January 2025

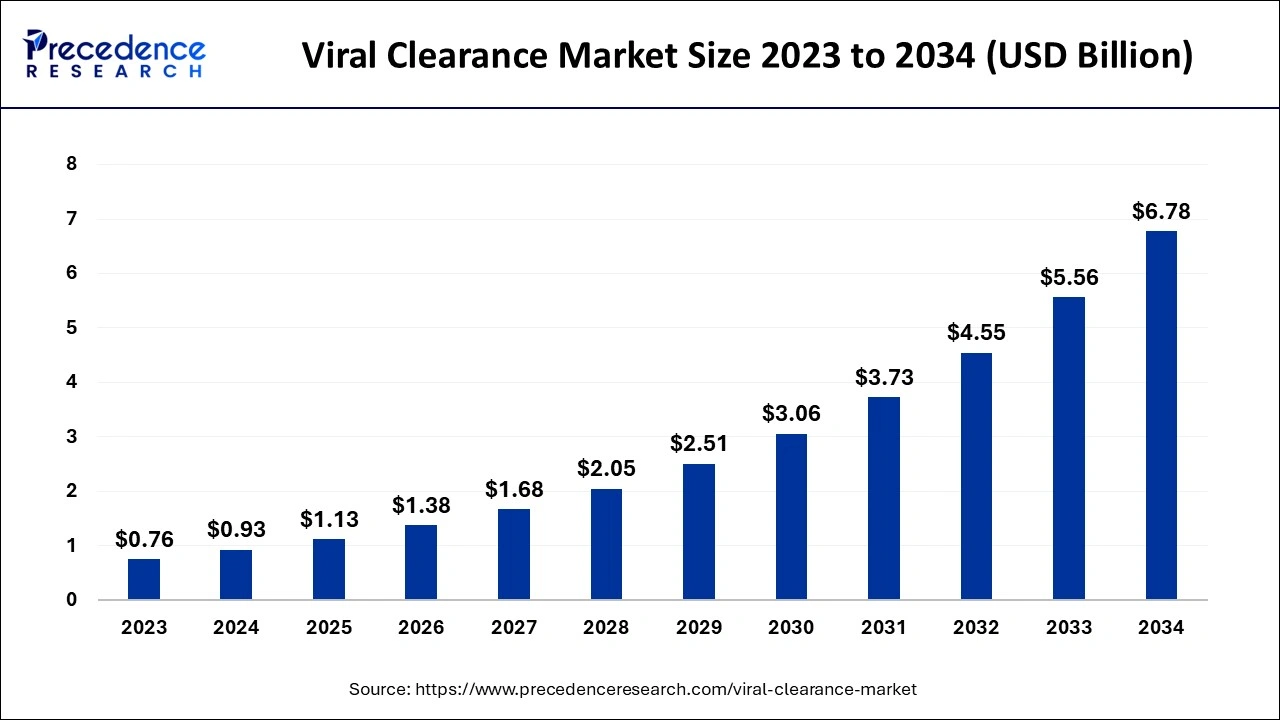

The global viral clearance market size accounted for USD 0.93 billion in 2024, grew to USD 1.13 billion in 2025 and is expected to be worth around USD 6.78 billion by 2034, registering a healthy CAGR of 22.01% between 2024 and 2034. The North America viral clearance market size is calculated at USD 430 million in 2024 and is estimated to grow at a fastest CAGR of 22.10% during the forecast period.

The global viral clearance market size is calculated at USD 0.93 billion in 2024 and is projected to surpass around USD 6.78 billion by 2034, expanding at a CAGR of 22.01% from 2024 to 2034. The viral clearance market is driven by the growing demand for biopharmaceutical products.

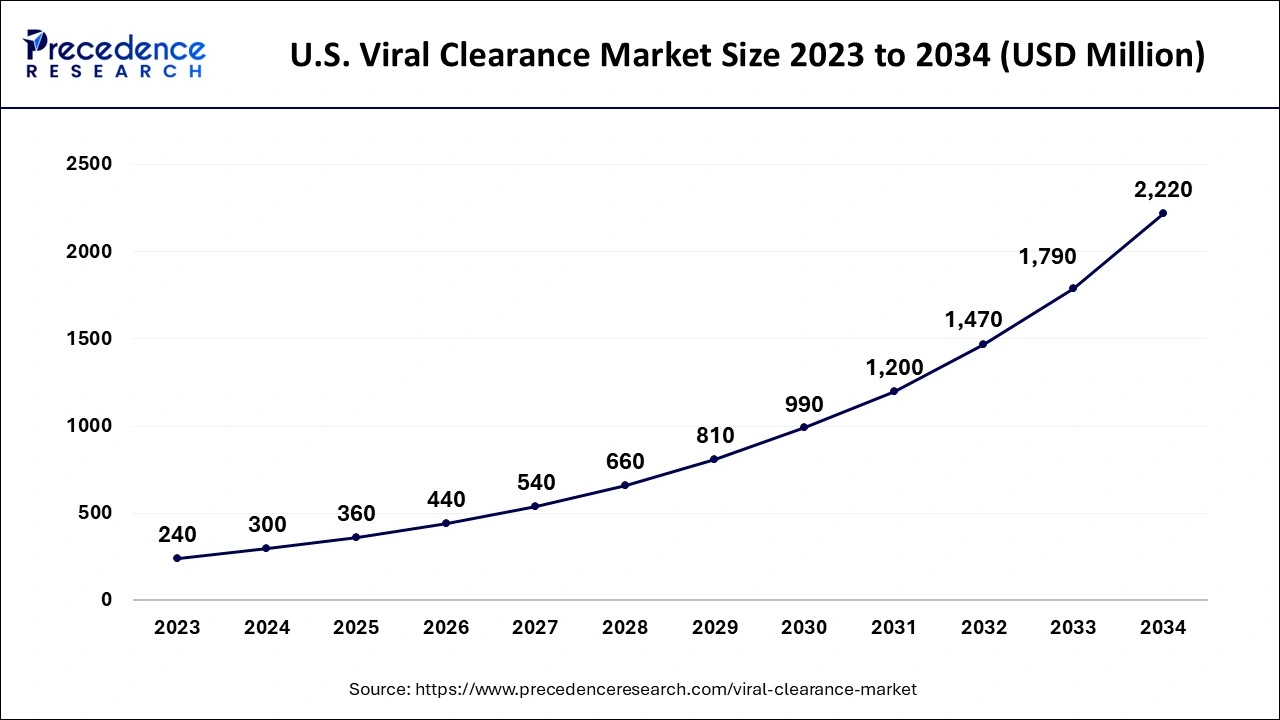

The U.S. viral clearance market size is evaluated at USD 300 million in 2024 and is projected to be worth around USD 2,220 million by 2034, growing at a healthy CAGR of 22.41% from 2024 to 2034.

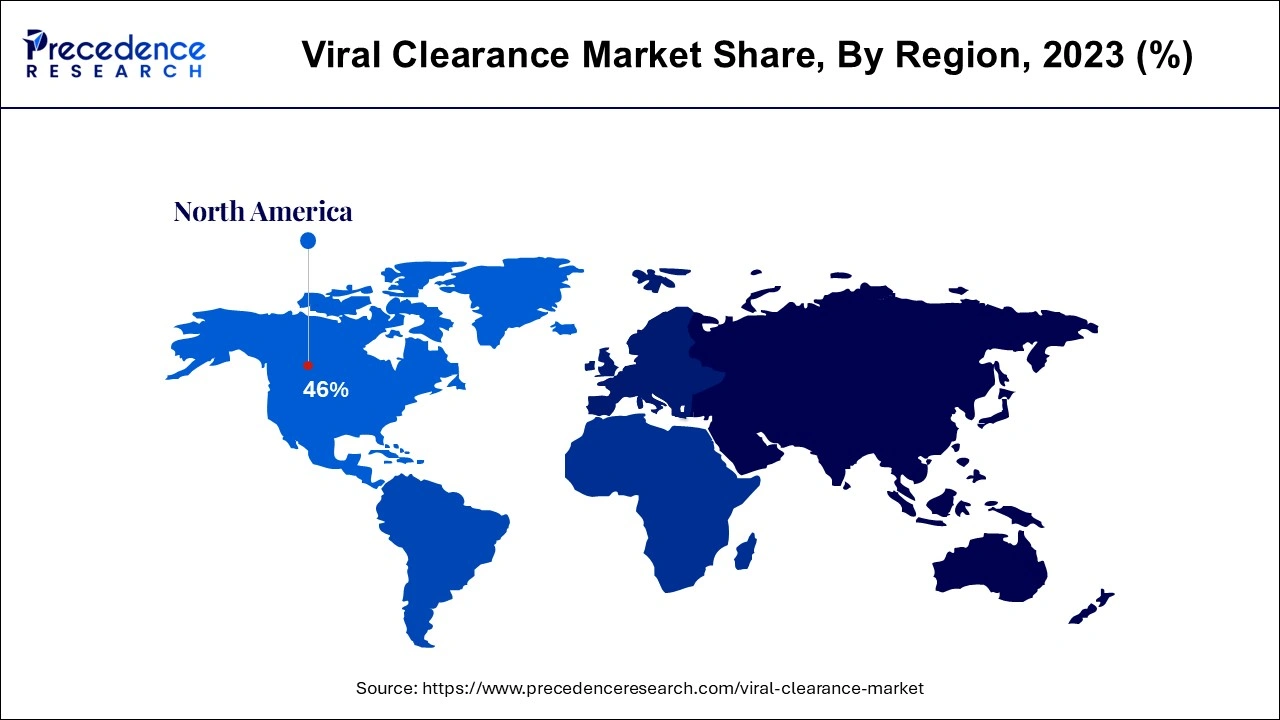

North America dominated the viral clearance market in 2023. North America's supremacy has benefited immensely from the work of respectable regulatory agencies such as the U.S. Food and Drug Administration (FDA). These organizations set stringent standards for developing, testing, and manufacturing biopharmaceutical products. The increasing demand for biologics, such as monoclonal antibodies, cell therapies, and recombinant proteins, contributed to the regional market growth. The COVID-19 pandemic also raised attention toward the value of immunizations, increasing the demand for viral clearance services.

