August 2024

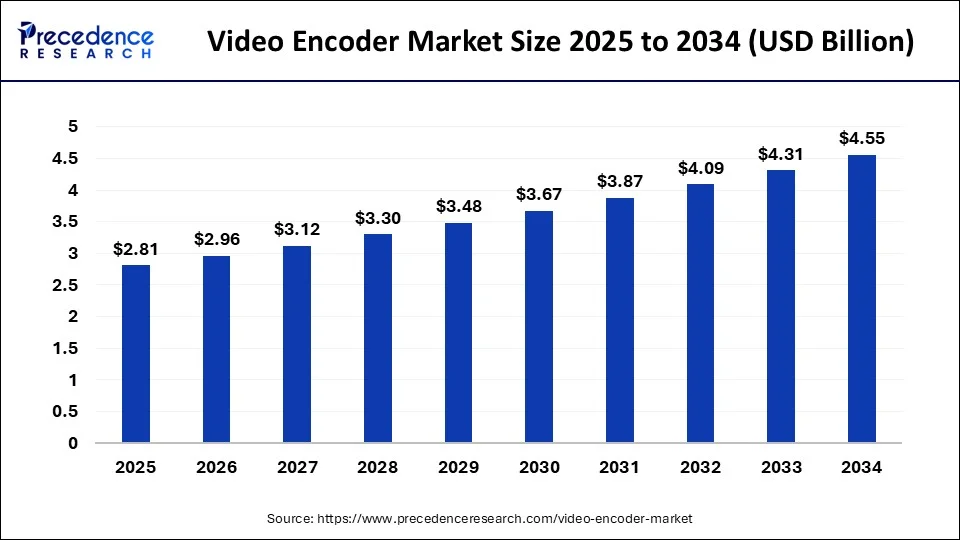

The global video encoder market size surpassed USD 2.52 billion in 2023 and is estimated to increase from USD 2.66 billion in 2024 to approximately USD 4.55 billion by 2034. It is projected to grow at a CAGR of 5.52% from 2024 to 2034.

The global video encoder market size is projected to be worth around USD 4.55 billion by 2034 from USD 2.66 billion in 2024, at a CAGR of 5.52% from 2024 to 2034. The video encoder market growth is attributed to increasing security needs and expanding digital media services.

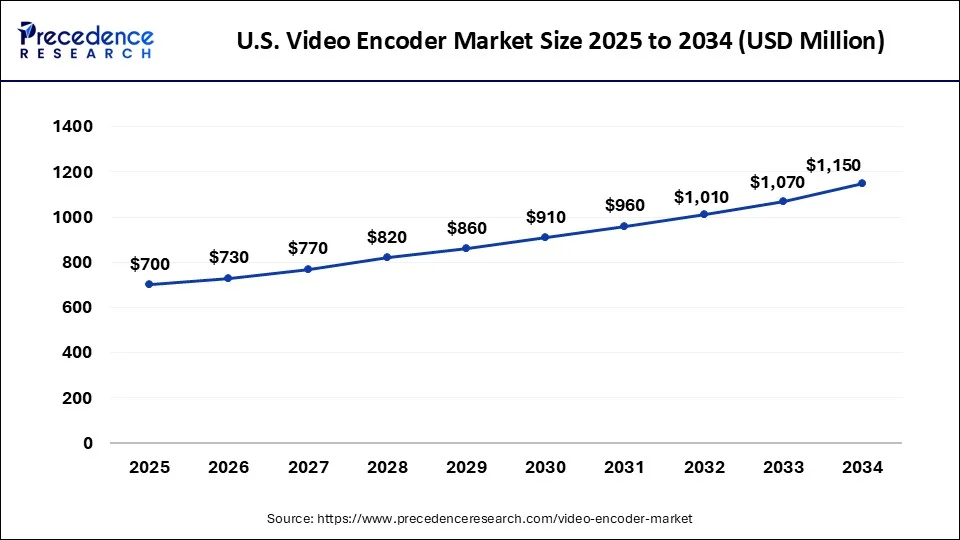

The U.S. video encoder market size was exhibited at USD 620 million in 2023 and is projected to be worth around USD 1,150 million by 2034, poised to grow at a CAGR of 5.77% from 2024 to 2034.

