October 2024

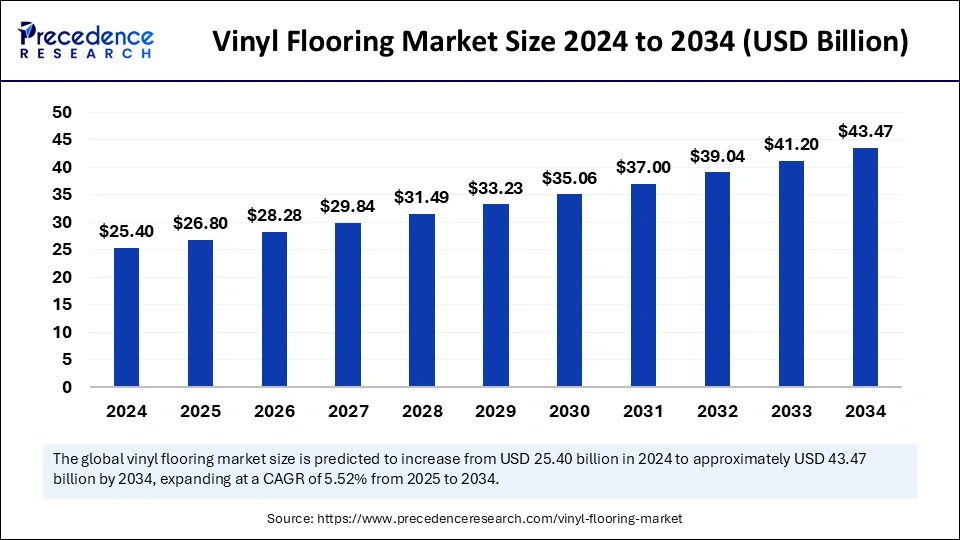

The global vinyl flooring market size is calculated at USD 26.80 billion in 2025 and is forecasted to reach around USD 43.47 billion by 2034, accelerating at a CAGR of 5.52% from 2025 to 2034. The Asia Pacific market size surpassed USD 10.92 billion in 2024 and is expanding at a CAGR of 5.64% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global vinyl flooring market size accounted for USD 25.40 billion in 2024 and is predicted to increase from USD 26.80 billion in 2025 to approximately USD 43.47 billion by 2034, expanding at a CAGR of 5.52% from 2025 to 2034. Increasing construction activities, rising consumer preference for aesthetically appealing and durable materials, increasing demand for cost-effective flooring solutions, and growing popularity for luxury vinyl tiles flooring are expected to drive the growth of the global vinyl flooring market

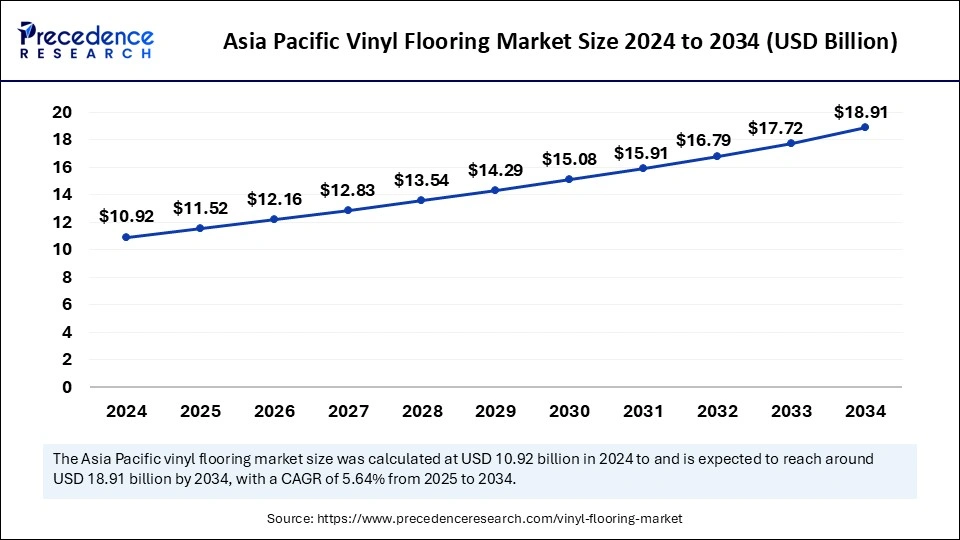

The Asia Pacific vinyl flooring market size was exhibited at USD 10.92 billion in 2024 and is projected to be worth around USD 18.91 billion by 2034, growing at a CAGR of 5.64% from 2025 to 2034.

