January 2025

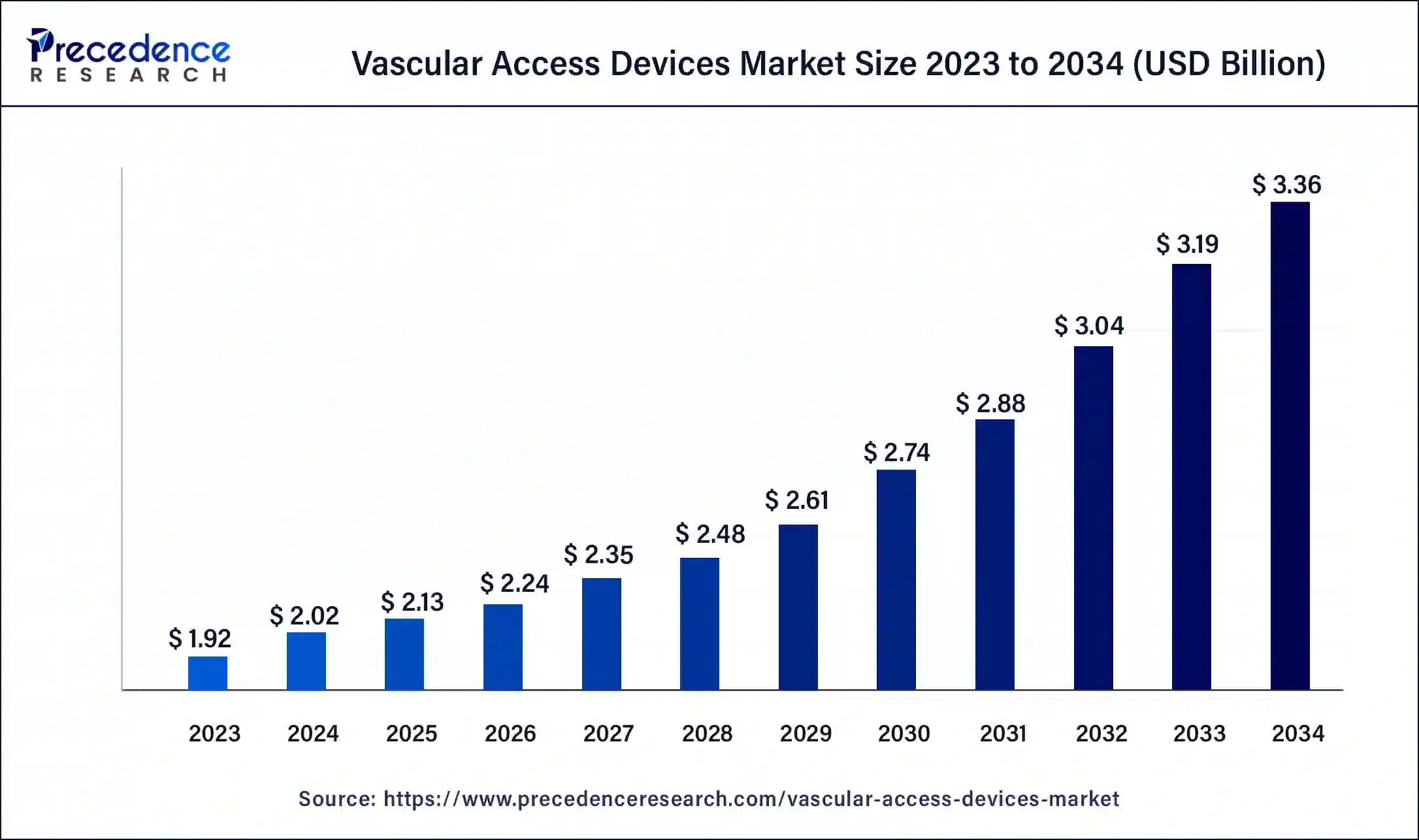

The global vascular access devices market size surpassed USD 1.92 billion in 2023 and is estimated to increase from USD 2.02 billion in 2024 to approximately USD 3.36 billion by 2034. It is projected to grow at a CAGR of 5.22% from 2024 to 2034.

