December 2024

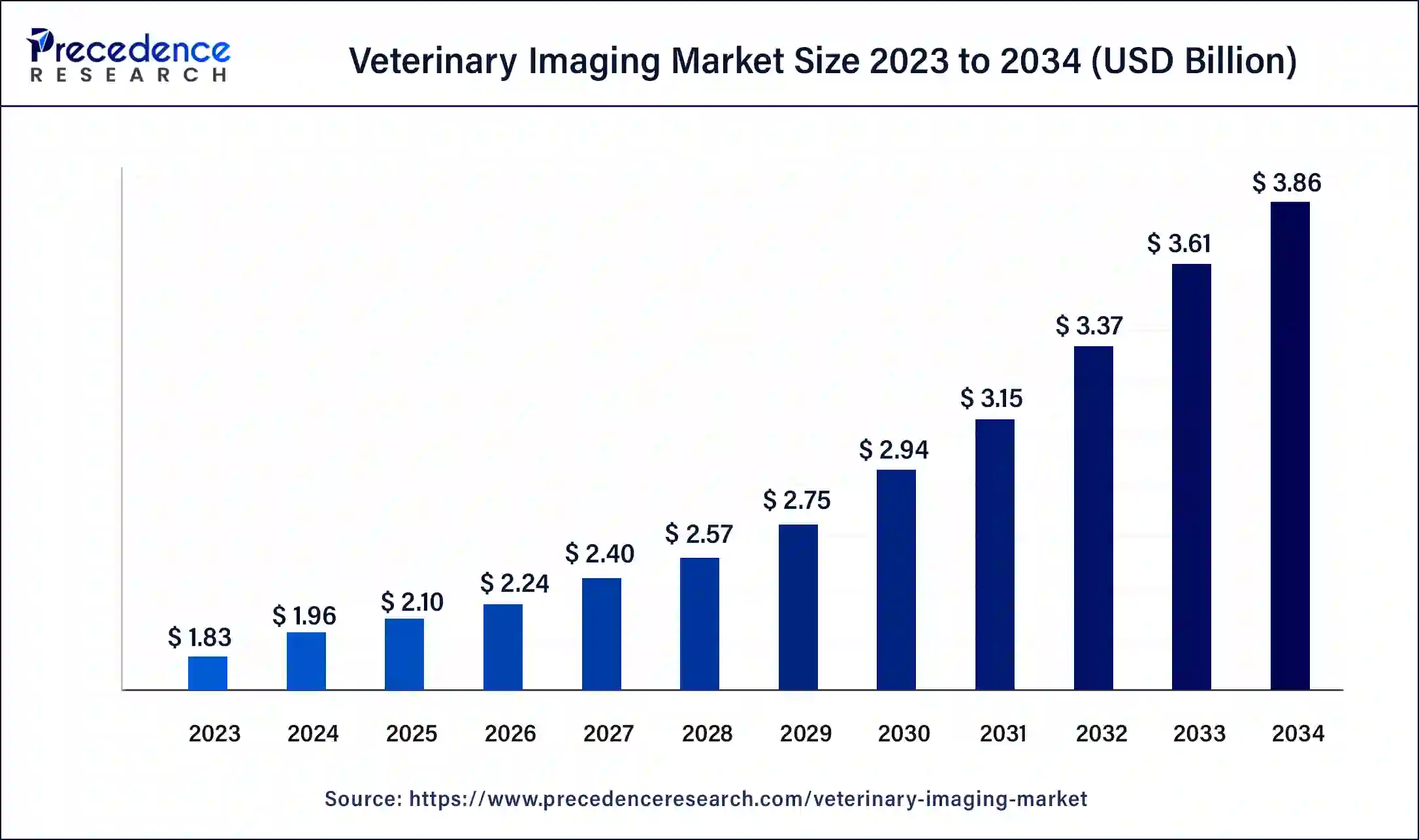

The global veterinary imaging market size was USD 1.83 billion in 2023, calculated at USD 1.96 billion in 2024 and is expected to be worth around USD 3.86 billion by 2034. The market is slated to expand at 7.02% CAGR from 2024 to 2034

The global veterinary Imaging market size is expected to be worth USD 1.96 billion in 2024 and is anticipated to reach around USD 3.86 billion by 2034, growing at a CAGR of 7.02% over the forecast period 2024 to 2034.

