Grant Management Software Market Size to Hit USD 7.44 Billion by 2034

The global grant management software market size is evaluated at USD 3.07 billion in 2025 and is for...

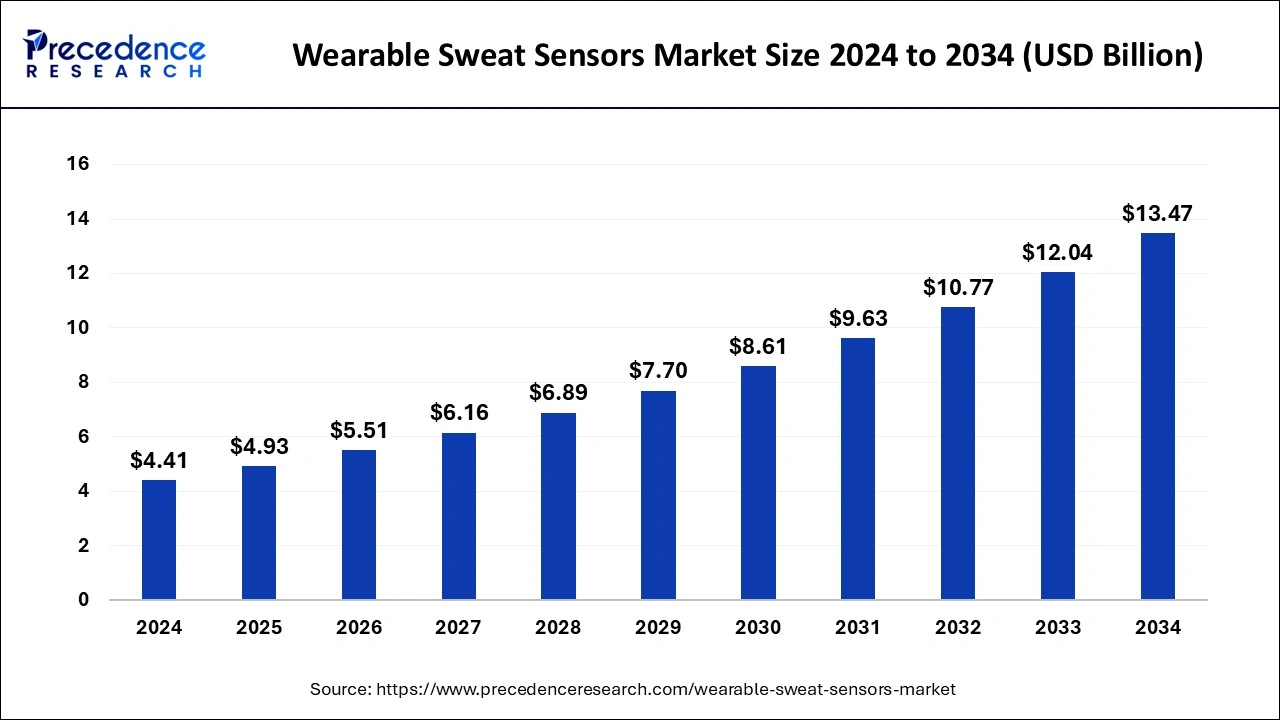

The global wearable sweat sensors market size was estimated at USD 4.41 billion in 2024 and is predicted to increase from USD 4.93 billion in 2025 to approximately USD 13.47 billion by 2034, expanding at a CAGR of 11.82% from 2025 to 2034.

