November 2024

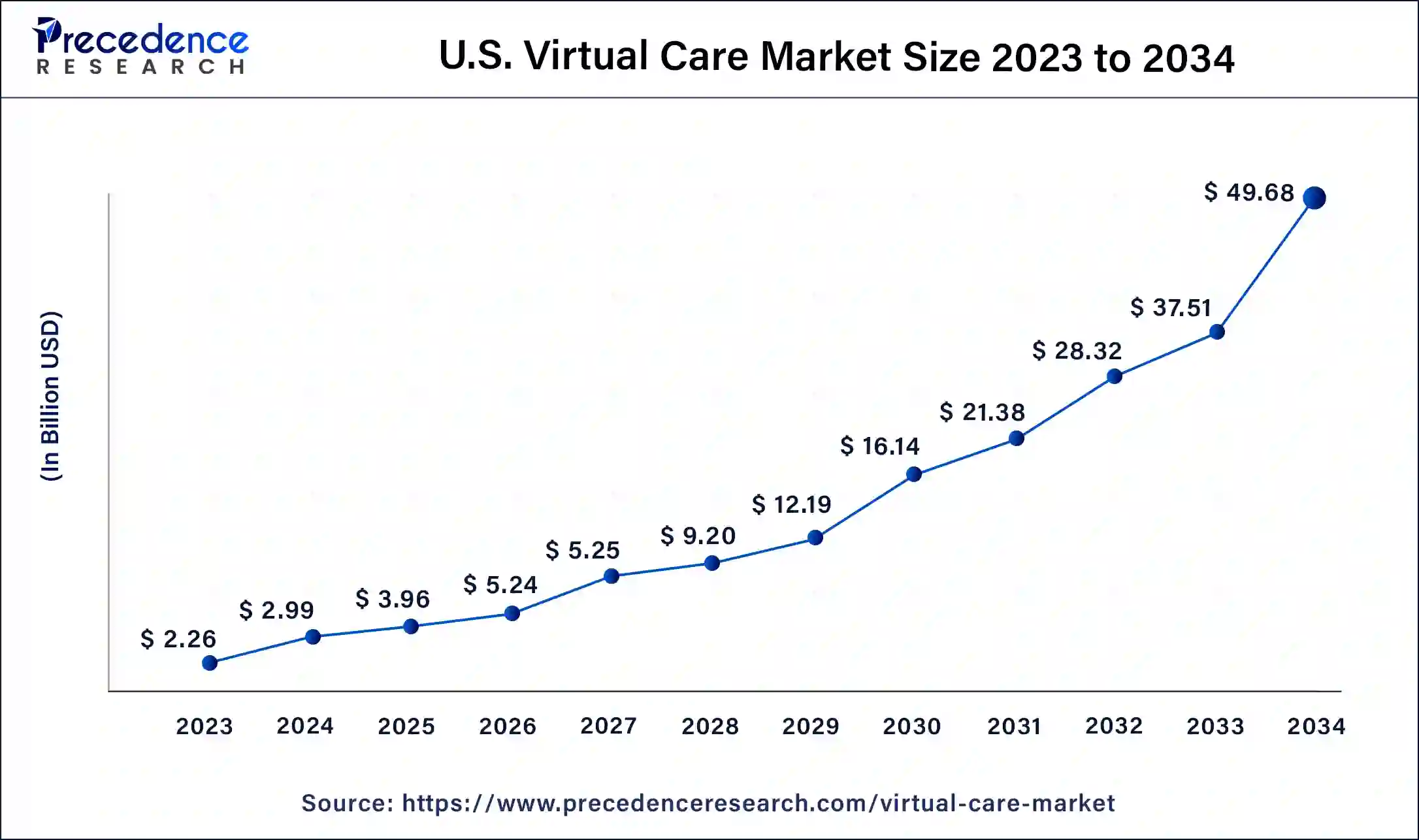

The U.S. virtual care market size was USD 2.26 billion in 2023, calculated at USD 2.99 billion in 2024 and is projected to surpass around USD 49.68 billion by 2034, expanding at a CAGR of 32.5% from 2024 to 2034.

