November 2024

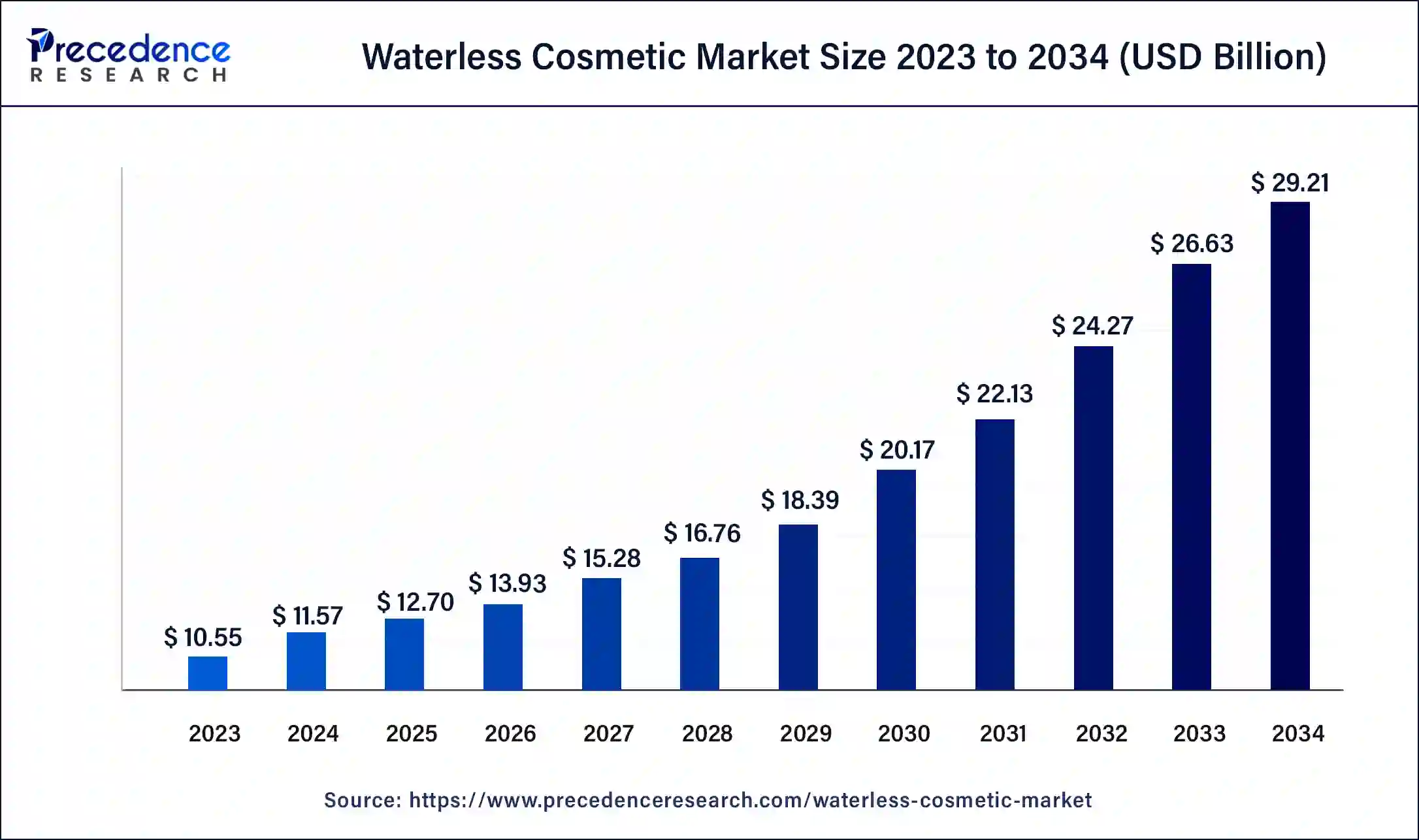

The global waterless cosmetic market size was USD 10.55 billion in 2023, calculated at USD 11.57 billion in 2024 and is projected to surpass around USD 29.21 billion by 2034, expanding at a CAGR of 9.7% from 2024 to 2034.

The global waterless cosmetic market size accounted for USD 11.57 billion in 2024 and is expected to be worth around USD 29.21 billion by 2034, at a CAGR of 9.7% from 2024 to 2034.

