August 2024

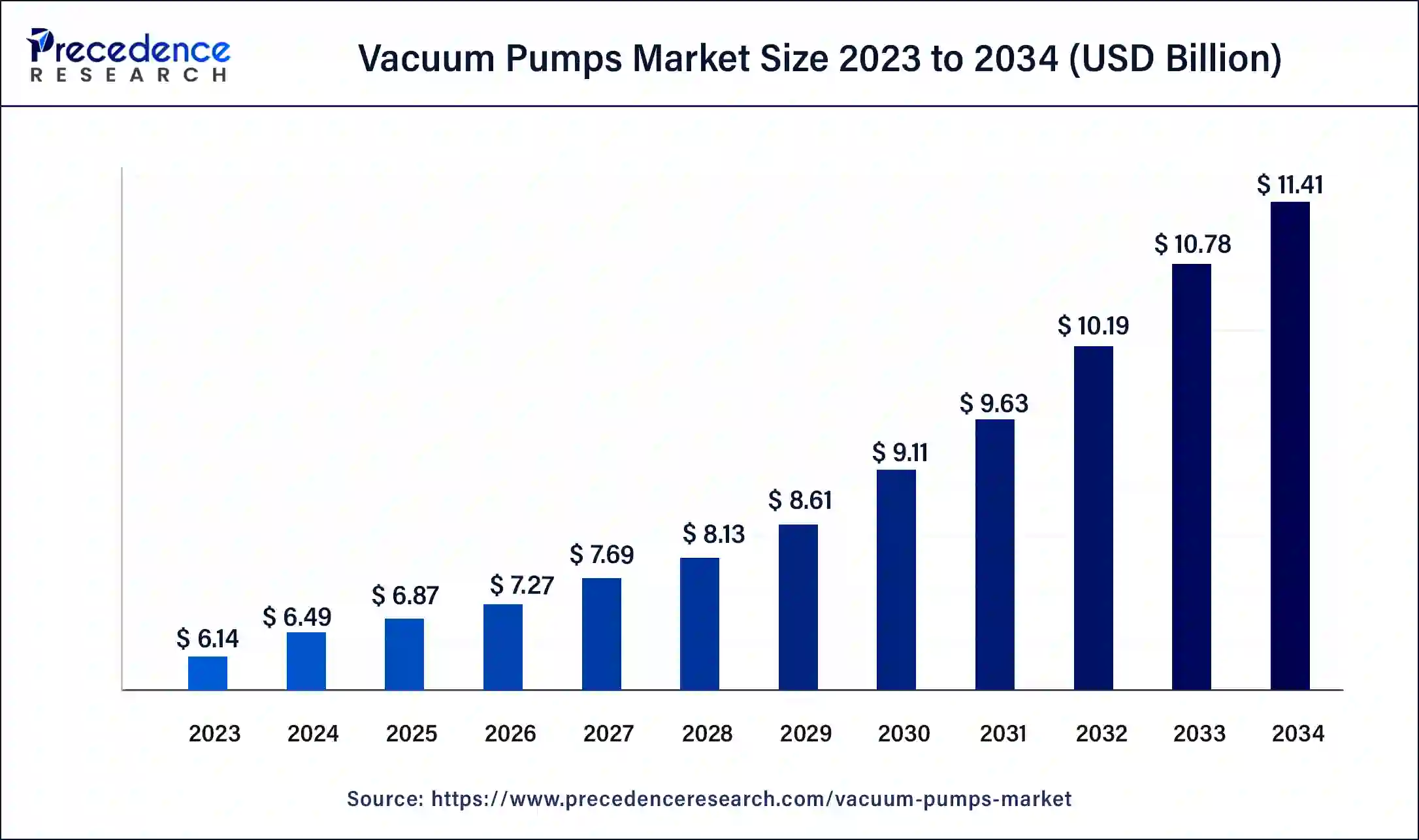

The global vacuum pumps market size was USD 6.14 billion in 2023, calculated at USD 6.49 billion in 2024 and is expected to reach around USD 11.41 billion by 2034. The market is expanding at a solid CAGR of 5.8% over the forecast period 2024 to 2034.

The global vacuum pumps market size accounted for USD 6.49 billion in 2024 and is expected to reach around USD 11.41 billion by 2034, expanding at a CAGR of 5.8% from 2024 to 2034.

