August 2024

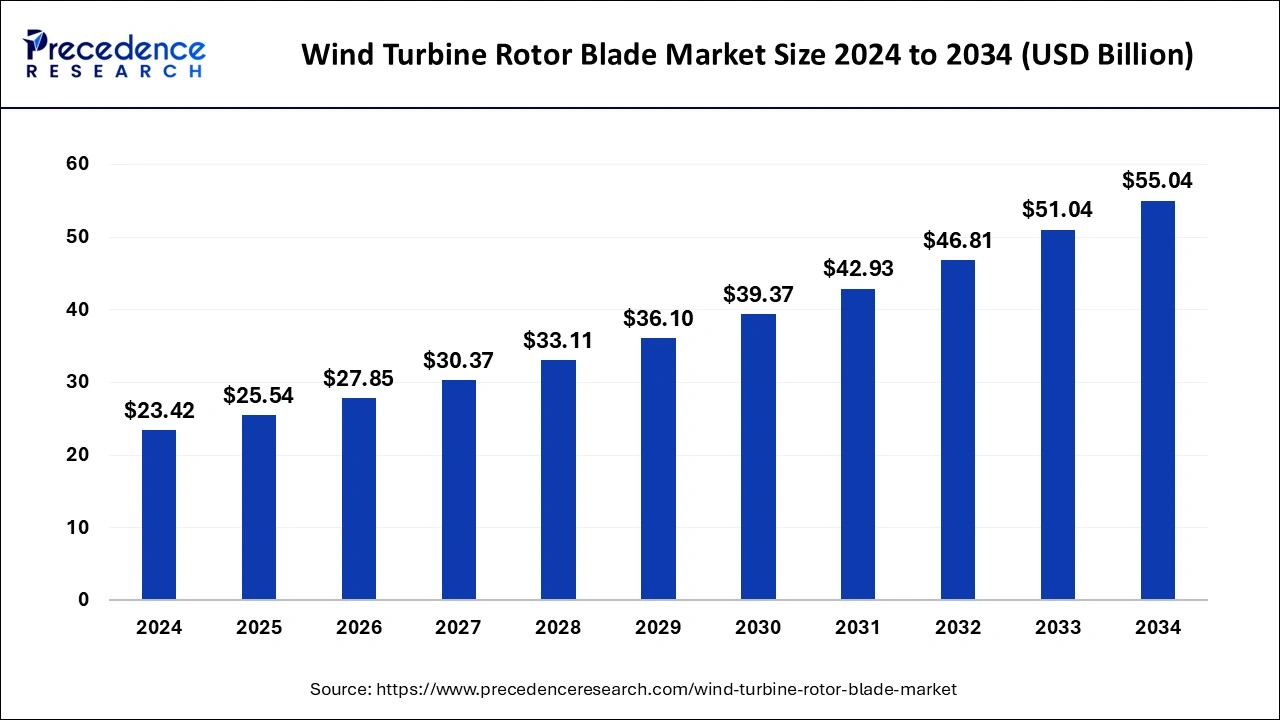

The global wind turbine rotor blade market size is calculated at USD 25.54 billion in 2025 and is forecasted to reach around USD 55.04 billion by 2034, accelerating at a CAGR of 8.92% from 2025 to 2034. The Asia Pacific wind turbine rotor blade market size surpassed USD 12.00 billion in 2025 and is expanding at a CAGR of 9.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global wind turbine rotor blade market size was estimated at USD 23.42 billion in 2024 and is predicted to increase from USD 25.54 billion in 2025 to approximately USD 55.04 billion by 2034, expanding at a CAGR of 8.92% from 2025 to 2034.