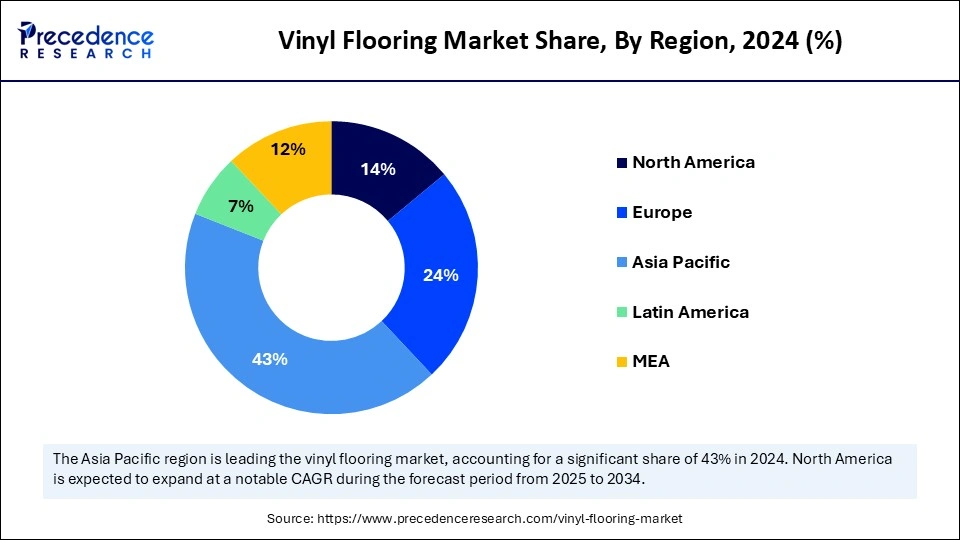

Asia Pacific held the largest share in the vinyl flooring market in 2024. The region growth is mainly attributed to the increasing standard of living along with the rising population that offers a great potential for infrastructural development and new housing demand, which significantly fuels the market growth in this region. The rise in building and construction trends to develop modern architectural structures, spurring the demand for vinyl flooring in the region. Additionally, increasing investments in the construction of single-family homes, apartments, complexes, shopping malls, offices, and other commercial spaces are positively influencing the growth of the vinyl flooring market in the region.

On the other hand, North America is observed to grow at the fastest rate during the forecast period. The growth of the region is driven by the presence of a well-established service industry, expansion of the construction sector, rapid technological advancement and product innovation, rising urbanization, increasing disposable income, surge in the number of single-family houses, and an increase in the number of MNCs operating in the region. In addition, the supportive government initiatives to develop social infrastructure across the region is expected to drive the regional market’s growth.

Vinyl flooring is a type of versatile and resilient flooring material made from polyvinyl chloride. Vinyl flooring offers several advantages, such as easy installation, low-maintenance nature, and high durability. It is available in various forms, including luxury vinyl tiles, vinyl sheets, and vinyl tiles, which cater to dynamic consumer preferences for construction applications related to residential and commercial projects. The use of vinyl flooring can enhance interior looks, aesthetics, and comfort underfoot in several residential and commercial spaces.

| Report Coverage | Details |

| Market Size by 2034 | USD 43.47 Billion |

| Market Size in 2025 | USD 26.80 Billion |

| Market Size in 2024 | USD 25.40 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.52% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising construction and renovation activities

The increasing construction activities around the world are expected to drive the growth of the vinyl flooring market in the upcoming years. Vinyl flooring is easy to install, moisture-resistant, affordable, low maintenance cost, and more durable than other flooring solutions. It can mimic natural materials such as stone and wood, making it a popular choice in the construction industry.

Additionally, several prominent manufacturers are increasingly investing to develop customized product solutions in a wide variety of colors, patterns, design textures, and dimensions, which are propelling the product penetration in the construction sector. The increasing need for renovation and construction of residential places, including apartments, family-homes, and condominiums along with the rising demand for vinyl flooring from schools, healthcare facilities, and several public buildings are anticipated to fuel the expansion of the market in the coming years.

Fluctuations in Raw Material Prices

The volatility in raw material prices is anticipated to hamper the growth of the market. Fluctuations in raw material prices can adversely impact the overall cost of the vinyl flooring as well as the profitability of manufacturers as they find it difficult to pass on the increased costs to potential customers due to severe competitive pressures. Such factors may restrict the expansion of the global vinyl flooring market.

Rising focus on sustainability and eco-friendly solutions

The increasing focus on sustainability and eco-friendly solutions is projected to offer lucrative opportunities to the vinyl flooring market during the forecast period. Manufacturers are increasingly using recycled materials and reducing VOC emissions as eco-friendly innovations are gaining significant popularity among environmentally conscious consumers. These innovations align with stringent environmental regulations and are attractive for green building certifications like LEED, making vinyl flooring the preferred option for sustainable projects.

