December 2024

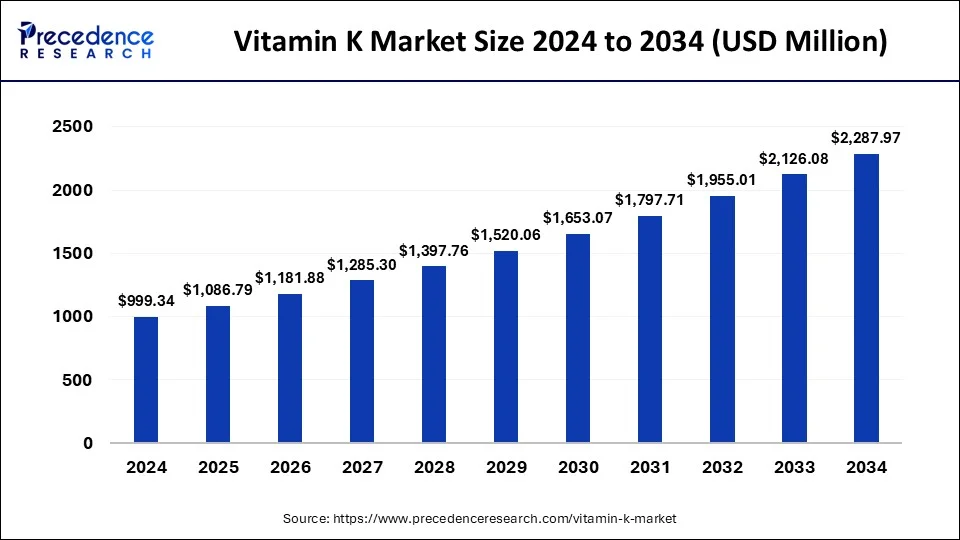

The global vitamin K market size is calculated at USD 1,086.79 million in 2025 and is forecasted to reach around USD 2,287.97 million by 2034, accelerating at a CAGR of 8.64% from 2025 to 2034. The North America vitamin K market size surpassed USD 369.76 million in 2024 and is expanding at a CAGR of 8.78% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global vitamin K market size was estimated at USD 999.34 million in 2024 and is predicted to increase from USD 1,086.79 million in 2025 to approximately USD 2,287.97 million by 2034, expanding at a CAGR of 8.64% from 2025 to 2034.

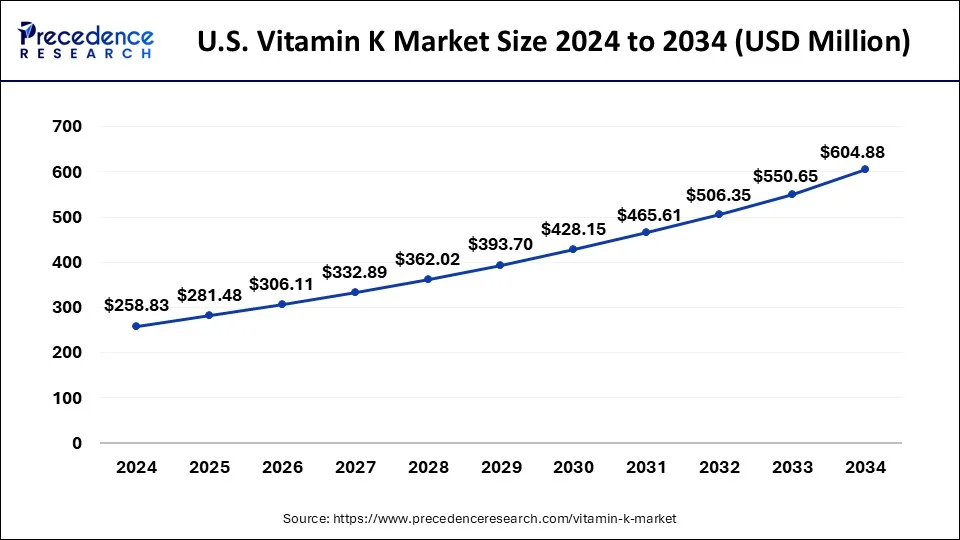

The U.S. vitamin K market size reached USD 258.83 million in 2024 and is anticipated to be worth around USD 604.88 million by 2034, poised to grow at a CAGR of 8.86% from 2025 to 2034.

