March 2025

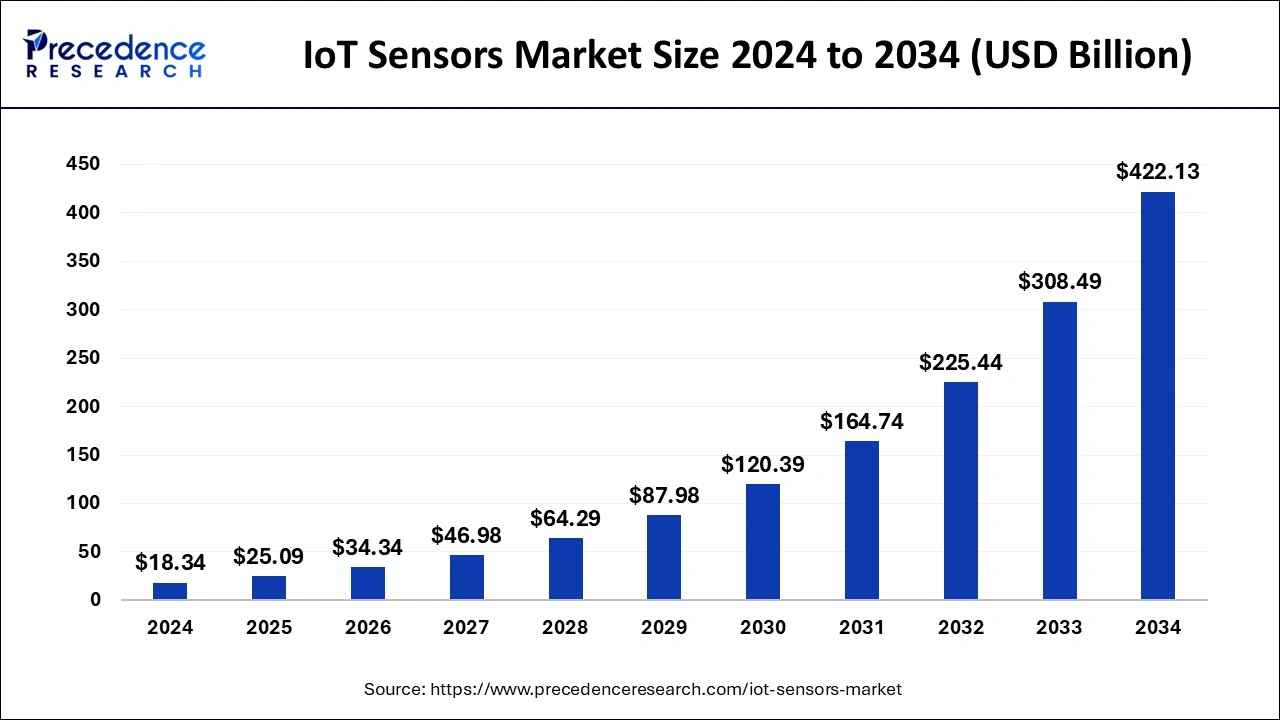

The global IoT sensors market size is calculated at USD 25.09 billion in 2025 and is forecasted to reach around USD 422.13 billion by 2034, accelerating at a CAGR of 36.84% from 2025 to 2034. The North America IoT sensors market size surpassed USD 7.34 billion in 2024 and is expanding at a CAGR of 37% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global IoT sensors market size was estimated at USD 18.34 billion in 2024 and is predicted to increase from USD 25.09 billion in 2025 to approximately USD 422.13 billion by 2034, expanding at a CAGR of 36.84% from 2025 to 2034. The fundamental drivers of IoT adoption include falling device costs and the emergence of new applications and business models.

