March 2025

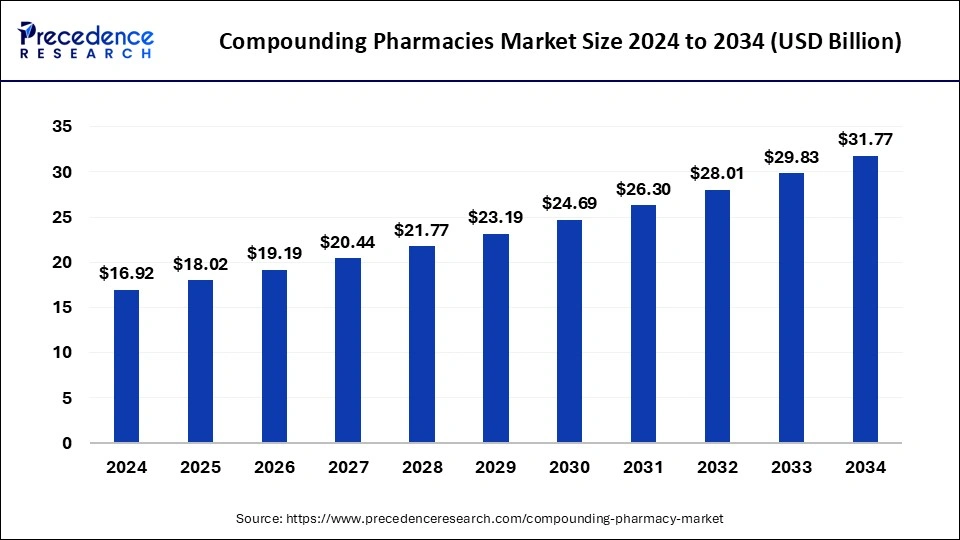

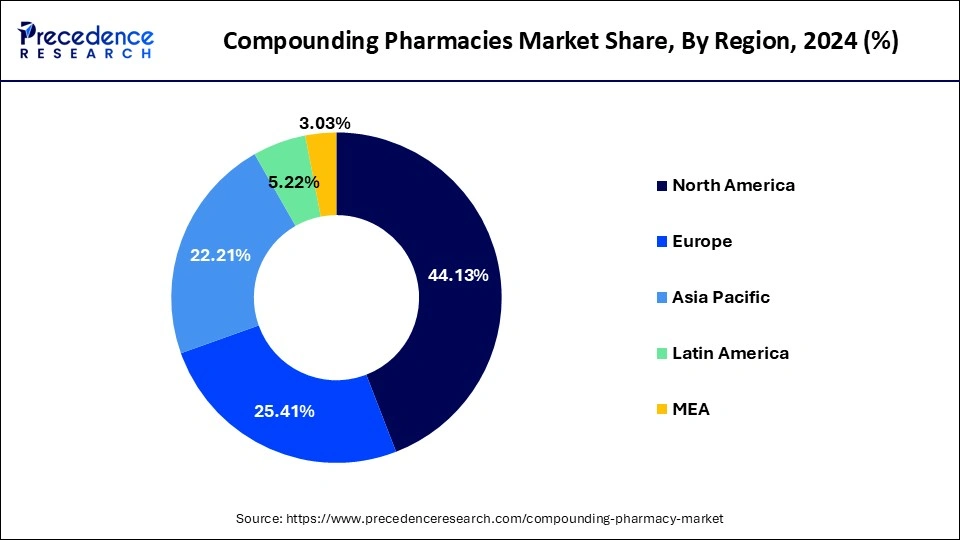

The global compounding pharmacy market size is calculated at USD 18.02 billion in 2025 and is forecasted to reach around USD 31.77 billion by 2034, accelerating at a CAGR of 6.50% from 2025 to 2034. The North America market size surpassed USD 7.28 billion in 2024 and is expanding at a CAGR of 6.49% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global compounding pharmacy market size accounted for USD 16.92 billion in 2024 and is predicted to increase from USD 18.02 billion in 2025 to approximately USD 31.77 billion by 2034, expanding at a CAGR of 6.50% from 2025 to 2034.

