March 2025

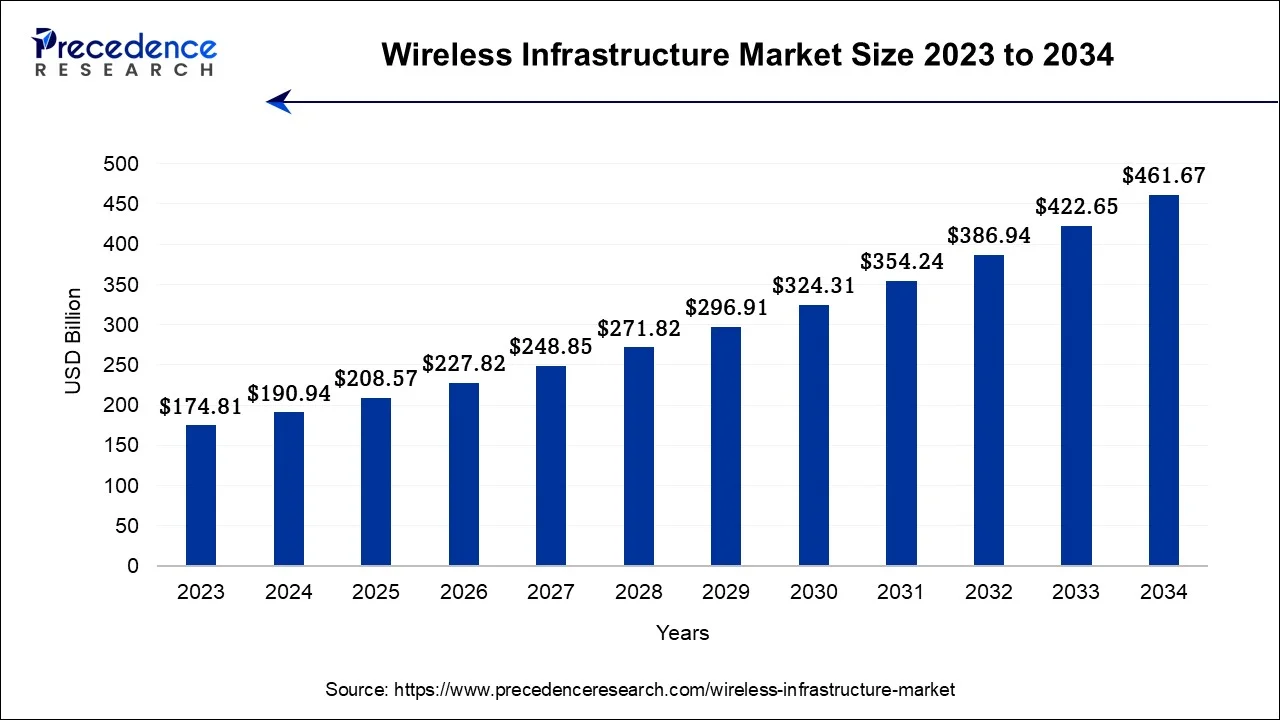

The global wireless infrastructure market size accounted for USD 190.94 billion in 2024, grew to USD 208.57 billion in 2025 and is projected to surpass around USD 461.67 billion by 2034, representing a healthy CAGR of 9.23% between 2024 and 2034.

The global wireless infrastructure market size is estimated at USD 190.94 billion in 2024 and is anticipated to reach around USD 461.67 billion by 2034, growing at a CAGR of 9.23% between 2024 and 2034.

Wireless infrastructure refers to a collection of numerous connectivity standards, communication devices, and connectivity solutions that function together to offer wireless networks. Some of the common examples of wireless infrastructure include wireless local area networks (WLANs), cell phone networks, satellite communication networks, wireless sensor networks, and terrestrial microwave networks.

Technologies such as Wear Your Own Device (WYOD) and Bring Your Own Device (BYOD) are becoming increasingly popular in various developed countries. The development of such technologies is enhancing the requirement for speedier connectivity and high-speed data in the commercial communication domain.

| Report Coverage | Details |

| Market Size in 2024 | USD 190.94 Billion |

| Market Size by 2034 | USD 208.57 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.23% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Platform, Type, Infrastructure, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

As per our research, the global 5G Infrastructure market is predicted to be worth around $98.57 billion by 2030 from about $5.82 billion in 2021. Our analysis indicates that the global 5G infrastructure market will grow at a compounded annual growth rate (CAGR) of 36.94% during the forecast period till 2030.

The smartphone penetration across the world rate was around 68% in 2022, up from 65% in 2016. This penetration rate is estimated to grow with the increasing population all over the world. As of April 2023, the number of internet users across the globe was nearly 5.18 billion. This accounted for 64.6% of the total global population. Increasing smartphone and internet penetration rates are creating remarkable opportunities for the global wireless infrastructure market.