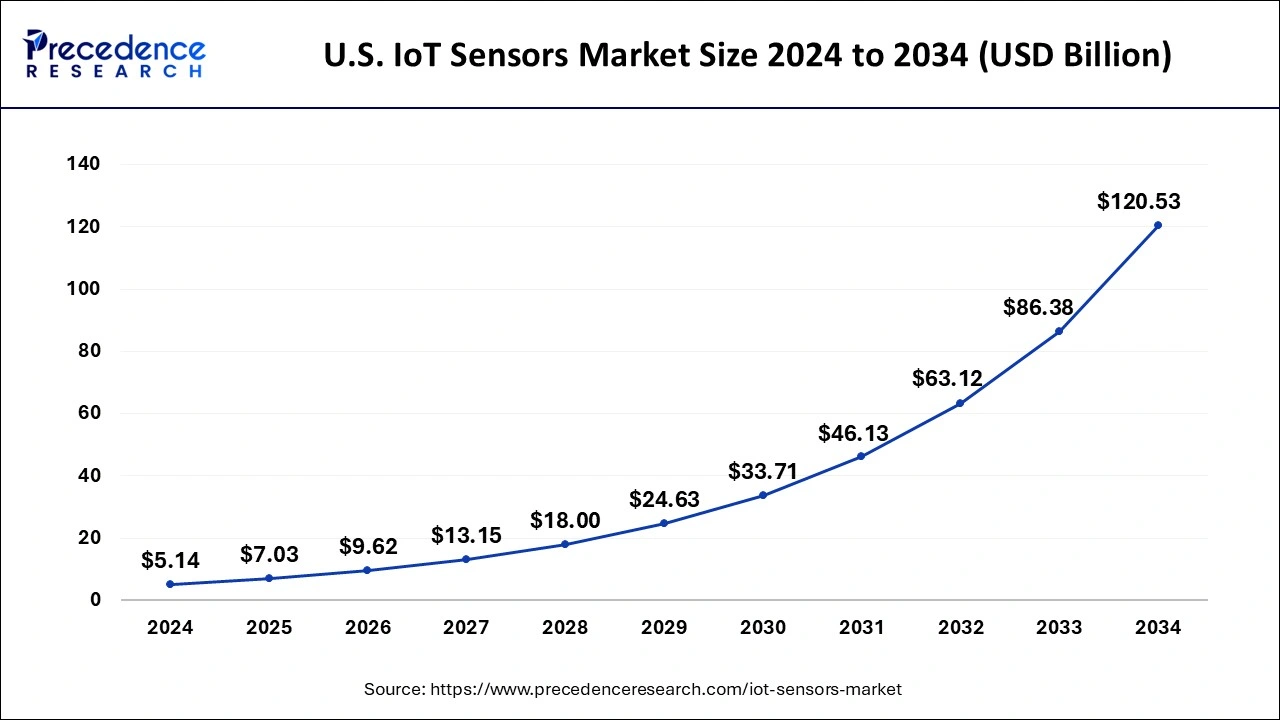

The U.S IoT sensors market size was valued at USD 5.14 billion in 2024 and is predicted to surpass USD 120.53 billion by 2034, expanding at a CAGR of 37.09% from 2025 to 2034.