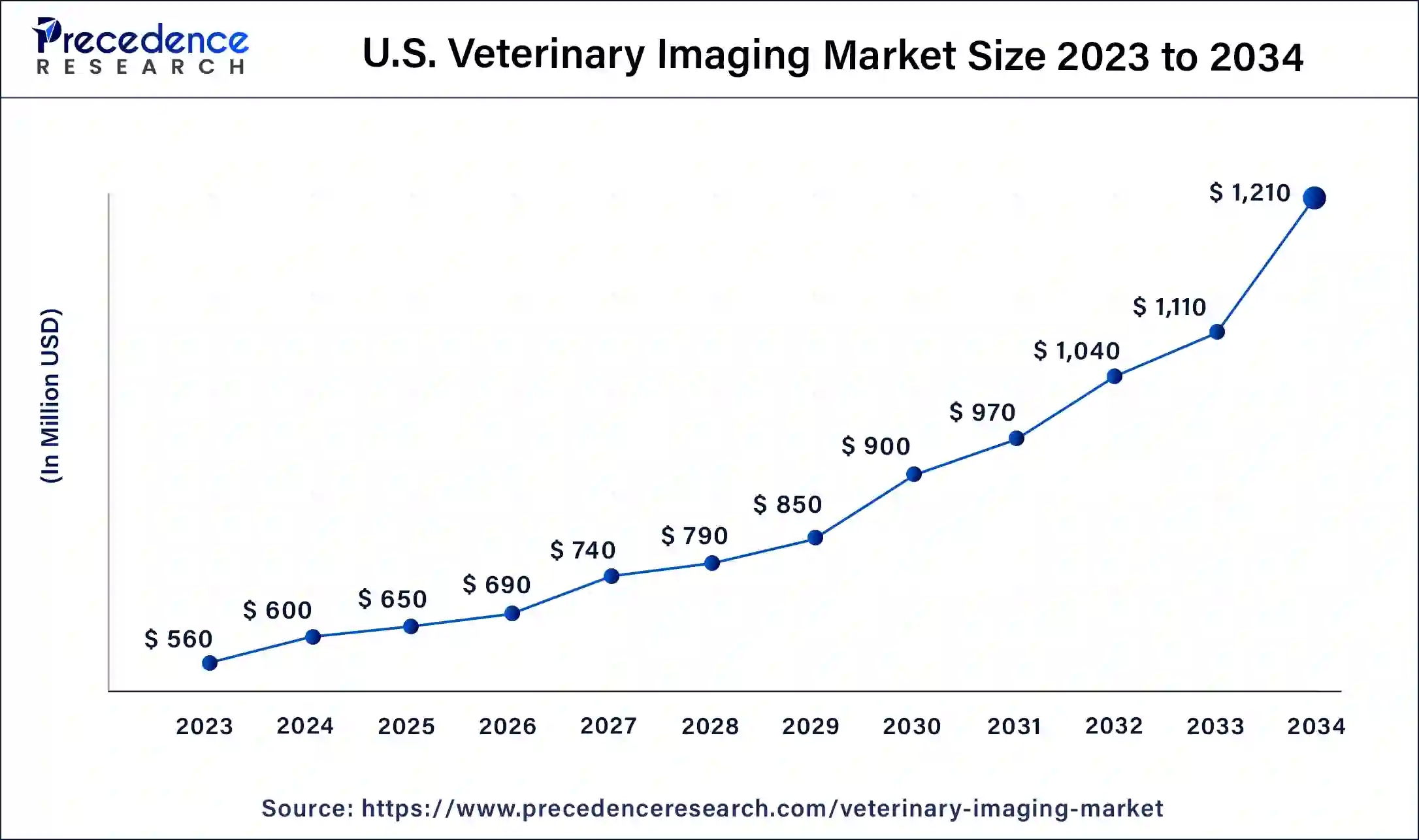

The U.S. veterinary Imaging market size was accounted at USD 600 million in 2023 and is projected to be worth around USD 1,210 million by 2034, poised to grow at a CAGR of 7.25% from 2024 to 2034.