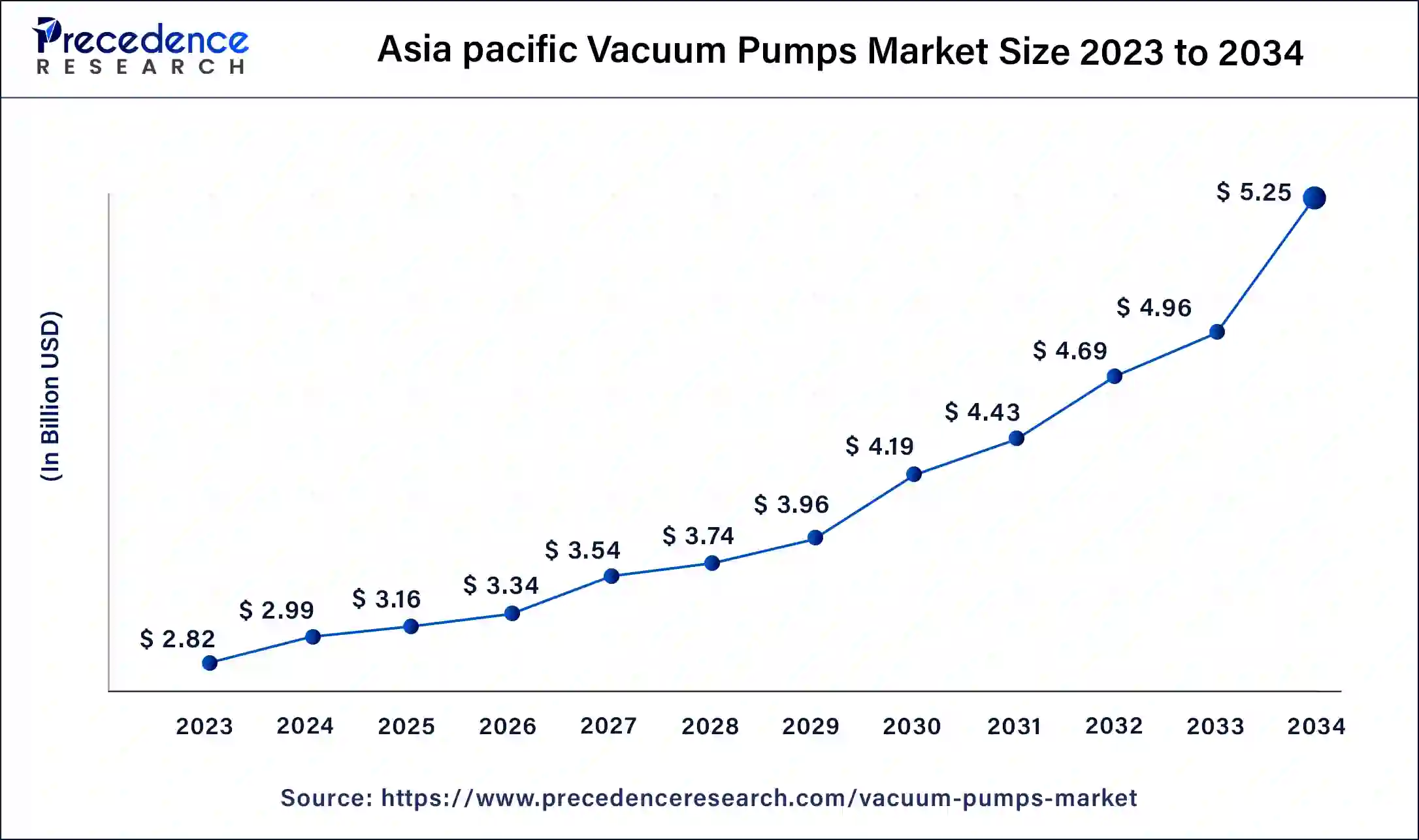

The Asia Pacific vacuum pumps market size was estimated at USD 2.82 billion in 2023 and is predicted to be worth around USD 5.25 billion by 2034, at a CAGR of 6% from 2024 to 2034.

