January 2024

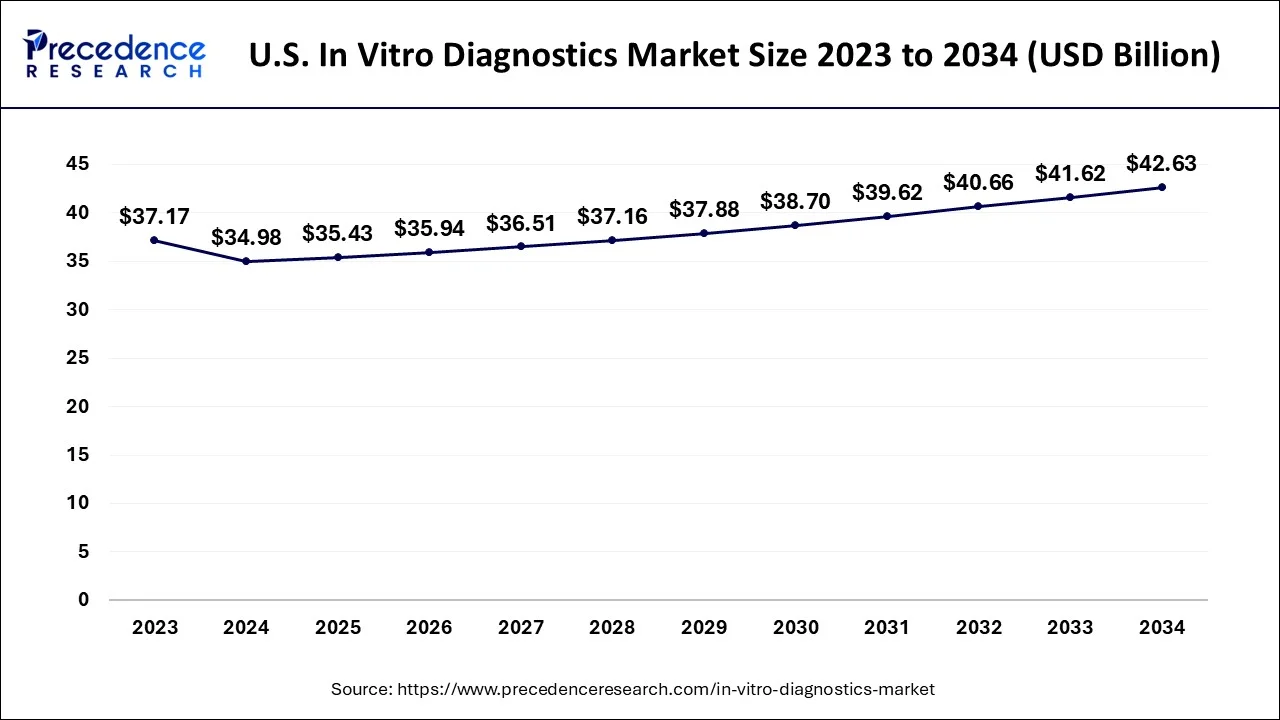

The U.S. in vitro diagnostics market size accounted for USD 34.98 billion in 2024, grew to USD 35.43 billion in 2025 and is projected to surpass around USD 42.63 billion by 2034, growing at a CAGR of 2% between 2024 and 2034.

The U.S. in vitro diagnostics market size is estimated at USD 34.98 billion in 2024 and is predicted to surpass around USD 42.63 billion by 2034, growing at a CAGR of 2% between 2024 and 2034.

In vitro diagnostics (IVD) refers to the medical tests and procedures that are performed outside of a living organism, typically in a laboratory setting. The term “In Vitro” is Latin for “In Glass”, and it signifies that these diagnostic tests are conducted using components such as cells, tissues, or biological molecules, which are extracted from the human body or other sources. In vitro diagnostics play a crucial role in healthcare by providing information about a patient’s health status, and aiding in the diagnosis, treatment, and monitoring of various diseases and conditions.

These tests are conducted on samples like blood, urine, saliva, tissues, or other bodily fluids. In vitro diagnostics encompasses a wide range of technologies and methodologies, including molecular diagnostics, immunoassays, clinical chemistry, hematology and microbiology. The development and improvement of these diagnostics tools have significantly contributed to advances in personalized medicine, early disease detection and overall healthcare management.

The US in vitro diagnostics market is driven by the growing prevalence of chronic diseases such as cancer, diabetes, cardiovascular disease and others. For instance, according to the data published by the CDC, the incidence of diagnosed diabetes was estimated to vary from 4.4% to 17.9% across US counties in 2021. Furthermore, the prevalence of diagnosed diabetes at the median county-level rose from 6.3% in 2004 to 8.3% in 2021.

Moreover, the increasing geriatric population in the country is also an important factor that propels the US in vitro diagnostics market growth during the forecast period. Furthermore, the increasing awareness of the benefits of personalized medicine and targeted therapies has fueled the demand for diagnostic tests that can provide detailed information about an individual’s genetic makeup, aiding in personalized treatment strategies.

| Report Coverage | Details |

| U.S. Market Size in 2024 | USD 34.98 Billion |

| U.S. Market Size by 2034 | USD 42.63 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 2% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Test Location, By Technology, By Application, and By End User |

Growing emphasis on precision medicine

The US in vitro diagnostics market has been greatly influenced by the increased emphasis on personalized treatment. The goal of personalized medicine is to provide patients with care that is specific to them, taking into account their lifestyle, genetic composition, and other variables. Companion diagnostics and genetic testing are examples of in vitro diagnostics that offer vital insights into the distinct qualities of each patient. These insights enable focused medicines, preventing needless treatments or unfavorable responses.

