May 2025

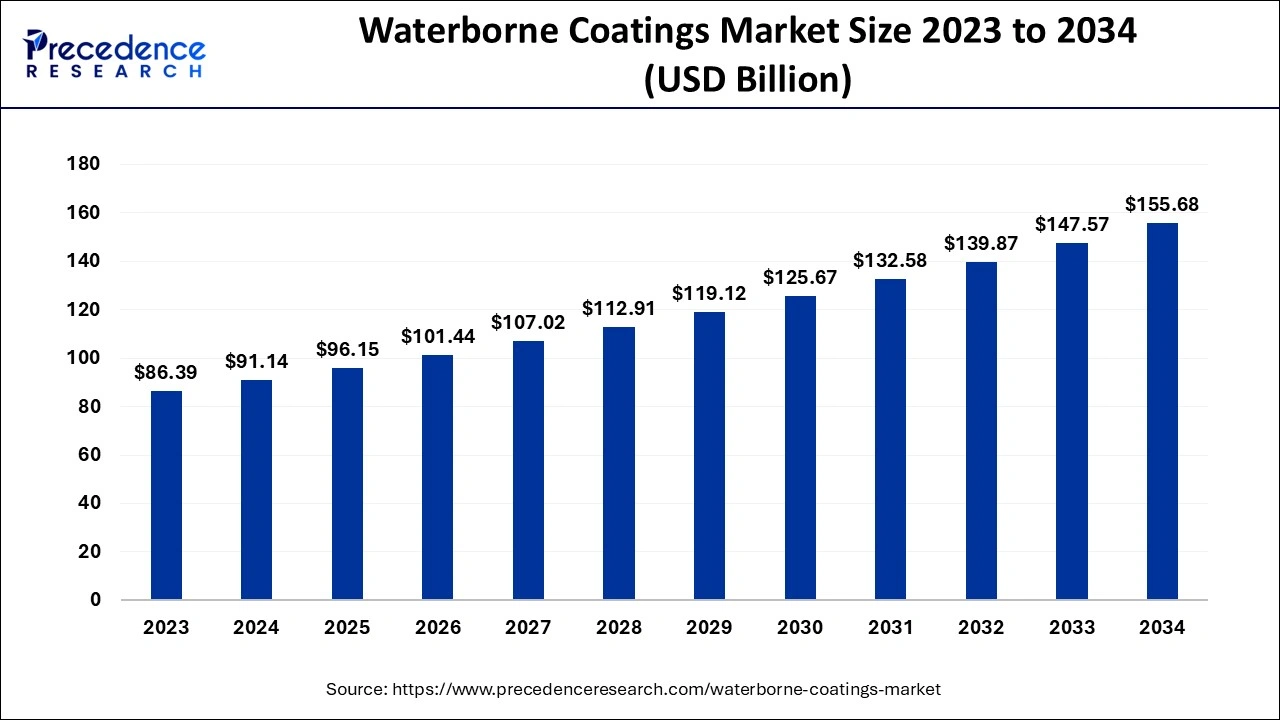

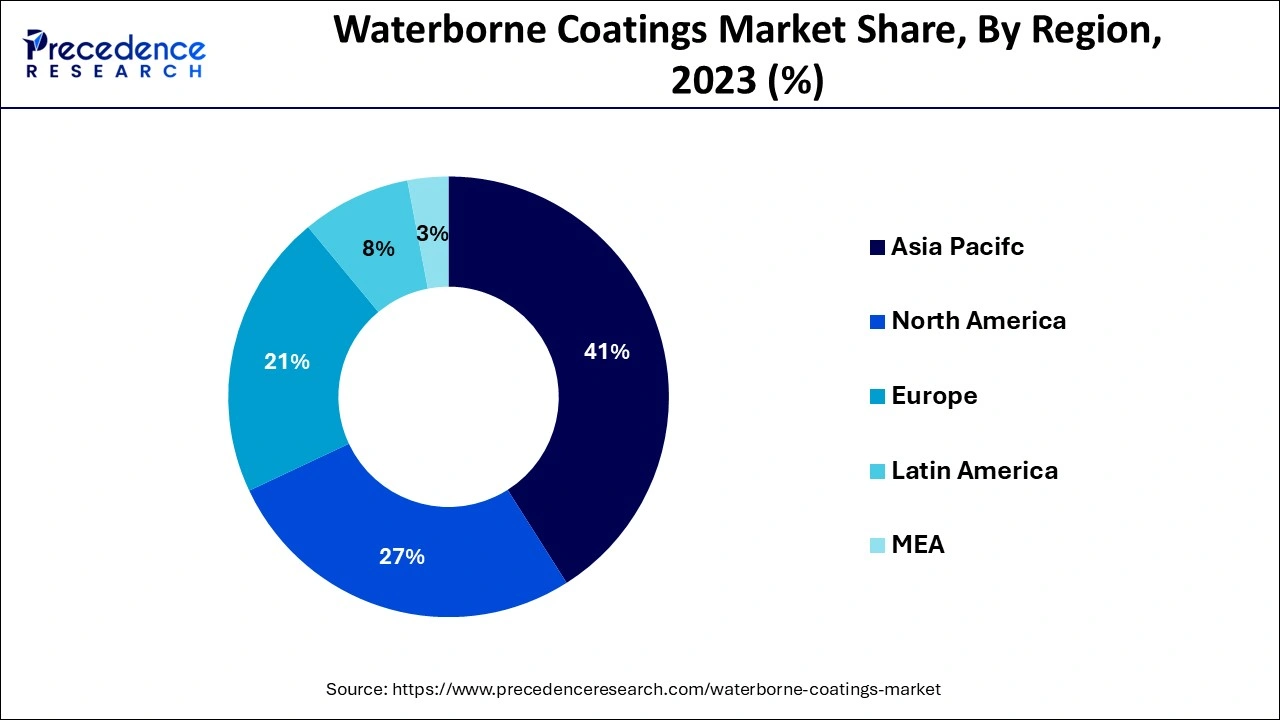

The global waterborne coatings market size accounted at USD 96.15 billion in 2025 and is predicted to surpass around USD 155.68 billion by 2034, representing a healthy CAGR of 5.50% between 2025 and 2034. The Asia Pacific waterborne coatings market size surpassed USD 39.42 billion in 2025 and is expanding at a CAGR of 5.62% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global waterborne coatings market size accounted for USD 91.14 billion in 2024 and is anticipated to reach around USD 155.68 billion by 2034, growing at a CAGR of 5.50% from 2025 to 2034.