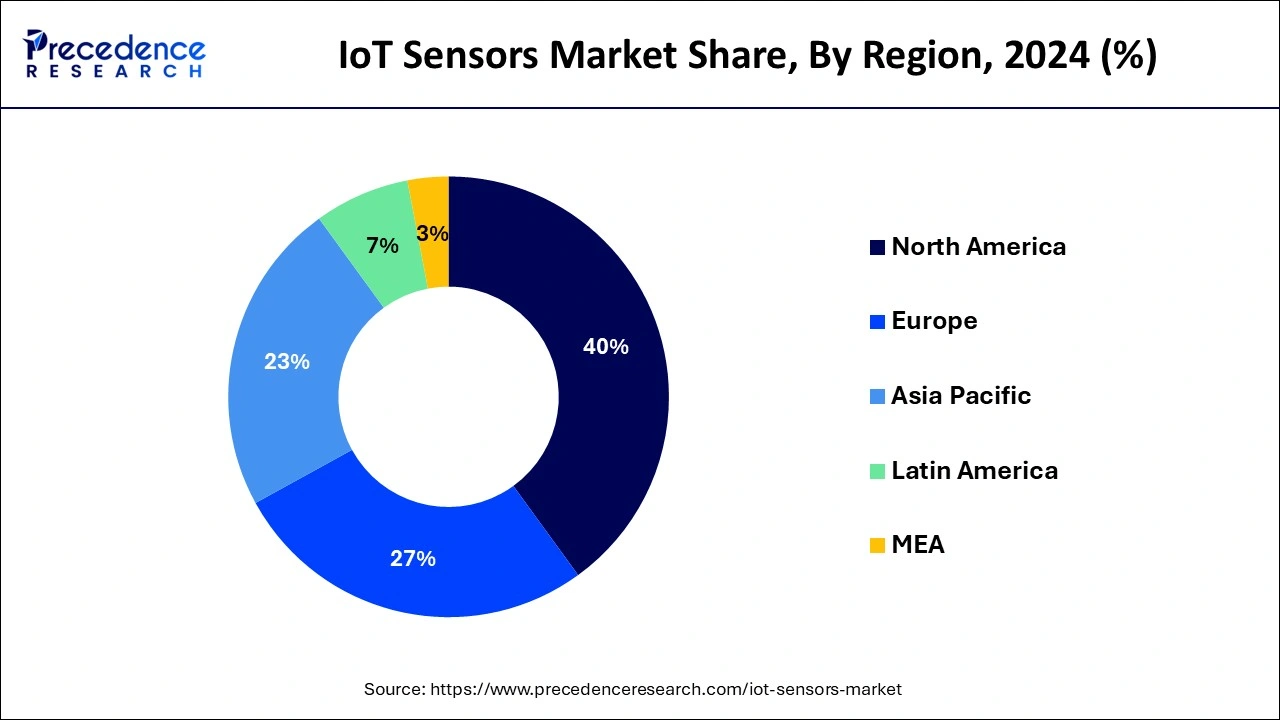

North America dominated the global IoT sensors market with revenue share of 40% in 2024. owing to numerous established vendors and early adoption of IoT technology across various industries. Companies in this region are increasingly turning to IoT to monitor the performance of their offerings, preventing costly breakdowns or inefficient maintenance shutdowns. The widespread use of IoT in North America is evident, with a study by Stanford University and Avast revealing that homes in this region have the highest density of IoT devices globally. Nearly 66% of North American homes have at least one IoT device, and 25% have more than two.

Asia Pacific holds one of the fastest growing area in the IoT sensors market, Countries like India, China, Japan, South Korea, and Australia are prominent users of IoT sensors, particularly in consumer electronics, vehicles, and healthcare products. APAC has become a key hub for significant investments and corporate expansion on a global scale. Implementing Industry 4.0 initiatives, especially in regions like Europe and China, drives the widespread deployment of IoT sensors in this region.

Before the advent of IoT technology, only personal computers and smartphones could connect to the internet. However, IoT innovations have enabled the connection of various physical objects to the internet. Entities like houses, factories, office buildings, and even cities are interconnected to collect data for diverse purposes. The IoT sensors market provides solutions that are crucial for creating IoT technologies, detecting external information, and translating it into signals understandable by humans and machines.

Sensors play a vital role in medical care, logistics, transportation, nursing care, disaster prevention, agriculture, industry, tourism, regional businesses, and more. A variety of IoT sensors are available for detecting and measuring physical phenomena and the five human senses: smell, sight, taste, touch, and hearing. Based on the communication interface, sensors are categorized into embedded sensors, USB, and wireless & Bluetooth modules. IoT sensors find applications in home security, online business support, wearable devices, remote monitoring for older people, women's healthcare, hazard detection, and more.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 36.84% |

| Market Size in 2025 | USD 25.09 Billion |

| Market Size by 2034 | USD 422.13 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Sensor Type, By Network Technology, and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rise in demand for smart factories and IIoT

The global demand for smart factories has been rising, a trend expected to persist due to the emergence of the Industrial Internet of Things (IIoT). IIoT integrates Industrial robots, smart machines, warehouses, and manufacturing plants. To achieve business objectives and key performance indicators. In these smart factories, various IoT sensors play a crucial role by collecting and relaying real-time information, enabling informed decisions on the ground, and assisting operators. Thereby, the demand for smart factories is observed to promote the growth of the IoT sensors market.