Advanced technologies such as next-generation sequencing (NGS) and companion diagnostics provide precision diagnostics, which make it easier to identify certain disease subtypes and molecular targets. Specialized diagnostic tests are becoming more and more in demand as precision medicine gets traction. To assist precision medicine objectives, pharmaceutical firms and healthcare providers are investing a greater amount in research and development to find novel biomarkers and develop creative diagnostic techniques.

Lack of skilled professionals

Most important diagnostic procedures, including immunoassay, clinical chemistry, and molecular diagnostics, require skilled personnel with enhanced dexterity to operate instruments and execute the procedure precisely. Nevertheless, there is a lack of qualified workers on the market to operate this equipment. Furthermore, several variables, including a lack of standardization and curricular knowledge on procedures, the immigration of well-established educated professionals from poor to developed nations, and inadequate training in handling equipment, are responsible for this shortage. The requirement for costly, multi-year theoretical education to become a certified professional or technician also adds to the scarcity of highly competent professionals. As a result, these elements negatively impact the US US in vitro diagnostics market.

Technological advancements

The market for in vitro diagnostics (IVD) has undergone a revolution due to the speed at which technology is developing. Next-generation sequencing, molecular diagnostics, and microfluidics are examples of advanced technologies that have made testing more sensitive and accurate. Diagnostic procedures have been simplified by automation, which has decreased human error and increased productivity. Point-of-care testing equipment and other automated methods have made it possible to make decisions about patient treatment more quickly by facilitating faster findings. These developments improve patient outcomes and save costs while also increasing diagnostic accuracy.

Additionally, automation has improved patient access to critical diagnostic services and addressed healthcare inequities by expanding the reach of diagnostic testing to rural or resource-constrained places. Diagnostic systems now have greater analytical power because of the integration of AI and machine learning algorithms, which enables more accurate and customized test interpretations. With an ever-growing array of diagnostic tests and applications, the in vitro diagnostics market is predicted to develop as long as technology continues to progress.

The reagents segment dominated the market with a share of 67% in 2023. Reagents are fundamental components of diagnostic assays and tests. They enable the detection of specific biomarkers or the presence of a particular substance in patient samples, such as blood, urine, or tissue. The increasing adoption of molecular diagnostic techniques, such as polymerase chain reaction (PCR) and nucleic acid amplification tests, has led to a rising demand for specialized reagents used in these assays. These reagents play a crucial role in DNA and RNA analysis. Therefore, the importance of reagents in various diagnostics techniques drives the market growth.

The point of care segment held the largest share of the market in 2023. Point-of-care testing refers to diagnostic testing performed at or near the patient, typically outside of a traditional laboratory setting. This approach allows for rapid and convenient diagnostic results, enabling quicker decision-making by healthcare providers. Advances in technology have led to the expansion of POCT applications beyond traditional tests. Molecular diagnostics, biosensors, and other innovative technologies are being incorporated into point-of-care devices, broadening their capabilities. Thus, driving the segment growth.

The immunoassay segment held the largest share of the market in 2023. Immunoassays rely on the interaction between antibodies and antigens. These tests use labeled antibodies or antigens to detect and measure the presence of specific analytes, such as proteins, hormones, drugs, or infectious agents, in patient samples. They find applications across various medical fields, including clinical diagnostics, infectious disease testing, oncology, endocrinology, allergy testing, and therapeutic drug monitoring. In addition, the growing product launches by the US in vitro diagnostics market players also offer a potential opportunity for segment growth.

The infectious diseases segment holds the dominating segment of the market. Infectious diseases pose significant public health challenges, and the ability to rapidly and accurately diagnose these conditions is crucial for effective disease management and control. In vitro diagnostics play a pivotal role in the timely detection of infectious agents.

The oncology segment is expected to grow at the fastest CAGR during the forecast period due to the rising prevalence of cancer. For instance, cancer is the second most prevalent cause of death in the United States, after heart disease, according to the American Cancer Society's January 2022 statistics. 2022 is predicted to bring 609,360 cancer-related fatalities (or around 1,670 deaths per day) and 1.9 million new cancer diagnoses to the United States. Thus, the aforementioned statistics are expected to propel the segment's growth.

The hospital segment held the largest share of the market in 2023. Hospitals are primary users of routine diagnostic tests performed in clinical laboratories. These tests include blood tests, urine tests, and other analyses that aid in the diagnosis and monitoring of various medical conditions. Additionally, hospitals utilize in vitro diagnostics for clinical chemistry and hematology tests, providing information about a patient's blood chemistry, cell counts, and related parameters. These tests are fundamental for assessing overall health and diagnosing diseases. Thus, propelling the segment growth.

By Product

By Test Location

By Technology

By Application

By End User

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2024

February 2025

December 2024

December 2024