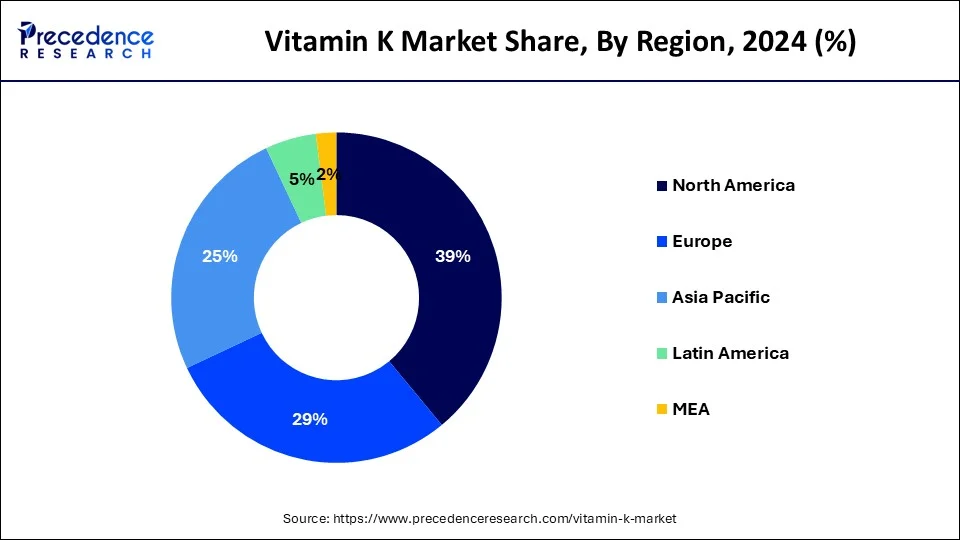

North America held the dominating market share of 39% in 2024. The growth of the North American region is attributed to the presence of prominent vitamin K product manufacturers, the increasing geriatric population, rising awareness of the significance of nutritional benefits, rising investments in the research and development activities of Vitamin K supplements, significant demand for vitamin K1 injectables and rising prevalence of chronic disorders such as neonatal bleeding, arthritis, cancer diabetes, vascular calcification, regulate blood sugar and osteoporosis. Thus, this is expected to fuel market growth in the region during the forecast period.

The U.S. market has undergone substantial expansion due to rising demand for nutritional products, the presence of sophisticated healthcare infrastructure, increasing focus on wellness, increasing incidence of vitamin K-related disorders, and rising innovation in product development.

The Asia Pacific vitamin K market is expected to grow at the fastest rate in the coming years due to several factors including increasing cases of Vitamin K Deficiency disorder, rising demand for vitamin K2 supplements, rising health concerns, increasing need for vitamin K1 injectables to save infants from any complexities, and growing demand for nutritional food & drinks.

The vitamin K market refers to the global industry involved in the production, distribution, and sale of vitamin K supplements, pharmaceuticals, and other related products. Vitamin K is a fat-soluble vitamin essential for blood clotting, bone metabolism, and cardiovascular health. It is available in various forms, including vitamin K1 (phylloquinone) and vitamin K2 (menaquinone), and is commonly found in leafy greens, dairy products, and certain animal products. The market for vitamin K products encompasses dietary supplements, fortified foods, pharmaceutical formulations, and medical applications.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.64% |

| Market Size in 2025 | USD 1,086.79 Million |

| Market Size by 2033 | USD 2,287.97 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product Type, By Route of Administration, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing prevalence of chronic disorders

The rapidly rising prevalence of chronic disorders is expected to boost the growth of the vitamin K market during the forecast period. The rapidly rising prevalence of vitamin K-associated diseases including hemorrhagic disease in newborn babies, neonatal bleeding, osteoporosis, arthritis, diabetes, cardiovascular disease, and others led to a spurring of the demand for vitamin K tablets, supplements, or injections. Infants or newborns are more susceptible to vitamin K deficiencies. VKDB commonly occurs when babies are unable to stop bleeding as their blood does not have enough Vitamin K to form a clot.

