November 2024

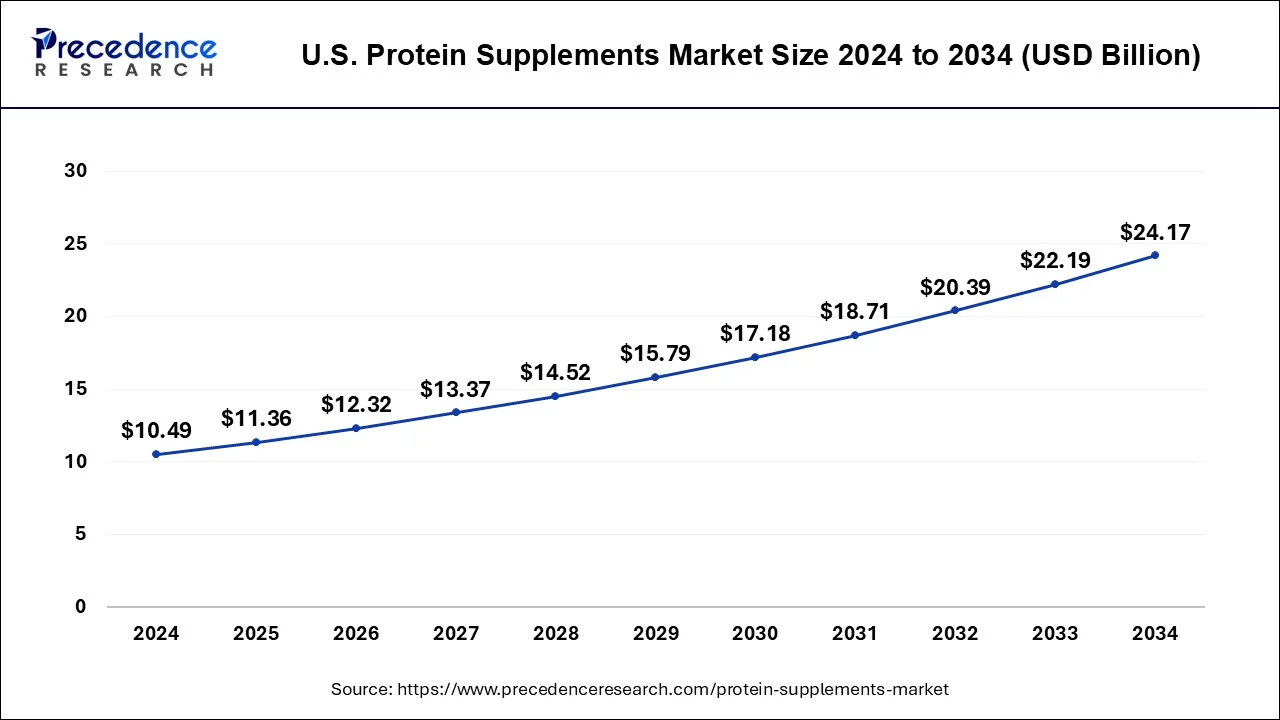

The U.S. protein supplements market size is calculated at USD 11.36 billion in 2025 and is forecasted to reach around USD 24.17 billion by 2034, accelerating at a CAGR of 8.70% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. protein supplements market size was USD 10.49 billion in 2024, estimated at USD 11.36 billion in 2025 and is anticipated to reach around USD 24.17 billion by 2034, expanding at a CAGR of 8.70% from 2025 to 2034.

The U.S. protein supplements market offers supplementary products with the concentration of protein, such as whey, casein, soy, pea, or eggs. They are frequently used by people who are trying to increase their protein consumption for a variety of objectives, such as meeting daily nutritional requirements, managing their weight, or developing muscle. They are made into powders, bars, or shakes by procedures like extraction, purification, and drying.

Essential amino acids included in protein supplements are necessary for the body's many processes, such as immune system support, muscle repair, and enzyme synthesis. They fulfil total protein requirements, especially for people with restricted dietary alternatives or specialized fitness objectives, and provide a handy and speedy way to consume protein, particularly after exercise. They also help in muscle repair.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.70% |

| Market Size in 2023 | USD 10.49 Billion |

| Market Size by 2034 | USD 24.17 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Source, By Application, By Distribution Channel, By Form, By Gender, and By Age Group |

Increasing fitness trends

The growing popularity of fitness and muscle enthusiasts has raised consumer demand for products that promote efficiency, such as beverages high in protein and carbohydrates. There are now commercially available amino-based, bio-based, and readily digested whey protein isolate products due to the growing usage of whey protein isolate in sports goods. Moreover, whey protein isolate is an inexpensive choice for making caramels with excellent processing efficiency and eating quality. Whey protein isolate is now commercially available due to the steady growth in the usage of protein isolate in sports goods brought about by several modifications. This has led to a rise in the use of whey protein isolate in the sports nutrition sector and will help fuel the expansion of the U.S. protein supplements market.

