February 2025

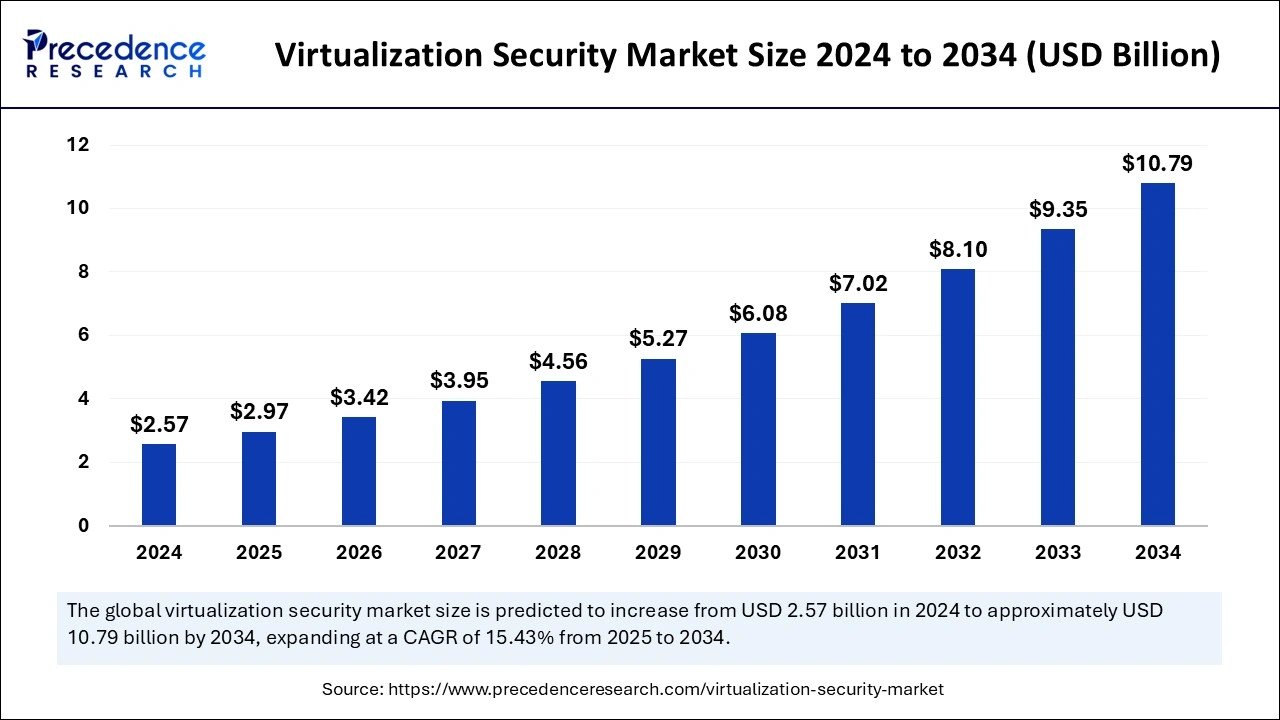

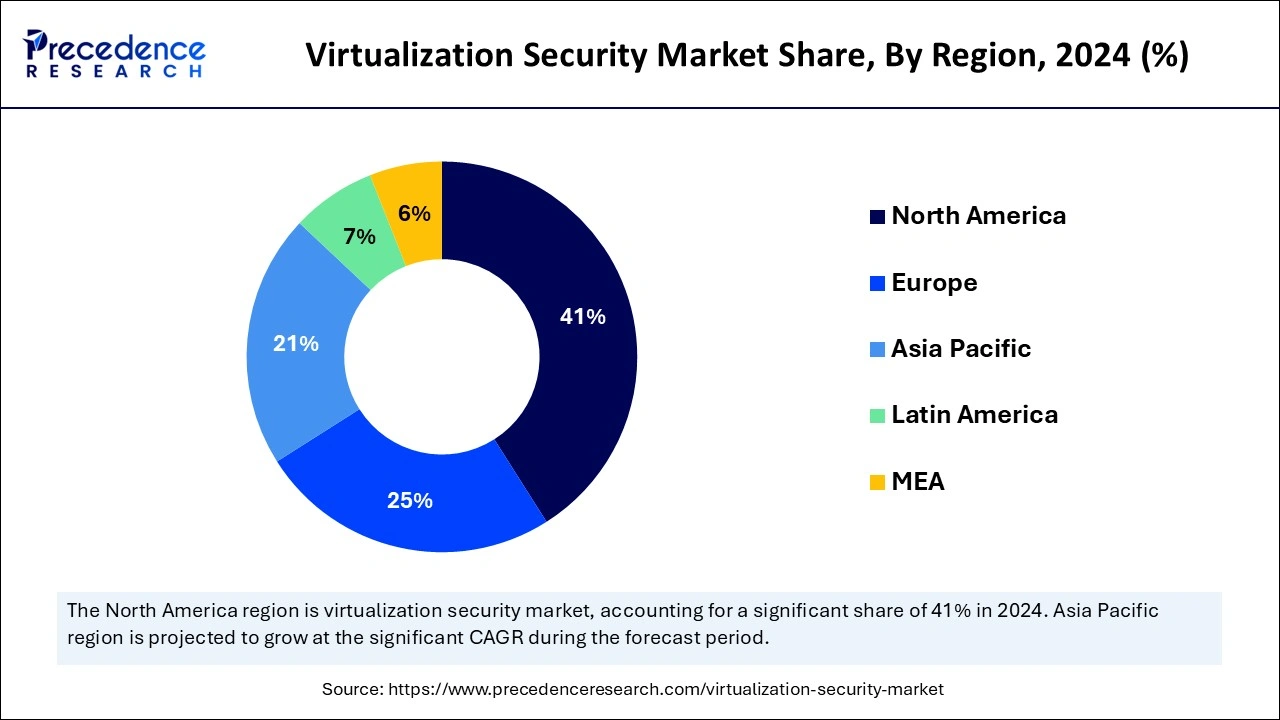

The global virtualization security market size is accounted at USD 2.97 billion in 2025 and is forecasted to hit around USD 10.79 billion by 2034, representing a CAGR of 15.43% from 2025 to 2034. The North America market size was estimated at USD 1.05 billion in 2024 and is expanding at a CAGR of 15.61% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global virtualization security market size was estimated at USD 2.57 billion in 2024 and is predicted to increase from USD 2.97 billion in 2025 to approximately USD 10.79 billion by 2034, expanding at a CAGR of 15.43% from 2025 to 2034. The rising adoption of virtualization technologies in many industries is the key factor driving market growth. Also, the surge in sophisticated cyber threats on hypervisors coupled with the rising proliferation of remote work can fuel market growth further.

The Artificial intelligence-powered virtualization security market growth is extensive. This growth is mainly fuelled by factors like the increasing complexity of cybercrimes and the need for real-time threat detection-enabled automated responses and defenses are driving the market growth further. Moreover, tools such as natural language processing and machine learning algorithms can detect, process, and respond to cyber-attacks more efficiently than conventional methods.