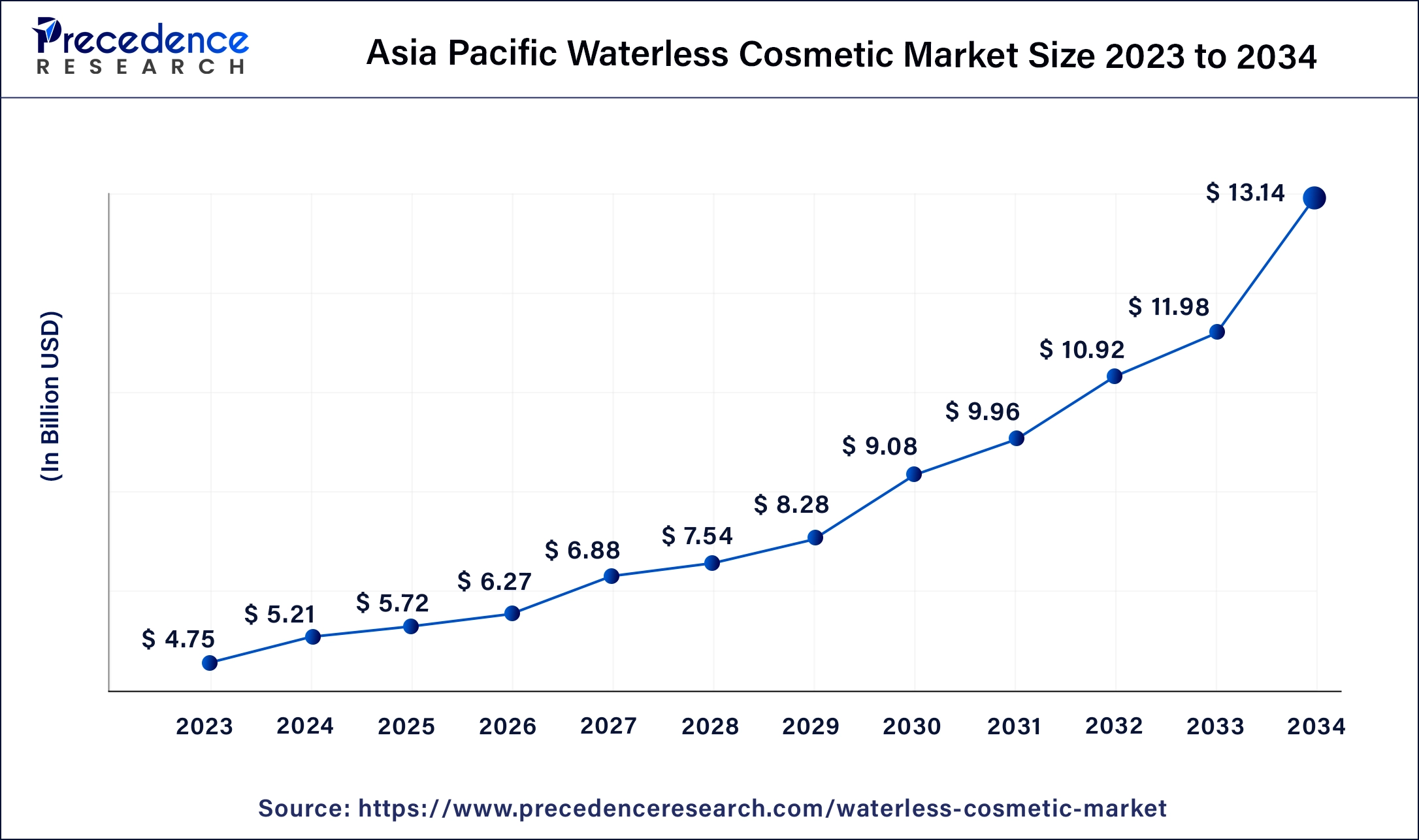

The Asia Pacific waterless cosmetic market size was estimated at USD 4.75 billion in 2023 and is predicted to be worth around USD 13.14 billion by 2034, at a CAGR of 9.9% from 2024 to 2034.