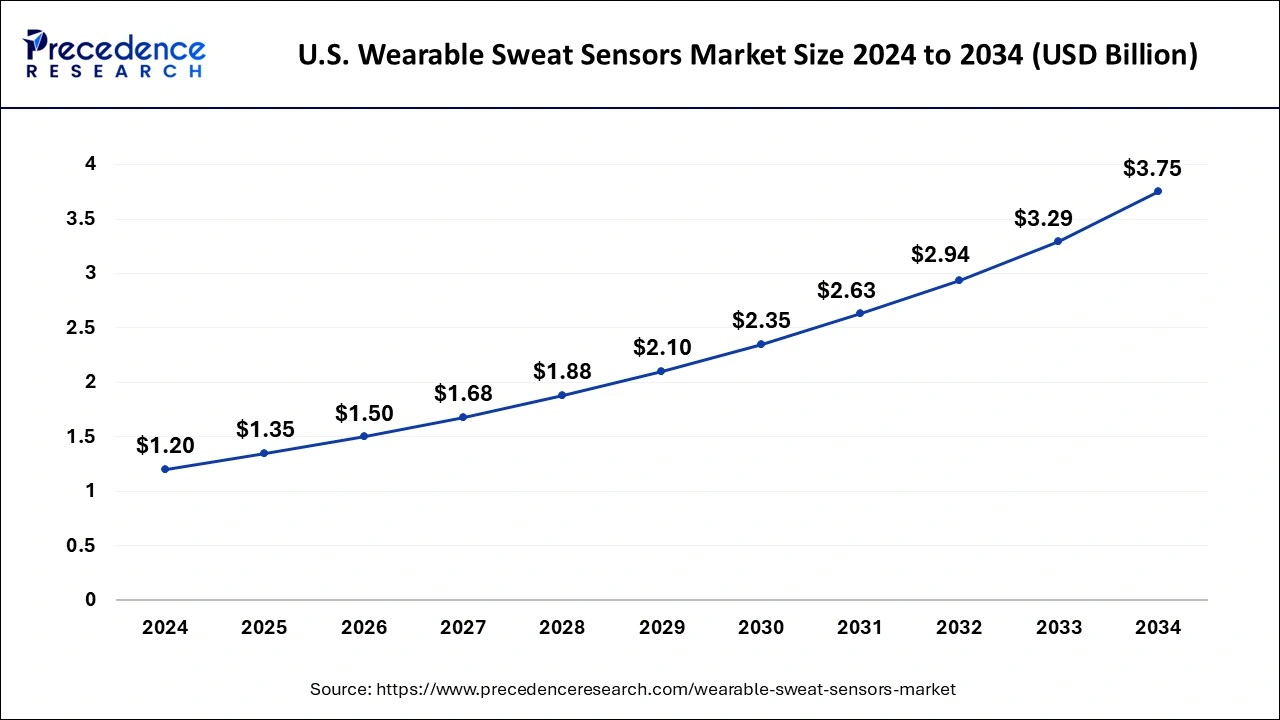

The U.S. wearable sweat sensors market size was estimated at USD 1.20 billion in 2024 and is anticipated to be surpass around USD 3.75 billion by 2034, rising at a CAGR of 12.07% from 2025 to 2034.