Growing demand for fresh foods and meals

The rising number of people suffering from obesity, diabetes, and other lifestyle-related illnesses is ascribed to poor eating habits and inactivity. People have changed their habits as a result of the risks associated with these diseases, which include eating a healthy diet rich in fresh foods and meals. Farmers markets and recipe boxes are becoming popular and will put strain on the expansion of the U.S. protein supplements market.

Growing collaboration

The growing collaboration is expected to offer a lucrative opportunity for the U.S. protein supplements market during the forecast period. Collaborative activities in different firms of the industry promote the distribution of products while supplementing the market’s growth. For instance, in August 2023, Active pharmaceutical ingredients (API) specialist Supriya Lifescience Ltd., based in Mumbai, announced a partnership with Delaware-based Plasma Nutrition, Inc., a US firm recognized for cutting-edge consumer goods. As part of the strategic relationship, Supriya Lifescience Ltd. has been granted exclusive rights to manufacture and commercialize Ingredient Optimized Protein (ioProtein) in India under an exclusive technology licensing arrangement.

This partnership's main goal is to introduce improved protein to the Indian market. The method used in ioProtein is patented (US patent pending). This ground-breaking protein powder has a major benefit and is highly bioavailable. It is intended to be used as a protein supplement. This implies that larger protein dosages cause the body to absorb them more quickly, giving users of protein supplements a more potent and effective option.

The protein powders segment held the largest share of the U.S. protein supplements market. The practice of adding protein powders to daily meals for weight control, muscle building, and general health and wellbeing has become more popular as people's awareness of health issues has grown. An increasing number of bodybuilders, casual exercisers, and top athletes are also requesting products. Due to the growing number of customers choosing vegan or vegetarian diets, plant-based protein powders are likewise becoming more and more popular.

The protein bars segment is expected to grow at the highest CAGR during the forecast period. The category proliferating due to the ease with which protein bars can be grabbed and consumed by consumers. Lean mass and increased protein synthesis are two benefits of protein bars. Demand for easy-to-eat, portable snacks with nutritional content has increased due to busy lives and lack of time for preparing balanced, nourishing meals. Protein bars are expected to drive market expansion due to their quick energy and nutritional value.

The animal-based segment dominated the U.S. protein supplements market with the largest share. Whey protein is one of the most widely consumed animal-based protein supplements. It is derived from milk during the cheese-making process and is known for its fast absorption and complete amino acid profile. Whey protein is popular among athletes and fitness enthusiasts for muscle building and recovery.

The demand for animal-based protein supplements has been driven by the increasing awareness of the importance of protein in the diet, coupled with a growing fitness and health-conscious population. Athletes, bodybuilders, and individuals looking to meet specific protein requirements often turn to animal-based supplements.

The sports segment held the dominating share of the U.S. protein supplements market while promising a sustained growth for the forecast period. Protein supplements are widely consumed by athletes and fitness enthusiasts to support their training goals. This includes muscle building, recovery after intense workouts, and overall performance enhancement.

Protein supplements are often integrated into pre- and post-workout nutrition strategies. Pre-workout formulations may include protein for energy and muscle support, while post-workout supplements aim to replenish nutrients and promote recovery. In addition, continuous innovation in product formulations, flavors, and delivery formats (such as protein bars, shakes, and powders) helps companies stay competitive and cater to evolving consumer preferences within the sports nutrition space. Thereby, driving the segment expansion.

Tthe supermarkets & hypermarkets segment held the largest share of the U.S. protein supplements market. Supermarkets and hypermarkets typically offer a diverse selection of protein supplements, including various brands, formulations, flavors, and types (whey, casein, plant-based, etc.). This allows consumers to compare products and choose those that align with their preferences and dietary needs.

Moreover, the widespread availability of protein supplements in supermarkets and hypermarkets makes them easily accessible to a broad consumer base. Shoppers can find these products while doing their regular grocery shopping, enhancing convenience and encouraging impulse purchases. Thus, driving the segment growth.

By Product

By Source

By Application

By Distribution Channel

By Form

By Gender

By Age Group

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

September 2024

November 2024

August 2024