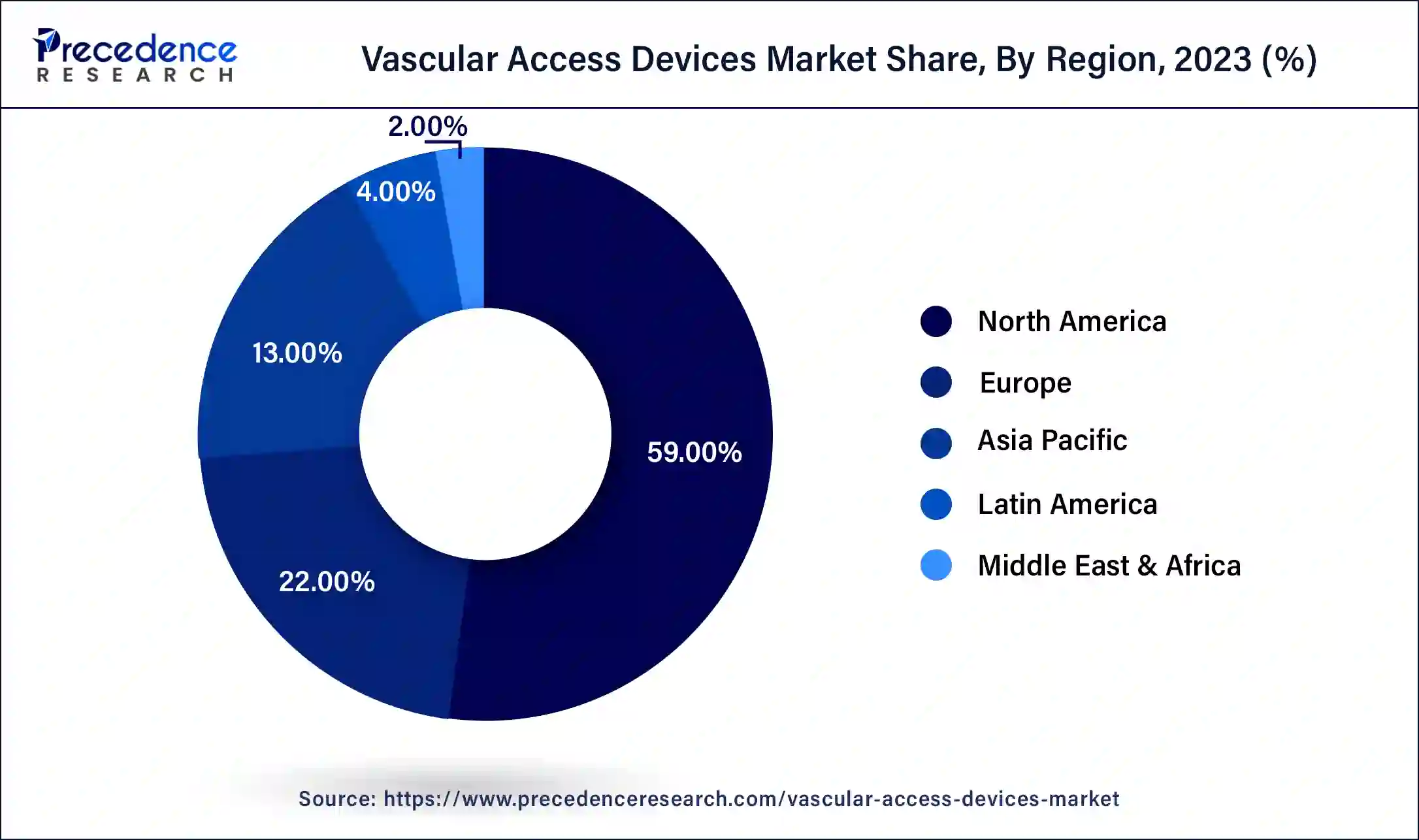

The global vascular access devices market size is projected to be worth around USD 3.36 billion by 2034 from USD 2.02 billion in 2024, at a CAGR of 5.22% from 2024 to 2034. The North America vascular access devices market size reached USD 1.13 billion in 2023. The rising population and the increasing demand for healthcare infrastructure are driving the growth of the market. Sealants