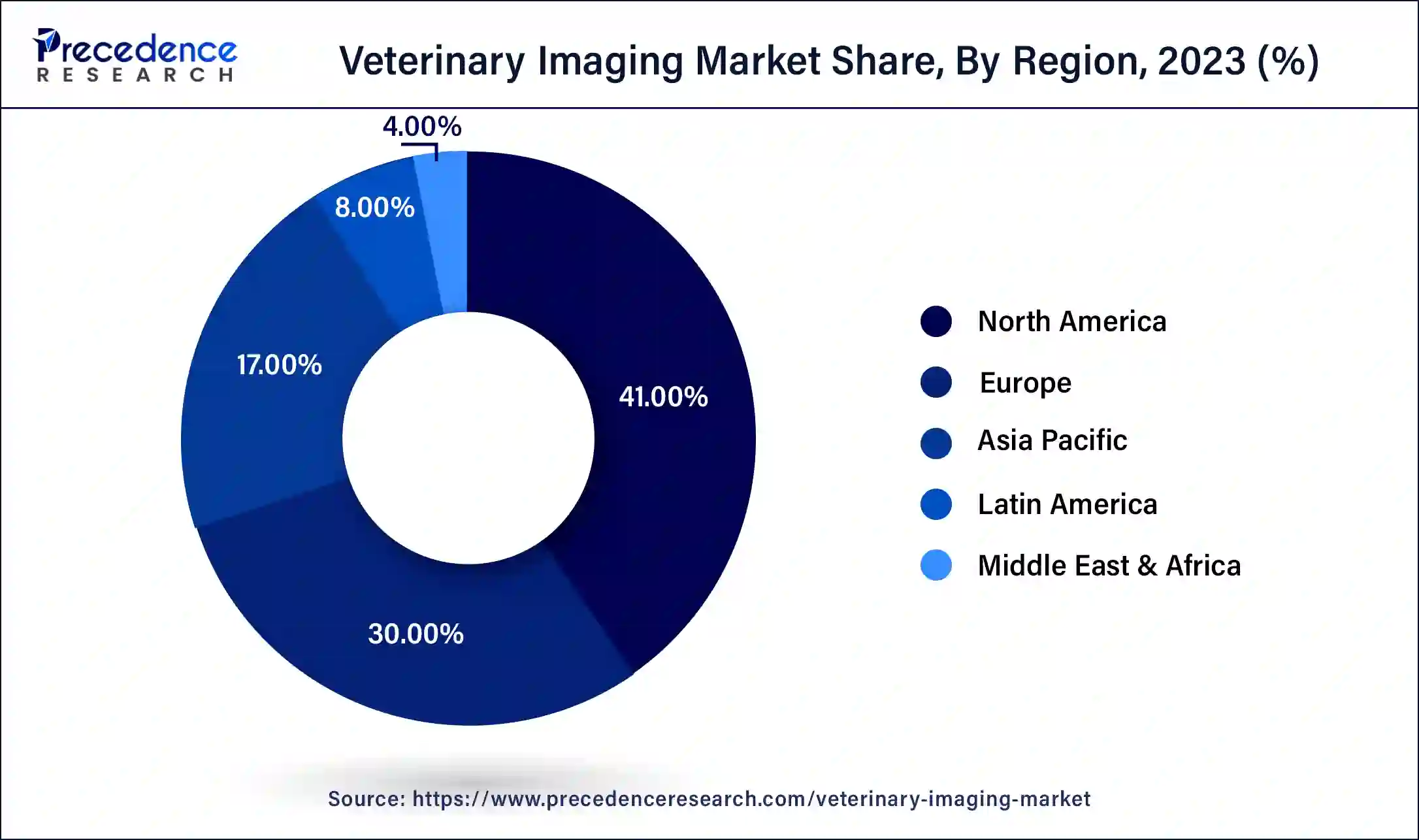

North America dominated the veterinary imaging market in 2023. The United States and Canada are the leading countries for the growth of the market in the North American region. The increasing demand for veterinary healthcare services is due to the increased pet population. In the United States, many animals suffer from different diseases, such as an increase in orthopedics conditions and incidences contributing to the market’s growth.

Asia Pacific is estimated to be significantly growing during the forecast period of 2024-2034. The rising prevalence of animal disorders, increasing livestock population, rising animal health vigilance, increasing health concerns, rising pet animals’ adoption, and increased healthcare spending on veterinary services and animal health are contributing to the growth of the veterinary imaging market.

The veterinary imaging market is a highly specialized discipline that focuses on the development and deployment of an extensive array of imaging technologies that cater to the medical requirements of animals. Veterinary imaging is one of the most frequently used types of diagnostic testing in both large and small animal hospitals across the world. Imaging provides a high amount of information by non-invasive means and does not cause unacceptable discomfort to patients or alter disease processes.

