December 2024

Veterinary Dermatology Drugs Market (By Animal Type: Companion Animal, Livestock Animal; By Route of Administration: Oral, Topical, Injectable; By Indication: Parasitic Infections, Allergic Infections, Others; By Distribution Channel: Retail, E-Commerce, Hospital Pharmacies) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

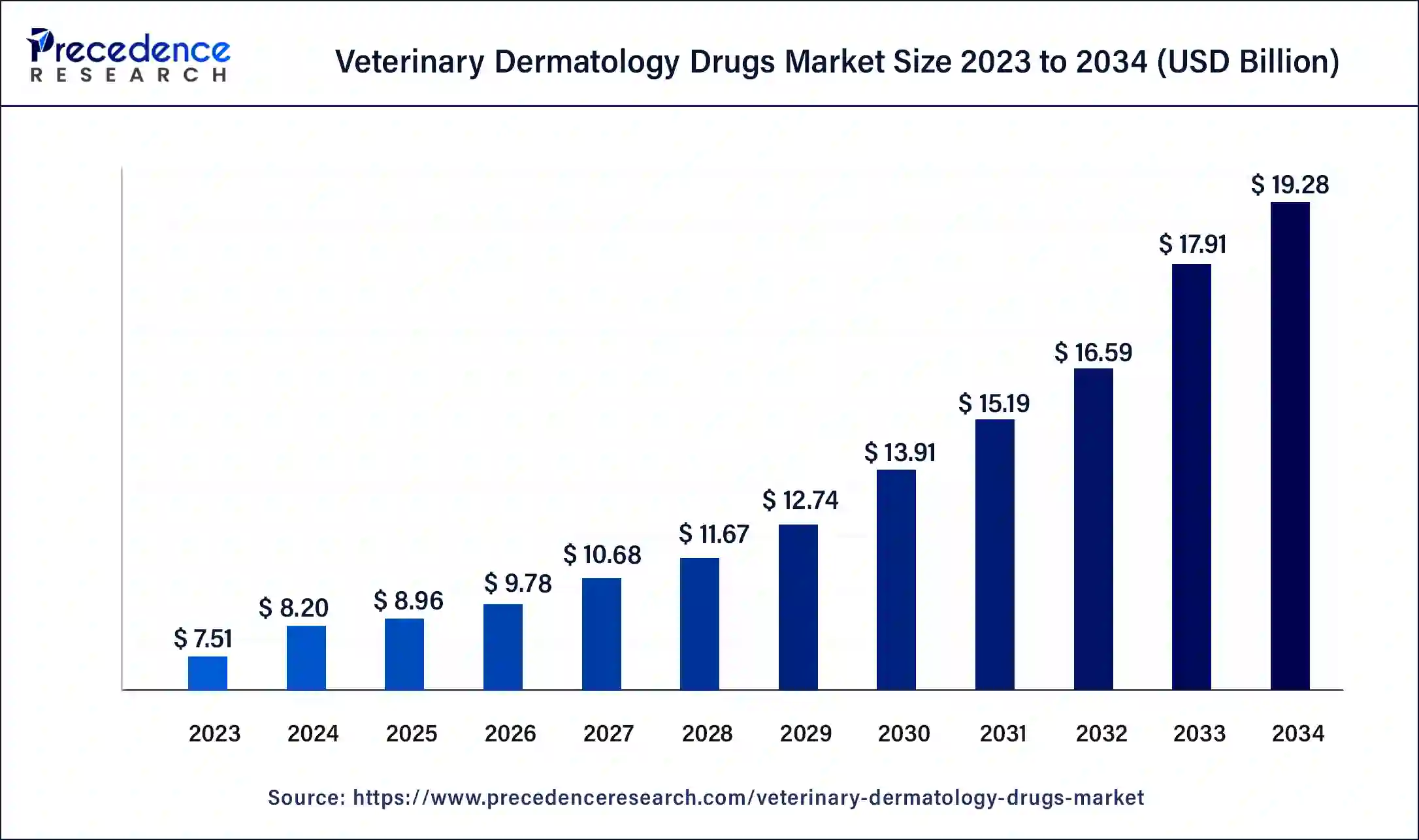

The global veterinary dermatology drugs market size is estimated at USD 8.20 billion in 2024 and is expected to reach around USD 19.28 billion by 2034, growing at a CAGR of 8.93% from 2024 to 2034. Drugs for veterinary dermatology are used to treat skin conditions or infections in animals, primarily pets and cattle.