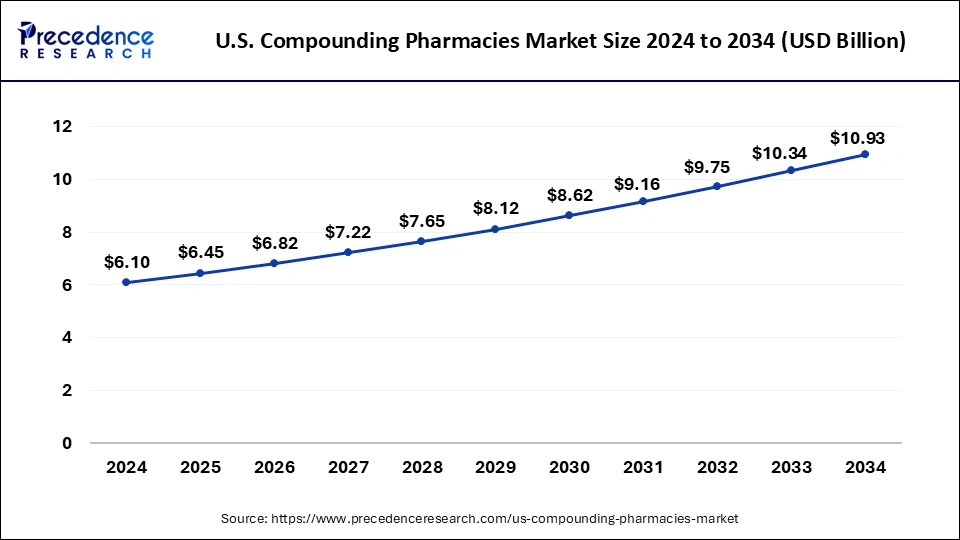

The U.S. compounding pharmacy market size was estimated at USD 6.10 billion in 2024 and is predicted to be worth around USD 10.93 billion by 2034, at a CAGR of 6.04% from 2025 to 2034.

North America is expected to dominate the market over the forecast period. Compounding pharmacies in North America focus on patient-centric care, working closely with healthcare providers to understand individual patient's needs and create customized medications accordingly. They cater to a diverse range of patients, including those with allergies, sensitivities, pediatric patients, geriatric patients, and individuals with rare or complex medical conditions. Additionally, compounding pharmacies in North America are subject to strict regulations and quality standards to ensure patient safety and the efficacy of compounded medications. Regulatory bodies, such as the Food and Drug Administration (FDA) in the United States and Health Canada in Canada, provide guidelines and oversight to ensure compliance with good compounding practices. Therefore, this is expected to drive market growth in the region.

Asia Pacific is expected to grow at the highest CAGR over the forecast period. The market growth in the region is driven by the increasing prevalence of chronic disease and the growing geriatric population. For instance, according to an Indian Council for Medical Research report on the 'Burden of Cancers in India,' seven cancers, such as breast, lung, oesophagus, mouth, stomach, cervical and liver account for more than 40% of the overall disease burden.

Moreover, advances in pharmaceutical science and technology are contributing to the expansion of compounding pharmacy services in the Asia Pacific region. These advancements enable compounding pharmacies to prepare innovative and effective medications for patients with diverse healthcare needs. Thus, this is expected to drive market growth in the region over the forecast period.

A compounding pharmacy, also known as a pharmaceutical compounding facility, is a specialized kind of pharmacy that creates customized medications based on specific prescriptions. Unlike traditional pharmacies that dispense mass-produced drugs manufactured by pharmaceutical companies, compounding pharmacies create personalized medications by mixing, altering or combining pharmaceutical-grade ingredients to meet the unique needs of a patient.

Compounding medicines is a centuries-old procedure, but it has seen a resurgence in modern healthcare to cater to patients with specific requirements. Compounded medications are often prescribed when commercially available medications do not suit the patient due to allergies, dosage preferences, or specific health conditions. They can come in various forms such as creams, ointments, capsules, torches, suspensions and suppositories.