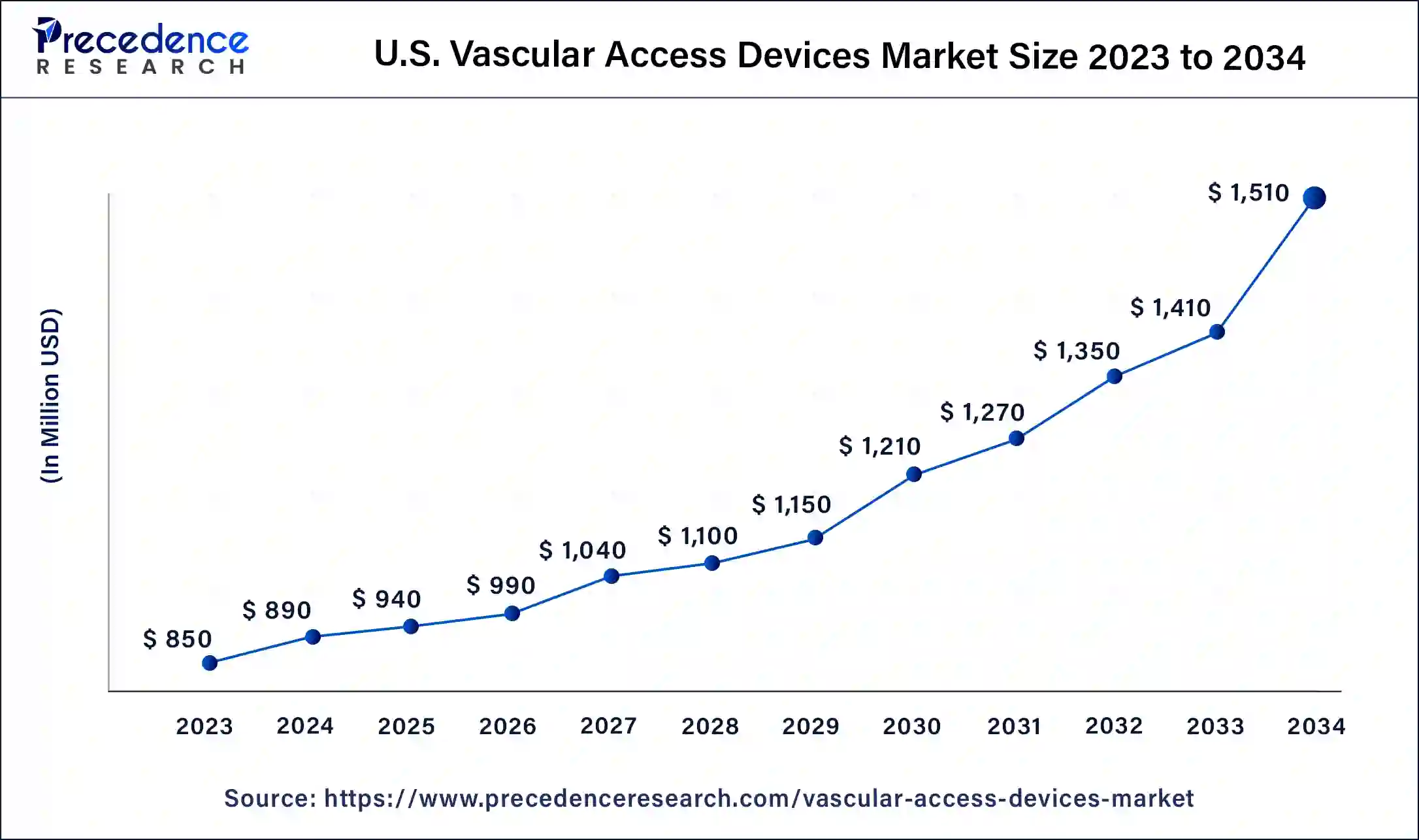

The U.S. vascular access devices market size was exhibited at USD 850 million in 2023 and is projected to be worth around USD 1.51 billion by 2034, poised to grow at a CAGR of 5.36% from 2024 to 2034.

North America dominated the vascular access devices market with the largest market share in 2023. The growth of the market is attributed to the rising healthcare infrastructure and the increasing penetration of chronic disorders such as cardiovascular disease, cancer, diabetes, and others that drive the demand for vascular access devices. Additionally, the supporting government initiatives and investments regarding innovations in medical devices and infrastructural development in the healthcare and pharmaceutical industry are driving the growth of the vascular access devices market across the region.

