July 2024

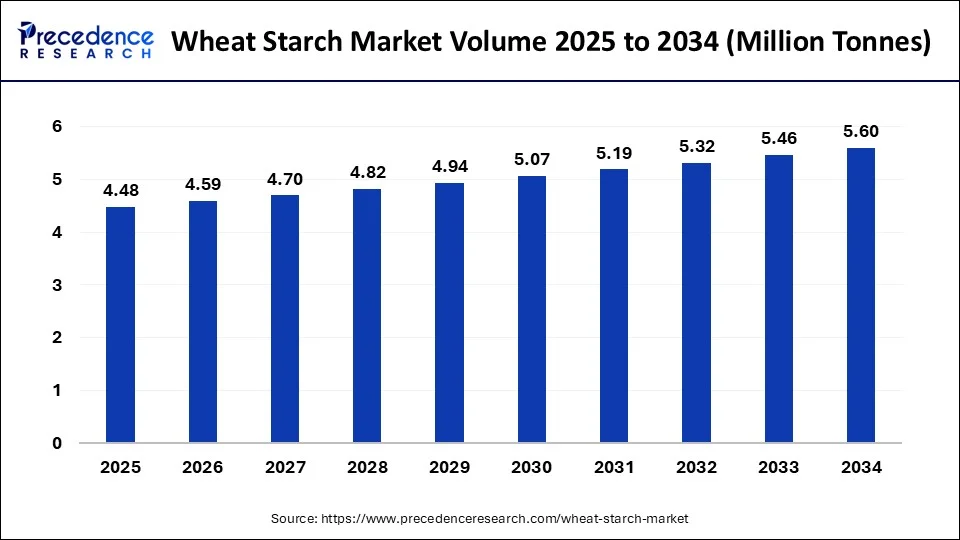

The global wheat starch market volume was 4.26 million tonnes in 2023, calculated at 4.37 million tonnes in 2024 and is expected to be worth around 5.6 million tonnes by 2034. The market is slated to expand at 2.51% CAGR from 2024 to 2034.

The global wheat starch market volume is anticipated to reach around 5.6 million tonnes by 2034 from 4.37 million tonnes in 2024, at a CAGR of 2.51% from 2024 to 2034. The increasing food consumption, rising demand for gluten-free diet, and expansion of pharmaceutical sector are the driving factors of wheat starch market.

Major Breakthroughs in the Wheat Starch Market

| Company Name | Roquette |

| Headquarters | Lestrem, France |

| Recent Development | In March 2022, Roquette announced an investment plan of €25m for liquid and powder polyols between 2022 and 2024. Polyols are produced from plant-based raw materials like maize and wheat; and widely used as sugar alternatives in food products. The investment was made to improve equipment efficiency, increase safety standards, standardize some industrial operations, and ensure sustainable supply in the market. |

| Company Name | Crespel & Deiters Group |

| Headquarters | Ibbenbüren, Germany |

| Recent Development | In July 2024, Loyma, a part of the Crespel & Deiters Group, developed three wheat-based specific solutions for fat reproduction, providing both processing and nutritional benefits, including reduced fat content in meat analogs while mimicking texture. |

Wheat Starch Market: From Food to Pharmaceuticals

The wheat starch market involves production and commercial utilization in various sectors. Wheat starch is a carbohydrate found as discrete granules within the wheat endosperm. More than 808.4 million metric tonnes of wheat was produced globally in 2022. China, India, Russia, the U.S., and Australia are the top five countries with the highest wheat production globally. Wheat starch is widely used in food, pharmaceutical, paper, textile, and construction industries. In the food industry, wheat starch is used as a thickening agent, emulsifier, stabilizer, glazing agent, and fat substitute.

Due to its ability to increase the strength and surface sizing of paper, wheat starch is used in the manufacture of corrugated paperboard, paper bags and boxes, and gummed paper and tape in the paper industry. In the textile industry, wheat starch is used as warp sizing, which increases the strength of the thread during weaving. In the construction industry, wheat starch is used in gypsum wallboard manufacturing, providing rigidity to the board. In the pharmaceutical industry, wheat starch is widely used as an excipient and in drug delivery systems to provide targeted delivery, sustained drug release, and precise dosing for the treatment of several disorders.

How Can AI Help the Wheat Starch Market?