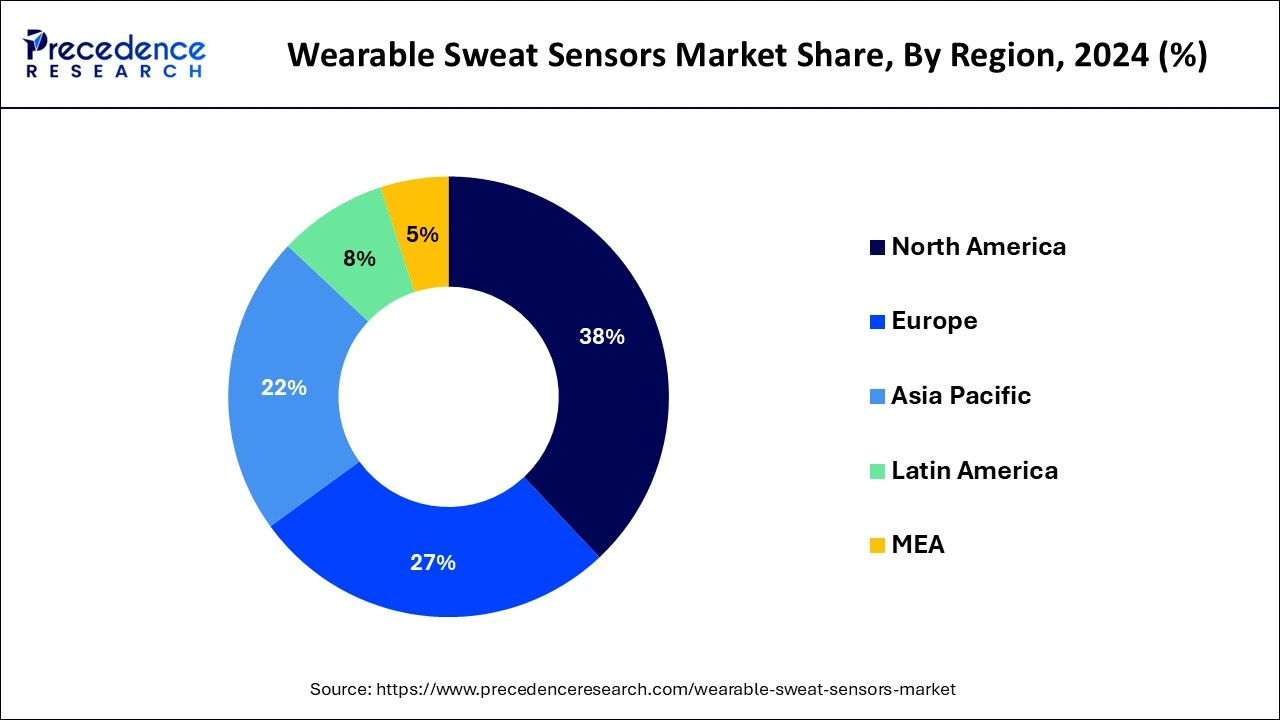

North America held the largest share of the market in 2024. due to its strong emphasis on health and fitness, and a well-established healthcare infrastructure. Wearable sweat sensors have gained significant attention in the region due to their applications in sports, fitness, healthcare, and research. Additionally, the region hosts numerous research institutions and companies actively engaged in R&D related to healthcare technologies. This fosters innovation in the development of wearable sweat sensors for medical applications.

Asia Pacific is poised for rapid growth in the wearable sweat sensors market due to various factors such as rapid technological advancements, increasing awareness of health and fitness, and a growing interest in wearable technologies. Countries like China, Japan, South Korea, and India are particularly active in this space. It is expected to witness significant growth as technology adoption increases, healthcare awareness rises, and the demand for fitness and health monitoring solutions continues to surge.

Meanwhile, Europe is growing at a notable rate in the wearable sweat sensors market European countries are at the forefront of research and innovation in healthcare technologies. Ongoing efforts contribute to the development of advanced sensor technologies, including those for sweat analysis. The region boasts an advanced healthcare infrastructure, supporting the integration of wearable sweat sensors into medical practices and research institutions.

Wearable sweat sensors offer real-time monitoring of hydration levels, electrolyte balance, and other health indicators, making them valuable tools in optimizing athletic performance and managing certain medical conditions. However, challenges such as accuracy, comfort, and regulatory considerations persist. Technological trends include the integration of sweat-sensing capabilities into mainstream wearables like smartwatches, expanding the market's reach.

The wearable sweat sensors market's segmentation encompasses various sensor types, applications across sports, healthcare, and industrial sectors, and different end-user preferences. Regional variations in adoption highlight the dynamic nature of this market, with more developed regions often driving innovation and market growth. For the latest insights, it is advisable to refer to recent market reports and industry updates, as market trends in technology can evolve rapidly.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.93 Billion |

| Market Size by 2034 | USD 13.47 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Mechanism, By Substance, and By Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Sports and performance monitoring

The rising demand for sports and performance monitoring is a pivotal factor propelling the wearable sweat sensors market into prominence. Athletes and fitness enthusiasts alike recognize the significance of real-time physiological data, and sweat-sensing wearables offer a unique and holistic approach to performance optimization. The ability to tailor training regimens and hydration strategies based on individualized data sets is a game-changer for athletes aiming to push their limits while minimizing the risk of dehydration and fatigue.

Moreover, the integration of sweat-sensing wearables with other sports technologies, such as smart clothing and fitness-tracking apps, enhances the overall training experience. Athletes can receive immediate feedback on their physical condition, enabling them to make informed decisions about their performance, recovery, and injury prevention strategies. As the sports industry increasingly embraces data-driven approaches to training, the demand for wearable sweat sensors is anticipated to soar.