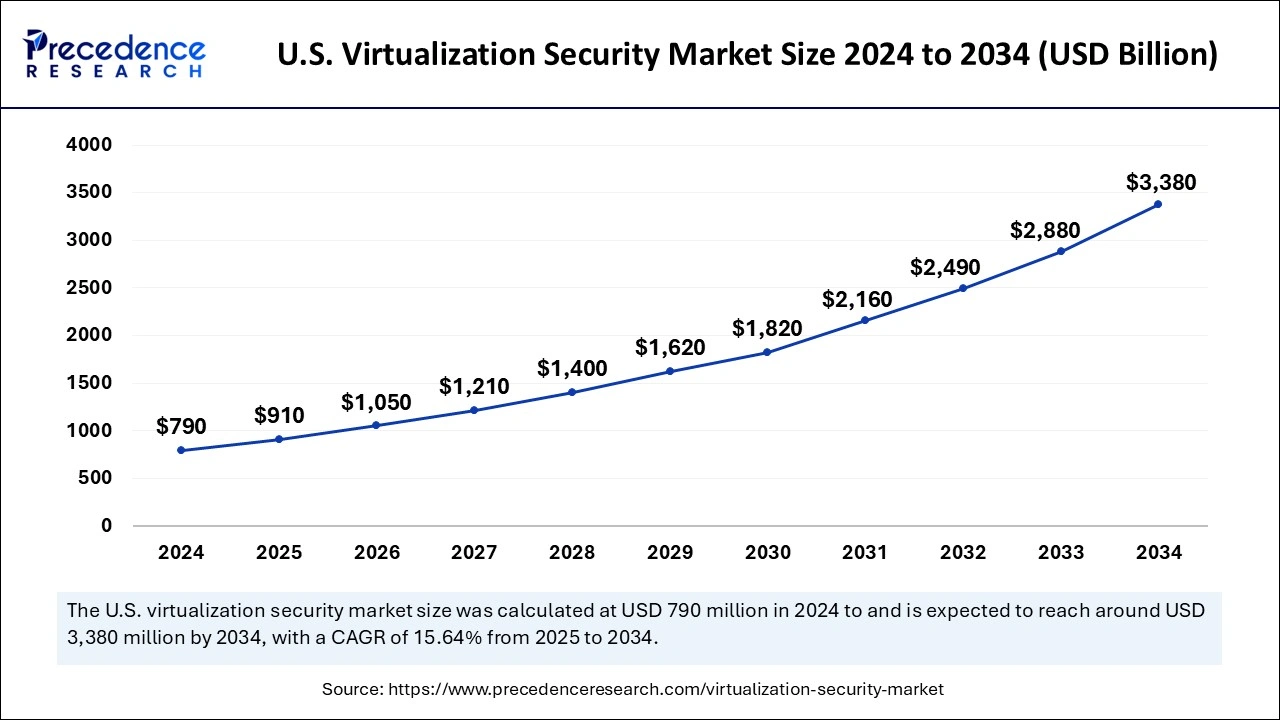

The U.S. virtualization security market size was exhibited at USD 790 million in 2024 and is projected to be worth around USD 3.38 billion by 2034, growing at a CAGR of 15.64% from 2025 to 2034.

North America dominated the virtualization security market in 2024. The dominance of the region can be attributed to the strong presence of large enterprises along with innovative technological infrastructure. The region is home to the largest tech firms such as players in IT services, cybersecurity, and cloud computing. Moreover, in the region, the U.S. led the market owing to the increasing emphasis on the integration of machine learning and artificial intelligence into virtualization security systems.

Asia Pacific is expected to show the fastest growth in the virtualization security market during the studied period. The growth of the region can be credited to the rising adoption of cloud computing and ongoing digital transformation in emerging economies such as China and India. Furthermore, businesses in the region are seeking scalable and cost-effective security solutions to safeguard their escalating virtualized environments impacting positive market growth in the region.

Virtualization security is a digital security solution created to function within a virtualized IT infrastructure. It is meant to replace the functions of conventional hardware security solutions and implement the solutions through software. The virtualization security market is a dynamic and flexible solution based on the cloud that can be deployed easily in the network. The flexibility of these solutions provides a safe infrastructure for multi-cloud and hybrid environments, where data travel around a complex ecosystem.

| Report Coverage | Details |

| Market Size by 2024 | USD 2.57 Billion |

| Market Size in 2025 | USD 2.97 Billion |

| Market Size in 2034 | USD 10.79 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.43% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Enterprise Size, End Use, Deployment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise of cloud-based security

The surge of cloud-based security solutions is the current trend in the virtualization security market. As organizations are marching towards cloud-first strategies, the requirement for security solutions that can efficiently protect cloud infrastructure has risen substantially. In addition, these solutions provide scalability, cost-effectiveness, and flexibility which makes them an attractive choice for companies of all sizes. These solutions use cloud infrastructure to offer real-time threat detection.

High implementation costs

The high implementation cost associated with virtualization security solutions is the major factor hampering the virtualization security market growth. Many organizations, particularly small and large-sized enterprises can find it difficult to allocate a substantial amount of budget to deploy innovative virtualization security tools. Furthermore, the complexity of implementing these solutions into current IT infrastructures can add additional cost to the system.

Introduction of zero trust security model

The conventional security approach depends on safeguarding the premises of the network and trusting the devices and users that are inside it. Because of the rising number of cyber-attacks, a new security model is necessary. The zero-trust model is the latest security approach to create future opportunities in the virtualization security market. This approach assumes that no device user or application should be trusted. Furthermore, this approach emphasizes continuous validation and verification of devices and users before gaining access.

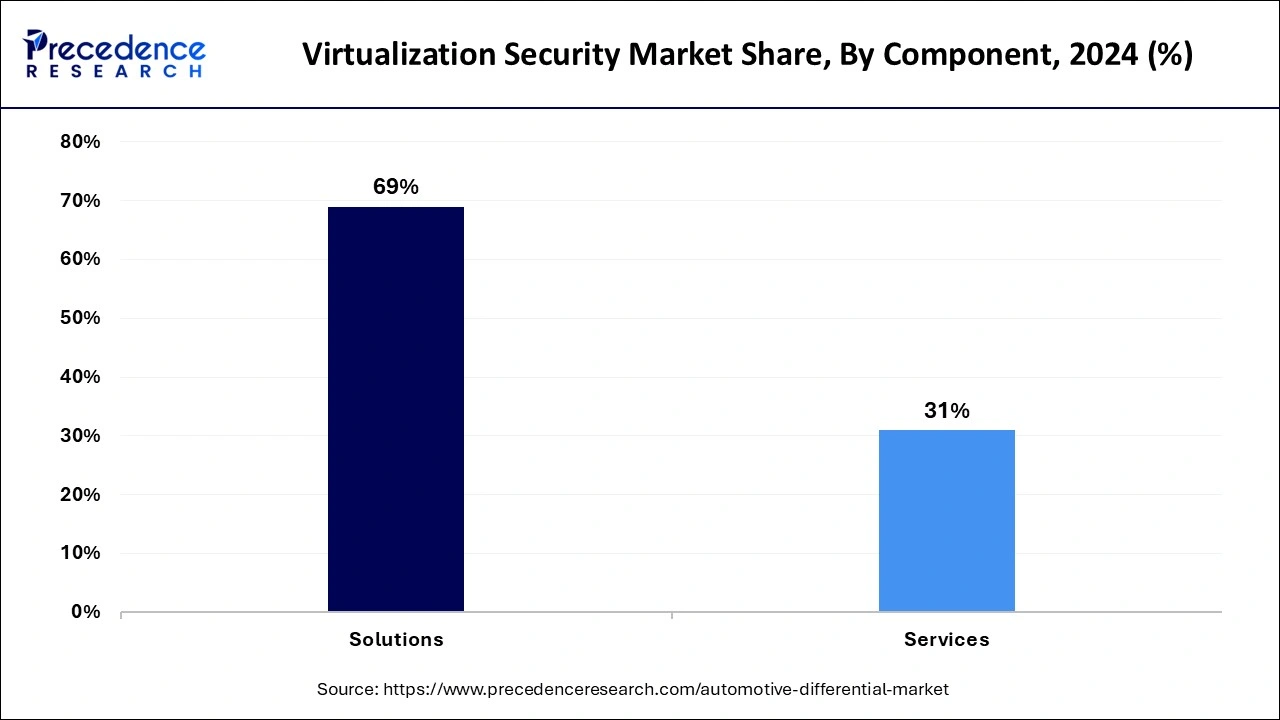

The solutions segment dominated the global virtualization security market in 2024. The dominance of the segment can be attributed to the extensive utilization of virtualization technologies across many industries. Companies are increasingly using this technology to improve scalability and operational efficiency; they face many security challenges like inter-VM threats and hypervisor vulnerabilities. Additionally, innovative virtualization security solutions can offer real-time threat detection and strong protection to an existing IT infrastructure.

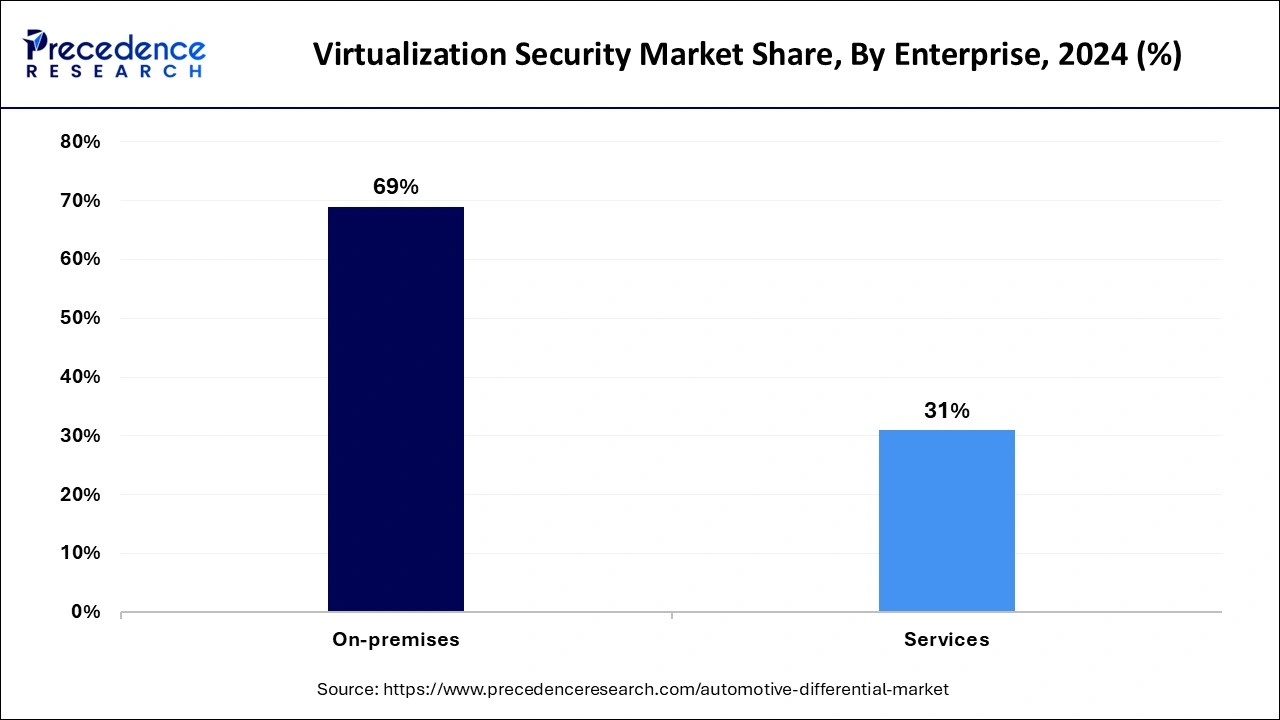

The services segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the increasing sophistication and complexity of cyber-attacks, especially targeting virtualized settings. Also, the growth of digital enterprises and the proliferation of remote work can further boost the need for reliable security services to protect the digital infrastructure.

