November 2024

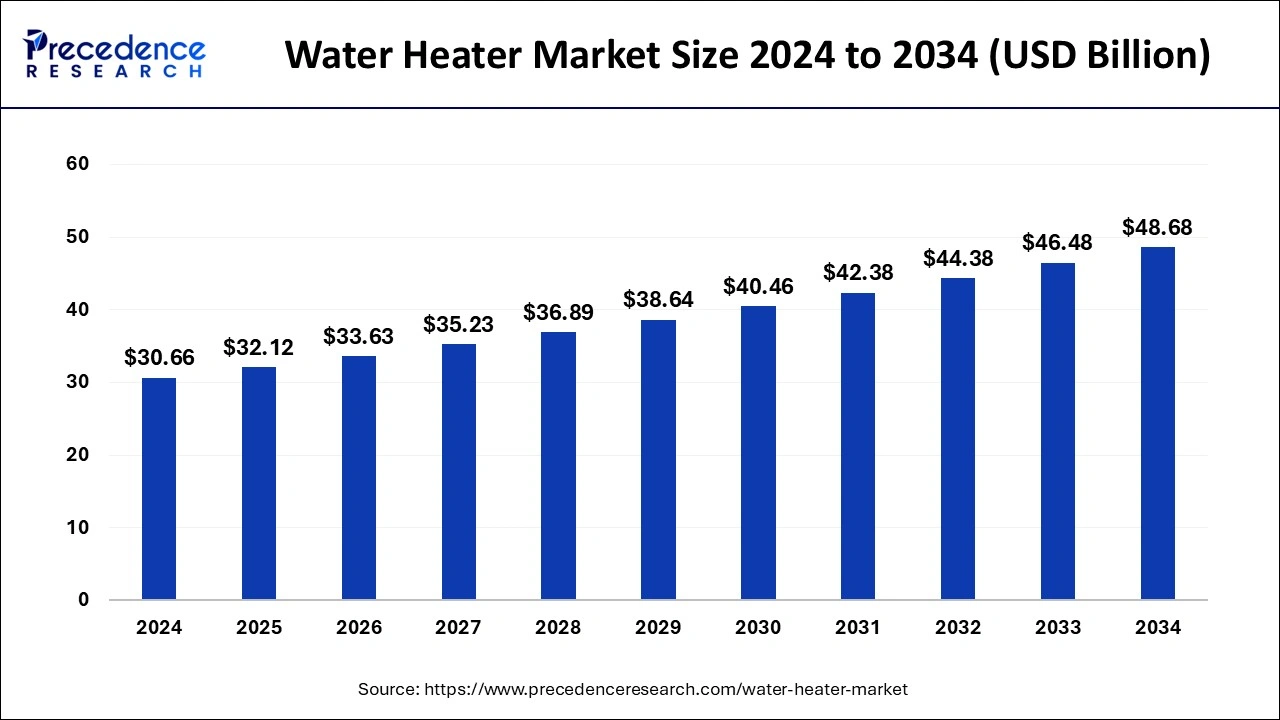

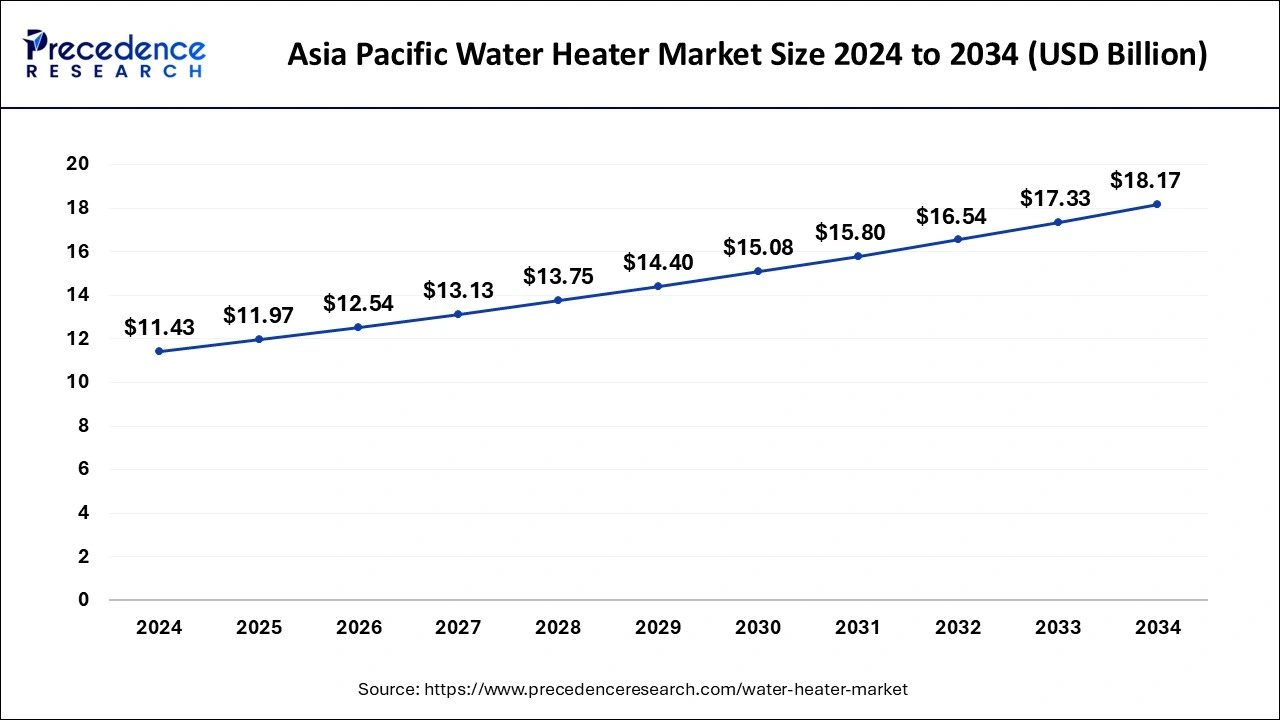

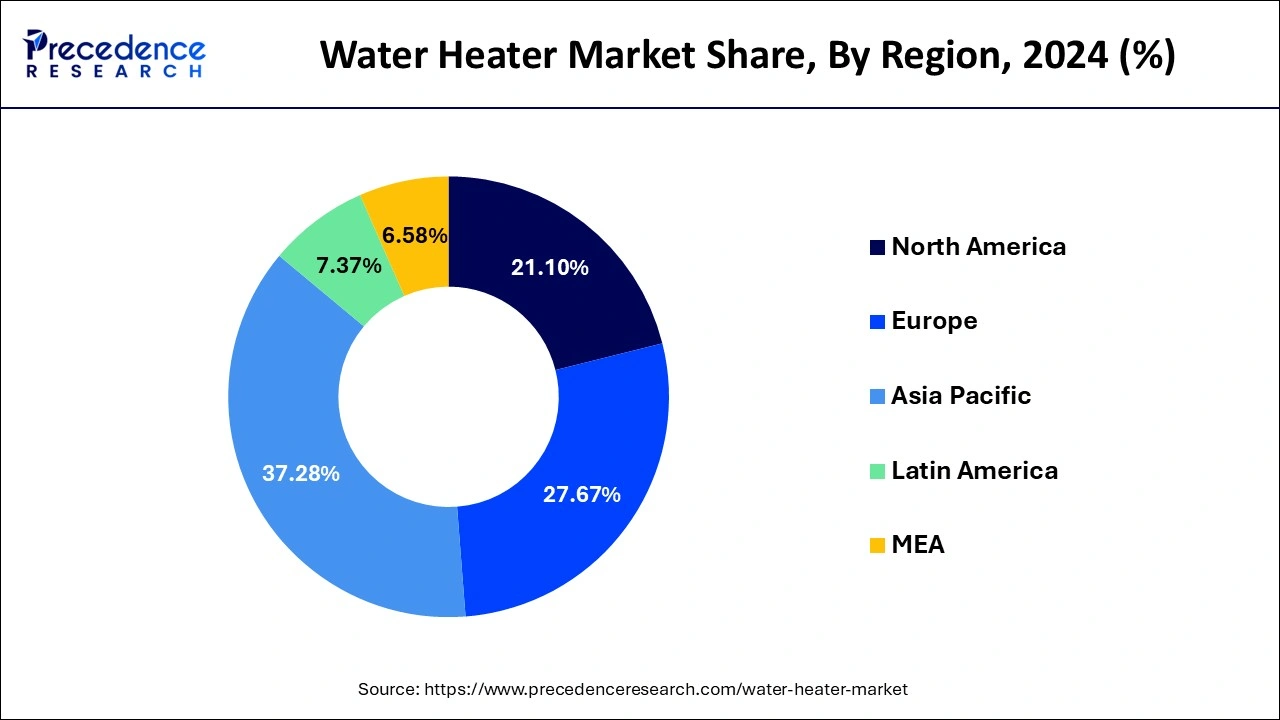

The global water heater market size is calculated at USD 32.12 billion in 2025 and is forecasted to reach around USD 48.68 billion by 2034, accelerating at a CAGR of 4.73% from 2025 to 2034. The Asia Pacific water heater market size surpassed USD 11.43 billion in 2024 and is expanding at a CAGR of 4.74% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global water heater market size was accounted for USD 30.66 billion in 2024 and is anticipated to reach around USD 48.68 billion by 2034, growing at a CAGR of 4.73% from 2025 to 2034.

Smart water heaters are water heaters that are reinforced with Machine Learning and connected systems to optimize heating. These systems pick a few things from their use, for instance, the hot water usage pattern or the desired temperature. The water heaters can be managed and controlled by the homeowners remotely, and send notifications regarding maintenance required or the development of significant problems. This maintenance will also take time which will also save money, it will assist in preventing the water heater from requiring constant repairs.

The Asia Pacific water heater market size was evaluated at USD 11.43 billion in 2024 and is predicted to be worth around USD 18.17 billion by 2034, rising at a CAGR of 4.74% from 2025 to 2034.

The growing availability of gas and power in rural areas, rising infrastructure investment, brisk growth in the building sector, and industrial expansion in South Asian and South East Asian countries are all factors driving the need for water heaters in the Asia Pacific region. Additionally, it is anticipated that the focus on carbon neutrality and energy-efficiency regulations would accelerate market growth.