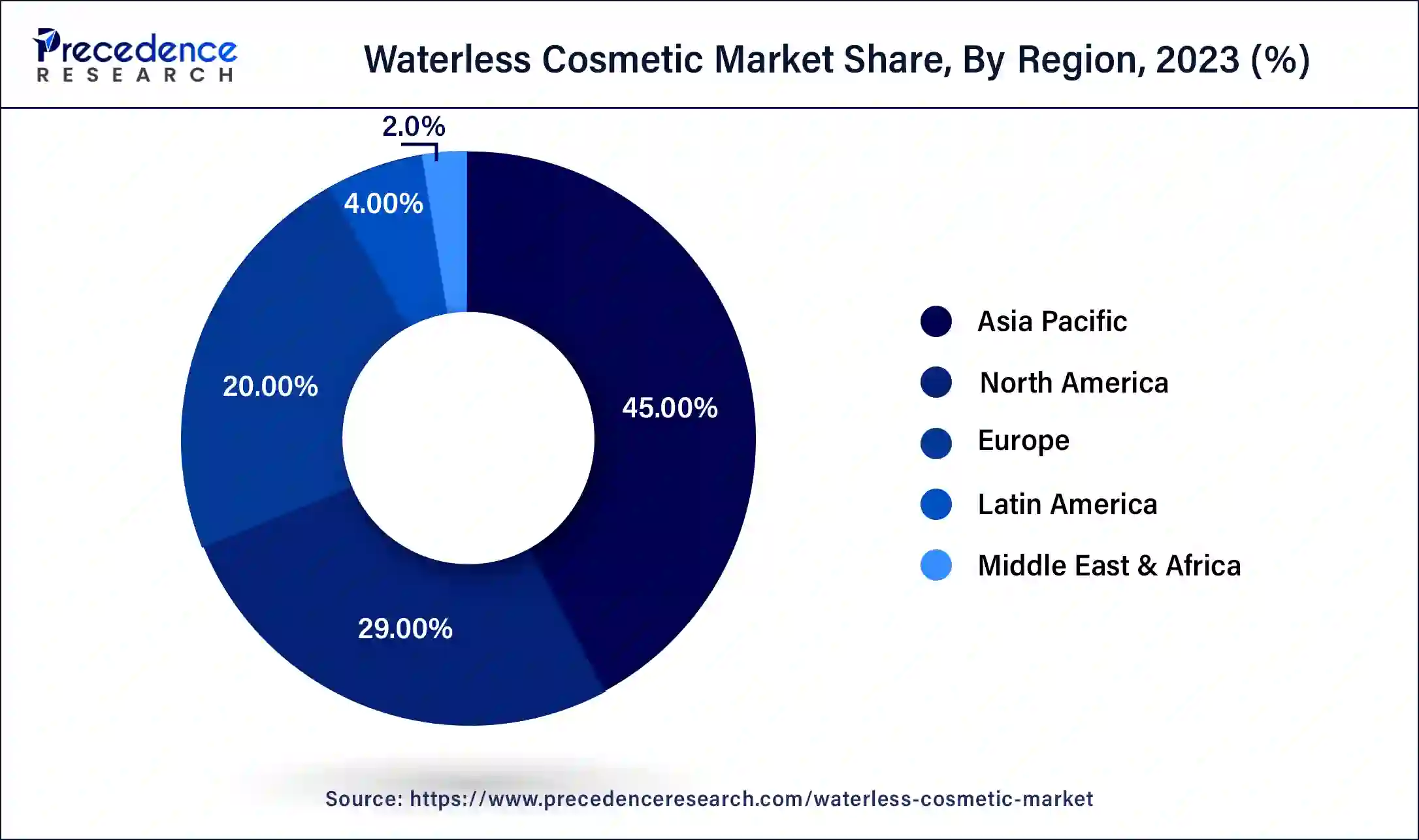

Asia-Pacific held the largest revenue share of 45% in 2023. Asia-Pacific dominates the waterless cosmetic market due to a confluence of factors. The region's robust economic growth, burgeoning population, and increasing disposable income drive the demand for innovative beauty products. Additionally, rising awareness of environmental issues aligns with the market's emphasis on sustainability. The diverse consumer base, coupled with a growing preference for natural and eco-friendly products, positions Asia-Pacific as a key market for waterless cosmetics. As the region embraces modern beauty trends, the waterless cosmetic market experiences substantial growth and market share in this dynamic and evolving market landscape.

North America is estimated to observe the fastest expansion. North America holds a major growth in the waterless cosmetic market due to a combination of factors. The region's consumers exhibit a strong preference for sustainable and eco-friendly beauty products, aligning with the core principles of waterless cosmetics. Additionally, robust e-commerce infrastructure, widespread awareness of environmental issues, and a thriving beauty industry contribute to the market's growth. The presence of innovative cosmetic brands, coupled with the high purchasing power of North American consumers, further solidifies the region's dominant position in the waterless cosmetic market.