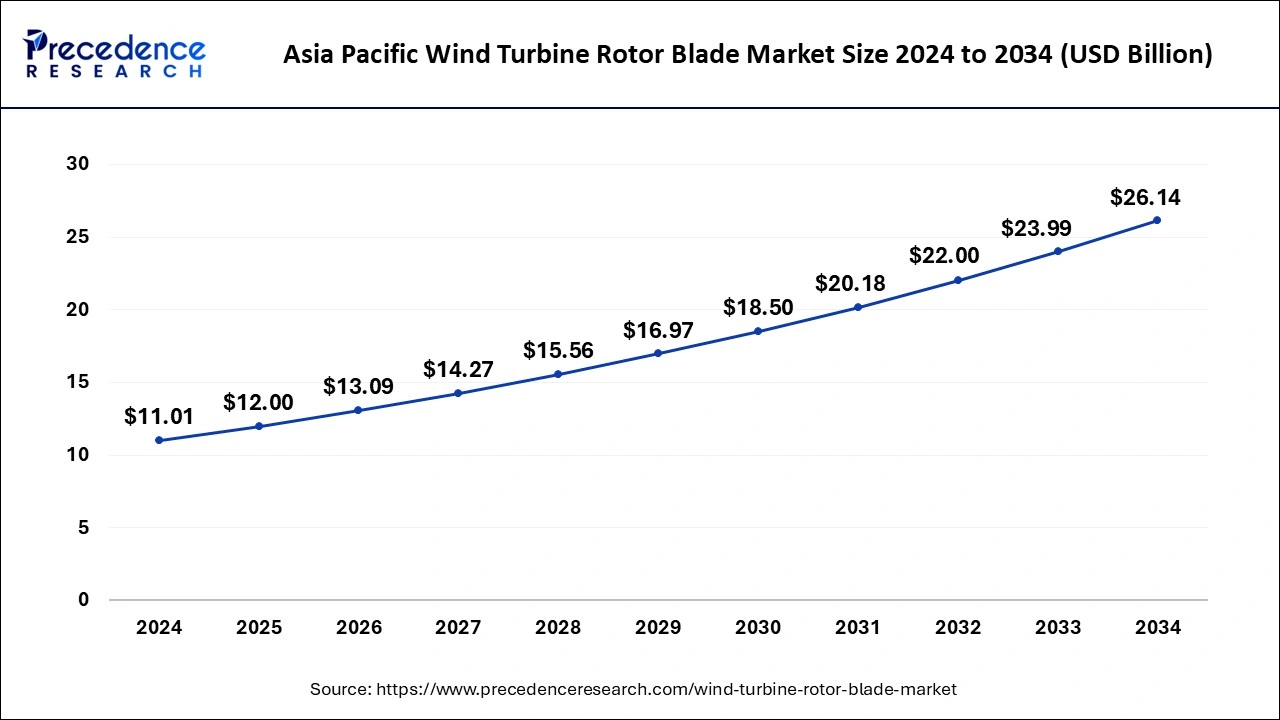

The Asia Pacific wind turbine rotor blade market size was valued at USD 11.01 billion in 2024 and is anticipated to reach around USD 26.14 billion by 2034, poised to grow at a CAGR of 9.03% from 2025 to 2034.