In order to enhance the wireless infrastructure, respective companies can consider acquisition, collaboration, partnership, and joint ventures. Furthermore, evolving wireless connectivity technology tends to make the existing technology obsolete very soon. Technology evolvement is expected to intensify the market competition among the significant market players.

Since the count of wireless service providers is very less in comparison to the count of buyers, the bargaining power of suppliers is considerably higher as compared to the bargaining power of buyers. Owing to promising profit margins, the threat of new entrants in the wireless infrastructure market is found to be moderate as of now.

Our wireless infrastructure market report includes a detailed analysis of the current market situation. The report includes relevant developments including key market players, the latest trends, regional analysis, and competitive landscape. The analytical research on the impact of the COVID-19 pandemic helps in realizing the respective effects on the demand and supply side. The segmental analysis offers an in-depth overview of the types of wireless infrastructures.

Based on the platform, the global wireless infrastructure market is segmented into defense, government, and commercial. The commercial segment held the largest market share in 2023. The commercial segment is predicted to grow with the highest compounded annual growth rate (CAGR) during the study period.

The consumer electronics wireless infrastructure market in India is forecast to account for $9,043.3 million in 2023. The Indian consumer electronics wireless infrastructure market is predicted to grow at a compound annual growth rate of 8.4% and reach a value of $12,479.7 million by 2027. In 2023, the global fashion wireless infrastructure market is anticipated to reach $820 billion. By 2027, this market’s value can amount to over $1.2 trillion.

Based on type, the global wireless infrastructure market is segmented into Satellite, 2G & 3G, 4G, and 5G. The 4G segment had the highest revenue share in 2023. The 4G segment is estimated to grow with the highest compounded annual growth rate (CAGR) during the forecast period till 2032.

Japan is one of the biggest wireless infrastructure markets in the world. Japan’s wireless infrastructure market is characterized by a growing emphasis on business-to-consumer (B2C) sales, dominance of business-to-businesses (B2B) transactions, and an emerging consumer-to-consumer (C2C) market. The business-to-consumer (B2C) wireless infrastructure market in Japan has more than doubled in the last decade.

Based on infrastructure, the global wireless infrastructure market is segmented into small and macro cells, radio access networks, mobile core, distributed area networks, and satellite communications (SATCOM). The distributed area network segment had the highest revenue share in 2022. The distributed area network segment is estimated to grow with the highest compounded annual growth rate (CAGR) during the forecast period till 2032.

The wireless infrastructure market is spread across North America, Europe, Asia Pacific (APAC), the Middle East and Africa, and Latin America. North America (NA) held a high share of the global wireless infrastructure market in 2023. In 2023, the U.S. had the largest share followed by Canada and Mexico. Considering the presence of nations with early adoption of the latest communication technologies, better financial policies, and high gross domestic product (GDP), the North American wireless infrastructure market is expected to grow notably during the study period.

The European wireless infrastructure market is segmented into France, Germany, the United Kingdom (UK), Italy, and the Rest of Europe. Germany is predicted to hold the largest share of the European wireless infrastructure market during the forecast period.

The wireless infrastructure market in the Asia Pacific (APAC) region is segmented into China, India, Japan, South Korea, and the rest of the Asia Pacific (APAC) region. In 2023, China dominated the Asia Pacific (APAC) wireless infrastructure market followed by Japan and India.

Being the region with the highest population, Asia-Pacific (APAC) has the largest count of internet users across the world. In 2022, the count of internet users in the Asia-Pacific region grew drastically to over 2.6 billion. Around half of these users are from India and China. As per GSMA, the adoption rate of smartphones in the Asia Pacific reached 74% in 2021. This rate is projected to rise to 84% by 2025.

Latin America, Middle East, and African (LAMEA) wireless infrastructure market is segmented into South Africa, Saudi Arabia, North Africa, Brazil, Argentina, and the Rest of LAMEA. The Latin America region is expected to account for considerable growth in the wireless infrastructure market during the forecast period. In 2022, Brazil had the highest market share in the LAMEA wireless infrastructure market region. As per International Trade Administration, with a 16% year-over-year (Y-o-Y) rise in 2021, Brazil is witnessing rapid growth in its e-commerce sector. The Brazilian wireless infrastructure market is expected to expand by 95% by 2025 and reach a combined transaction value of $79 billion.

The United Arab Emirates (UAE) is the 28th largest wireless infrastructure market with an estimated revenue of $11,782.3 million by 2023. With a projected CAGR of 8.6% from 2023 to 2027, the UAE wireless infrastructure market size will be around $16,373.4 million by 2027. Owing to illiteracy, unfavorable economic conditions, and uncertainty in African countries, the wireless infrastructure market in the African region is predicted to grow at a slower rate.

Segments Covered in the Report:

By Platform

By Type

By Infrastructure

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

February 2025

August 2024