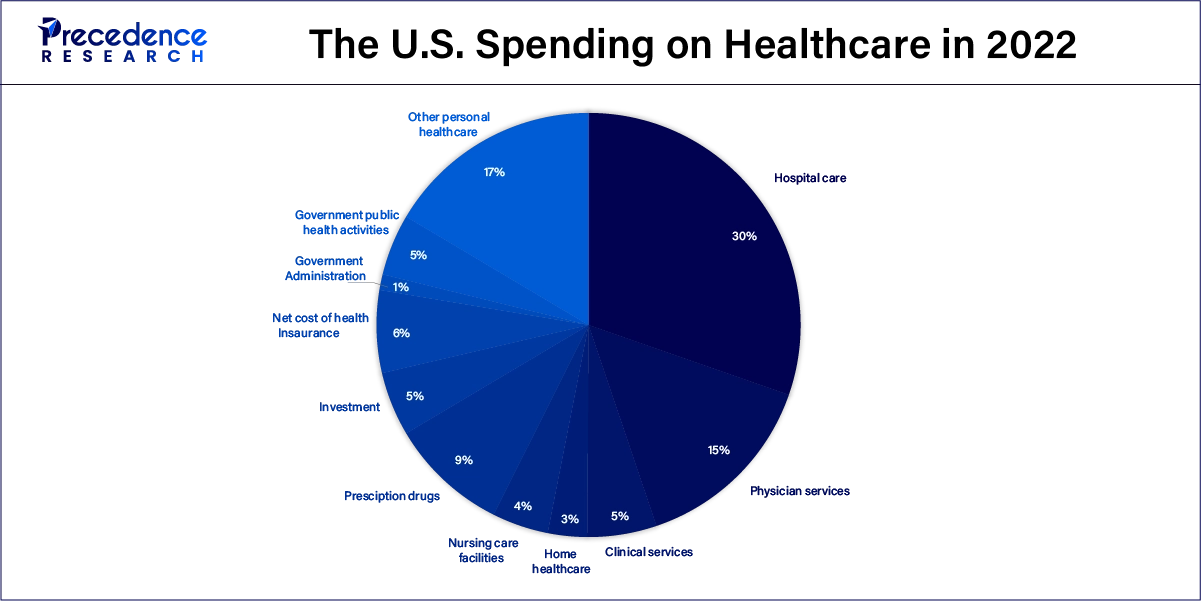

The U.S. healthcare spending is $4,464.4 billion in 2022. Hospital care accounted for the largest portion of the total, and physician services emerged as the second largest category in healthcare spending.

Asia Pacific is expected to have the fastest growth in the market during the forecast period. The growth of the market is owing to the rising population and the increasing demand for efficient healthcare infrastructure, which drives the growth of the market. The rising geriatric population that is more likely to get affected by chronic disease conditions like heart disease, cancer, high blood pressure, diabetes, and others is driving the growth of the vascular access devices market in the region.