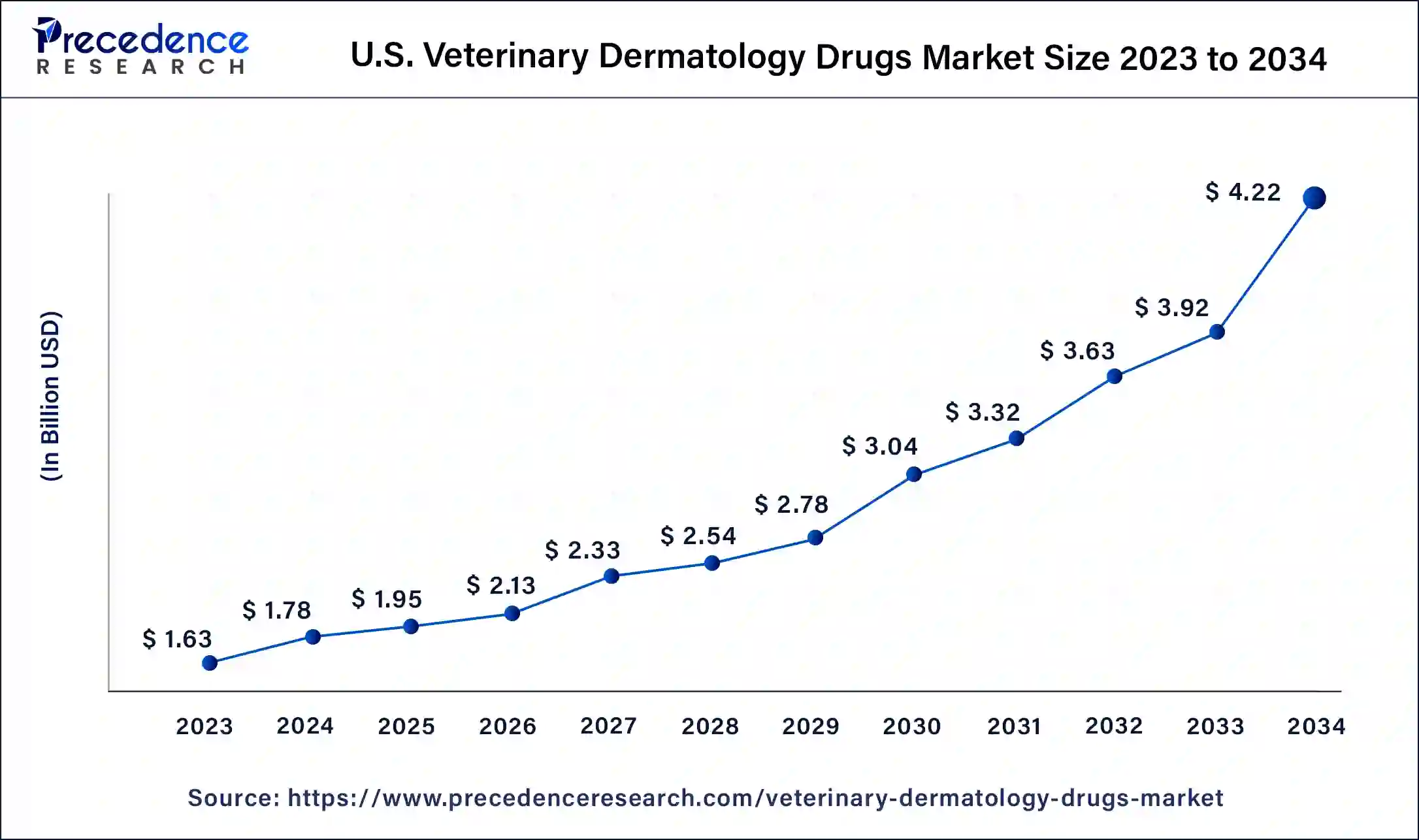

The U.S. verinary dermatology drugs market size was valued at USD 1.63 billion in 2023 and is expected to reach around USD 4.22 billion by 2034, expanding at a CAGR of 9% from 2024 to 2034.

