. The growing demand for the sterile compounding pharmacies owing to the increasing adoption of ophthalmic and parenteral medications is further fueling the growth of the segment during the forecast period

U.S. Compounding Pharmacies Market Revenue, By Sterility, 2022-2024 (USD Billion)

| By Sterility | 2022 | 2023 | 2024 |

| Sterile | 1.53 | 1.62 | 1.71 |

| Non-Sterile |

3.95 | 4.16 | 4.39 |

Others include, oncology, haematology, dental, and others. According to the International Diabetes Federation (IDF), there will be 537 million adult diabetics globally in 2021, rising to 643 million by 2030. Cancer patients are harder to live with than the disease itself. The adverse effects of chemotherapy can make patients weak and compromise their overall health, making other medications a complicated issue. Thus, oncology compounding is used by the doctor and prescribes a particular combination of drugs and treatments to meet patients' needs, minimizing the amount of time and effort a patient has to take medications. Innovative formulations such as mouthwash or topical creams are used to produce drugs who suffer from nausea, cannot swallow pills, or have other conditions that make traditional dosage difficult. Moreover, using topical medications decreases the effectiveness lost through absorption during the digestive process and the potential for adverse interaction with cancer treatment. Similarly, with dental compounding unpleasant experiences and anxiety from patients can be removed, when the dentist and pharmacist work together. Dental compounding has grown more popular in recent years because many variables go into a dental procedure. Dental compounding is the practice of developing customized medications for your dental needs. These customized medications are prescribed for procedural anxiety, pain relief, gum disease, mouth ulcers, and many others. Thus, the growing applications of others in compound pharmacies are likely to enhance market growth during the forecast period.

The pain management segment reached at USD 0.54 billion in 2024 and is projected to grow at a CAGR of 6.10% from 2025 to 2034. Pain is the most obvious symptom for which patients explore medical help. Acute pain can easily grow into chronic pain, which later becomes difficult to treat. Commercially convenient pain relief medications can treat chronic conditions such as arthritis, fibromyalgia, migraine, and other nerve and muscle pain; however, these medication can grow undesired side effects such as dizziness, drowsiness, or stomach irritation. Therefore, many patients seek a more suitable solution through pharmacy compounding.

U.S. Compounding Pharmacies Market Revenue, By Therapeutic Area, 2022-2024 (USD Billion)

| By Therapeutic Area | 2022 | 2023 | 2024 |

| Hormone Replacement | 1.05 | 1.17 | 1.17 |

| Pain Management | 0.48 | 0.51 | 0.54 |

| Dermatology | 0.25 | 0.26 | 0.28 |

| Pediatrics | 0.19 | 0.20 | 0.21 |

| Urology | 0.15 | 0.16 | 0.17 |

| Others | 0.54 | 0.56 | 0.58 |

The major players in the market are constantly involved in various developmental strategies such as partnerships, collaborations, agreement, mergers, and acquisitions to gain competitive advantage over others, strengthen their position in the market, and strengthen their product portfolio.

By Pharmacy Type

By Product

By Sterility

By Compounding Type

By Therapeutic Area

By End-User

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

April 2024

July 2024

August 2024