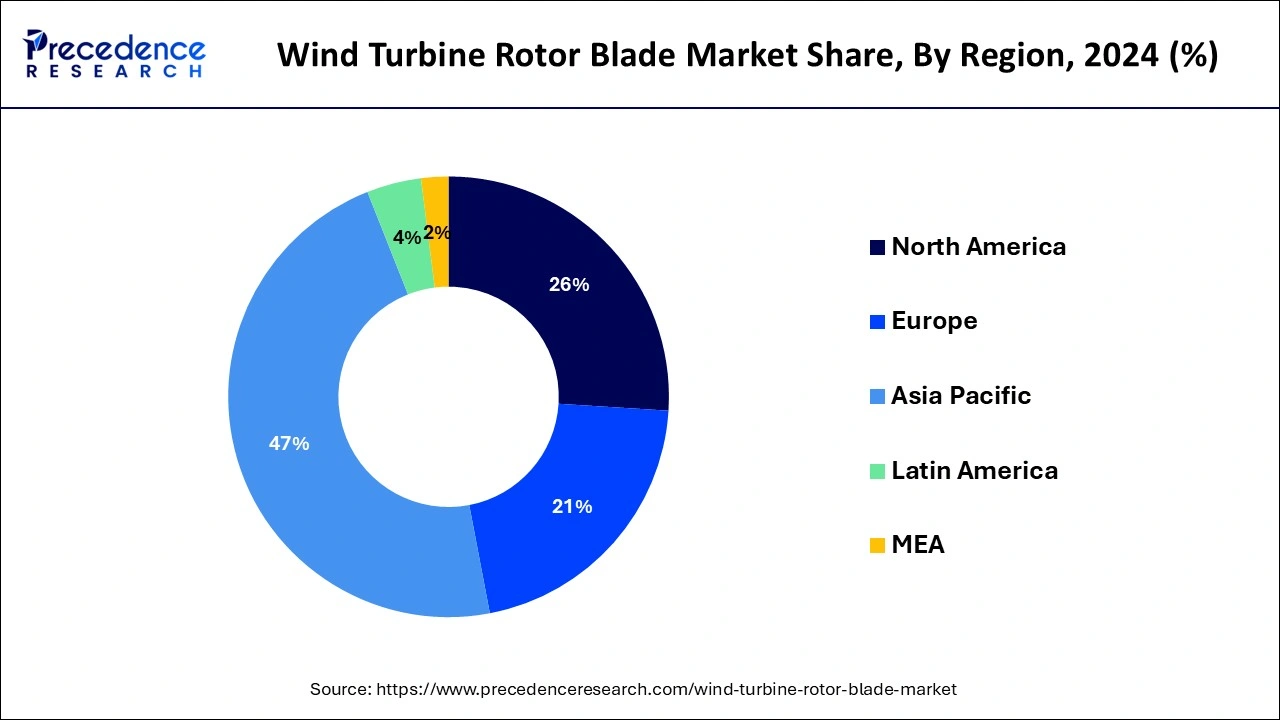

Asia-Pacific led the market with the biggest market share of 47% in 2024 which is observed to sustain its position throughout the forecast period. The growth of the region is attributed to the rising investment in generating clean sources of energy, increasing R&D activities in renewable energy sources, the rapid pace of urbanization, advancement in technology and requirements of improvements in energy efficiency. The market in the region is also observed to be supplemented by rapid industrialization, electrification of end-use sectors, and a supportive regulatory framework of the governments. Thus, such factors are expected to propel market ‘s growth in the region during the forecast period.

In the region, developing countries such as China, India, and Japan are the major contributors to the market. The growth of the market in these countries is attributed to the significant growth in domestic power consumption, increasing demand for sustainable sources of energy, the presence of prominent market players, the increasing number of offshore and onshore wind energy installations, the increasing adoption of advanced energy solutions, and the rising focus on wind energy expansion.

Additionally, several governments incentives and subsidies for wind energy projects and technological innovations in rotor blade design and materials resulted in enhancing the efficiency and lifespan of wind turbines, which makes them more affordable and reliable.

The wind turbine rotor blade market revolves around the production, innovation and application of rotor blades as a crucial component in the renewable energy production sector. Their work is to convert the atmosphere's mechanical power and energy into a rotary motion around a central hub. Wind power plants produce electricity through wind turbines.

The deployment of a wind power plant widely depends on several factors, including wind conditions, access to electric transmission, the surrounding terrain, and others. Generally, the job of the wind turbine is to turn wind energy into electricity with the help of aerodynamic force from the rotor blades, which may work as a helicopter rotor blade or an airplane wing. Wind turbine rotors, another vital part of a wind turbine, determine how well the wind turbine works for renewable energy production.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.92% |

| Market Size in 2025 | USD 25.54 Billion |

| Market Size by 2034 | USD 55.04 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Location of Deployment and By Blade Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for electricity

The rising focus on wind energy expansion is expected to fuel the growth of the wind turbine rotor blade market. The rising demand for better energy production, sustainable energy sources, and placement of wind power production technology to maximize electricity generation has accelerated the growth of the market during the forecast period. Power generated from wind sources is a clean and alternative source of energy. Wind power energy is among the fastest-growing sectors within clean energy sources.