The vascular access device is one of the important components in the treatment of patients with chronic disease. The vascular access devices are used for the administration of liquid, fluid medications, and blood directly into the veins. It allows the monitoring of the hemodynamic functions used in the collection of blood specimens and in the dialysis process.

Vascular access devices are also used in the treatment of infectious diseases, including local infections, urinary tract infractions (UTIs), and bloodstream infections (BSIs) that can cause major health issues and sometimes mortality. There are some types of vascular access devices, including intravascular devices inserted in the peripheral veins, peripheral arterial devices, central nervous catheters, peripheral intravenous catheters (PIVC), peripherally inserted central catheters (PICC lines), and others. The rising number of medical emergency cases is driving the growth of the vascular access devices market.

How can AI Impact the Vascular access devices market?

AI helps transform the healthcare and pharmaceutical sectors by enabling cutting-edge technological advancements in healthcare infrastructure. Artificial intelligence plays an important role in vascular access for minimizing the high-morbidity, ruptures, and ESRD in patients with hemodialysis. AI devices allow the examination and grade of aneurysms in both arteriovenous and arteriovenous fistula grafts. Furthermore, the development of AI-enabled intervention devices that are used in emergency vascular access boosts the adoption of AI in vascular access devices.

AI in vascular access devices is a robotic catheterization tool that is portable and easy to use. It includes three main components: portable ultrasound devices that are connected to smart devices, smartphones, or tablets. The real-time software application that is connected to the ultrasound device helps in detecting required blood vessels. The robotic system identifies the blood vessel as a dot and allows physicians to inject the needle and guidewire placements.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.36 Billion |

| Market Size in 2023 | USD 1.92 Billion |

| Market Size in 2024 | USD 2.02 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.22% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The increasing demand for hemodialysis

The increasing prevalence of chronic kidney disorders in the global population due to the aging factor, changing lifestyle preferences, and rising consumption of unhealthy food, alcohol, smoking, and other junk products are driving the cases of kidney-related diseases like kidney failures and others. The rising economies and the rising living standards due to the increase in disposable income drive the growth in unhealthy lifestyles, sleeping, and eating habits are some of the leading causes of the rising cases of kidney failure that drive the demand for hemodialysis for the frequent and regular treatment for the disease.

Vascular access is important in the dialysis process; it is the access point where the dialysis machine connects to the bloodstream. Artery vein fistula, catheters, and artery vein grafts are the three main types of vascular access devices that are used in hemodialysis. In which the artery vein fistula is known as the best vascular access device for hemodialysis. Thus, the rising cases of kidney disease and the prevalence of hemodialysis treatment drive the growth of the vascular access devices market.

High cost

The increased cost associated with vascular access devices due to technological advancements in medical devices and further improvements in healthcare devices are restraining the growth of the vascular access devices market.

Technological advancement in the vascular access device

The ongoing investment in the healthcare and pharmaceutical infrastructure for the development of new treatment procedures and medicinal usage boosts the growth of vascular access devices. Additionally, the rising investment in major technological advancements in vascular access devices boosts the growth opportunity in the vascular access devices market.

The short peripheral intravenous catheter segment dominated the market with the largest vascular access devices market share in 2023. The increasing adoption of short peripheral intravenous catheters in hospitals for medicinal purposes boosts the growth of the segment. It is mainly used in the administration of medicinal fluids and blood products. It is the plastic tube inserted into the vein using a needle. The increasing penetration of chronic diseases in the population and the increasing number of hospitalized patients are driving the demand for the short peripheral intravenous catheter market.