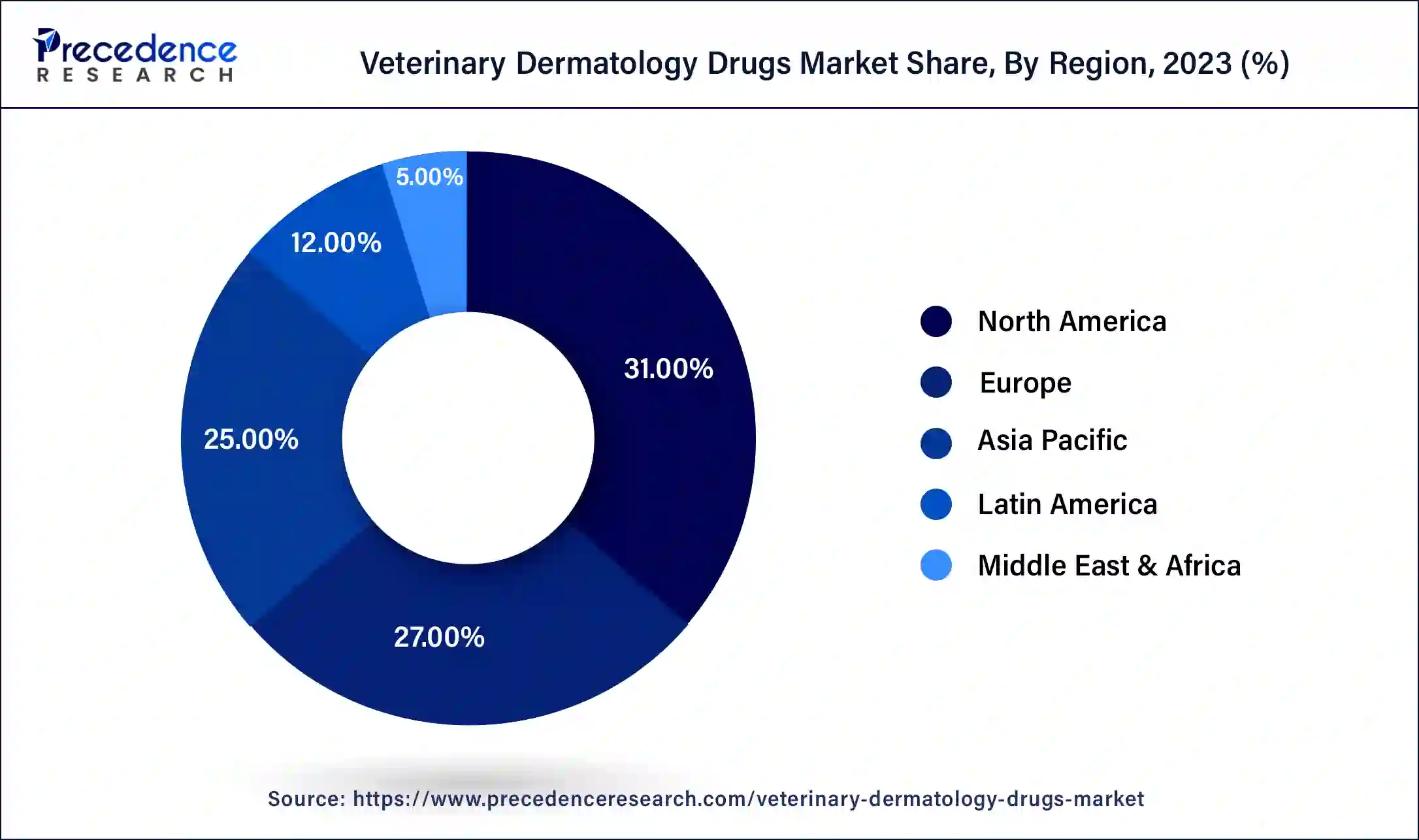

North America led the market and accounted for over 30.50% in 2023 of total sales. Initiatives from the public and commercial sectors, growing pet care costs, and the existence of important players are the main drivers of this expansion. Additionally, the prevalence of zoonotic illnesses is anticipated to increase market growth.

Due to factors like the rising demand for veterinary dermatology drugs and the gradually spreading awareness of these products availability in emerging economies like India and China, the veterinary dermatology drugs market in the Asia Pacific is predicted to experience significant growth over the forecast period. Additionally, the fact that several significant market participants, like Elanco, have production facilities in Asia Pacific helps the region's growth.

The primary factors anticipated to propel market expansion include the increased prevalence of skin disorders in animals and significant expenditures made in this area by major industry competitors. The market is predicted to develop as a result of a trend in which pet owners are making more decisions about their pets' care. More than 20% of all animal veterinary consultations are now for dermatological issues. The four most prevalent chronic dermatological illnesses are allergies, otitis externa, seborrheic dermatitis, and surface pyoderma. In order to identify and treat major skin illnesses, the market is being supported by the introduction of cutting-edge medical equipment and technologies as well as an increase in the number of research papers on veterinary dermatology. As a consequence, it is anticipated that throughout the projected period, the rise in veterinary consultation visits would support the expansion of the global market for veterinary dermatology drugs.

Market growth is anticipated to be fueled by the rising prevalence of skin conditions in animals as well as rising industry investment by veterinary pharmaceutical firms. The adoption of new pet treatment options by pet owners is a growing trend in the pet care sector that is expected to fuel market expansion. The rising incidence of skin disorders and significant investments by market participants is the industry's development accelerators. Additionally, pet owners are increasingly making more decisions regarding their pets' care, which is anticipated to drive the market's expansion. Additionally, the global veterinary dermatology medications market is anticipated to see new growth opportunities due to an increase in incidences of dermatological conditions such as allergic dermatitis and flea-and-tick-related disorders. The market is also growing as a result of more clinical studies being conducted with medications for veterinary dermatology.

| Report Coverage | Details |

| Market Size by 2034 | USD 19.28 Billion |

| Market Size in 2023 | USD 7.51 Billion |

| Market Size in 2024 | USD 8.20 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.93% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Animal Type, Route of Administration, Indication, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of diseases among animals

