What is U.S. Healthcare Staffing Market Size?

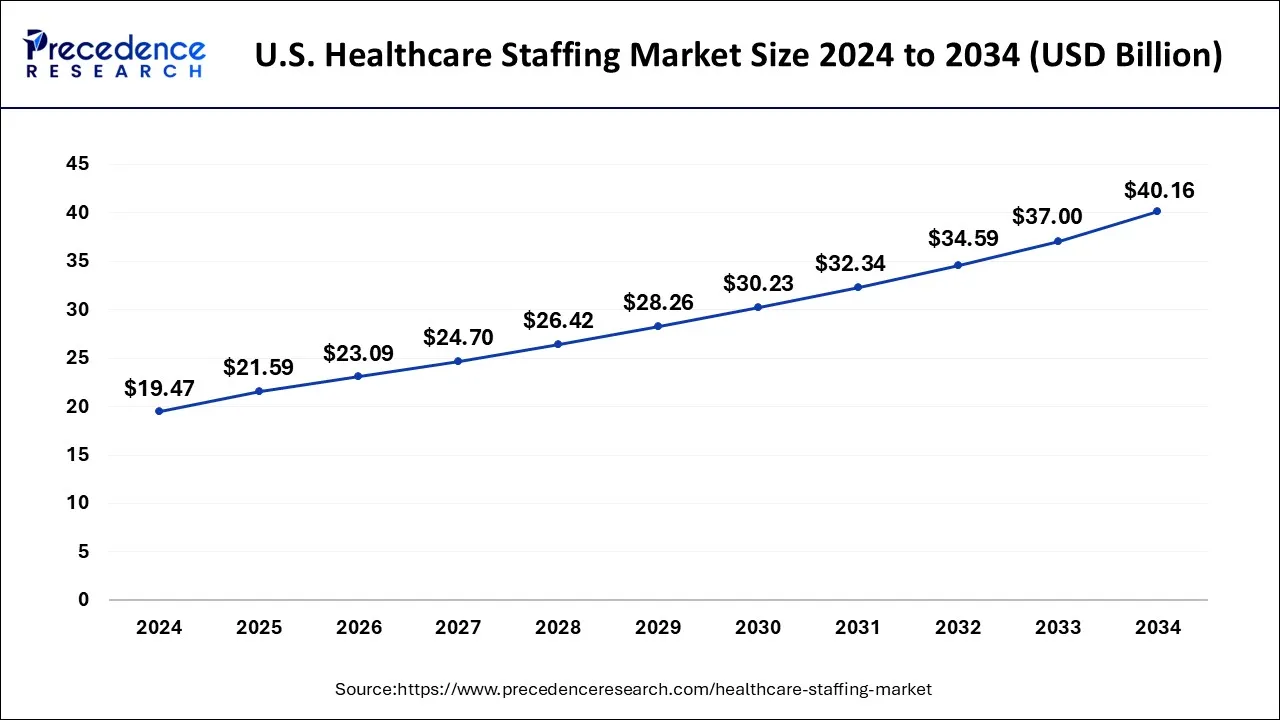

The U.S. healthcare staffing market size accounted for USD 21.59 billion in 2025 and is predicted to increase from USD 23.09 billion in 2026 to approximately USD 42.82 billion by 2035, expanding at a CAGR of 7.09% from 2026 to 2035.