The demand for wind energy increases as the most secure and sustainable solution to meet the growing energy demand. The global shift towards clean energy and the rising use of electricity demand continues to increase globally to accelerate rapid infrastructure development. The growing number of offshore and onshore wind energy installations worldwide supports the increasing demand for electricity. Therefore, such factors are likely to propel the growth of the wind turbine rotor blade market during the forecast period.

High cost-related challenges

The high costs associated with R&D and challenges during transportation are anticipated to hamper the global wind turbine rotor blade market's growth. Handling and transporting large rotor blades from manufacturing units to installation sites for offshore wind farms act as logistic challenges. In addition, the wide availability of other alternative energy generation sources, such as solar energy, is likely to limit the expansion of the global wind turbine rotor blade market during the forecast period.

Rising focus on wind energy expansion

The rising focus on wind energy expansion is expected to fuel the growth of the wind turbine rotor blade market. The rising demand for better energy production, sustainable energy sources, and placement of wind power generation technology to maximize electricity gene has accelerated the growth of the market during the forecast period. Power generated from wind sources is a clean and alternative source of energy. Wind power energy is among the fastest-growing sectors within clean energy sources.

Wind energy with advanced rotor blades significantly benefits the environment by reducing the carbon footprint. Several environmental issues related to fossil fuels are promoting a rise in alternative energy sources. The establishment of wind power for electricity production plays a role. Electricity from renewables is nearly 40% of the total renewable energy supply. Moreover, the growing investments in various countries, such as China, the United States, Japan, and India, are projected to propel the market's expansion in the coming years.

The onshore segment held the largest segment of the wind turbine rotor blade market in 2024 and is expected to sustain the position throughout the forecast period owing to the increasing energy demand through clean sources. In recent years, wind power has delivered increasing percentages of electricity generation. Onshore wind power is the turbines that are located on land and through using the wind it generates electricity. This power generation technology is working aggressively to maximize electricity produced per megawatt capacity installed to cover more sites with lower wind speeds.

Onshore wind turbines are very quick and easy to install. The ease of installation, transportation, and other several factors make onshore wind farms less expensive than offshore wind farms. They have no adverse impact on the environment around them, and energy transportation produces very few emissions. In addition, these wind turbines do not release any toxins or contaminate the land as they usually co-exist with farming.

The offshore segment is expected to grow significantly during the forecast period in the wind turbine rotor blade market. Offshore wind power is gaining popularity rapidly. Offshore wind power is referred to as when wind over open water to generate electricity. Offshore wind farms are constructed in water bodies where higher wind speeds are available, allowing for more energy collection, which wind speeds tend to be faster. Offshore wind power is a more reliable and cleaner source of energy.

The carbon fiber segment dominated the wind turbine rotor blade market in 2024. Wind energy is a renewable energy source for enhancing climate conditions and environmental friendliness. Wind turbine blades are a vital element in collecting wind energy. Carbon fiber offers several benefits and has been widely recognized for its excellent overall performance in large-scale wind turbine blades.

Carbon fiber assists in reducing wind turbine blade mass due to its enhanced properties of strength and stiffness compared to fiberglass. According to some secondary research, wind blades containing carbon fiber weigh 25% less than ones made from traditional fiberglass materials. Carbon fiber blades capture more energy in locations with low wind. A shift to carbon fiber extends the blade lifetime as carbon fiber materials have a high fatigue resistance.

By Location of Deployment

By Blade Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

March 2025

August 2024

August 2024