Wheat starch is produced using the wheat wet milling process, which includes steeping, grinding, and separation of grain components. Artificial Intelligence (AI) has the potential to revolutionize wheat milling by providing unparalleled options for optimization, efficiency, and quality enhancement. The adoption of AI, like machine learning, deep learning, and computer vision, can overcome the limitations of wheat milling. Machine learning (ML) algorithms assist in predictive modeling, process optimization, and quality control. ML can optimize milling settings and predict outcomes by analyzing the grain properties, milling parameters, and product characteristics. Deep learning algorithms help in image analysis by automated inspection and classification of wheat grains. In addition, computer vision technology maintains product quality and safety by detecting defects and impurities in real-time.

| Report Coverage | Details |

| Market Volume by 2034 | 5.6 Million Tonnes |

| Market Volume in 2023 | 4.26 Million Tonnes |

| Market Volume in 2024 | 4.37 Million Tonnes |

| Market Growth Rate from 2024 to 2034 | CAGR of 2.51% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising global food demand

The rising population worldwide leads to an increase in the demand and consumption of food. Additionally, the rising awareness of nutrient-rich food poses a high demand for starch or starchy foods. Starchy foods are rich in carbohydrates and fibers and are a major source of energy in the body. Starch metabolizes in the body into glucose and circulates within the body through the bloodstream. Fiber is also essential for humans as it aids digestion. Wheat starch is a type of insoluble fiber that facilitates bowel movements and prevents constipation. Commercially, wheat starch is widely used as a thickening agent to thicken desserts, sauces, and instant foods. Also, the glucose produced from starch can be further fermented to biofuel corn ethanol using the wet milling or dry milling process. In addition, the rising demand for plant-based meat increases the use of wheat starch.

Restraint

Cost related issues

The funding for wheat production can be hampered due to several factors, like population growth, weather, supply chain disruptions, and currency fluctuations. Natural calamities like floods and droughts greatly affect wheat production, resulting in rising prices. Another challenge for the wheat starch market is the inappropriate ratio of A and B-type granules, which affects the quality of wheat-based foods like bread and pasta. Wheat starch contains two different types of granules: larger A-type granules and smaller B-type granules. The quality of wheat-based foods is affected by different physicochemical properties and size distribution of both the granules. Additionally, the different sizes of both granules negatively influence the starch manufacturing industry due to the loss of smaller B-type granules, thereby increasing wastage during the milling process.

Opportunity

Environmental wastewater treatment

Industrial wastewater management is a major concern due to the presence of several harmful chemicals like heavy metals, aromatic compounds, and dyes. Since starch is a natural polysaccharide, it is non-toxic and biodegradable. However, the adsorption capability of native starch is limited due to its low molecular weight, low water solubility, limited surface area, and rapid degradability in water. Hence, native starch is chemically modified to increase its adsorption capability by around 90%. Modified starch has the ability to remove various pollutants like oil, organic solvents, pesticides, heavy metals, dyes, pharmaceutical impurities, etc.

The native starch segment dominated the wheat starch market in 2023. Native starch is the starch that is obtained directly from plants. Native starch is a long-chain carbohydrate that is insoluble in cold water and swells to different degrees, depending on type and temperature. Native starch has immense potential in food applications due to its gelatinization, biodegradability, and retrogradation. It is used as a thickening, gelling, and stabilizing agent in bakery products. Cargill, Inc., an American multinational food corporation, uses native starch along with other label-friendly ingredients to overcome the limitations of native starch and replace modified starch in bakery foods.

The modified starch segment is estimated to grow at the fastest rate in the wheat starch market during the forecast period. Modified starch is derived from physically, chemically, or enzymatically modifying the native starch to enhance its potential. The modification can be done through wet and dry chemical processes, drum drying, and extrusion methods. Modified starch can have improved freeze-thaw stability, acid or alkali resistance, and better shear stability. Hence, modified starches transform foods to make them suitable for microwaveable foods, instant preparations, and ultrahigh temperatures.