Adverse effects of the veterinary dermatology drugs

Imposition of stringent regulations

Development of cutting-edge medical therapies

An increase in the cost of veterinary treatment

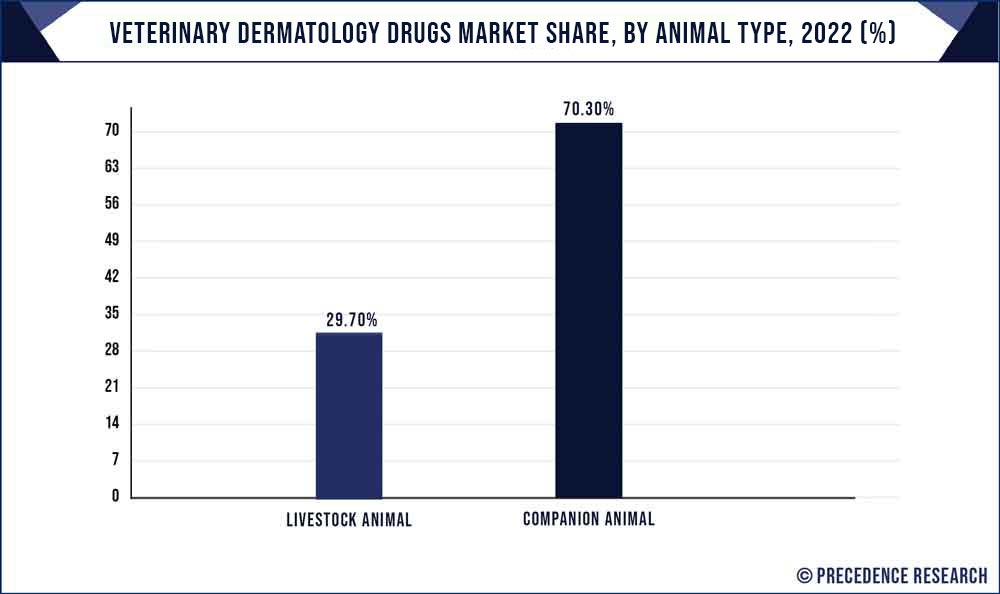

The companion animal market segment led and accounted for more than 70.30% 2023 of total revenue. Growing pet ownership is anticipated to accelerate market expansion. Dogs, cats, horses, and other animals are further separated into several segments. Due to the wide availability of products for canine therapy, the dogs category is predicted to have the biggest market share.

In 2023, the livestock animal segment's revenue share was the second-largest. Cattle and other categories are added to it. The increased demand for animal protein and the frequency of parasitic infections in farm animals are anticipated to boost the market for veterinary dermatology medications. Additionally, the category for cattle is anticipated to experience the fastest CAGR of 9.1% throughout the projection period.

With a market share of 37.40% in 2023, the oral sector led the industry. It is anticipated that the market would rise due to the widespread availability of oral medications in the form of tablets, feed additives, and pills among others. Initiatives taken by market participants in this category are also anticipated to accelerate market expansion. For instance, Bioiberica expanded its offering of dermatological treatments in September 2021 when it introduced the oral and topical dermatology medication line Atopivet.

Since injectable medications allow for simple administration in a substantially lesser number of doses compared to oral medications, the injectable category is anticipated to experience the quickest CAGR of nearly 10.70% throughout the projected period. In contrast to 28 doses of tablets, Convenia from Zoetis cures the animal in just one treatment. Due to its widespread acceptance, the topical category is also anticipated to expand rapidly.

With a market share of 45.31% in 2023, parasitic infections led the industry. It is anticipated that the market would rise due to the widespread availability of oral medications in the form of tablets, pills, and feed additives, among others. Initiatives taken by market participants in this category are also anticipated to accelerate market expansion. For instance, Bioiberica expanded its offering of dermatological treatments in September 2021 when it introduced the oral and topical dermatology medication line Atopivet.

Since injectable medications allow for simple administration in a substantially lesser number of doses compared to oral medications, the injectable category is anticipated to experience the quickest CAGR of nearly 10.5% throughout the projected period. In contrast to 28 doses of tablets, Convenia from Zoetis cures the animal in just one treatment. Due to its widespread acceptance, the topical category is also anticipated to expand rapidly.

Hospital pharmacy led the industry and accounted for 45.50% of all sales in 2023. The expansion of the category is anticipated to be aided by the growing number of hospital pharmacies. Additionally, when it comes to treating their pets or farm animals, animal owners sometimes start by contacting veterinary institutions. As a result, hospital pharmacies are the go-to locations for purchasing prescription pharmaceuticals, accounting for their dominant market position.

During the projection period, the e-commerce segment is anticipated to experience the quickest CAGR of about 10.5%. This rise can be attributed to the increasing use of veterinary telemedicine platforms and e-commerce websites that are specifically dedicated to selling veterinary items. By 2028, the sector's market share is anticipated to surpass that of the retail sector.

Segment Covered in the Report

By Animal Type

By Route of Administration

By Indication

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

November 2024

January 2025