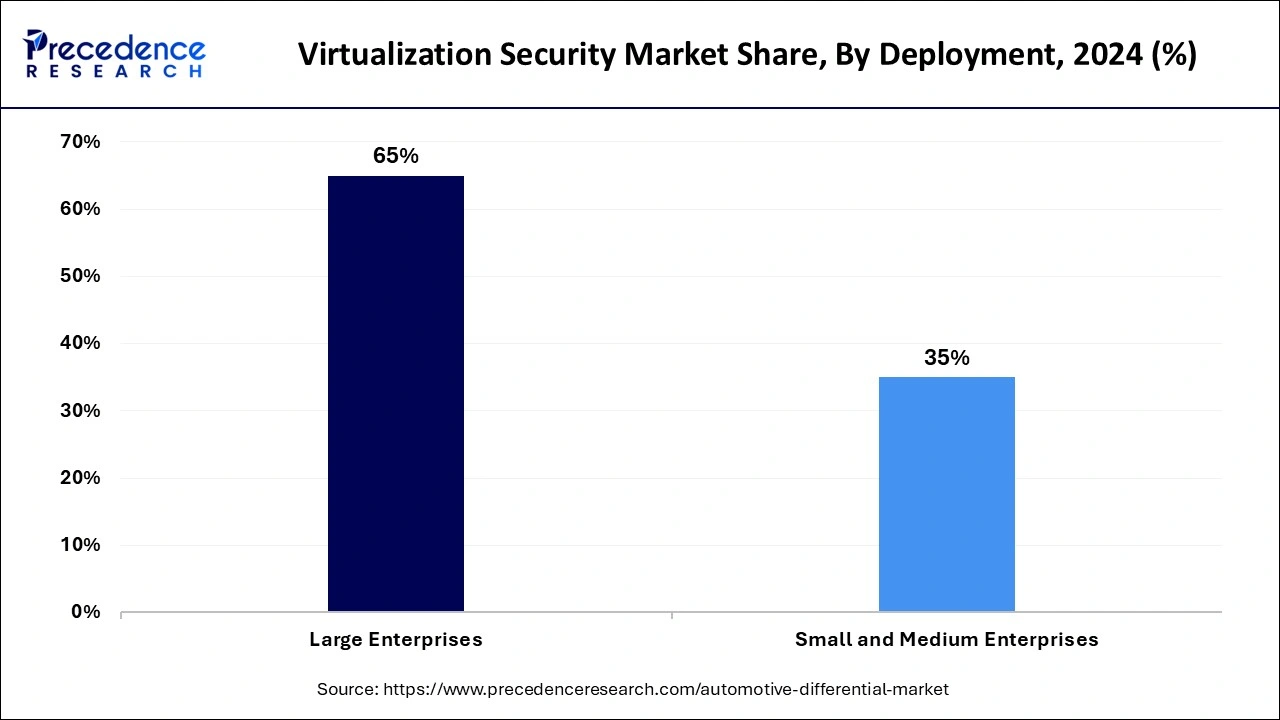

The large enterprises segment led the virtualization security market by holding the largest share In 2024. The dominance of the segment is due to the surge in the need for reliable security solutions within large-scale enterprises, that operate globalized and complex IT infrastructures. Large organizations generally have big IT infrastructures that necessitate wide security measures to safeguard confidential data and intellectual property for the smooth conduction of business operations.

The small and medium enterprises segment is estimated to witness the fastest growth over the projected period. The growth of the segment is because of the increasing adoption of virtualization security systems from these organizations to protect their virtual assets while keeping operational efficiency and cost-effectiveness. These security solutions enable SMEs to safeguard their digital infrastructure from cyber-crimes.

The BFSI segment led the global virtualization security market in 2024. The dominance of the segment is owing to the handling of highly confidential and sensitive data from institutions in this field. Financial institutions such as insurance companies and banks manage large sets of financial and personal data, which makes them the main targets for cyberattacks. Furthermore, the BFSI sector has strict regulatory standards including PCI DSS, Sarbanes-Oxley Act, and GDPR which necessitate high-level data safety.

The IT and telecom segment is anticipated to show the fastest growth during the projected period. The growth of the segment can be driven by the growing need to protect dynamic and complex virtualized infrastructures that strengthen many applications and huge networks. Also, this sector's dependence on virtualization for efficiency, scalability, and advancements makes it ideal to deploy strong security measures in this sector.

The on-premises segment held the largest virtualization security market share in 2024. The dominance of the segment can be linked to the growing need from the organizations to keep direct control on their data and IT infrastructure. Businesses prefer on-premises solutions to secure strict safety measures and compliance with market standards. In addition, this security solution enables personalized and catered security protocols to fulfill businesses' needs.

The cloud segment is expected to grow at the fastest rate during the forecast period. The growth of the region can be driven by a growing shift towards cloud-based infrastructure and services, as protecting these virtualized cloud environments has become more crucial because organizations are seeking the flexibility, scalability, and cost-efficiency provided by cloud computing. Moreover, cloud service providers give strong security standards and managed services to ensure real-time monitoring.

By Component

By Deployment

By Enterprise

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2024

November 2024

October 2024