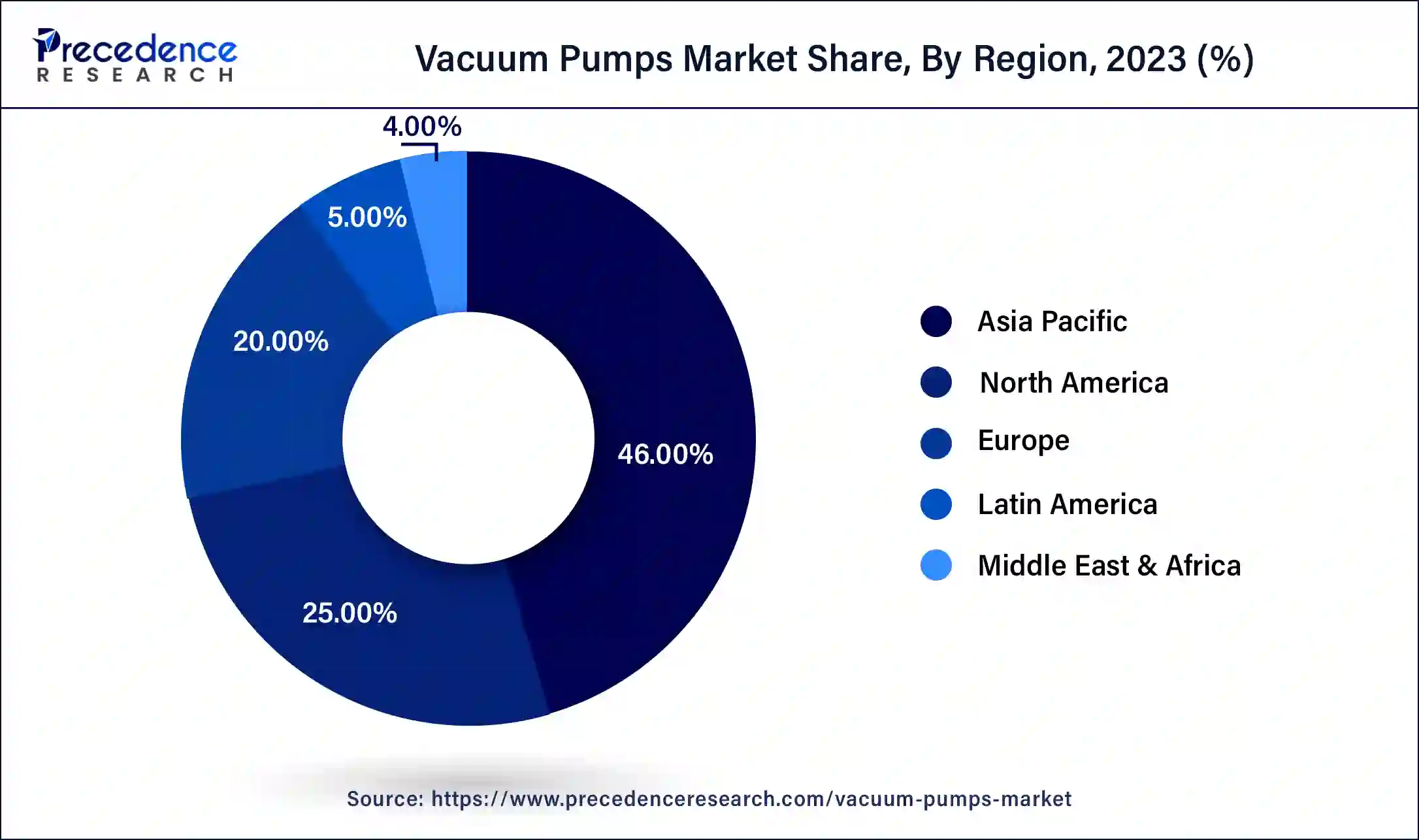

Asia Pacific has held the largest revenue share of 46% in 2023. Asia Pacific dominates the vacuum pumps market due to several key factors. The region's robust industrialization, particularly in electronics, semiconductor manufacturing, and automotive sectors, drives substantial demand for vacuum pumps. Additionally, the expanding healthcare and pharmaceutical industries further contribute to the market's growth.

Favorable government policies and investments in manufacturing infrastructure also bolster Asia Pacific's vacuum pumps market. Moreover, the presence of key manufacturers and suppliers in countries like China, Japan, and South Korea, combined with a vast consumer base, makes this region a major player in the global vacuum pump market.