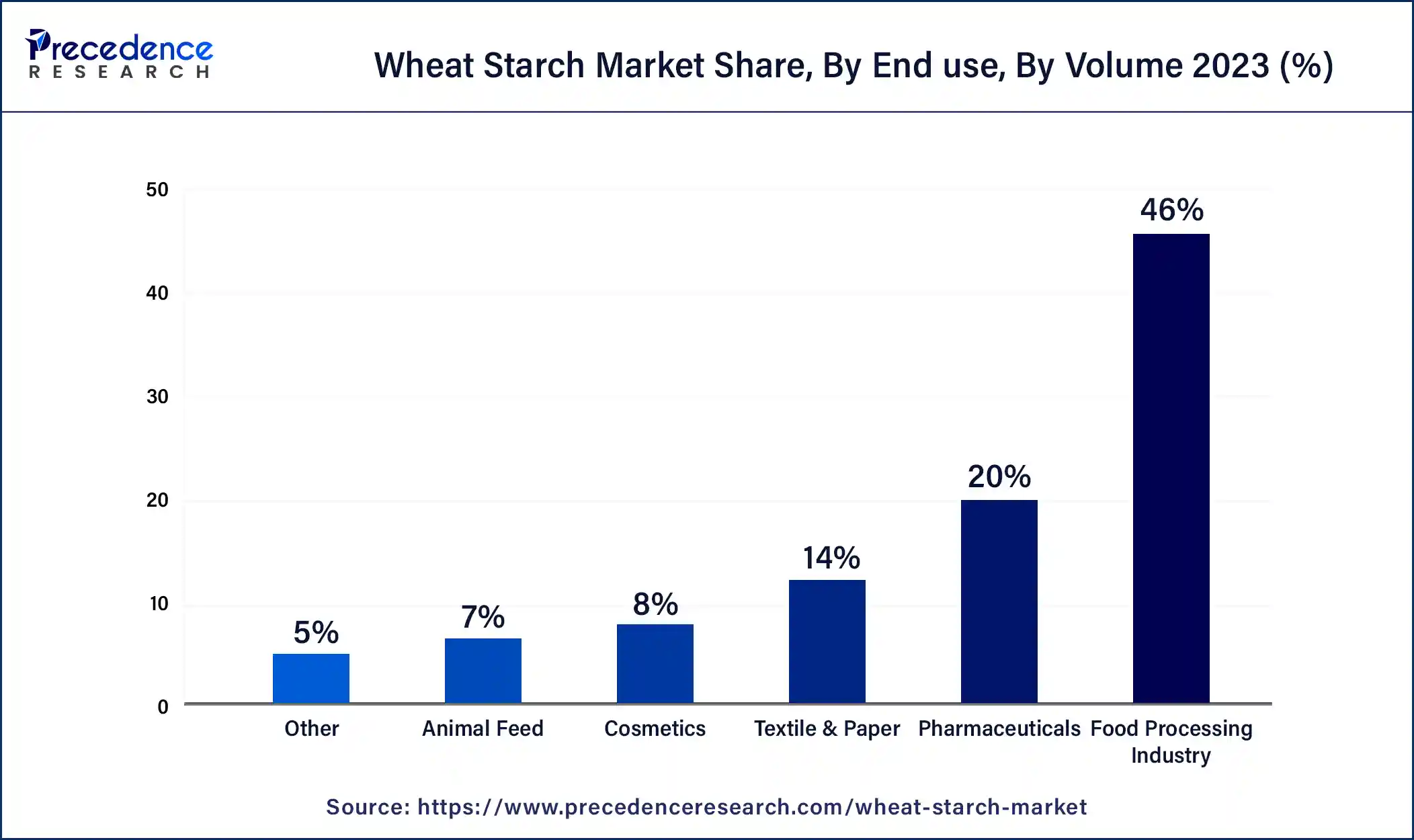

The food processing industry segment dominated the wheat starch market in 2023. Wheat starch has widespread use in the food processing industry due to its physicochemical properties like heat stability, solubility, transmittance, color, and texture. It is used for adhesion and binder in bread, as dustings in chewing gums and bakery products, as a fat replacer and juiciness enhancer in ice cream and salad dressings, as a stabilizer in beverages, as a gelling agent in jellies, and as a foam stabilizer in marshmallows. The increasing consumer preferences for safe and hygienic foods increase the demand for the food processing industry.

The pharmaceuticals segment is estimated to grow fastest in the wheat starch market over the studied period. Wheat starch is widely used in the pharmaceutical sector due to its nontoxic, intrinsic, and nonirritant properties, low cost, ease of modification, and versatility. Starch is majorly used as the diluent, disintegrant, binder, and lubricant in conventional dosage forms like tablets and capsules. It is also used in drug delivery systems to the targeted site.

Asia Pacific dominated the wheat starch market in 2023. The rising population, increasing food consumption demand, rapid expansion of the pharmaceutical sector, and highest wheat production drive the market growth. Countries like China and India have the largest populations in the world, which results in changing food demands. Also, the agricultural production of wheat is highest in the Asia-Pacific region. China, India, Australia, and Pakistan are among the top ten countries with the highest wheat production. The Ministry of Food Processing Industries, Government of India, formed a policy, “National Food Processing Policy 2019,” with a vision to achieve a minimum of six-fold increase in investment over fifteen years up to 2034-35 for a significant increase in output.

Europe is expected to grow rapidly in the wheat starch market during the forecast period. The presence of key players, rising food demands, increased collaborations and investments, research and innovation, and rising demand for paper packaging potentiate market growth. European countries like Russia, France, Germany, and Argentina reported the highest production of wheat in 2022. The European Government’s policy “Starch Europe 2019-2024” was formed to strengthen the EU starch market and to create a more sustainable future for Europe and a stronger EU economy. Germany is the biggest food and beverage market in the European Union. Crespel & Deiters is the leading producer of wheat starch globally. In 2023, it processed 368,000 tonnes of wheat and produced 140,000 tonnes of wheat starch.

New Advancement in the Wheat Starch Market

Segments Covered in the Report

By Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

January 2025

February 2025

October 2024