Market Highlights

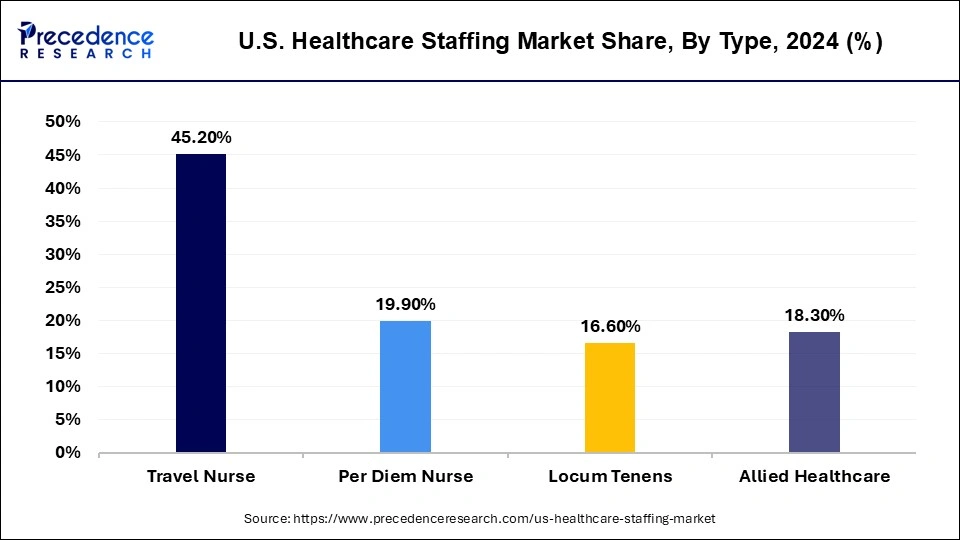

- By tye, the travel nurse staffing type segment accounted around 45.30% of market share in 2025.

- By tye, the per diem nurse type segment has captured market share of around 19.85% in 2025.

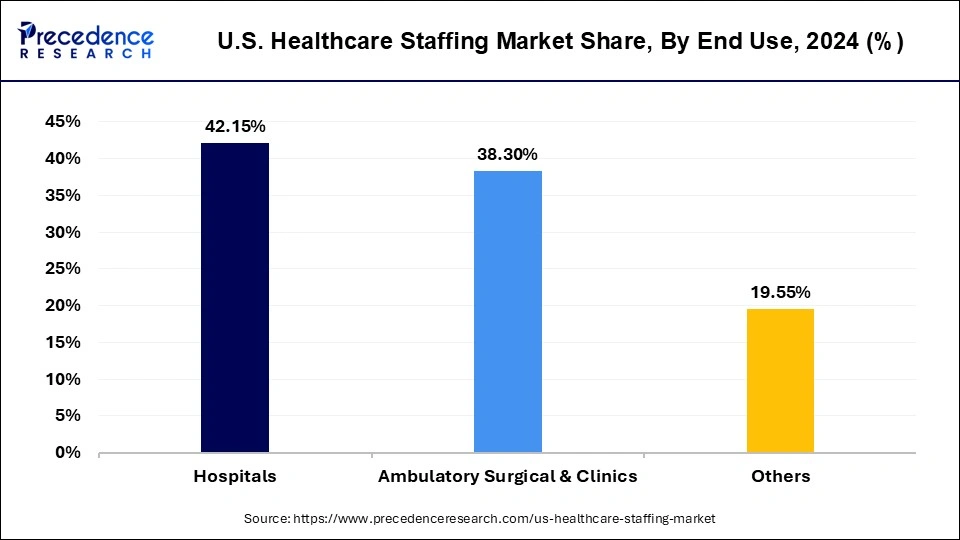

- By end-use, the hospitals end use segment has generated market share of around 42.05% in 2025.

- By end-use, the ambulatory surgical & clinics segment has held 38.20% market share in 2025.

AI in the U.S. Healthcare staffing market

The Artificial Intelligence-driven predictive analytics is a popular application in the US healthcare staffing market. The market operates on data-based decisions to bolster workforce management. The real-time data and historical analysis help in modifying the healthcare facilities by predicting accurate levels, staffing requirements, and patient volumes. This leads to an efficient and effective resource recruitment process that also diminishes overtime cost and satisfies staff. The advanced use of this application can improve patient care and address staffing shortages. The on-point forecasting of historical patient data covers seasonal trends, events, and admissions that give an overview of the future patient volume. It also gives an idea of the patient's demand that helps to allocate staffing volume accordingly.

- For instance, the Children's Mercy, Kansas City, has adopted this application. The hospital uses predictive models to predict the number of patients in advance, which helps them manage staffing schedules. Due to this, the hospital was able to attend to 67 more patients per year. By perfectly analyzing the data of staff skills, patient volume, and condition level, this application has encouraged many hospitals and clinics to practice it.

The flexibility and adjustments to the scheduling structure have eased the healthcare organizations' work patterns. The system linked to this application automates schedule adjustments and streamlines processes that minimize manual interactions. The AI has covered a vast concept and introduced a data-based approach to staffing. The popular technology enhances and improves the healthcare management system and unlocks various scopes to expand through new technologies. The U.S is ahead in adopting and introducing new advancements.