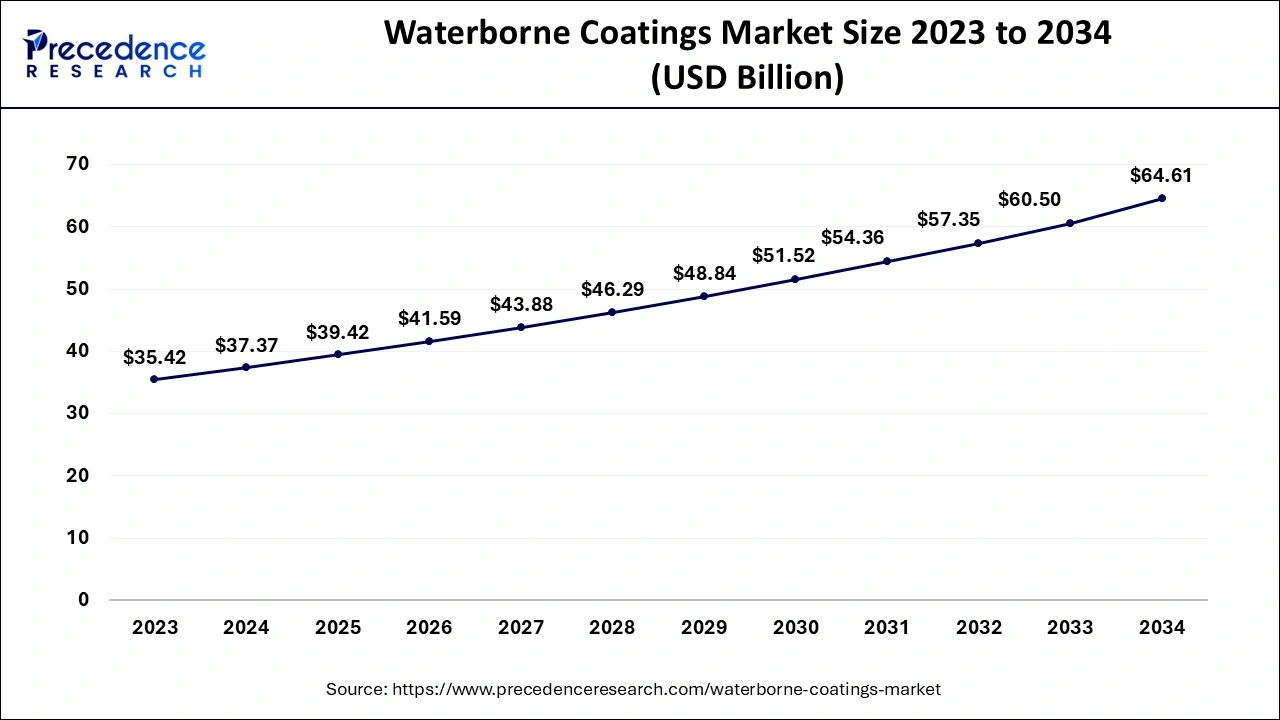

The Asia Pacific waterborne coatings market size is evaluated at USD 37.37 billion in 2024 and is predicted to be worth around USD 64.61 billion by 2034, rising at a CAGR of 5.62% from 2024 to 2034.

The highest market share and dominant position in the waterborne coatings industry belong to Asia-Pacific. Demand is anticipated to rise as major automakers relocate to Asia Pacific nations including China, India, and Indonesia. Asia Pacific demand is predicted to increase as a result of this factor. The expansion in the area is anticipated to be fueled by the formation of new sectors in the region due to low labor costs and government tax incentives. High growth rates and huge investments across the automotive, and furniture industries are largely responsible for economic development. Based on the production and demand for waterborne coatings, it is one of the locations with the fastest rising populations.

Asia-Pacific Commands the Lead

The Asia-Pacific region remains the dominant force in the global waterborne coatings market, driven by rapid urbanization, infrastructural expansion, and strong demand from the automotive and consumer goods sectors. China, India, Japan, South Korea, and Indonesia are among the top contributing countries, largely due to their robust manufacturing bases and export-driven economies. Governments in these countries have played a pivotal role by encouraging green construction and enforcing environmental compliance. For instance, China’s Green Building Action Plan and India’s Smart Cities Mission promote the use of low-emission construction materials, including waterborne coatings. Moreover, subsidies and incentives for eco-friendly manufacturing practices have further accelerated the adoption of sustainable coating technologies across the region.

The market for waterborne coatings has experienced significant growth in Europe as a result of the expansion of the construction industry brought on by the post-recession rebound. The replacement of solvent-borne coatings used in construction will also enhance demand for the product, which will fuel the expansion of the waterborne coatings market in the area over the course of the projected period. Moreover, a few regulations that strive to lower the VOC content in coatings and paints are stated in the strict regulatory framework in Germany and the Environmental Protection Act in the UK. Given that traditional solvent-borne coatings in the construction industry are being rapidly replaced by water coatings, this is certain to benefit the market for such goods.

