April 2025

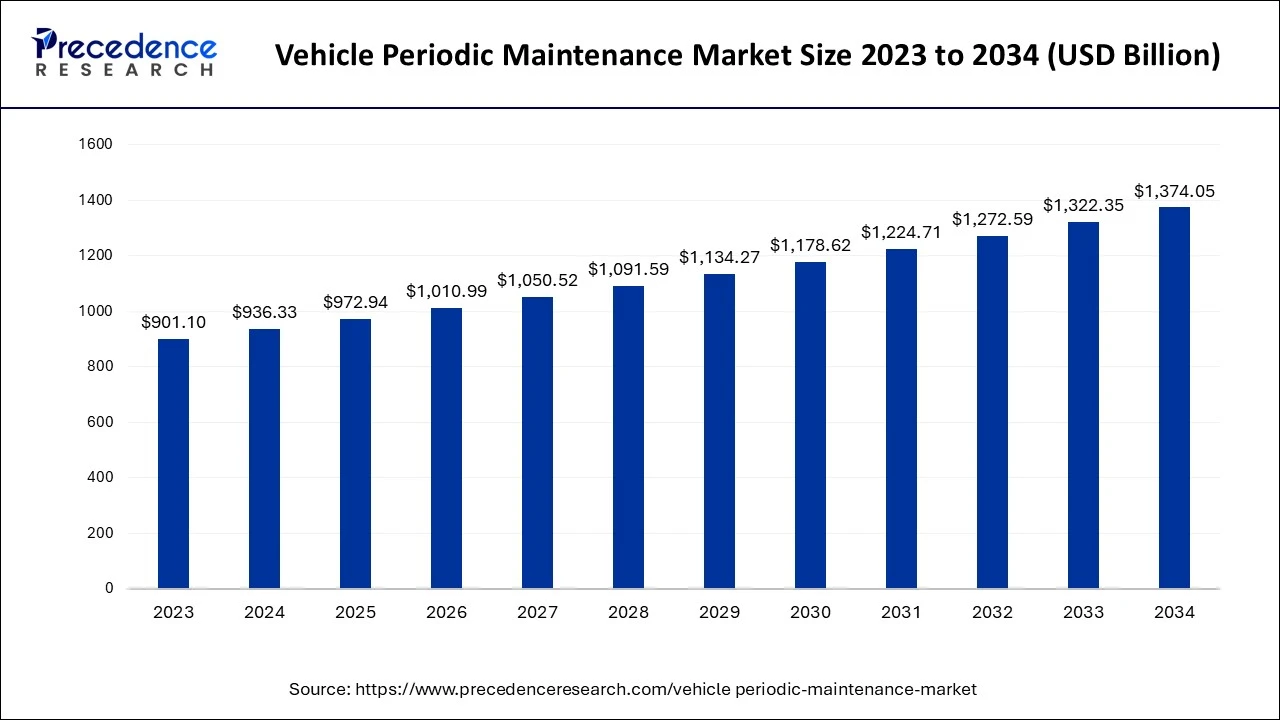

The global vehicle periodic maintenance market size accounted for USD 936.33 billion in 2024, grew to USD 972.94 billion in 2025 and is expected to be worth around USD 1,374.05 billion by 2034, growing at a CAGR of 3.91% between 2024 and 2034.

The global vehicle periodic maintenance market size is calculated at USD 936.33 billion in 2024 and is projected to surpass around USD 1,374.05 billion by 2034, expanding at a CAGR of 3.91% from 2024 to 2034. The increasing awareness among consumers of the necessity of vehicle maintenance at regular intervals of time increases vehicle efficiency and cost-effectiveness and achieves a perceived sense of safety, fuelling the vehicle periodic maintenance market on a global scale.

The vehicle periodic maintenance market is growing significantly due to the increase in automotive sales worldwide. People understand the value of maintaining the vehicle to keep it going smoothly, fuelling the market's demand further. Periodic maintenance has already been decided. It is a comprehensive approach in terms of servicing the vehicle, which involves regular inspection, repairing the automobile parts, cleaning, and replacing, if necessary, to ensure optimum performance of the vehicle.

Vehicle periodic maintenance comes with refilling of liquids such as wiper fluid, radiator coolant, brake fluid, power steering fluid, and oiling the motor to avoid damage due to friction. Various automotive parts get cross-checked to ensure maximum efficiency. These parts include brake pads, wipers, driving belts, spark plugs, air filters, fluid filters, etc. Region-wise, Asia Pacific dominated the global vehicle periodic maintenance market, while North America is witnessing the fastest growth.

AI Impact on the Vehicle Periodic Maintenance Market

Artificial Intelligence (AI) is revolutionizing the vehicle periodic maintenance market by enhancing accuracy, efficiency, and cost-effectiveness with the help of predictive maintenance, which is based on AI algorithms. It allows the monitoring of real-time data about vehicles by using various sensors to predict failures of parts before they occur, giving major relief from mishaps. It reduces maintenance costs and minimizes breakdowns before any issue escalates.