The U.S. virtual care market size accounted for USD 2.99 billion in 2024 and is expected to be worth around USD 49.68 billion by 2034, at a CAGR of 32.5% from 2024 to 2034.

Virtual care is a method of treating patients with everyday health problems using video, audio, or written communication. This is also called a virtual visit using a communication device that both the patient and the doctor hold at different locations. Virtual care methods are mainly used for meetings, routine health consultations, etc. Virtual visits consist of “virtual visits” conducted between a patient and a healthcare provider using telecommunication technology. The term “virtual” refers to the real-time virtual meeting of patients and physicians from anywhere.

| Report Coverage | Details |

| Market Size in 2023 | USD 2.26 Billion |

| Market Size in 2024 | USD 2.99 Billion |

| Market Size by 2034 | USD 49.68 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 32.5% |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Service Type, Technology Type, and End-user |

Increasing prevalence of chronic diseases

The growing elderly population in the United States is creating a highly favourable environment for chronic diseases. For instance, the CDC stated that chronic diseases like cardiovascular diseases, cancer, diabetes, and respiratory diseases increase approximately 70% of deaths every year in the united states. Moreover, the WHO report also found that the global population aged 60 and over will double from 12% to 22% between 2015 and 2022.

A growing number of smartphone users

The smartphone users are increasing continuously as the availability of the internet. The total smartphone users in Unite State are 298 million. The smartphone is the easiest way for using and connecting virtually. The US smartphone market is one of the largest in the world with approximately 298 million smartphone users (as of 2021). In line with the overall growth of the global smartphone market, US smartphone penetration has increased steadily in recent years, reaching 85% in February 2021.

Security concerns might restrict the US virtual care market progression

Security concerns related to sensitive patient data may limit its value to the industry. Telemedicine solutions require platform integration for electronic prescriptions, electronic patient files, and medical or fitness apps, among others. Data breaches can lead to unauthorized access to sensitive information such as medical records, medical records, prescriptions, insurance cards, personal ID cards, social security numbers, and addresses. Data breaches therefore negatively affect the overall reputation of telemedicine providers.

Rising demand for tele-consulting to showcase significant market growth

The rapid change in the acceptance of virtual consultations has improved access to medical services, even in remote areas. It was also observed that the user adoption rate jumped from 11% to 46% within one year. Additionally, telemedicine maximizes patient reach at minimal cost, making it cost-effective. The need for remote patient monitoring is driving increased demand for tele-hospital services. The growing need to provide efficient, high-quality healthcare services at affordable prices is also a major contributor to industry sales. In addition, growing public awareness of the-hospital services such as daytime patient visits, emergency room visits, night-time calls and hospitalizations is projected to increase industry demand for telemedicine. 84 percent of physicians were offering virtual visits and 57 per cent would prefer to continue offering virtual care.

The telemedicine segment dominated the U.S. virtual care market in 2023 due to the increased emphasis on remote consultation. Telemedicine is increasingly used due to its ability to provide remote consultations and treatment, reducing frequent hospital visits. It allows patients to connect with physicians through video calls, thereby enhancing convenience and overall patient outcomes. Advancements in technology, such as electronic health records and remote monitoring devices, have improved the effectiveness and capabilities of telemedicine. Moreover, the rising policies in the U.S. that facilitate telemedicine reimbursement contributed to the segment growth.

The video conferencing technology segment held a large share of the market in 2023. Video conferencing platforms, including Zoom and Microsoft Teams, have become essential in delivering virtual care services. These platforms have become essential for conducting virtual appointments and consultations, enabling continuity of care during challenging times. The COVID-19 pandemic has further boosted the adoption of remote healthcare solutions. The increasing demand for personalized care further augmented the segment.

The patients segment dominated the U.S. virtual care market in 2023. The increasing adoption of wearable devices, remote monitoring devices, and mobile health apps among patients to reduce healthcare costs and enhance health outcomes contributed to the segment expansion. The growing prevalence of chronic diseases in the U.S. further encouraged patients to use remote patient monitoring and remote consultation services, as some chronic diseases require regular checkups to manage symptoms. Moreover, the increasing adoption of mHealth apps among patients contributed to the segmental growth.

Segments Covered in the Report

By Service Type

By Technology Type

By End-user

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2024

February 2025

February 2024