Increasing investment and innovation in the building industry, funding for R&D, and the adoption of mandatory CO2 emission reduction measures are the primary factors driving the demand for water heaters in China and will continue to do so throughout the course of the forecast period. The increasing need for better and dependable water heaters from various commercial and industrial end-users is what is driving the expansion of water heaters in the European area. Additionally, the region's extremely cold weather and the consequent requirement for hot water to maintain the necessary environmental conditions are projected to increase product demand.

A water heater, sometimes known as a storage water heater, is a residential device used to heat water. It employs a hot water storage tank to maximize its heating capability and deliver quick hot water anytime it is required. Oil, electricity, propane, natural gas, and oil are among the fuels used by conventional storage water heaters.

The rising need for hot water for different domestic uses, such as cooking, washing, bathing, and cleaning, is predicted to drive the worldwide water heater market. As various states and towns around the nation pursue legislative initiatives to reduce greenhouse gas emissions as well as energy usage in buildings, green technology and sustainability are becoming increasingly important. The demand for intelligent water heating as well as energy-efficient systems for heating water is expected to rise in the next years as a result of stricter building standards and regulations. It is projected that the market for water heaters run by solar energy would expand as a consequence of effective actions to enhance air quality as well as raise public awareness of the use of renewable solutions. Moreover, it is anticipated that the market growth will be pushed by the continuous industry competition as well as the growing attention that different market players are paying to product design. The demand for the product is expected to be fueled by the rising usage of a wide range of water heaters in the industrial and commercial sectors. A surge in hot water usage, mostly from healthcare facilities and hotels, is anticipated to boost the market. Since the product is utilized in several industrial industries, including the production of food and drinks industries, the need for water heaters is also anticipated to increase. Significant expenditures in product development and innovation are anticipated to drive the market for electric water heaters. Leading manufacturers take part in the release of cutting-edge products and technologies that enhance customer experience and save operational expenses.

| Report Coverage | Details |

| Market Size in 2025 | USD 32.12 Billion |

| Market Size by 2034 | USD 48.68 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.73% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, Capacity, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Easy installation and maintenance

Higher installation and maintenance cost

Increasing demand for instantaneous heaters

Ongoing infrastructure investments

Due to the market's dominance by electric water heaters and their 51.3% revenue share in 2023, primarily in the nations of the Asia Pacific and Africa, growing electrification rates and improved consumer accessibility were major factors. Energy efficiency increased environmental sustainability, and temperature control is predicted to be the main drivers of product demand throughout the projection period.