In addition, the rising advancements in digital printing technology can enhance the aesthetic appeal of vinyl flooring. Digital printing technology allows for the creation of very intricate designs and lifelike textures. This advancement caters to residential, commercial, and industrial sectors for personalized aesthetics, bolstering the growth of the market during the forecast period.

The luxury vinyl tiles segment accounted for the dominating share in 2024 owing to the rising investments in construction and renovation activities. The growth of the segment is majorly driven by the increasingly popularity of Luxury vinyl tiles (LVT) among consumers for residential and commercial applications owing to its affordability, ease of installation, durability, and water resistance properties. Luxury vinyl tiles (LVT) are also gradually replacing industry staples including solid wood flooring, engineered wood flooring, and porcelain. LVTs can significantly reduce replacement cost and material wastage as well as align with environmental and sustainability objectives. This flooring type is highly preferred in commercial sectors such as retail, offices, hospitals, educational buildings, and others.

On the other hand, the vinyl sheets segment is expected to witness a significant growth rate during the forecast period. Vinyl sheet flooring offers a variety of benefits, such as being easy to install, durable, and stress-free to clean. To meet the diverse customers' needs, manufacturers are offering color and texture customization to match any décor. These sheets are increasingly being adopted among customers as a substitute for natural stone flooring, hardwood flooring, ceramic tiles, and others. Vinyl sheet flooring is becoming a preferred choice for many businesses and commercial spaces like offices, schools, and hospitals.

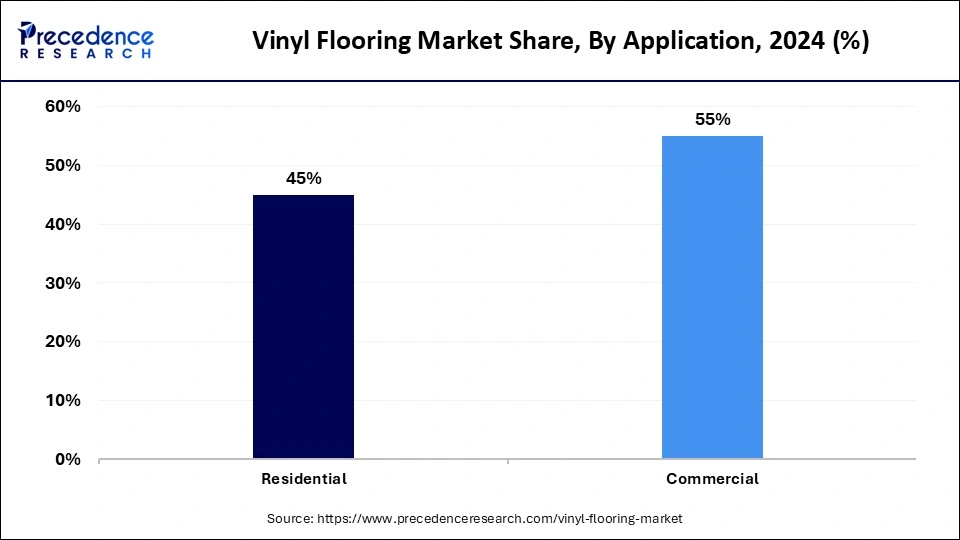

The commercial segment accounted for the dominant share in 2024 owing to the rising demand for vinyl flooring in commercial settings such as residences, retail, offices, shopping malls, hotels, and others. Vinyl flooring can be used in areas with heavy foot traffic, which has led to an increase in the demand for vinyl flooring for commercial uses. Vinyl flooring offers features like easy cleaning, slip & water resistance, and stylish designs are expected to accelerate the adoption of the products in commercial applications.

On the other hand, the residential segment is expected to grow at a notable rate in global vinyl flooring market over the forecast period. The residential application segment includes apartments, residential buildings, complexes, and houses. In the residential applications, vinyl floorings are widely used due to their low cost, long-lasting, ease of installation, and resistance to water, stains, and dirt. This flooring is available in various patterns, colors, and sizes, making it a preferred choice to create patterns resembling natural stone or wood.

Vinyl flooring is either waterproof or water-resistant, which makes it highly durable against spills, wet feet, and other moisture exposure. This characteristic of vinyl is an excellent choice for areas like kitchens, bathrooms, and other spaces that frequently encounter wetness. Moreover, the surge in the number of single-family houses in developing nations, rising urbanization, and the growing disposable income of consumers are anticipated to propel the product demand in the residential segment during the forecast period.

By Product

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

October 2024

August 2024

December 2024