North America is estimated to observe the fastest expansion. North America's prominent growth in the vacuum pump market is primarily attributed to its thriving semiconductor and electronics sector, a substantial user of vacuum pump technology.

The region's robust presence in key industries such as healthcare, aerospace, and automotive manufacturing, all of which depend significantly on vacuum pumps, also plays a pivotal role. North America's dedication to research and innovation, coupled with its commitment to environmentally responsible practices, fosters the adoption of energy-efficient vacuum pump solutions. These factors collectively establish North America as a major player in the vacuum pump industry.

A vacuum pump is a sophisticated mechanical apparatus designed to eliminate air and various gases from a confined space, thereby creating a controlled vacuum or low-pressure environment. This is achieved through the pump's ability to manipulate the pressure within a chamber, effectively extracting gases, moisture, and contaminants. Vacuum pumps are indispensable tools utilized across a spectrum of industries, serving vital roles in industrial, scientific, and commercial settings.

These pumps are particularly valuable in fields such as manufacturing, pharmaceuticals, and electronics, where precise vacuum conditions are imperative for processes like degassing, desiccation, or molding. A variety of vacuum pump types are available, including rotary vane pumps, diaphragm pumps, and turbomolecular pumps, each tailored to specific applications. Vacuum pumps are pivotal in upholding the integrity of vacuum systems, facilitating experiments, industrial procedures, and the efficient operation of an array of devices reliant on a controlled vacuum environment.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.8% |

| Market Size in 2023 | USD 6.14 Billion |

| Market Size in 2024 | USD 6.49 Billion |

| Market Size by 2034 | USD 11.41 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Lubrication, By Vacuum Level, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Semiconductor industry and healthcare advancements

The semiconductor industry acts as a primary catalyst for the heightened demand in the vacuum pump market. Vacuum pumps serve as indispensable tools in semiconductor manufacturing, particularly in the production of ever-smaller and more powerful integrated circuits.

As the semiconductor sector progresses, necessitating the creation of increasingly compact and advanced chips, the demand for precision vacuum pumps escalates. These pumps are instrumental in maintaining a clean and controlled environment, ensuring contamination-free processes during key stages like lithography, etching, and deposition. The relentless drive for technological innovation within the semiconductor industry consistently propels the growth of the vacuum pumps market.

On the other hand, healthcare advancements have significantly surged the demand for vacuum pumps. These pumps are integral to various healthcare applications, such as vacuum-assisted wound closure, blood analysis, and medical sterilization processes. As medical research and innovation progress, vacuum pump technologies are continually adapted to ensure the highest levels of precision, safety, and performance in these critical healthcare applications. Therefore, the healthcare sector's continuous pursuit of technological advancements and improved patient care fuels the ever-growing need for vacuum pumps in this domain.

Energy consumption and economic cycles

Energy consumption serves as a significant restraint on the growth of the vacuum pumps market. Vacuum pumps are known to be energy-intensive devices, consuming substantial amounts of power during their operation. This high energy demand results in increased operating costs for businesses, particularly in industries that require continuous vacuum operations.

Rising energy prices and a growing emphasis on environmental sustainability further exacerbate this issue, compelling users to seek more energy-efficient alternatives or to optimize their existing vacuum systems. Consequently, the high energy consumption of vacuum pumps can discourage potential users and pose a financial burden on existing users, thus restraining the market's growth. Economic cycles also have a notable impact on the vacuum pumps market.

The demand for vacuum pumps is closely tied to industrial activities and capital investments. During economic downturns or periods of economic uncertainty, businesses may curtail capital expenditures, affecting the adoption of vacuum pump systems. Conversely, in times of economic growth, industries may be more inclined to invest in these systems. Economic fluctuations, therefore, introduce a level of volatility into the vacuum pumps market, making it sensitive to broader economic conditions and potentially limiting its sustained growth in uncertain economic environments.

Green technology adoption and customization & specialization

Green technology adoption is a significant opportunity in the vacuum pumps market. As environmental sustainability becomes a top priority, there is a growing demand for energy-efficient and eco-friendly vacuum pump technologies. Manufacturers can capitalize on this by developing pumps that minimize energy consumption and reduce emissions. Additionally, the use of clean and environmentally friendly lubricants, like dry pumps, can align with green technology principles.