The vehicle periodic maintenance market services can help optimize the scheduled maintenance and routine services by analyzing the pattern of vehicle usage and recommending customized maintenance services with dates. It can be achieved by AI chatbots and virtual assistance that book appointments prior to ensure workshops have the needed parts on hand, which further minimizes downtime.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,347.05 Billion |

| Market Size in 2024 | USD 936.33 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.91% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Service Type, Maintenance Part, Service Provider, Vehicle Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing frequency of automotive sales

The major driving factor for the growth of the vehicle periodic maintenance market is the increasing frequency of automotive sales. To prevent accidents, it is necessary to repair automobile parts and check them on a periodic basis to avoid malfunctioning on the spot. Reducing downtime, preventing breakdowns, and minimizing maintenance costs by acknowledging the potential threat before it occurs is the prime target of the market.

Excessive servicing

One major drawback that hinders vehicle periodic maintenance market growth is the potential risk of unnecessary servicing, which causes higher estimates for consumers. Many scheduled maintenance is based upon specific time intervals, which are not needed every time, creating distrust among consumers and service providers. Moreover, small repair shops may not be able to keep pace with the rapidly evolving technology, causing inconsistent service quality, further compromises on the performance of vehicles, and losing their efficiency, which, in turn, adds extra cost to the customer.

Increasing sales of EVs and HEVs

The significant opportunity that the vehicle periodic maintenance market holds is the increasing demand for electric vehicles and hybrid electric vehicles, which again demand specialized maintenance with technically advanced services and tools, fuelling the demand for such tools and creating massive turnover in the automobile sector. EV maintenance includes software updates, the repair of electrical systems, and the diagnostics of batteries, which are crucial parts of the HEVs and EVs.

Additionally, the integration of advanced digital tools like AI-based battery diagnostics and cloud-based service platforms in the vehicle periodic maintenance market enhances consumers' experience while providing time flexibility and greater convenience. Since consumers are becoming more conscious about ecosystems and climate changes, EV demand is increasing day by day.

The mechanical segment accounted for the largest share of the vehicle periodic maintenance market in 2023. The mechanical segment is dominating due to the frequency of mechanical part failure more than any other problem that can arise in the context of vehicle maintenance. Issues are mostly related to the brakes, internal combustion engines, parts replacement, and schedule maintenance. These parts undergo a daily friction state, causing them to deteriorate more and need mechanical repair.

The exterior & structural segment is anticipated to witness the fastest growth in the vehicle periodic maintenance market over the forecast period. The growth of this segment is attributed to the consumer's inclination to focus more on the aesthetic look of the vehicle with the help of customized services like dent repair, color change or paint protection, and bodywork to increase its aesthetic facet.

The engine oils segment dominated the global vehicle periodic maintenance market in 2023. The growth of this segment is attributed to major factors like the internal combustion engine, the key part of the existing vehicles that need to be taken care of at regular intervals of time by oiling it with specially formulated liquids, which helps keep the engine healthy and efficient for the long run.

The brake oil segment is anticipated to witness the fastest growth in the vehicle periodic maintenance market over the forecast period. Brakes are a crucial part of any two-wheeler or four-wheeler vehicle since they give complete control of the vehicle to the driver and a perceived sense of safety, fuelling the growth of this segment further, brakes oil must be applied on a regular basis since it is the most used part of the vehicle which require special attention.

The automobile dealerships segment dominated the global vehicle periodic maintenance market. The segment is proliferating because automobile dealers have the authority to sell the original parts of the vehicles and automobile tools for the particular brand. Moreover, consumers are inclined towards reliable and warranty-covered services for the safety and repair of the vehicle, which are provided by automobile dealers.

The passenger cars segment accounted for the highest share of the vehicle periodic maintenance market in 2023. The segment is continuously growing due to the widespread adoption of passenger cars for personal traveling with family and friends, which offers more convenience. Also, appealing factors for passenger cars are affordability, fuel efficiency, and safety protocols, which increase demand on a larger scale.

The two-wheeler segment is expected to witness the fastest growth in the vehicle periodic maintenance market in the coming years. The growth of this segment is due to affordable, fuel-efficient transportation, specifically in densely populated areas like cities and urban areas. Also, increasing traffic congestion due to the massive sales of vehicles is again creating hurdles for safely traveling to reach the destination. Hence, two-wheelers are more convenient than other vehicles.

Asia Pacific accounted for the largest share of the vehicle periodic maintenance market in 2023. The growth of this region is due to the rising awareness among consumers about the urgency and need for regular vehicle maintenance for vehicle safety and performance.

Furthermore, increasing disposable income in the evolving countries of Asia Pacific, such as India, China, and Japan, is observed. The implementation of stringent regulations about vehicle safety and carbon emission and the rapid growth of the automotive aftermarket are the major driving factors of the vehicle periodic maintenance market in the Asia Pacific.

North America is expected to witness the fastest growth in the vehicle periodic maintenance market during the forecasted years. The growth of this region is due to the affluent group of people who tend to buy luxury vehicles, disposable income, and an increasing rate of repair and maintenance centers in North America, in particular, the U.S. Moreover, the number of vehicles in the U.S. is increasing with each passing year. Major players are acquiring and collaborating with each other to provide better services.

Segments Covered in the Report

By Service Type

By Maintenance Part

By Service Provider

By Vehicle Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

August 2024