Waterless cosmetics represent an innovative shift in the beauty sector, with a primary goal of reducing water consumption and lessening environmental impact. Unlike traditional cosmetics that often incorporate a substantial amount of water, contributing to a larger carbon footprint through production, transportation, and packaging, waterless cosmetics take a different approach. They are crafted without water as a primary ingredient, utilizing alternative bases like oils, butters, and botanical extracts.

This approach not only addresses sustainability concerns but also results in more concentrated and potent products. Waterless cosmetics can take various forms, including powders, balms, and solid formulations, offering consumers a diverse range of choices. As the beauty industry continues to embrace eco-friendly practices, waterless cosmetics play a crucial role in promoting environmental sustainability while providing consumers with effective and innovative beauty solutions.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 9.7% |

| Market Size in 2023 | USD 10.55 Billion |

| Market Size in 2024 | USD 11.57 Billion |

| Market Size by 2034 | USD 29.21 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Gender, By Nature, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Travel-friendly products and packaging innovation

Travel-friendly products and innovative packaging solutions significantly boost the demand for the waterless cosmetic market. The compact and lightweight nature of waterless cosmetics makes them ideal for on-the-go consumers, aligning with the growing trend of travel-friendly beauty products. Consumers increasingly prioritize convenience, and waterless cosmetics cater to this need by offering easy-to-carry formulations, including powders, solid products, and compact balms.

Moreover, the surge in market demand is further propelled by packaging innovations that accompany waterless cosmetics. Sustainable and eco-friendly packaging options contribute to the overall appeal of waterless products, resonating with environmentally conscious consumers. Reduced packaging waste and the use of materials that align with sustainable practices enhance the market's attractiveness. As the beauty industry continues to emphasize both convenience and sustainability, the combination of travel-friendly features and packaging innovation establishes waterless cosmetics as a preferred choice for modern, eco-conscious consumers.

Restraint

Perceived lack of hydration and limited product range

The perceived lack of hydration and a limited product range pose significant restraints on the market demand for waterless cosmetics. Consumers, accustomed to traditional water-based formulations, may hesitate to embrace waterless alternatives due to concerns about potential dryness. The misconception that waterless cosmetics lack the ability to provide sufficient hydration creates a barrier, hindering widespread adoption. Brands need to invest in clear communication and education to dispel these concerns, emphasizing the hydrating properties of alternative ingredients used in waterless formulations.

Additionally, the limited product range within the waterless cosmetic market impacts consumer choice and adoption. While the variety of waterless products is expanding, there is still a gap in the availability of diverse options, limiting choices for consumers with specific beauty preferences. This restriction can impede the market's growth as consumers may revert to traditional cosmetics that offer a broader range of formulations until waterless alternatives can provide a comparable selection. Overcoming these restraints requires continuous innovation in formulations and a strategic approach to addressing consumer perceptions through targeted marketing and education campaigns.

Opportunity

Rising eco-conscious consumerism and innovation in formulations

Rising eco-conscious consumerism is a key driver of opportunities in the waterless cosmetic market. As consumers increasingly prioritize sustainable choices, waterless cosmetics align with their values by minimizing environmental impact. Brands that emphasize eco-friendly practices and communicate the positive environmental footprint of waterless formulations can tap into this growing market segment, fostering brand loyalty and attracting environmentally conscious consumers. Simultaneously, innovation in formulations presents a significant opportunity for the waterless cosmetic market.

Ongoing research and development efforts enable brands to create innovative, high-performance products that meet consumer demands for effective and sustainable beauty solutions. By incorporating cutting-edge ingredients, advanced technologies, and addressing specific skincare needs, waterless cosmetics can differentiate themselves in a competitive market, appealing to consumers seeking both efficacy and eco-consciousness. Embracing these opportunities positions waterless cosmetic brands at the forefront of the beauty industry's evolution toward sustainability and innovation.

In 2023, the skincare segment had the highest market share of 32% on the basis of the product. The skincare segment in the waterless cosmetic market encompasses products formulated without water, emphasizing concentrated and nourishing ingredients. This category includes waterless cleansers, moisturizers, serums, and masks. A notable trend is the integration of natural oils, botanical extracts, and innovative solid formulations, offering consumers effective hydration and skincare benefits without the environmental impact of traditional water-based products. The waterless skincare segment aligns with the broader industry shift towards sustainability and addresses consumer demands for potent, eco-friendly alternatives in their skincare routines.