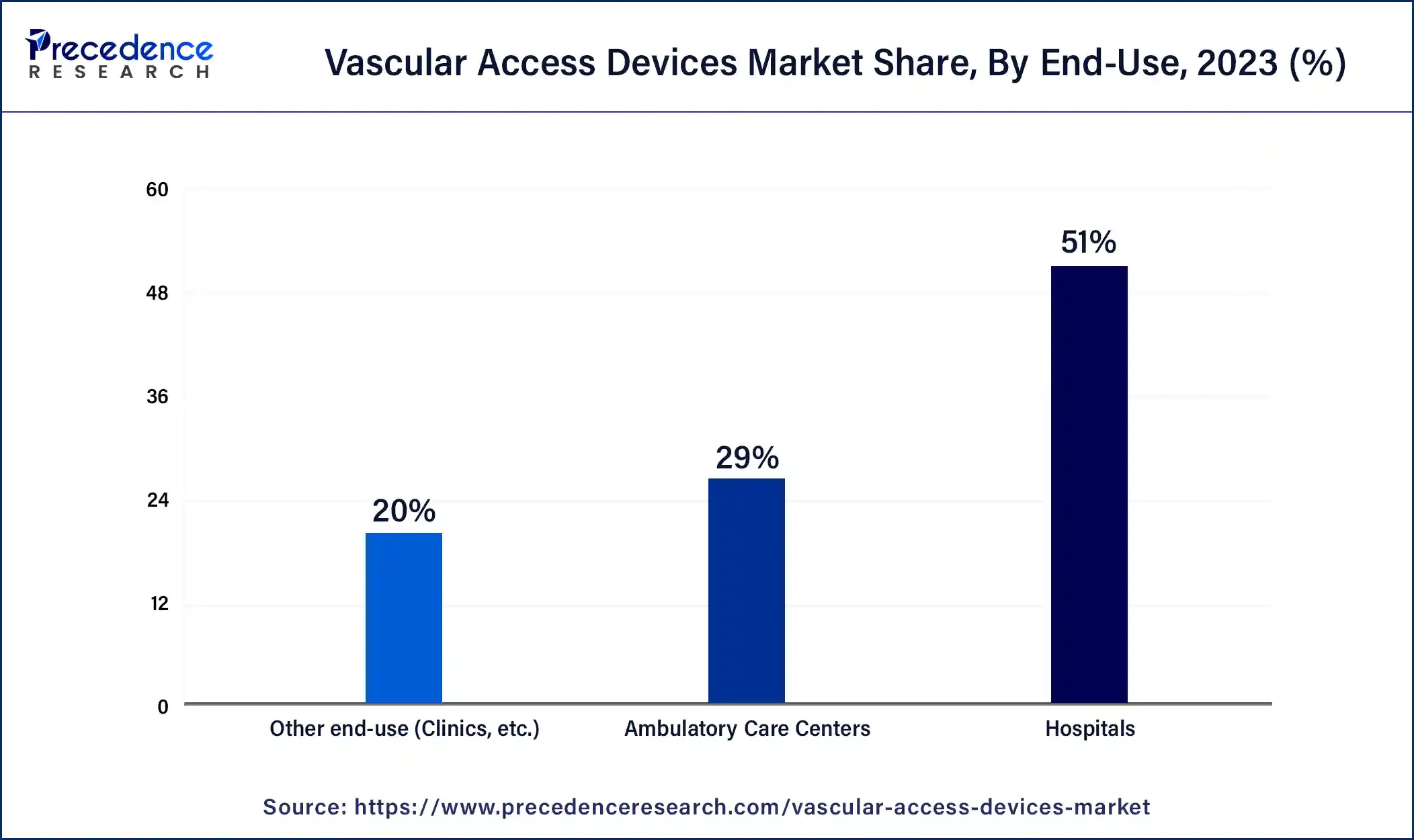

The hospital-based segment held the largest share of the vascular access devices market in 2023. The growth of the segment is attributed to the rising investment in the healthcare infrastructure, which is driving the growth of the hospital segment.

The rising emergence of hospitals for the treatment and surgical procedures for a number of diseases. The higher availability of skilled healthcare professionals and advanced medical devices boosts the growth of the segment.

Segments Covered in the Report

By Product

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

August 2024

March 2025