What is the role of AI in the Veterinary Imaging Market?

Artificial intelligence (AI) in veterinary medicine is an emerging field. Machine learning (ML) is a subfield of artificial intelligence (AI) that enables computer programs to examine large imaging datasets and to learn to perform veterinary diagnostics imaging. AI in veterinary imaging plays an important role in filling the gaps and providing important information for evaluating illness and injury and for routine prevention. The benefits also include accurate, precise, and faster diagnosis and help to improve care.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.86 Billion |

| Market Size in 2023 | USD 1.83 Billion |

| Market Size in 2024 | USD 1.96 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.02% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Solution, Animal Type, Application,End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing pet adoption demand

The increasing pet adoption demand and awareness for innovative, efficient, and high-quality products are pushing companies to improve their offspring, contributing to the growth of the veterinary imaging market. This demand from emerging economies and developed markets helps the growth of the market. Also, supportive government regulations and policies help the market’s growth.

Limitations that investors and businesses need to consider

The limitations that investors and businesses need to consider include technological disruptions, geopolitical tensions, and economic volatility that may impact the stability of the market, affecting business operations and investment returns. In some segments of the market, competition is great, which leads to market saturation, regulatory hurdles, etc., which can hamper the growth of the veterinary imaging market.

Advanced imaging technology

The use of advanced imaging technologies like CT scans, MRIs, and ultrasound contributes to the growth of the veterinary imaging market. Increasing investment in research and development and exposure to advanced imaging system technology help the market’s growth. The increasing prevalence of many veterinary disorders and the need for early and accurate diagnosis fueled the growth of veterinary imaging.

The X-ray segment dominated the veterinary imaging market in 2023. In veterinary diagnosis, X-rays, also called radiographs, play an important role. They can provide a comprehensive image of the internal structures of animals, like abdominal organs, lungs, joints, and bones. This painless technique enables veterinarians to visualize potential foreign objects, tumors, fractures, and other abnormalities, which helps them understand many conditions accurately. It is a readily available and quick imaging method, enabling veterinarians to receive critical diagnostic information rapidly.

The video endoscopy segment is expected to be the fastest-growing during the forecast period. Video imaging has many benefits in terms of documentation, operator comfort, teaching, and client relations, which help the growth of the veterinary imaging market. Video endoscopy also allows endoscopists to work more effectively with any assistance who is supporting the process. The advanced and innovative video endoscopy includes minimally invasive procedures, video recording capabilities, high-resolution images, etc. The benefits of veterinary imaging video endoscopy for veterinarians include customer satisfaction, greater efficiency, a wide range of procedures, accurate diagnosis, exceptional customer service, competitive prices, superior quality, etc.

Ottomed Endoscopy provides veterinary video endoscopes for large and small animals with next-generation imaging technology, which is designed to help veterinary endoscopists enhance the precision diagnostic at the time of making diagnosis and therapeutic endoscopic treatments:

The equipment segment dominated the veterinary imaging market in 2023. The benefits of veterinary imaging equipment include saving money on costs, lower exposure, more accurate images, and seeing images that are clearer and more defined to reduce guesswork needed for accurate diagnosis making. The rapid imaging process is able to access images in an effective way, which helps to save time and also makes rapid diagnosis and treatment decisions in emergency situations. Veterinary imaging equipment can be used to analyze dental problems, evaluate soft tissue, determine bone issues, and more.

The PACS segment is anticipated to be the fastest-growing during the forecast period. The PACS solution plays an important role in improving animal care. The benefits of PACS for veterinary imaging include less time wasted because of inaccessible images and downtime; better patient diagnoses because of accurate diagnoses, and improved workflows for less frustration and stress for the staff, leading to less burnout and better outcomes.

