March 2025

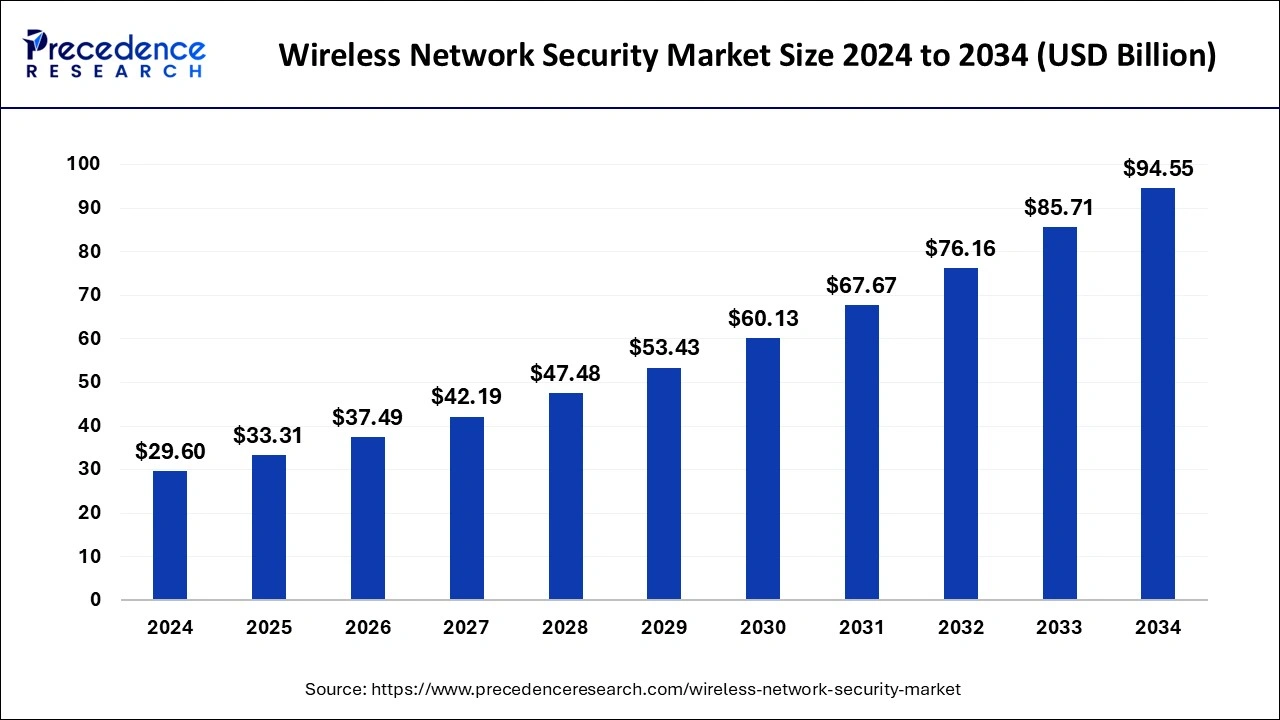

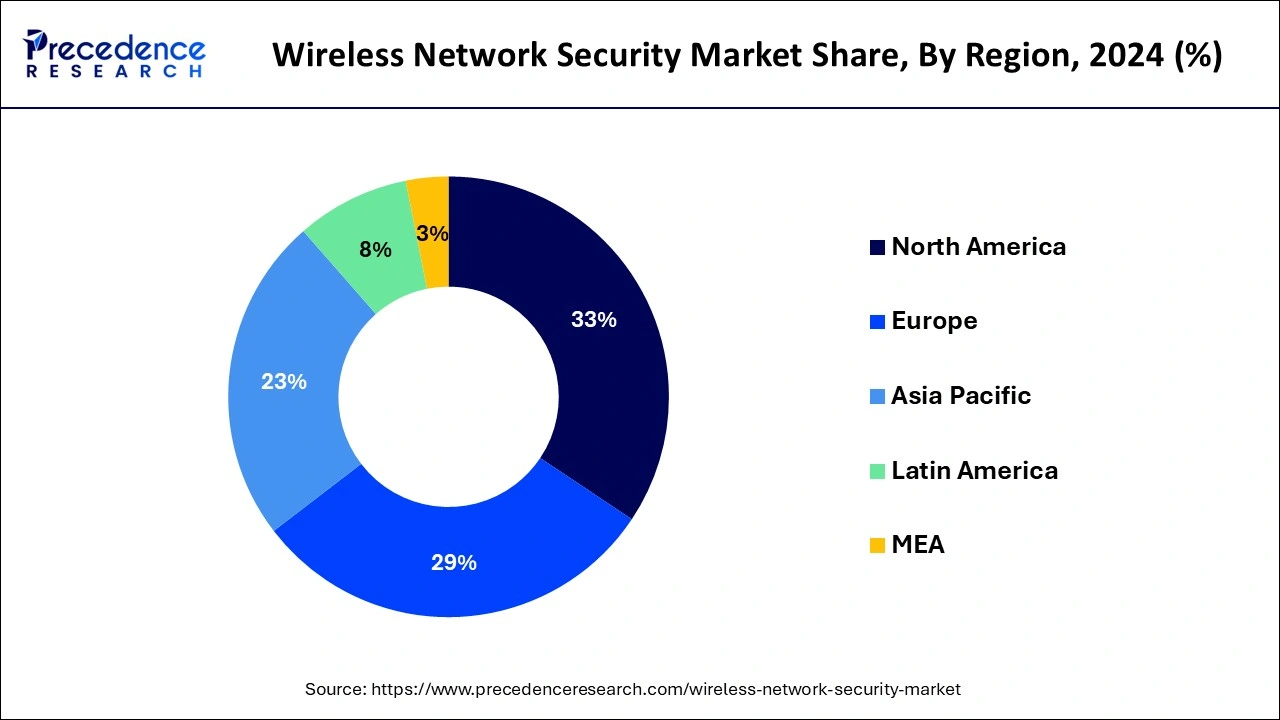

The global wireless network security market size is evaluated at USD 33.31 billion in 2025 and is forecasted to hit around USD 94.55 billion by 2034, growing at a CAGR of 12.31% from 2025 to 2034. The North America market size was accounted at USD 9.77 billion in 2024 and is expanding at a CAGR of 12.35% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global wireless network security market size accounted for USD 29.60 billion in 2024 and is predicted to increase from USD 33.31 billion in 2025 to approximately USD 94.55 billion by 2034, expanding at a CAGR of 12.31% from 2025 to 2034. The rise in the number of diagnostic centres and hospitals is driving the growth of the ultrasound market. Protection against malicious and unauthorised access drives the market growth.