This trend not only caters to environmentally conscious industries but also attracts incentives and favorable regulations, further boosting market growth. Customization and Specialization present another avenue for market expansion. The ability to provide tailored vacuum solutions for niche applications is a valuable opportunity. Industries such as 3D printing, aerospace, and research laboratories require highly specialized vacuum systems to meet their unique requirements. Manufacturers that offer customization services or design pumps specifically for these applications can gain a competitive edge and tap into previously unaddressed markets. This specialization allows for higher product differentiation and increased demand for vacuum pump systems in various sectors.

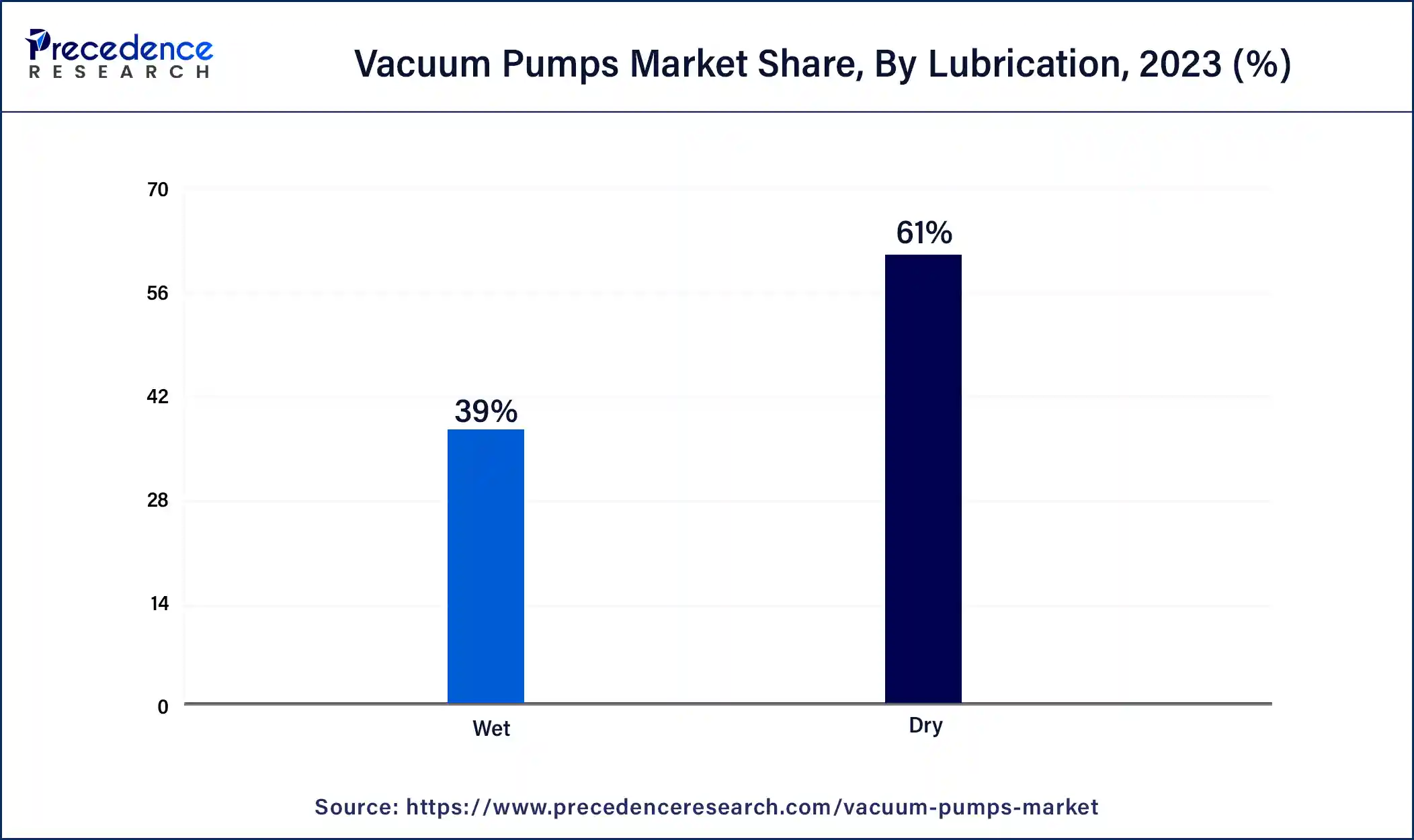

The dry lubrication segment had the highest market share of 61% in 2023. Dry lubrication in the vacuum pumps market refers to a lubrication method that doesn't rely on liquid or oil-based lubricants. Instead, it employs solid or dry film lubricants to reduce friction and wear between moving parts within the pump. This approach offers several advantages, including lower maintenance requirements, reduced contamination risk, and improved efficiency.

A notable trend in the vacuum pumps market is the increasing adoption of dry lubrication systems. This trend is driven by the desire to minimize environmental impact, enhance operational cleanliness, and reduce downtime for maintenance. Dry lubrication not only improves the performance and lifespan of vacuum pumps but also aligns with the industry's sustainability goals and regulatory compliance.

The wet lubrication segment is anticipated to expand at a significant CAGR of 5.9% during the projected period. In the vacuum pumps market, "wet lubrication" refers to a lubrication method where a liquid, typically oil, is used to reduce friction and maintain the sealing between moving parts within the pump. Wet lubrication helps extend the pump's lifespan and enhances its performance by reducing wear and heat generation.

This segment has witnessed a growing trend towards the development of environmentally friendly lubricants that aim to minimize oil emissions and enhance the sustainability of vacuum pump operations. Additionally, manufacturers are focusing on designing pumps with improved oil management systems to reduce maintenance requirements and overall operating costs.

The low vacuum level segment has held a 53% revenue share in 2023. In the vacuum pumps market, the low vacuum level segment refers to the range of vacuum pressures typically between 1 and 1,000 Torr. This segment finds applications in areas such as food packaging, laboratory equipment, and HVAC systems where moderate vacuum levels are required. Recent trends in the low vacuum level segment include a focus on energy-efficient pump designs, improved reliability, and quieter operation. Additionally, the integration of smart technologies and digital controls to enhance monitoring and maintenance has gained prominence. Manufacturers are also emphasizing eco-friendly features and materials to align with sustainability initiatives, further driving the demand for low vacuum level pumps.