MarketOverview

Healthcare staffing services (HCSS) provide an independent and comprehensive assessment of an organization's ability to provide professional staffing services. Medical staffing agencies seek accreditation to demonstrate their commitment to providing a higher standard of service. Other benefits of certification include: the medical staffing activities are widely used by hospitals, ambulatory care organizations, nursing homes, clinics, government agencies, pharmaceutical companies, educational institutions, and medical software companies around the world.

What is Healthcare Staffing?

The healthcare staffing is a process of recruiting medical providers to manage staffing levels to serve every healthcare facility. It also includes managing and hiring of doctors, nurses, and respective healthcare professionals according to the requirements. This helps clinics, hospitals, and other suitable healthcare areas perform well in the competitive world and an advanced hospital setting. This market strongly highlights the healthcare staffing agencies. The agencies play a vital role in the U.S. healthcare staffing market.

It is a center of connection to various facilities and professionals for permanent and temporary options. The requirement for qualified professionals is in heavy demand as the competition has raised the bar of expectations from healthcare management, including clinics and hospitals. The technology and development are at first place to the fair competition for every sector practicing and adopting innovation and advancement in their respective field, complementing their role in the market.

This market covers a vast range of factors, consisting of selection, placement, assessment, management, and compliance. The U.S. healthcare staffing market is adopting strategies to fuel its recognition in the global market. The strong collaboration with healthcare professionals is one of the well-established strategies of the U.S. In terms of technological advancement, the U.S. is leading globally.The approach and social acceptance of the new technologies have fueled the growth of the market. The attentiveness to the updates and upcoming events regarding regulations strengthens and prepares healthcare management for change and opportunities. The market has almost covered all specialized areas to secure the future of the market.

U.S Healthcare Staffing Market Outlook

- Industry Growth Overview:  It is driven by an aging population, chronic clinician shortages, and increased need for flexible labor; the market is shifting toward technology-based, platform-driven, and per diem models.

- Major Investors: It includes Leonard Green & Partners, Ares Management, One Equity Partners, H.I.G. Capital, along with Warburg Pincus, focusing on high cash-flow firms. It provides high-growth opportunities driven by an aging population, severe workforce shortages, and the need for flexible staffing.

U.S. Healthcare Staffing Market Trends

- Nurse Staffing Shortage: The primary drivers are the aging nursing population who are retiring early, and the high incidence of stress and burnout among younger staff. The National Council of State Boards of Nursing (NCSBN) reported that more than 138,000 nurses left the workforce between 2022 and 2024. Research suggests that almost 40% nurses will aim to leave the workforce by 2029, which would impose labor shortage concerns.

- Travel Nurse Staffing: It is a growing trend due to the increased use of travel nursing staff in healthcare. The rising shortage of nursing staff and their burnout have raised the importance of travel nurse staffing.

- AI in Healthcare Employment: AI-driven recruitment has become an emerging trend due to the huge adoption of AI by healthcare organizations to streamline administrative tasks. It also includes the use of generative AI to streamline every stage from writing job descriptions to automating compliance checks.

- Data-Driven Workforce Planning: The real-time insights into staffing metrics are provided by advanced data platforms, which allow leaders to shift away from reactive scheduling. It also enables proactive resource allocation and helps to control labor costs.

- Allied Health Demand: There is a rising demand for specialized allied health professionals, such as imaging technologists, respiratory therapists, and physical therapists.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 21.59 Billion |

| Market Size in 2026 | USD 23.09 Billion |

| Market Size by 2035 | USD 42.82 Billion |

| Growth Rate from2026 to 2035 | CAGR of 7.09% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, and End User |

Market Dynamics

Drivers

Incapacitated patients

The patients undergone severe surgeries or failed treatments face various challenges in their daily routine. To assist and manage these patients, nurses or assistants are required. The demand for skilled professionals and nurses is growing rapidly. It could be a temporary or permanent requirement based on the nature of the surgery and the health history of the patients. This factor accelerates the growth, demand, and opportunity of the U.S. healthcare staffing market. The side effects of the medication are best learned by the medical experts, and further, the care is a crucial stage for the patient's improvement.