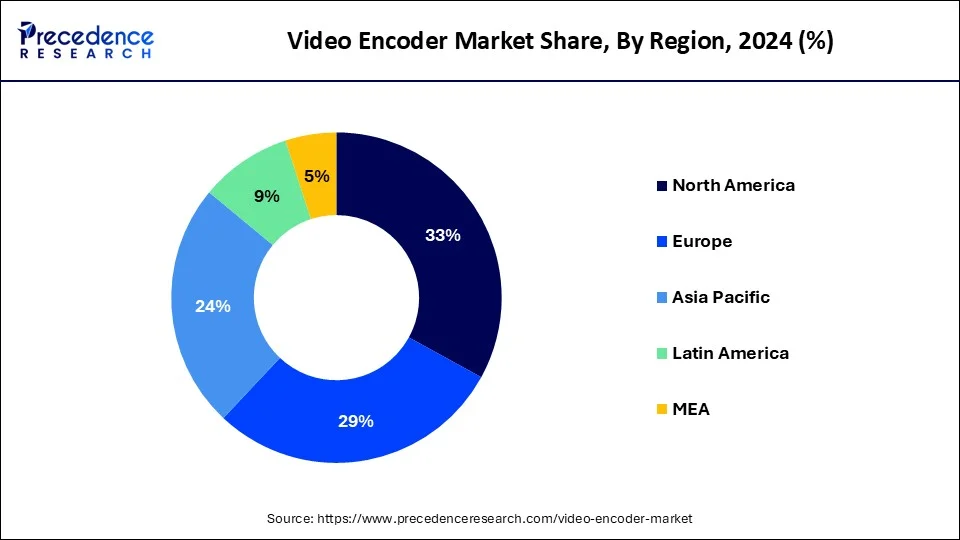

North America dominated the video encoder market in 2023 due to the greater development of technological resources and increased usage of video encoding technologies by numerous businesses in different sectors. A large number of technology companies and broadcast dealers are situated in North America. This creates a steady increase in smart city investments and security systems, which led to the demand for video encoders in the region. The region's emphasis on innovation and the first adoption of the newest technologies, including high-definition or ultra-high-definition video, contributes to the growth of video encoders’ performances. Furthermore, the strong penetration of the media and entertainment industry, which comprises streaming platforms and content providers, further boosts the market in this region.

Asia Pacific is expected to grow with the fastest CAGR in the video encoder market during the forecast period owing to the greater emphasis on infrastructure outlay and technology in many fields. Increasing security demand in the emerging markets of Asia Pacific, along with fast-growing digital media and streaming services, requires advanced technologies of video encoding. Emerging smart cities and enhanced transportation of telecommunications also help facilitate the demand for high-quality encoders. Moreover, increasing concern for public safety and surveillance systems, along with the increasing local and regional media production, further boosts the market.

The use of cloud services for storing enormous amounts of data is the major factor boosting the growth of the video encoder market. Video encoders are essential in the conversion of existing analog systems to IP systems, meaning that manufacturers continue to improve their development through R&D. Globalization of digitalization services and the growth of video CDN services for different industries have led to multiple opportunities for the video encoder market.

There is increased demand for the video encoder market due to the quality of video streaming and real-time video communication, which facilitates the utilization of video encoding solutions. Software engineers are working hard to come up with more efficient and less latency video encoders that handle the new, more sophisticated technologies. This tendency promotes adoption in media and entertainment, security and surveillance, healthcare, and educational services industries. Additionally, business entities looking for better, superior, and cheaper video solutions further propel the demand for appropriate video encoders.

Artificial Intelligence's Impact on the Video Encoder Market

In the video encoder market, the use of AI/ML technologies in encoders improves the efficiency of the data compression process while maintaining video quality. They result in the consumption of less bandwidth and storage space, a very vital factor owing to the current high demands on data. Furthermore, artificial intelligence (AI) enables the addition of more specific features, including object identification and motion detection, as part of the encoding process, which creates added value for segments such as security and surveillance.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.55 Billion |

| Market Size in 2023 | USD 2.52 Billion |

| Market Size in 2024 | USD 2.66 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Number of Channel, Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing adoption of high-efficiency video coding

Increasing adoption of high-efficiency video coding (HEVC) is anticipated to drive the video encoder market. HEVC standards provide extensive compression performance, namely, achieving higher video quality with fewer bits, which are essential for increasing the consumption of high-definition and ultra-high-definition video. HEVC leads to a decrease in bandwidth and storage, which contributes to the cost-efficient strategy for companies. CDNs and streaming platforms continue to develop, and HEVC is likely to broaden its consumers, thus driving the need for better video encoding services.