North America’s Sustainable Surge

North America is currently one of the fastest-growing regions in the waterborne coatings space, buoyed by sustainability mandates, technological innovation, and rising consumer awareness about environmental health. The United States and Canada lead the region, primarily because of stringent regulatory frameworks such as the Environmental Protection Agency (EPA) regulations, which favor low-VOC alternatives. There has also been a noticeable shift toward bio-based resins and smart coatings that offer multifunctional benefits like corrosion resistance, self-cleaning, and antimicrobial properties. The growing popularity of green buildings, combined with the automotive sector’s push toward lightweight and sustainable materials, is acting as a catalyst for growth. Additionally, investment in R&D and collaborative ventures between coating manufacturers and research institutions is unlocking further potential in this segment.

Water is used as a solvent in waterborne coatings to disperse a resin, making them eco-friendly and simple to use. It can be used to describe any complete or surface coating that uses water as a solvent to separate the resin that is put to it, which in turn forms the coating. Waterborne coatings can be made up of a variety of solvents combinations, including significant volumes of water and minor amounts of other solvents.

In India, China, and Taiwan, the usage of waterborne coatings has increased in sectors including general industrial, automotive, new building, remodel & repaint, and marine due to the rising need for high-tech electronics and the quickly changing lifestyle.

The demand for waterborne coatings is expected to increase from numerous end-use industries, including the automotive, industrial, and infrastructure sectors, in the upcoming years. These coatings are typically preferred over other traditional ones because they have a water content that is close to 80%, making them good solvents with low VOC emissions. Some of the most often utilized raw ingredients in the production of waterborne coatings are synthetic resins, surfactants, additives, and pigments. The aforementioned raw materials aid in the production of various waterborne coating types, which are then used in a variety of applications, including general industrial, architectural, wood, automotive OEM, coil, protective coatings, marine, industrial wood, metal packaging, and automotive refinishing.