Restraint

Limited qualified professionals or staff

The market will be approachable if it shows the potential to sustain in the long run by providing advanced facilities or an alternative as per the required volume. The limited qualified healthcare professionals and staff will affect the growth rate in the market. Otherwise, reasons or clarification are not entertained by an individual receiver; neither hospitals nor clinics respond to the shortage of assistance/provider to meet their needs in a certain timeframe. This leads to a challenging situation. The recruitment of professionals with different expertise is a task in this market. To cover the hiring process, sometimes the time is not sufficient, or the professional is not acceptable. The possibilities are the preferences of the management or an individual patient. The whole procedure of the employment needs to meet all criteria, and the highest level of experience should be taken into consideration to cover the needs of the respective receiver.

Opportunity

Healthcare private agencies and employment

The healthcare agencies have largely occupied the U.S. healthcare staffing market. Healthcare agencies act as a center for resources and information in this market. The private agencies are a key source to understand new trends in this industry. It takes several departments to explore new insights and structure the plans accordingly. The need for resources is common to the private agencies to accelerate workflow. The knowledge to understand requirements requires a smart employee to find an appropriate individual for the respective work. Agencies with smart technologies and smart employees rule the market.

Around 2,927 businesses are running in the U.S. healthcare staffing market, which has experienced growth in the year between 2019 and 2024. The top agencies, such as Jackson Healthcare, Medical Solutions, Aya Healthcare, AMN Healthcare, Favorite Healthcare Staffing, Medix Staffing Solutions, Cross Country Healthcare, and CHG Healthcare, have contributed massively to this market. These top companies have been fueling the healthcare market with their strong collaborations and acquisitions, which are made possible due to satisfied resources.

Segment Insights

Type Insights

Based on type the healthcare staffing market is segmented into travel nurse staffing, Per Diem Nurse Staffing, Locum Tenens Staffing, and Allied Healthcare Staffing. The travel nurse staffing segment dominated the healthcare staffing market. This is due to high salaries, travel opportunities, and short-term assignments. In addition, hospitals are being forced to downsize due to soaring medical costs. That is why they choose these services to ensure caregivers are available when their workload increases.

On the other hand, the locum tenens staff segment is expected to register the largest growth during the forecast period. A growing shortage of GPs and specialists and hospitals hiring paramedics during peak seasons to cut costs are the main reasons for the growth of this segment. In 2019, They had nearly 52,000 doctors working as visiting physicians, according to Staff Care's 2020 Dispatch Physician Dispatch Trends report. An increase in the number of doctors preferring to work as locum doctors is anticipated to support the growth.

Allied healthcare staffing is specialized in healthcare employment with an emphasis in allied health and nursing. Allied Healthcare offers first-class enrolment services staffed 24 hours a day. Your facility can improve its recruitment process by utilizing vetted professional Temporary, Temporary Hiring, and Direct Placement services.

U.S. Healthcare Staffing Market Revenue, By Type, 2023-2025 (USD Billion)

| By Type | 2024 | 2024 | 2025 |

| Travel Nurse Staffing | 11.23 | 11.87 | 12.57 |

| Per Diem Nurse Staffing | 4.97 | 5.23 | 5.51 |

| Locum Tenens Staffing | 4.12 | 4.36 | 4.62 |

| Allied Healthcare Staffing | 4.58 | 4.81 | 5.05 |

End-Use Insights

Hospitals are the main and demanding end-users of this market, as the rising patient volume, mainly during the pandemic, was at its peak. The need for staffing for the day and night shifts, and management to handle a vast department, is a challenging task in hospitals. Also, hospitals have adopted advanced technologies, so to practice these technologies, guidance is required. The professionals are hired to perform advanced tasks in the hospitals. The clinics are mainly specialized (advanced) clinics that seek professionals to operate the advanced equipment. Other than providing specialized care, the staffing is also in demand to understand patient needs and carry out operations more efficiently and effectively.

The ambulatory surgical centers also demand skilled professionals to strengthen patient outcomes and improve care. The home healthcare agencies and long-term care facilities are in heavy demand either due to relative migration or a lack of attention towards the patients. Most of the geriatric population comes under these facilities. The medical devices market can also approach this market by providing medical instruments along with assistance that will unlock new opportunities in the US healthcare staffing market. Most of the industries have adopted this strategy by offering products along with assistance. This will lead to the expansion of business and an opportunity to partner with the top companies.