Compounding pharmacies work closely with healthcare providers to understand individual patients' needs and then prepare medication accordingly. This level of customization allows for precise dosing, removal of allergens or irritants, and the incorporation of various medications into a single dose form if needed. The ability to customize medications makes compounding pharmacies particularly useful in pediatric, geriatric and veterinary medicine as well as for patients with unique health requirements. The compounding pharmacy market is driven by various factors including the growing geriatric population, increasing prevalence of chronic disease, growing collaboration among key players and continuous product launches.

| Report Coverage | Details |

| Market Size in 2025 | USD 18.02 Billion |

| Market Size by 2034 | USD 31.77 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.50% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 To 2034 |

| Segments Covered | Therapeutic Area, Route of Administration, Application, Compounding Type, Sterility, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Chronis disease and the ageing population

The prevalence of chronic diseases, such as diabetes, cardiovascular conditions, and arthritis, has been rising globally, particularly as the population ages. Compounding pharmacies play a crucial role in managing chronic conditions by creating personalized medications that address the specific needs of patients with these conditions.

For instance, as per the data given by UICC, the global population is ageing quickly. Currently, more than 703 million individuals worldwide are over 65, making up 9.1% of the world's population. According to projections, by 2050, this percentage will reach 15.9% (1.5 billion people). Similarly, according to data from World Health Organization, more than 50% of cancer patients are 65 years of age or older. This is most likely caused by the buildup of ageing-related risk factors for certain cancers and diminished cellular repair systems. Thus, the aforementioned facts support the market growth during the forecast period.

Regulatory compliance

Compounding pharmacies are subject to stringent regulations and quality standards to ensure patient safety and the efficacy of compounded medications. Meeting these regulatory requirements can be complex and costly for compounding pharmacies, particularly smaller establishments, leading to compliance challenges. Thus, regulatory compliance is expected to hamper market growth over the forecast period.

Growing collaboration

The increasing collaboration among the market participants is expected to offer a lucrative opportunity for market growth over the forecast period. For instance, in February 2023, Front Range Laboratories (FRL), a full-service testing facility that has been a dependable partner of compounding pharmacies for more than 25 years, was acquired by Wedgewood Pharmacy from Loveland, Colorado. To meet the testing requirements of pharmacies across the nation, FRL offers analytical, microbiological, and other testing services in addition to product stability and other services. Michael Travis and Jennifer Travis, who created FRL, will continue to work for the company and be associated with Wedgewood Pharmacy. The FRL brand, which is well-known for providing top-notch services in the compounding pharmacy industry, will be retained by wedgewood pharmacy.

Based on the therapeutic area, the global compounding pharmacy market is segmented into pain management, hormone replacement, dermal disorders, nutritional supplements and others. The pain management segment is expected to dominate the market over the forecast period. The pain management segment is one of the key areas where compounding pharmacies have seen significant growth and demand. Chronic pain is a widespread health issue, affecting millions of people worldwide, and managing it effectively is essential for improving patients’ quality of life.

The standard approach to pain management often involves using commercially available analgesics, but these medications may not always provide optimal relief or may lead to unwanted side effects. Compounding pharmacies are particularly valuable in pain management because they can tailor medication to suit individual patient needs.

This customization may involve creating personalized formulations that combine different pain-relieving agents, adjusting dosages to precise levels, or preparing medications in alternative delivery forms like topical creams, gels, or patches. By providing personalized pain management solutions, compounding pharmacies can help healthcare providers address their patient's unique pain profiles more effectively. Thereby, driving the segment growth.

Based on the route of administration, the global compounding pharmacy market is segmented into oral, topical, parenteral and others. The oral segment is expected to hold the largest revenue share over the forecast period. Compounded oral medications can be mould to make them more palatable, especially for patients who have difficulty swallowing pills or find the taste of certain medications unpleasant. Adding flavours can improve patient compliance, especially for children and individuals with sensory sensitivities. In addition, this can create oral medications that combine multiple active ingredients into a single dosage form.

Based on the distribution channel, the global compounding pharmacy market is segmented into compounding pharmacy, hospital pharmacy and others. The hospital pharmacy segment is expected to dominate the market over the forecast period. Hospital pharmacies often encounter patients with complex medical conditions or specific treatment requirements. Compounding pharmacies can provide customized medications, adjust dosages, and prepare formulations to address the individual needs of each patient.

Moreover, hospital pharmacies frequently treat pediatric patients who may require medications in forms that are not available commercially or need flavoring to improve compliance. Compounding pharmacies can prepare pediatric-specific formulations to ensure appropriate dosing and administration. Thereby, driving the segment development during the forecast period.

By Therapeutic Area

By Route of Administration

By Age

By Compounding Type

By Sterility

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

July 2024