Due to the growing demand from consumers for water heating systems that are both environmentally friendly and energy efficient, the solar category is predicted to grow at a CAGR of 5.1% during the projection period. Industry expansion is anticipated to be boosted by the growing focus of different product producers on creating new systems and technologies that operate more efficiently. Demand for solar goods is expected to increase as a result of strict government regulations to minimize greenhouse gas emissions and a growing focus on energy conservation due to the swift depletion of nonrenewable resources.

Furthermore, it is anticipated that rising environmental consciousness for both developed and emerging countries will fuel demand. During the projected period, it is anticipated that gas water heaters would be used extensively as a result of the growth of piped gas networks in several developing countries. Additionally, it is anticipated that increased emphasis on product innovation and distinctiveness would increase demand for gas water heaters, supporting the expansion of the entire sector.

Due to the significant potential for energy conversion and minimal maintenance requirements of the product, the storage segment led the market for water heaters and contributed 55% of worldwide revenue in 2023. Demand for the device is also being fueled by an increase in industrial and commercial applications being installed in various chilly areas throughout the world. Due to product benefits such as quick hot water delivery and minimal standby heating losses, the tankless category is predicted to grow at a CAGR of 4.8% between 2024 and 2033. Tankless devices also consume less energy than storage water heaters, which will increase their appeal over the next years.

Products without tanks provide benefits such as better temperature control, more energy efficiency, and more environmental sustainability. Demand for these items is anticipated to increase throughout the projection period as a result of rising product acceptance across several business sectors due to improved operational advantages. Due to major product features like providing cooling and heating from a single unit, the hybrid category is predicted to have increasing demand. These devices are more energy-efficient than electric ones because they don't generate power directly; instead, they use electricity to move heat from one place to another.

Due to its widespread suitability for use in both residential and commercial settings, including banks, healthcare facilities, hotels, government institutions, hotels, and shopping centers, the 30–100 liter capacity segment dominated the water heater market in 2023 and accounted for 29.4% of total revenue. Demand for the 100-250 liter sector is anticipated to increase as a result of increasing urbanization and ongoing migration to metropolitan areas. The product's availability in a variety of applications satisfies a variety of consumer requests, including its usage in kitchens, swimming pools, and restrooms, so promoting market expansion.

Due to the growing deployment of low-capacity heating systems, particularly in residential settings, the market for water heaters with a capacity of fewer than 30 liters is predicted to grow at a CAGR of 4.2% during the projected period. Additionally, the installation of water heaters with a capacity of fewer than 30 liters is anticipated to increase in the upcoming years due to the growing usage of storage tanks. Due to a variety of industrial applications, both alone and in conjunction with heat exchangers, the demand for water heaters with a capacity exceeding 400 liters increased at a CAGR of 5.2% over the predicted period. Growth in this market is anticipated to be aided by the ability of water heaters with a capacity of more than 400 liters to pair heat pumps with thermal solar systems.