U.S. Healthcare Staffing Market Revenue, By End Use, 2023-2025 (USD Billion)

| By Type | 2023 | 2024 | 2025 |

| Hospitals | 10.47 | 11.06 | 11.69 |

| Ambulatory Surgical & Clinics | 9.48 | 10.04 | 10.63 |

| Others | 4.94 | 5.18 | 5.42 |

Country-level Insights

U.S. Healthcare Staffing Market Analysis

The U.S. healthcare staffing industry is growing and expanding due to physician and nurse deficits, and high demand for specialized medical care, emergency medicine, primary care, and surgical specialties. The major government programs and legislative actions include the Rural Health Transformation (RHT) Program, the Health Workforce Innovation Act, and many more, which improve healthcare delivery in rural communities. The healthcare staffing industry is driven by large-scale staffing and workforce solutions providers. These leading providers include AMN Healthcare, Maxim Healthcare Group, and Envision Healthcare Corporation.

Value Chain Analysis for the US Healthcare Staffing Market

- R&D

It aims to develop AI-driven platforms, predictive analytics, and automated workflows to improve talent sourcing, scheduling, and even credentialing, rather than drug discovery.

Key Players: ASML Holding NV, Nikon Corporation, Canon

- Clinical Trials and Regulatory Approvals

It acts as a main driver for the US healthcare staffing market, creating a high need for specialized, temporary, and contract labor, particularly in pharma, biotech, and medical device sectors.

Key Players: Insight Global, RapidTrials, Proclinical, Scientific Search

- Formulation and Final Dosage Preparation

It involves hiring specialized pharmacists, pharmacy technicians, as well as compounding specialists, sterile or non-sterile, to prepare customized, patient-specific medications.

Key Players: Aya Healthcare, Medical Solutions, AMN Healthcare, CHG Healthcare, & Cross Country Healthcare

Top Companies' Offerings for the US Healthcare Staffing Market

- CHG Management, Inc.: CHG Healthcare provides a wide range of temporary and permanent staffing services, technology solutions, and talent management, specializing in connecting hospitals and healthcare organizations with qualified professionals.

- Maxim Healthcare Group: Maxim Healthcare Staffing provides comprehensive US healthcare staffing solutions, including travel nursing, per diem, and allied health professionals. They serve schools, government facilities, hospitals, and correctional institutions with recruitment, placement, and workforce management software.

- Cross Country Healthcare, Inc.: Cross Country Healthcare, Inc. offers comprehensive, tech-enabled workforce solutions as well as staffing services in the US, specializing in allied health, travel per diem nursing, and physician locum tenens.

Other U.S. Healthcare Staffing Market Companies

- Amn Healthcare

- Envision Healthcare Corporation

- Trustaff

- Aya Healthcare

- Teamhealth

- Adecco Group

- Locumtenens.Com

Recent Developments

- On 8th July 2025, Health Advocates Network Holdings Corp. company known for its unique healthcare workforce solutions, serving staffing to the United States, has completed its oversubscribed debt and equity offerings. The investors are attracting investors and showing trust in the company's strategy.(Source :https://cbs4indy.com)

- On 17th June 2025, StaffDNA, a plano, Texas, acquired the per diem staffing business of Kevala. The deal gives authority to StaffDNA to extend its candidate pool through Kevala's passive and active candidate database in Texas, Oregon, Washington, Utah, Tennessee, and Wisconsin(Source : https://www.staffingindustry.com )

- On 11th June 2025, Travel Nurse Across America, a known healthcare staffing firm, has joined hands with TotalMed, which is a global clinical travel solutions and MSP services provider. This merger will expand the portfolio of the firm's services.(Source:https://www.staffingindustry.com)

Segments Covered in the Report

By Type

- Travel Nurse Staffing

- Per Diem Nurse Staffing

- Locum Tenens Staffing

- Physicians

- Physician Assistants

- Nurse Practitioners

- Others

- Allied Healthcare Staffing

By End-User

- Hospitals

- Ambulatory Surgical & Clinics

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting