November 2024

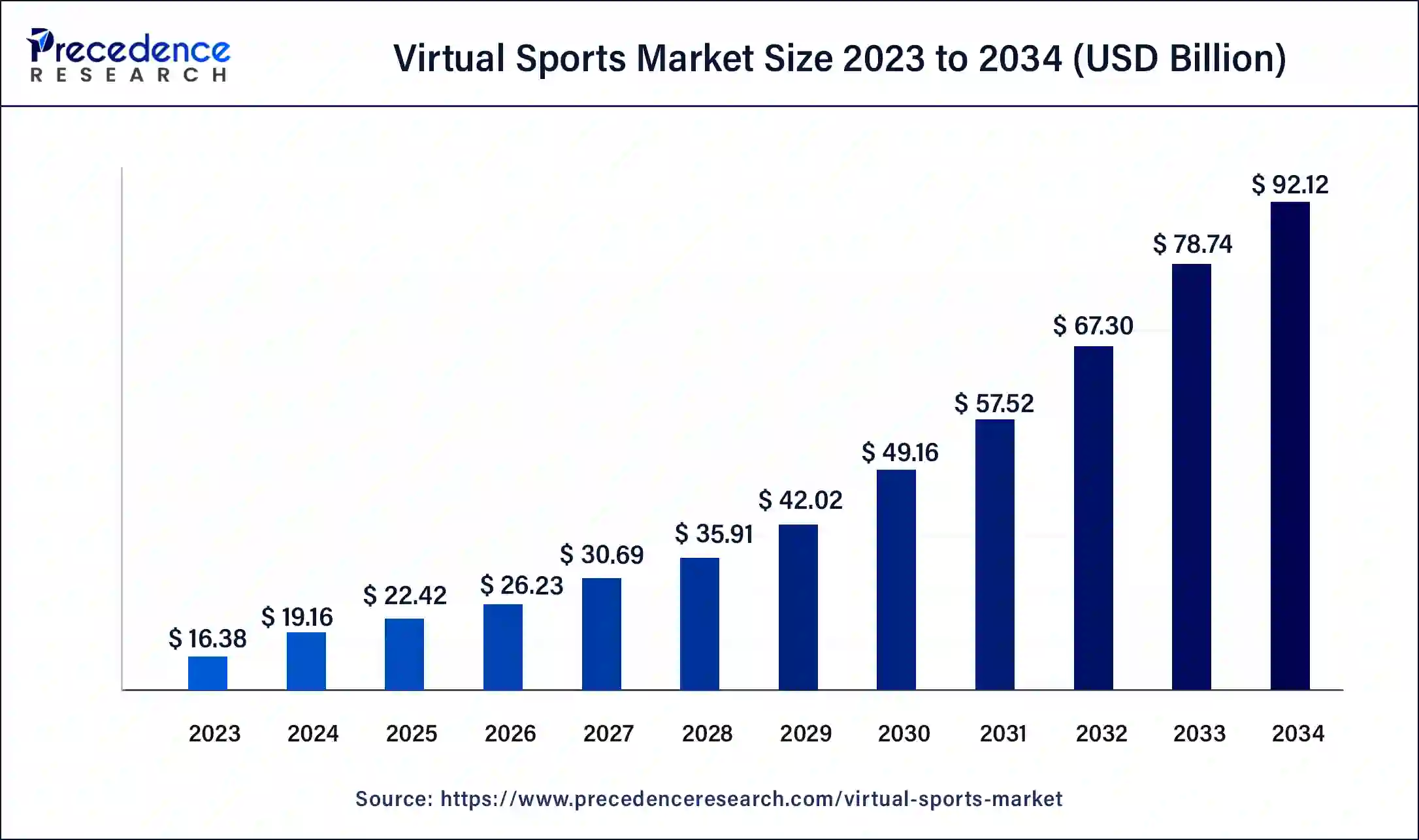

The global Virtual Sports Market size was USD 16.38 billion in 2023, calculated at USD 19.16 billion in 2024 and is expected to reach around USD 92.12 billion by 2034. The market is expanding at a solid CAGR of 17% over the forecast period 2024 to 2034.

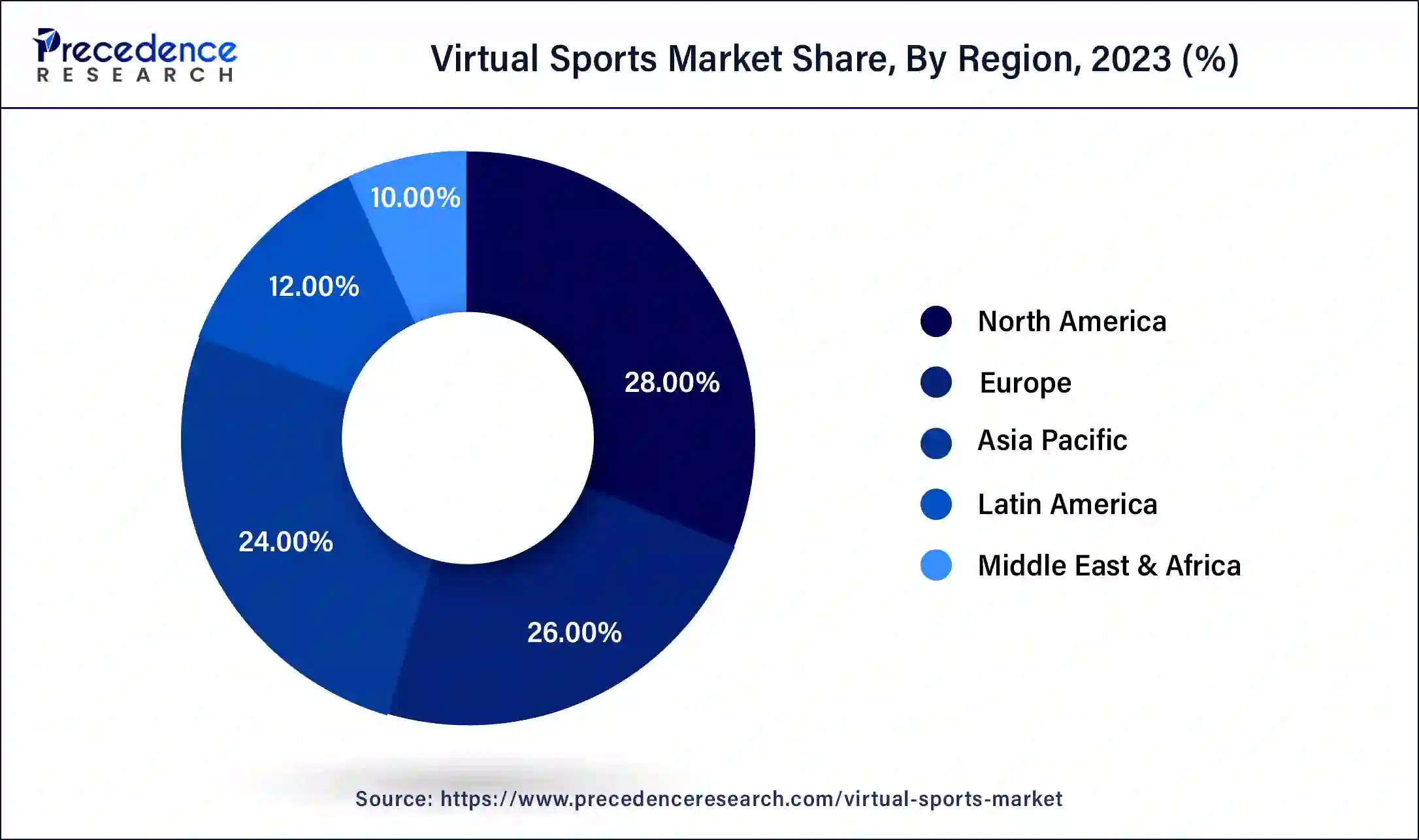

The global Virtual Sports Market size accounted for USD 19.16 billion in 2024 and is expected to reach around USD 92.12 billion by 2034, expanding at a CAGR of 17% from 2024 to 2034. The North America Virtual Sports Market size reached USD 4.59 billion in 2023.

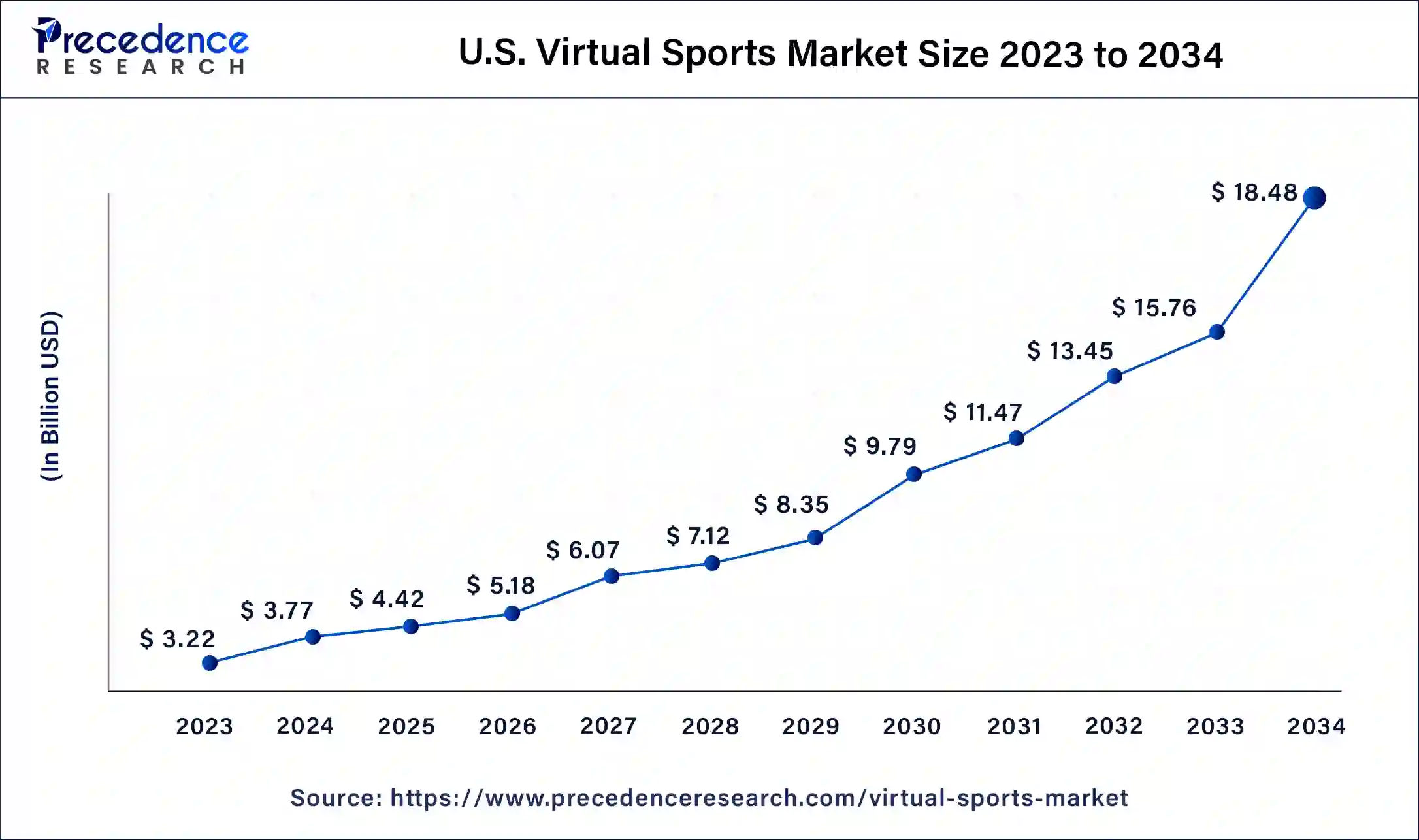

The U.S. Virtual Sports Market size was estimated at USD 3.22 billion in 2023 and is predicted to be worth around USD 18.48 billion by 2034, at a CAGR of 17.2% from 2024 to 2034.

In 2023, North America dominated the virtual sports market due various factors including technological advancements, a robust gaming culture, and increasing interest in virtual experiences. North America has been at the forefront of technological innovation, and this trend extends to the virtual sports market. Ongoing advancements in graphics, artificial intelligence, and virtual reality technologies have enhanced the realism and immersive nature of virtual sports experiences.

Additionally, the prevalence of mobile gaming has played a significant role in the virtual sports market in North America. The accessibility and convenience of mobile devices have made virtual sports experiences more accessible to a wide range of users, contributing to increased engagement. With a deep-rooted passion for traditional sports, North America has seen a seamless integration of virtual sports into its sports culture. Virtual sports platforms often offer simulations of popular sports like football, basketball, and baseball, catering to the interests of sports enthusiasts.

Asia-Pacific is poised for rapid growth in the virtual sports market due to various factors such as increasing internet penetration, rising smartphone adoption, and a growing interest in gaming and sports-related content. The Asia-Pacific region has been a global hub for gaming culture, with countries like China, Japan, and South Korea leading in terms of both gaming consumption and production. The popularity of esports and online gaming has contributed to a receptive environment for virtual sports. In addition, the prevalence of mobile gaming in Asia-Pacific has played a significant role in the growth of the virtual sports market.

Meanwhile, Europe is growing at a notable rate in the virtual sports driven by factors such as technological advancements, the popularity of gaming culture, and a growing interest in virtual experiences. Europe has a strong gaming culture, with a significant number of gamers and esports enthusiasts. The popularity of esports events and competitive gaming has fostered an environment where virtual sports are well-received, especially among the tech-savvy demographic. Europe has a rich sports culture, and virtual sports platforms often offer simulations of popular sports such as football (soccer), basketball, and racing. The region's existing passion for traditional sports contributes to the acceptance and adoption of virtual sports experiences.

The virtual sports market refers to a sector within the broader sports and entertainment industry that involves the creation and simulation of sports events through computer-generated graphics and technology. Unlike traditional sports that are played in physical arenas, virtual sports take place in virtual environments, often facilitated by advanced computer software and simulations. Virtual sports events are created using advanced simulation technologies, incorporating realistic graphics, physics, and artificial intelligence to mimic the dynamics of real-world sports.

The virtual sports market often overlaps with the online gaming and betting industry. Users can place bets on virtual sports events, and virtual sports simulations may serve as the basis for various sports-themed video games. It also provide entertainment for both participants and spectators. Gamers can compete against each other, and fans can watch virtual sports events as a form of entertainment, often featuring commentary and analysis similar to traditional sports broadcasts.

| Report Coverage | Details |

| Market Size by 2034 | USD 114.72 Billion |

| Market Size in 2023 | USD 114.72 Billion |

| Market Size in 2024 | USD 114.72 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 26.53% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Game, Demographic, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise of mobile gaming

The rise of mobile gaming has emerged as a powerful driver for the increasing demand in the virtual sports market. With the widespread penetration of smartphones and the continuous evolution of mobile gaming technology, users now have the convenience of accessing virtual sports experiences at their fingertips. The portability and accessibility of mobile devices have democratized participation in virtual sports, enabling a diverse and global user base. Mobile gaming's influence extends beyond accessibility, as smartphones provide an immersive platform for engaging virtual sports content.

The integration of advanced graphics, responsive touch controls, and augmented reality features on mobile devices enhances the overall user experience, bridging the gap between virtual and real-world environments. This trend aligns with evolving consumer preferences, especially among younger demographics, who seek interactive and on-the-go entertainment experiences.

Furthermore, mobile platforms serve as a catalyst for social interaction and community building within the virtual sports realm. Multiplayer modes, real-time competitions, and in-app communication features create a dynamic and connected virtual sports ecosystem. As the mobile gaming landscape continues to thrive, its symbiotic relationship with the virtual sports market not only propels the demand but also establishes a transformative paradigm in the way audiences engage with sports and entertainment on a global scale.

Limited physical interaction

The limited physical interaction inherent in virtual sports poses a potential constraint on the demand for this burgeoning market. Unlike traditional sports that thrive on the tangible, real-world engagement of players and fans, virtual sports lack the physicality and hands-on experiences that have long characterized sports culture. This absence of direct physical interaction may hinder the widespread adoption of virtual sports among individuals who cherish the visceral aspects of traditional sports events.

Human beings are inherently social creatures, and the camaraderie and shared experiences in a physical sporting arena contribute significantly to the allure of sports. Virtual sports, existing in the digital realm, may struggle to replicate the emotional intensity and genuine connection that fans experience when witnessing live events. The tactile elements of cheering for a favorite team, the adrenaline of live competition, and the collective energy of a crowd are difficult to replicate in a virtual environment.

Moreover, the limited physical interaction may impact the perceived authenticity of virtual sports, potentially deterring traditional sports enthusiasts who find fulfillment in the raw, unscripted moments of real-world competitions. Overcoming this restraint will require innovative approaches to enhance the virtual sports experience, such as integrating augmented reality or creating immersive, socially interactive virtual environments that offer users a sense of physical presence and shared participation.

Continued advancements in virtual reality (VR) and augmented reality (AR) technologies

Continued advancements in virtual reality (VR) and augmented reality (AR) technologies present unprecedented opportunities for the virtual sports market. As augmented reality and virtual reality capabilities progress, the potential for creating highly immersive and lifelike virtual sports experiences becomes increasingly tangible. VR headsets, in particular, allow users to step into virtual stadiums, interact with 3D simulations, and experience sports events as if they were physically present. Augmented reality introduces exciting possibilities for merging virtual elements with the real world, enhancing the viewing experience for users.

AR applications could overlay real-time statistics, player profiles, or interactive graphics onto a user's physical surroundings during virtual sports events, providing a dynamic and engaging experience. These technologies have the potential to transcend the limitations of traditional 2D screens, offering users a more compelling and interactive means of engaging with virtual sports content.

Furthermore, VR and AR advancements open doors to innovative training and educational applications within the virtual sports realm. Athletes could use VR simulations for skill development, tactical training, and strategic analysis. Fans might participate in immersive virtual sports experiences, bringing them closer to the action and deepening their connection to their favorite teams and players. As VR and AR technologies continue to evolve, the virtual sports market stands at the forefront of a transformative era, poised to redefine how sports enthusiasts engage with and experience their favorite games.

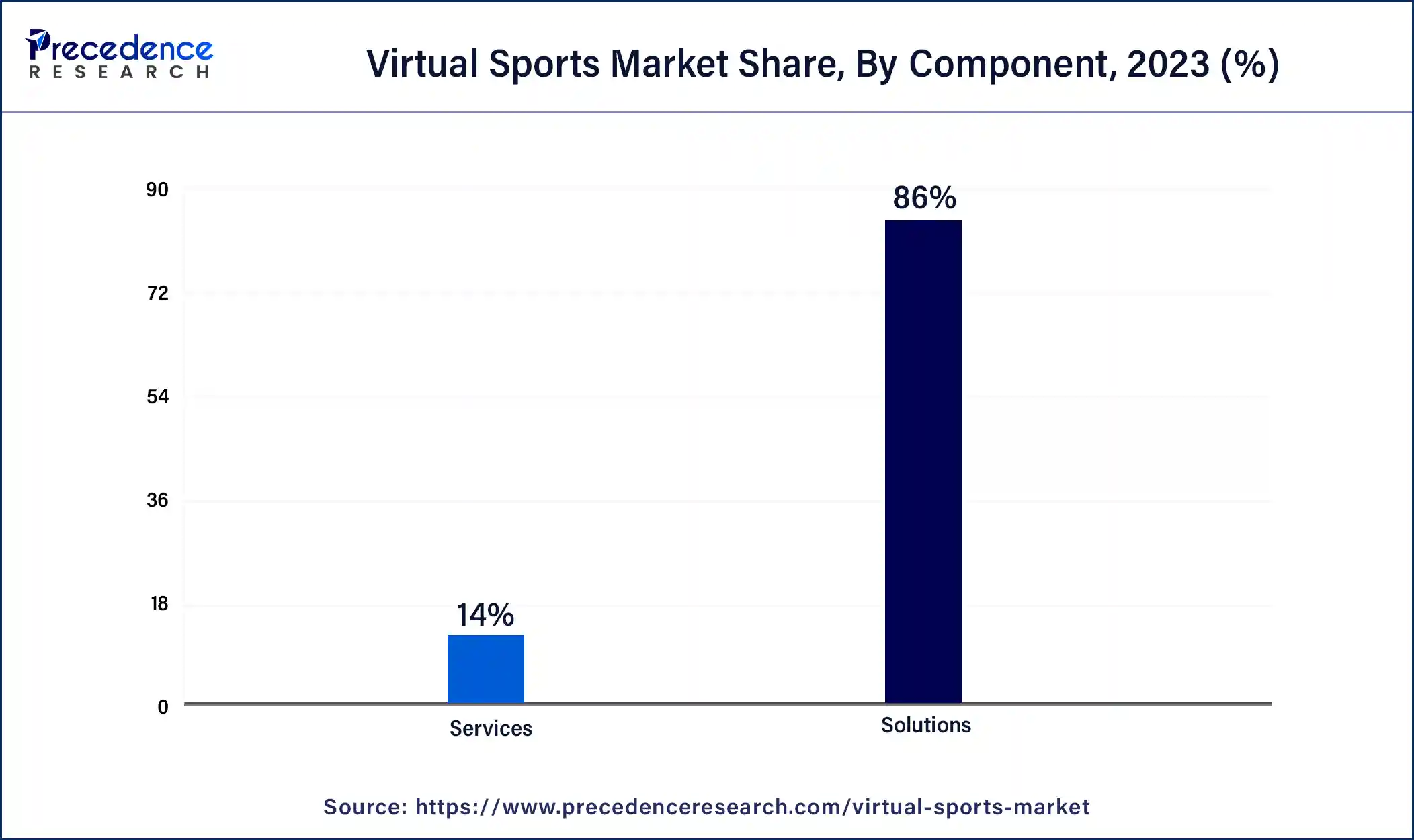

The kits segment dominated the virtual sports market in 2023; the segment is observed to continue the trend throughout the forecast period. The solutions segment encompasses the technological products and software applications that form the core offerings of the virtual sports market. This includes the development and deployment of virtual sports simulations, gaming platforms, and content creation tools. Solutions within this category focus on providing realistic and engaging virtual sports experiences, incorporating advancements in graphics, artificial intelligence, and simulation technologies.

Virtual sports solutions cater to a variety of sports simulations, ranging from traditional sports like soccer and basketball to innovative and futuristic game concepts. The development of cutting-edge solutions is crucial for capturing user interest and ensuring the immersive quality of virtual sports experiences.

The services segment is expected to grow at a significant rate throughout the forecast period. The services segment of the virtual sports market encompasses a range of offerings that support the implementation, customization, and maintenance of virtual sports solutions. These services may include consulting, system integration, training, and ongoing technical support. Consulting services assist clients in understanding the potential of virtual sports, defining strategies, and selecting suitable solutions based on their specific needs.

System integration services focus on seamlessly incorporating virtual sports solutions into existing infrastructure. Training services aim to educate users on how to maximize their virtual sports experience, while ongoing support ensures the smooth operation and troubleshooting of virtual sports platforms. The services component is instrumental in enhancing the overall value proposition of virtual sports, ensuring that clients can effectively leverage and optimize their virtual sports solutions.

The football virtual sports segment held the dominating share of the virtual sports market in 2023. Virtual football simulations replicate the dynamics of traditional football (soccer) matches. These games offer users the experience of playing or spectating football matches in a virtual environment, complete with realistic graphics, player movements, and strategic gameplay.

The basketball virtual sports segment is expected to generate a notable revenue share in the market. Virtual basketball games replicate the fast-paced and dynamic nature of basketball matches. Users can enjoy playing or watching virtual basketball games that capture the essence of the sport, including team coordination, scoring, and strategic gameplay.

The 21 to 35 years segment is observed to hold the dominating share of the virtual sports market during the forecast period. Individuals in the 21 to 35 years age group represent a key demographic for virtual sports platforms. This age range typically includes a tech-savvy audience with a strong interest in sports and gaming. Virtual sports experiences designed for this segment may focus on providing a balance between realism, interactivity, and social features to cater to the preferences of users in their prime gaming years.

The below 21-year segment is expected to generate a notable revenue share in the market. This demographic segment comprises individuals who are younger than 21 years old. Younger users often embrace technology and digital experiences more readily, making them a significant target audience for virtual sports platforms. Virtual sports can cater to the preferences and gaming habits of this age group, offering engaging and innovative experiences.

Segments Covered in the Report

By Component

By Game

By Demographic

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

November 2024

January 2025

November 2024