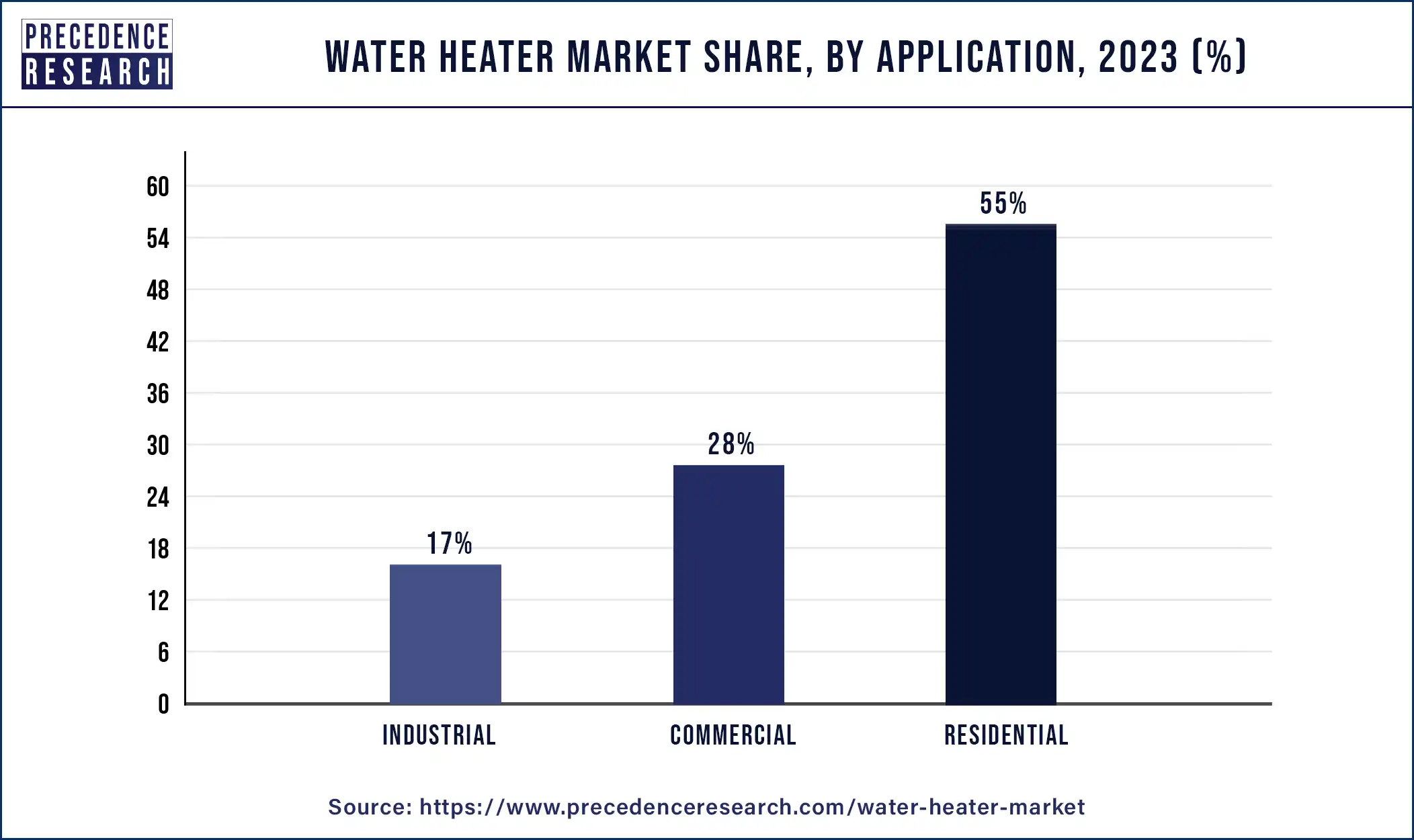

The residential sector is expected to lead the market for water heaters and account for 55% of the revenue share in 2023. Market growth is anticipated to be fueled by the rising need for dependable, affordable, and environmentally friendly water heating technologies, notably in the industrial and residential sectors. Additionally, it is anticipated that the ability of water heaters to operate at lower costs up to 75% less expensive in the summer and 30% to 40% less expensive in the winter will increase product demand throughout the course of the projection period. Construction, food & beverage, pharmaceutical, power, and agricultural industries all utilize water heaters, which is expected to drive the industry's expansion. Water heaters are used for producing steam, preventing frost, and heating water in the construction sector.

Due to increased government expenditure on the construction of healthcare facilities, which in turn would greatly increase the number of water heater installations, the product demand in the commercial sector is anticipated to increase at a CAGR of 4.6% over the projection period. Furthermore, the market is anticipated to grow because of the rising use of tankless solutions in commercial settings.

By Product

By Technology

By Capacity

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

November 2024

September 2024

January 2024