Asia Pacific is expected to witness the fastest growth during the forecast period. This is due to the availability of a large number of CROs and the increasing production of pharmaceuticals. Many global biopharmaceutical companies are outsourcing viral clearance and other procedures from Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) in Asia Pacific due to the cost benefits of a skilled workforce and high compliance with regulatory standards. Moreover, there is a substantial increase in demand for viral clearing services in the region, thus contributing to regional market growth.

Viral clearance is essential for developing biologics and is necessary to ensure product safety. One way to control product contamination is to ensure the production process can sufficiently remove any potential viral contaminants. In order to manufacture human monoclonal antibodies, specialized unit operations such as low pH inactivation, viral filtering, and chromatographic separation are used to remove the virus. The rapid expansion of cells and gene therapy, which frequently entails modifying viruses or viral vectors to treat genetic illnesses or cancer, makes viral clearance even more crucial. To guarantee that no dangerous viral impurities are left in the finished product, these treatments must pass stringent viral safety testing. International standards established by health agencies such as the WHO need to be followed in viral clearance procedures. No matter where biopharmaceutical goods are produced or disseminated, these criteria guarantee they are viral contamination-free.

How is AI Helping the Viral Clearance Market to Grow?

Developing each viral clearance step for creating a novel antibody in wet laboratory tests for process characterization research requires time, money, and effort. However, machine learning techniques may facilitate creating and improving viral clearance unit operations for novel therapeutic antibodies. They can predict the viral clearance performance, significantly accelerating the viral clearance validation process.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.78 Billion |

| Market Size in 2024 | USD 0.93 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 22.01% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for biologics

Since biologics contain molecules such as nucleic acids and proteins, they are vulnerable to fungi, bacteria, and viruses. Thus, specific viral clearance techniques are needed to reduce any possible viral contamination. Viral contamination in biologics emphasizes the importance of reliable viral clearance procedures in previous records. Businesses are incentivized to allocate resources toward these procedures to avoid product recalls and guarantee patient safety.

High costs of viral clearance services

Viral clearance necessitates advanced laboratory equipment and highly qualified workers. Operating and maintaining this equipment adds to overall service costs, which include operational, maintenance, and calibration charges. High service prices may stifle innovation in biopharmaceutical businesses, limiting the amount of cash available for R&D in other crucial areas.

Advancements in viral clearance technologies

Filtering techniques like ultrafiltration and nanofiltration increase viral elimination effectiveness. These technologies improve the yield of the product by filtering out a wider variety of viral sizes. Technology suppliers can set themselves apart in the market by offering customized viral clearance solutions for particular goods or procedures. Creating industry consortia to tackle shared viral clearance difficulties might result in pooled resources, expertise, and technological advancements, thus propelling the market's growth.

The viral removal segment dominated the viral clearance market in 2023. This is due to the rising importance of viral removals in biologics production. The need for viral clearance technologies has been driven by the rising demand for biological medications, including gene therapies, vaccines, and monoclonal antibodies. Since biologics are produced from living things and are susceptible to viral contamination, eliminating viruses from their source is a crucial step in the manufacturing process. As the development of biologics continue to expand, the necessity for effective viral elimination methods increases. Viral safety is receiving more attention as public and regulatory worries about viral contamination rise, particularly during pandemics like COVID-19.

The recombinant proteins segment led the viral clearance market in 2023 due to the increasing production of recombinant proteins. The rising creation of recombinant proteins is supported by new technologies in developing viral clearance methods, such as robust inactivation methods, high-performance liquid chromatography (HPLC), and viral filtering. To demonstrate their ability to eliminate any possible viral pollutants, every step in the viral clearance process must be confirmed, including virus inactivation and removal.

The pharmaceutical and biotechnology companies segment dominated the viral clearance market in 2023. These companies heavily use viral clearance during the manufacturing of pharmaceutical products. There is a high possibility of viral contamination in gene therapy and cell-based medicines, notably regenerative medicine. The use of viral vectors in these treatments to introduce genetic material into cells raises the possibility of viral contamination. Thus, pharmaceutical and biotech firms heavily use viral clearance techniques to ensure the security and effectiveness of these therapies. Pharma and biotech businesses also concentrate on product development and commercialization while maintaining viral safety.

The contract research organizations segment is expected to grow at a significant rate in the market during the forecast period. CROs are extensively aware of testing procedures, virus clearance technology, and regulatory compliance. Pharmaceutical businesses can access technical expertise and knowledge from CROs they might not otherwise have. Global regulatory agencies demand CROs to manage extensive documentation, audits, and continuous viral safety testing. CROs are skilled in these. Because of their expertise, biopharmaceutical businesses choose them as their preferred partner when they want to achieve compliance criteria without having to develop internal resources.

Segments covered in the report

By Method

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

October 2024

June 2024