Furthermore, with the growth of video-on-demand services and live broadcasts of specific events, better encoding is needed to ensure great performance. New developments in HEVC are expected to improve support for other new technologies, such as 4K and 8K video, VR, and AR. Moreover, the growing number of people shifting towards short-form content further fuels the demands for video quality, enhancing the necessity of compliance with HEVC, which contributes to booting the use of video encoders.

High initial costs of video encoding solutions

High initial costs are anticipated to hamper the video encoder market in the coming years. These are rather high initial costs that prevent the expansion of these technologies in small businesses and startup markets. The constantly rising necessity to replace equipment with new models due to innovations within this sphere also increases costs, posing difficulties for organizations to explain the necessity of investing. The cost factor is very important in these market segments since the buyer acts in accordance with the cost structure known in the low-cost segment. Moreover, the high cost of maintenance, training, and support services adds to this technology further hinders the market.

Rising demand for video content in remote and hybrid work environments

The rising popularity of video content for remote and hybrid work environments is likely to create immense opportunities for the players coming into the video encoder market. Ongoing trends of remote and hybrid work experience provide a need for high-definition video conferencing and collaboration tools that are based on efficient video coding. The report published by Forbes reveals that around 32.6 million Americans are expected to shift to remote work by 2025. Business organizations are purchasing video encoding systems to have high-quality, uninterrupted, and manageable communication through video conferencing, webinars, and other online sessions. With the increase in video project management and collaborative team applications, high-quality video encoding is needed to support the interactions. Furthermore, the increasing number of organizations adopting integrated video solutions and their push for enhanced user interactions further boosts the market.

The 4-channel segment dominated the video encoder market in 2023 due to their performance and cost, which makes them suitable for various uses, such as small to medium SDS & SS systems. 4-channel encoders allow for four different inputs from the cameras at the same time, which helps users work with many cameras at the same time without compromising the quality of the videos recorded. Retail stores, educational facilities, and small businesses are embracing surveillance systems that require affordable and effective video management solutions. Additionally, the additional features, including better compression standards and a better underlying connection specification, have further boosted the segment in the coming years.

The 8-channel segment is projected to expand rapidly in the video encoder market in the future years owing to their capability to manage even complicated and efficient surveillance systems installations. The offered options for these encoders enable the reception of eight video inputs, which makes them appropriate for extensive safety systems in industrial, large commercial, and essential facilities and structures. The need for monitoring systems and better security makes the demand for the 8-channel encoder ideal. The ability to handle multiple high-definition video streams and their additional options, such as higher image quality and better compression rates, make organizations in search of efficient and scalable security systems. Moreover, modern 8-channel encoders present top-network integration and real-time analytics, which further fuel demand.

The standalone segment held the largest share of the video encoder market in 2023 due to their high functionality and ability to easily incorporate into most of the video surveillance and broadcasting systems. Stand-alone encoders are small, complete devices for converting analog video signals into digital ones, which attract users of different experiences, starting from small business owners and finishing with school or university administrators. Their plug-and-play nature makes them a codec of choice for simple and cheap video encoding. The development of standalone encoders is also based on the fact concerning their capability to process various video formats and resolutions. Their lower expense of the enclosed systems in comparison to the rack-mounted solutions further boosts the segment.

The rack-mounted segment is projected to grow rapidly in the video encoder market in the coming years, owing to the innovative features and its compatibility with the size and objectives of the organization, which makes them propounded for large and extensive video management systems. These encoders integrate into standard server shelves, which enables the utilization of a lot of space and also manages numerous video inputs.

The increase in demand for high-capacity video surveillance & broadcasting applications in transportation, critical infrastructure, and large enterprises increases the need for rack mount solutions. Their capacity to handle and connect many channels at a time and new-generation network and storage systems are consistent with the rising demands for extensive and efficient video encoding services. Additionally, the trends in improving rack-mount technologies, including processing capabilities, networking systems, and heat dissipation means, are expected to foster rack-mount demand as the optimal solution for massive and resource-intensive applications.