Sensor data guides robots and machines in production and assembly processes, ensuring the workforce's safety and the protection of machines. As IIoT integration becomes more widespread, factories transform into connected and synchronized entities. Countries like China and Germany are at the forefront, adopting IoT sensors to enhance communication and coordination in manufacturing processes.

Rising demand for real-time data monitoring for predictive analytics

Industries globally are leveraging big data to enhance process efficiency. In the past, disconnected devices hindered real-time data collection, making obtaining insights challenging. Now, with IoT-connected smart devices, operators can access real-time factory data. Predictive analytics play a crucial role in maintenance planning, allowing companies to anticipate issues based on data analysis. Collecting real-time data enables vendors to assess the actual condition of plant equipment, predicting potential failures and preventing unnecessary downtime.

Challenges to offering high quality at low cost

Engineers and system developers are consistently exploring products with enhanced features to diversify their offerings. In the growing industrial automation market, industrial sensor vendors must offer easily customizable and cost-effective sensors. The expense of industrial sensors is often driven by the customization needed to ensure accurate and reliable performance for end-users. However, the overall cost of sensors is decreasing annually, primarily due to the availability of off-the-shelf sensor variants widely utilized in industrial automation systems and equipment.

Application of IoT in the automotive and transportation sector

The global automotive sector is gradually moving towards an autonomous era, propelled by recent collaborations among cybersecurity providers, automotive giants, chip makers, and system integrators. IoT is revolutionizing the automotive, transportation, and logistics industries, driven by preventative maintenance, connected mobility, and real-time data access.

The global spending on IoT in transportation and logistics has significantly increased. IoT enables efficient route mapping, maximizes fuel usage, provides track-and-trace capabilities for logistics, and offers real-time monitoring of parking spaces. Major companies like Google, Mercedes-Benz, Toyota, Volkswagen, and Volvo. They invest in developing smart cars with advanced features for safer and more comfortable driving experiences.

Increasing government funding and initiatives to support IoT projects

The government sector is expected to be a significant user of IoT, leading to global initiatives and funding for IoT-related developments while offering a significant opportunity for the IoT sensors market. Governments are particularly interested in advancements in smart traffic control, energy-saving with smart meters, and security enhancements through smart cameras. Additionally, governments sponsor IoT research initiatives for smart city development, playing a crucial role in expanding IoT in the coming years.

Furthermore, sensors, driven by a rapid decrease in size and the widespread use of microelectromechanical systems technology, are extensively employed in healthcare, automotive, and consumer products. The adoption of smaller sensors in wearables, smartphones, drones, and robotics has significantly contributed to the overall growth of the sensor industry in the last five years.

The pressure sensors segment dominated the IoT sensors market in 2024. A pressure sensor is a tool that detects and measures pressure, which is the force applied over an area. Using pressure sensors allows for specialized maintenance strategies like predictive maintenance. These devices gather real-time data on equipment conditions. In IoT, a pressure sensor senses pressure and transforms it into an electric signal. The voltage produced by the sensor corresponds to the applied pressure level. These sensors are crucial in IoT sensors market that monitor devices propelled by pressure, contributing to efficient monitoring and maintenance.

The inertial sensors segment is expected to capture a significant share of the IoT sensors market over the forecast period. In various fields like robotics, aerospace, automotive, virtual reality, motion analysis, and navigation systems, inertial sensors are frequently employed. These sensors are essential for tracking and comprehending how objects move and orient themselves in three-dimensional space.

The wired segment held the largest share of the market in 2024, under the segment, the ethernet subsegment is observed to capture a promising share in upcoming years. Ethernet is a technology that provides the necessary components, like the computer chip, port, cable, and protocol, to connect a desktop or laptop to a local area network (LAN). This connection allows for fast data transmission using coaxial or fiber optic cables. This also benefits the overall IoT sensors market.

The wireless technology segment is rapidly expanding in the IoT sensors market. The rising demand for wireless data from mobile devices and smart grids propels this growth. Additionally, the increasing adoption of cloud platforms contributes to the significant growth of this segment.

By Sensor Type

By Network Technology

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

July 2024

January 2025

November 2024