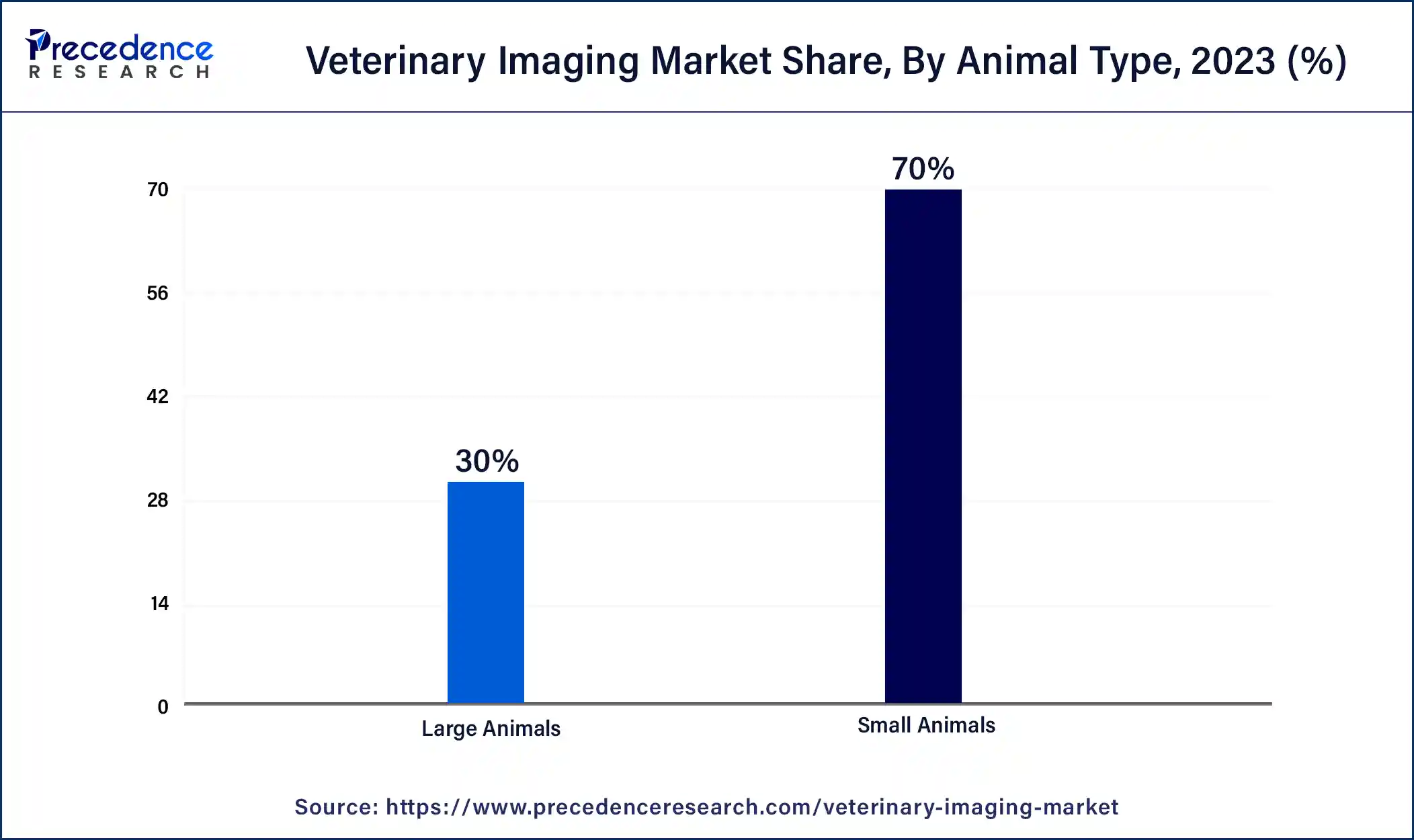

The small animals segment dominated the veterinary imaging market in 2023, and it is estimated to be the fastest-growing segment during the forecast period. Small animals play an important role in veterinary imaging. Specific molecular target imaging with small animal PET allows earlier detection and characterization of diseases. The benefits of small animal veterinary imaging include screening of drug candidates, detailed biochemical parameters, complete kinetics, statistical benefits, lowered use of animals, etc., contributing to the market’s growth.

The orthopedics and traumatology segment dominated the veterinary imaging market in 2023. Veterinary imaging plays an important role in the diagnosis and management of orthopedics and traumatology conditions. The benefits of veterinary imaging for orthopedics and traumatology include accurate diagnosis, treatment planning for soft tissue injuries, joint diseases, fractures, monitoring progress, etc.

The oncology segment is expected to be the fastest-growing during the forecast period. Veterinary imaging plays an important role in adequate diagnosis and staging in human and veterinary oncology, contributing to the growth of the veterinary imaging market. Sensitive detection of lesions is essential to determine proper local and systematic therapy and to monitor therapeutic results.