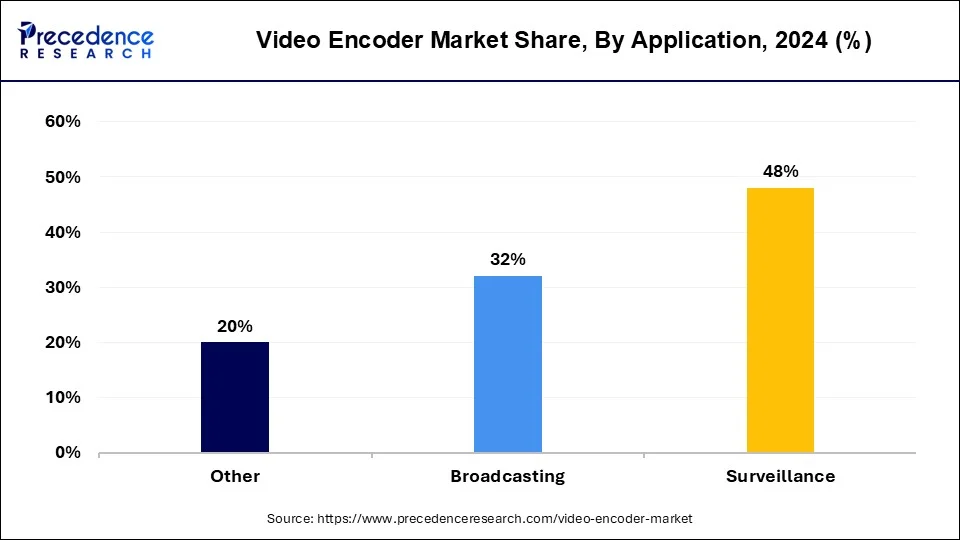

The surveillance segment dominated the video encoder market in 2023 due to the rising trend of security consideration in both private and social domains in contemporary global society. The requirement for video encoders in surveillance systems arises from the need to convert and compress video streams from various surveillance cameras for monitoring and recording purposes. Large-scale businesses, such as retailing and transportation sectors and the growing municipal infrastructures, are applying hi-tech surveillance systems for the improvement of security. The increasing requirement for high-quality video feeds and live statistics further boosts the segment.

The broadcasting segment is projected to lead the video encoder market in the future owing to the expanding high-definition and ultra-high-definition coverage in all types of media. The number of broadcasting and streaming services is growing, and with the high density of users and global reach of the services, the systems need to have efficient video encoders that meet the requirements. The current trend is to deliver 4K and 8K content and the requirement of new encoding solutions for handling increased bit rates and better compression ratios. The popularity of live streaming and other on-demand video services requires strong encoding platforms to maintain the desired broadcast quality of the stream. Furthermore, the rich support for new compression standards for encoders and improved integration with CDNs fuels the segment growth in the coming years.

MainConcept Announces Live Encoder 3.4 with Advanced VVC and LCEVC Support

| Company Name | MainConcept |

| Headquarters | Aachen, Germany |

| News | In November 2023, MainConcept, a leading provider of video and audio codecs, unveiled the latest version of its real-time encoding application, Live Encoder 3.4, designed to enhance OTT and TV broadcasting workflows. This new version introduces two significant additions: support for VVC/H.266 and MPEG-5 LCEVC, marking a transformative step for broadcasters and OTT content providers in live video distribution. Live Encoder is an all-in-one, real-time encoding engine aimed at simplifying broadcast and OTT workflows. The 3.4 update integrates MainConcept’s HEVC and AVC codecs while adding cutting-edge VVC (Versatile Video Coding) and LCEVC (Low Complexity Enhancement Video Coding) technologies, positioning it as one of the most innovative tools in the video production industry. |

Allegro DVT Launches E300 Series Video Encoder IPs with Enhanced Performance

| Company Name | Allegro DVT |

| Headquarters | Allegro DVT |

| News | On September 12, 2023, Allegro DVT, a prominent provider of video encoding semiconductor IP solutions, announced the launch of its E300 series, a new generation of video encoder IPs featuring a high-performance architecture that supports resolutions ranging from 4K60 to 8K120. The E300 series offers an upgraded hardware design that delivers exceptional video throughput and provides an optimal balance between video quality and real-time performance. This series supports multiple video formats, including H.264, HEVC, VP9, AV1, and JPEG, through resource-sharing capabilities that reduce power consumption and silicon area, making it a versatile and efficient solution for advanced video encoding needs. |

Segments Covered in the Report

By Number of Channel

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

August 2024

January 2025

January 2025