Infants who do not receive a vitamin K shot at birth are 81 times more likely to develop late VKDB than infants who do receive a vitamin K shot at birth. As a result, the rising prevalence of chronic disorders is accelerating the growth of the market during the forecast period.

Lack of awareness

The lack of awareness is anticipated to restrain the market's expansion during the forecast period. Vitamin K is an essential nutrient that the body needs in sufficient amounts and plays a significant role in blood clotting and overall bone health. Less awareness among people regarding the benefits of Vitamin K, particularly in underdeveloped countries, may result in restricting the expansion of the global vitamin K market.

Rising health awareness

The rising health awareness is projected to offer a lucrative opportunity for the growth of the vitamin K market during the forecast period. The market has experienced health consciousness which increases the demand for vitamin supplements. Vitamin K is gaining significant attention due to its multiple medical benefits in treating diseases and promoting better well-being. The emerging benefits of preventive healthcare solutions are encouraging people to intake sufficient amounts of nutrients.

In addition, Sedentary lifestyles or hectic lifestyles and dietary changes cause vitamin K deficiency. An individual who leads a sedentary lifestyle and intakes junk food is likely to develop chronic diseases and may also suffer from vitamin deficiencies. Thus, the rising health consciousness is contributing to the market’s revenue.

The Vitamin K2 segment accounted for a significant share of the vitamin K market in 2024. and is also anticipated to continue its dominance over the forecast period owing to the rising use of vitamin k2 in bone development, vascular protection, and blood coagulation. Vitamin K2 is more effective in bone metabolism than vitamin K1. Vitamin K2 is widely known as menaquinone and can be found in fermented foods, dairy, and animal products. It is beneficial for bone health, regulating blood sugar, preventing heart-related diseases, promoting proper brain function, and boosting the overall metabolism of the body.

The osteoporosis segment held a significant share of the vitamin K market in 2024. Vitamin K plays a crucial role in bone metabolism and mineralization, making it essential for maintaining bone strength and density. Individuals with osteoporosis, a condition characterized by weakened and porous bones, often have insufficient levels of vitamin K. Therefore, healthcare professionals frequently recommend vitamin K supplementation to support bone health and reduce the risk of fractures in osteoporotic patients.

Osteoporosis primarily affects older adults, particularly postmenopausal women and elderly individuals, who are at higher risk of bone-related complications such as fractures. With the global population aging rapidly, the prevalence of osteoporosis is expected to rise, driving the demand for interventions that support bone health, including vitamin K supplements. As a result, the osteoporosis segment represents a significant portion of the vitamin K market's consumer base.

The dermal application segment held a notable share of the vitamin K market in 2024, the segment is expected to sustain the position throughout the forecast period. Vitamin K has numerous skin applications including resolving bruising, suppressing pigmentation, prophylactically limiting the occurrence of acneiform side effects, and helping in wound healing. Vitamin K is non-irritating and safe for use with all skin types. Vitamin K improves wound healing by increasing wound contraction and assisting in the formation of collagen and blood vessels. Vitamin K has redox properties which means the skin's ability to detoxify reactive oxygen species that are formed when an individual is exposed to UV rays and pollution.

The Vitamin K Deficiency Bleeding (VKDB) segment is expected to grow significantly during the forecast period. Vitamin K deficiency bleeding (VKDB) often occurs in newborn babies during the first few days and weeks of life up to 6 months of age. This health condition is referred to as hemorrhagic disease of the newborn. The bleeding can occur anywhere on the inside or outside of the infant’s body. Thereby driving the segment’s growth.

The oral segment held the largest share of the vitamin K market in 2024. The segment is observed to sustain dominance over the forecast period. Vitamin K can be taken in various forms, including powders, liquids, and pills. It also makes it easier for patients to consume. Due to the increase in chronic illnesses, the usage of oral administration will rise.

By Product Type

By Route of Administration

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

November 2024

July 2024

September 2024