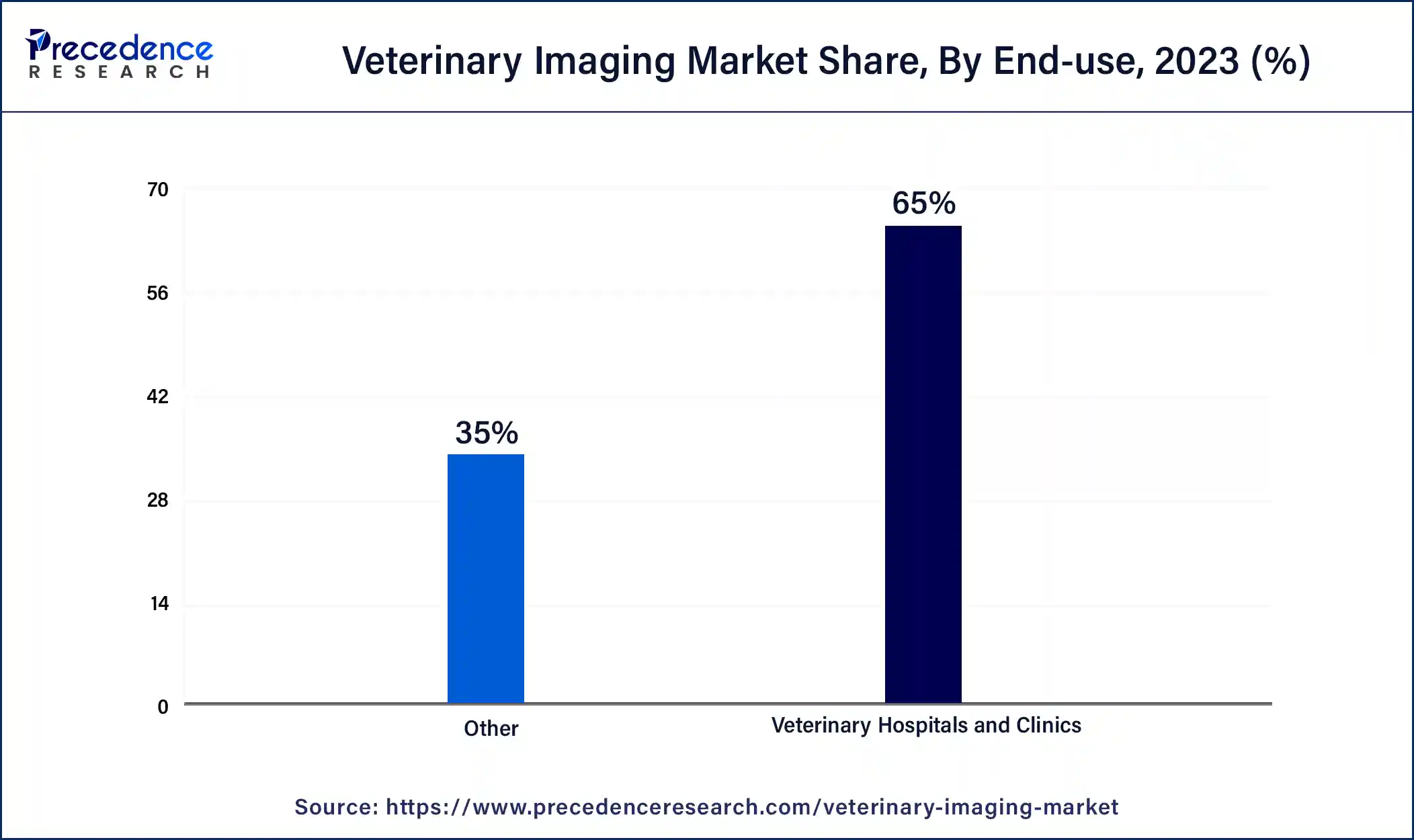

The veterinary clinics and hospitals segment dominated the veterinary imaging market in 2023, and the segment is anticipated to be the fastest-growing during the forecast period. The benefits of veterinary clinics and hospitals include tax benefits for veterinary practices, potential practices for business expansion and franchising, fulfilling work that helps animals and their owners, potential to specialize and offer unique services, potential for repeat business and customer loyalty, recession-resistant industry because of pet ownership, steady income from pet care routine care, etc.

Segments Covered in the Report

By Product

By Solutions

By Animal Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

August 2024

November 2024