High manufacturing and research cost

The demand for the wearable sweat sensors market may encounter a significant constraint due to the high research and manufacturing costs associated with the development and production of advanced devices. The intricate nature of designing and producing cutting-edge sensor technologies capable of accurately capturing and analyzing sweat biomarkers can necessitate substantial financial investments. Research endeavors to enhance sensor accuracy, reliability, and compatibility, coupled with the exploration of innovative materials and manufacturing processes, contribute to escalating research costs.

Moreover, companies in the wearable sweat sensors market may face challenges in achieving economies of scale initially, which can impact cost-effectiveness. As a result, the accessibility of these devices to a broader consumer base may be hindered, impeding market penetration.

Ongoing research and development efforts in the biomedical field

Researchers are delving into the vast potential of sweat as a non-invasive source of valuable health information, analyzing its composition to detect specific biomarkers associated with various health conditions.

The biomedical applications of wearable sweat sensors extend to disease detection, offering a revolutionary approach to early diagnosis and monitoring. These devices provide continuous, real-time data, allowing for the timely identification of biomarkers related to conditions such as diabetes, cystic fibrosis, and metabolic disorders. Furthermore, the integration of wearable sweat sensors into drug delivery systems is a promising avenue for advancing personalized medicine. These sensors can offer real-time feedback on the effectiveness of medications, facilitating precision in drug administration and improving therapeutic outcomes. Thus, ongoing research and development (R&D) initiatives in the biomedical field are presenting substantial opportunities for the wearable sweat sensors market.

The biochemical segment dominated the wearable sweat sensors market in 2024; the segment is observed to continue the trend throughout the forecast period. Biochemical sweat sensors operate by analyzing the chemical composition of sweat. They detect and measure specific biomarkers, ions, or molecules present in sweat, providing information about an individual's health status. It is commonly used for monitoring various health parameters such as glucose levels, lactate, electrolytes, and other metabolites. They find applications in healthcare, sports science, and general wellness monitoring. It offers high specificity and sensitivity for targeted analyses. They are suitable for applications requiring precise measurement of specific chemical markers in sweat.

The bioelectrical segment is expected to grow at a significant rate throughout the forecast period. Bioelectrical sweat sensors measure electrical properties or signals associated with sweat. This can include parameters such as conductivity or impedance, providing insights into the overall electrical characteristics of sweat. It is often used to assess hydration levels and electrolyte balance. Changes in the electrical properties of sweat can indicate variations in the concentration of ions, offering valuable information for sports performance and health monitoring. it may provide real-time, continuous monitoring of sweat properties, offering insights into hydration status and electrolyte balance. They can be less invasive than biochemical sensors.

The cortisol segment is observed to hold the dominating share of the wearable sweat sensors market during the forecast period. Cortisol is a steroid hormone associated with stress and plays a crucial role in various physiological processes, including metabolism and immune response. Cortisol monitoring through wearable sweat sensors can provide insights into an individual's stress levels. This has applications in stress management, mental health monitoring, and overall well-being assessment.

The ethanol wearable sweat sensors segment is expected to generate a notable share in the wearable sweat sensors market. Ethanol is the primary component of alcoholic beverages. Monitoring ethanol levels in sweat can be relevant for tracking alcohol consumption and its impact on the body. Ethanol sensors in wearables are valuable for applications such as alcohol monitoring, especially in scenarios where continuous, non-invasive tracking of alcohol levels is desired.

The soft polymer segment held the largest share of the wearable sweat sensors market in 2024. Soft polymers are flexible and elastic materials, often used to enhance the comfort and conformability of wearable devices. They allow the sensor to bend and stretch, making it suitable for applications where the device needs to adhere closely to the skin. Soft polymer-based sensors are commonly used in wearable devices that require a comfortable and skin-friendly interface. This is especially important for sensors designed for continuous and prolonged use.

The plastics segment is expected to generate a notable revenue share in the market. Plastics are versatile materials with a wide range of properties. Depending on the type of plastic used, it can provide flexibility, durability, and cost-effectiveness in the production of wearable sweat sensors. Plastics find applications in various components of wearable devices, including the sensor housing, substrate, or encapsulation. The choice of plastic can influence the mechanical properties and overall performance of the sensor.

By Mechanism

By Substance

By Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

The global grant management software market size is evaluated at USD 3.07 billion in 2025 and is for...

January 2025

April 2025

July 2025

March 2025