The increase in automotive production in countries like Mexico, China, Malaysia, Germany, and Indonesia also supports the market expansion for waterborne coatings. Increased construction activity in developing nations in the Middle East and Asia Pacific should further help the market expand. End customers in these nations are increasingly seeking high-performance, application-specific additives and pigments with exceptional corrosion resistance and aesthetically pleasing qualities, offering appealing potential to producers of aqueous coatings.

Market Key Trends in the Waterborne Coatings Market

The waterborne coatings market has witnessed remarkable evolution due to a growing demand for eco-friendly and low-VOC solutions across various industries. These coatings, known for their minimal environmental impact, are increasingly being adopted in automotive, construction, furniture, and industrial applications. The market is trending toward nanotechnology integration, enhanced durability, and UV-curable waterborne coatings that offer superior performance while meeting stricter environmental regulations. Additionally, technological advancements in raw materials and formulation chemistry are expanding the scope of waterborne coatings, allowing them to replace traditional solvent-based alternatives even in high-performance sectors

| Report Coverage | Details |

| Market Size in 2024 | USD 91.14 Billion |

| Market Size in 2025 | USD 96.15 Billion |

| Market Size by 2034 | USD 155.68 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.50% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Resin Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Depending upon the resin type, the alkyd segment is the dominant player and is anticipated to have the biggest impact on waterborne coatings market. Some paints and transparent coatings use the complex oil-modified polyester known as alkyd resin as its film-forming component. The components of an alkyd paint typically include an oil-modified polyester to create the coating layer, a solvent to help with application, such as hexane or mineral spirits, metal naphthenates to catalyze the drying reaction, and pigment to add color and conceal the coated surface.

Epoxy coatings segment has a significant position in the waterborne coating market. Epoxy coatings are used for a variety of purposes because they may produce a strong, long-lasting, and chemically resistant substance. In addition to being used in industrial production facilities, they are used in a variety of electrical, automotive, and marine applications. They are well-liked because they provide metals and other materials with a sturdy, protective coating that dries quickly. They make excellent metal protectors because of their exceptional resistance to corrosion and severe chemicals. In high-load concrete constructions, pipes, poles, pillars, and reinforcement steel are coated with epoxy-based powder coatings. A variety of advantages of epoxies for corrosion prevention are enjoyed by subterranean structural foundations and naval vessels. Due to their mechanical strength, aesthetic appeal, and resistance to corrosive substances like oil, chemicals, and weak acids, epoxy flooring coatings are frequently used in factories and warehouses.

Polyurethane resins have exceptional flexibility and durability and are made up of soft and hard segments. By altering the formulation and molding technique, different performance criteria can be met. As several different diisocyanates and polyols may be manufactured to react to produce polyurethane resin, polyurethane resin has a wide variety of uses that span many different industries. A product's shelf life and aesthetics can both be improved by adding polyurethane. Strong bonding is made easier with polyurethane adhesives, and sealing is made more secure with polyurethane sealants. Polyurethane elastomers may be molded into a variety of shapes, are lightweight, resilient to a variety of environmental stresses, and recover more quickly from adversity.

During the projected period, the architectural segment is anticipated to be the largest. The increased emphasis on infrastructure, which supports economic growth and raises people's quality of living, is driving more construction activity. Developed nations like the U.S., Canada, and the European Union (EU) member states want to upgrade their current infrastructure. Repair needs for bridges, dams, structures, and roads in these developed economies are predicted to propel the worldwide coatings market's expansion. Moreover, rise in population is another factor contributing to more construction of residential as well as commercial buildings. Rising population and rising demands are the core of any market to propel hence, architectural segment is driving the market.

The industrial segment is projected to grow significantly. Coatings are required in almost every sector in order to provide protection from externa factors harming the material. In addition to extending the lifespan of the current substrates, protective coatings are applied. There are systems that operate continuously in several sectors. A few of these involve the usage of harsh materials or exposure to changing climatic conditions. As a result, the equipment's structure degrades or the process becomes less efficient, leading to the shutdown of the plant or a halt in all operations. These coatings aid in averting these problems, saving on the expense of equipment repair and shutdown. Because seawater is corrosive, the marine industry is vulnerable to damage to boats, ships, and docks. In the marine industry, coatings like waterproofing coats and joints & crack filler coats are frequently utilised for maintenance.

By Resin Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

February 2025

June 2025

May 2025