The high vacuum level segment is anticipated to expand fastest over the projected period. The high vacuum level segment in the vacuum pumps market typically refers to vacuum levels below 10^-3 Torr. In this category, precision and efficiency are paramount, making it crucial for industries like semiconductor manufacturing, research, and space exploration. Trends in the high vacuum level segment include a growing demand for oil-free and dry vacuum pump technologies to meet stringent cleanliness requirements.

Additionally, there is a focus on the integration of digital monitoring and control systems to enhance precision and ensure consistent performance, aligning with Industry 4.0 principles. High vacuum level applications continue to advance, with an emphasis on achieving cleaner, more efficient, and technologically sophisticated vacuum environments.

The manufacturing segment had the highest market share of 30% in 2023. In the vacuum pumps market, the manufacturing segment encompasses a wide range of industries, including automotive, electronics, pharmaceuticals, and more. This segment primarily utilizes vacuum pumps for various manufacturing processes, such as degassing, forming, and packaging. Trends in this sector involve an increasing emphasis on energy-efficient and sustainable manufacturing practices.

Manufacturers are adopting vacuum pump technologies that reduce energy consumption and environmental impact. Additionally, there's a growing demand for smart and connected vacuum systems that can be monitored and controlled remotely, enhancing efficiency and reducing downtime in manufacturing operations.

The semiconductor & electronics segment is anticipated to expand fastest over the projected period. The semiconductor and electronics segment in the vacuum pumps market is defined by its extensive use of vacuum pumps for critical manufacturing processes. These pumps are indispensable for creating clean, controlled environments during semiconductor fabrication, ensuring high precision and low contamination levels. Recent trends in this segment include the growing demand for dry and oil-free vacuum pumps to minimize contamination risks and improve process efficiency.

Moreover, the development of advanced materials and technologies in the semiconductor industry is driving the need for specialized vacuum solutions, aligning with the increasing focus on miniaturization and precision in electronics manufacturing.

Segments Covered in the Report

By Lubrication

By Vacuum Level

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024