The makeup segment is anticipated to expand at a significant CAGR of 10.3% during the projected period. In the waterless cosmetic market, the makeup segment refers to products formulated without water, offering sustainable alternatives to traditional cosmetics. Waterless makeup trends focus on innovative formulations like waterless foundation powders, solid blushes, and dry eyeshadows. This segment caters to eco-conscious consumers seeking reduced environmental impact, compact travel-friendly options, and concentrated, long-lasting pigments. As the demand for sustainable beauty grows, waterless makeup continues to evolve with advanced formulations, meeting both ecological and cosmetic performance expectations.

According to the gender, the women segment held 78% revenue share in 2022. The women's segment in the waterless cosmetic market refers to products designed specifically for female consumers. A notable trend in this segment includes a heightened demand for sustainable and eco-friendly beauty solutions. Women are increasingly seeking waterless cosmetics that align with their environmental values, opting for formulations with natural ingredients and innovative packaging. The market caters to this trend by offering a diverse range of waterless products, including powders, balms, and solid formulations, providing women with effective and sustainable choices for their skincare and beauty routines.

The men's segment is anticipated to expand the fastest over the projected period. In the waterless cosmetic market, the men's segment refers to skincare and grooming products specifically formulated for male consumers. This segment is witnessing a surge in demand as men increasingly prioritize sustainable and efficient beauty routines. Waterless formulations, offering convenience and eco-friendliness, align with the trends in the men's grooming sector. The market is responding with innovative waterless products tailored to men's skincare needs, catering to a growing demographic seeking effective, time-efficient, and environmentally conscious grooming solutions.

According to nature, the synthetic segment has held 75% revenue share in 2022. In the waterless cosmetic market, the synthetic segment refers to formulations that utilize man-made or artificially created ingredients rather than natural sources. This segment is characterized by the incorporation of synthetic compounds, offering stability, consistency, and often cost-effectiveness in formulations. A notable trend within the synthetic segment involves the continuous advancement of cosmetic technology to create innovative, high-performance waterless products. Brands are leveraging synthetic ingredients to develop cutting-edge formulations that cater to diverse consumer preferences, contributing to the overall growth and dynamism of the waterless cosmetic market.

The organic segment is anticipated to expand fastest over the projected period. The organic segment in the waterless cosmetic market refers to products formulated with certified organic ingredients, avoiding synthetic chemicals. This segment reflects a growing consumer preference for clean, green beauty. With an emphasis on natural sourcing, the organic waterless cosmetic trend aligns with eco-conscious choices. Consumers increasingly seek products free from harmful additives, contributing to the rise of organic formulations within the waterless cosmetic market, promoting both environmental sustainability and skin health.

According to the distribution channel, the supermarkets and hypermarkets segment has held 41% revenue share in 2023. The supermarkets and hypermarkets segment in the waterless cosmetic market refers to the distribution of waterless beauty products through large-scale retail outlets. This channel provides consumers with convenient access to a diverse range of waterless cosmetics, allowing them to explore and purchase products easily during routine shopping trips. As the demand for sustainable beauty options grows, supermarkets and hypermarkets play a pivotal role in meeting consumer needs by offering an array of waterless cosmetic choices and contributing to the overall accessibility and mainstream adoption of eco-conscious beauty products.

The e-commerce segment is anticipated to expand fastest over the projected period. The e-commerce segment in the waterless cosmetic market refers to the online retailing of waterless beauty products. This distribution channel allows consumers to conveniently explore and purchase a wide range of waterless cosmetics from the comfort of their homes. The trend in the waterless cosmetic e-commerce segment is characterized by the growing popularity of online platforms, enabling brands to reach a global audience, offer personalized shopping experiences, and capitalize on the increasing consumer preference for eco-friendly beauty products through digital channels.

In January 2021, Everist Inc. entered the market with the introduction of a cutting-edge beauty product within the hair care sector. This high-performance offering reflects Everist Inc.'s commitment to delivering innovative solutions, catering to the evolving needs and preferences of the beauty and personal care market.

Segments Covered in the Report

By Product

By Gender

By Nature

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

March 2025

July 2024