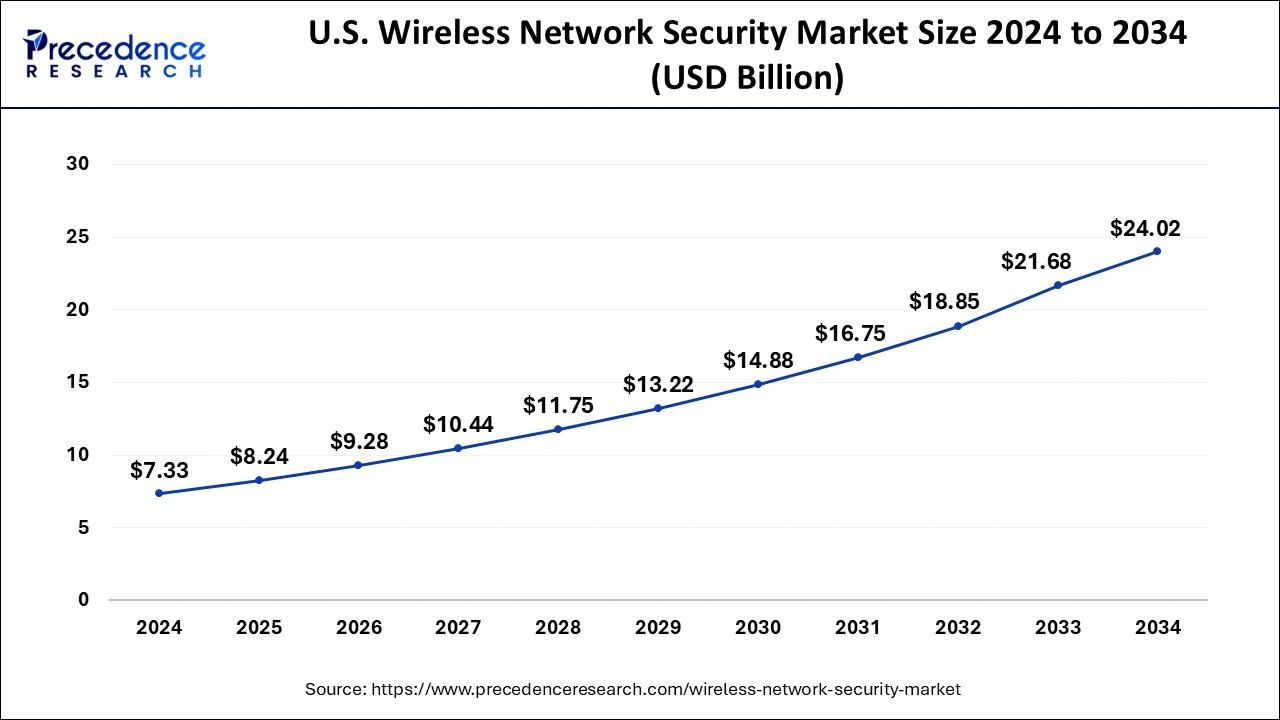

The U.S. wireless network security market size was exhibited at USD 7.33 billion in 2024 and is projected to be worth around USD 24.02 billion by 2034, growing at a CAGR of 12.60% from 2025 to 2034.

North America held a high share of the global wireless network security market in 2024. In 2023, the U.S. held the largest share, followed by Canada. Considering the presence of countries with well-developed IT infrastructure, lucrative economic policies, early adoption of the latest technologies, and high gross domestic product (GDP), the North American market is anticipated to grow promisingly. The North American automotive cybersecurity market accounted for around $0.92 billion in 2022 and is estimated to grow a decent CAGR during the study period. Wireless Fidelity (Wi-Fi) meets the security requirements of the Federal government and is approved by respective policies. As per the Cybersecurity and Infrastructure Security Agency (U.S. Department of Homeland Security), Wi-Fi Protected Access (WPA), WPA2, and WPA3 are among the prominent encryption protocols that provide enhanced protection. WPA3 is considered to be one of the strongest encryptions. All Wi-Fi routers permit users to safeguard their device’s Service Set Identifier (SSID).

Asia Pacific is expected to grow at the fastest rate during the forecast period in the wireless network security market. The wireless network security market in the Asia Pacific region is segmented into India, Japan, South Korea, China, and the rest of the Asia Pacific region. In 2023, China dominated the Asia Pacific (APAC) market, followed by Japan and India. According to an expert, 99.8% of the 16,000 international standards in the world are created by foreign organizations. However, China has created 19,278 new standards. It is necessary to request that China follow its new standard as it pertains to the security of the nation's WLAN.

According to the expert, China has a sizable WLAN market, but the lack of national standards would make it difficult for the government to control the sector. If WLAN security is not adequately managed, it will put the security of e-government, company informationization, family networks, and even state information infrastructure at risk. In order to create a more organized WLAN environment, the national WLAN standard's prompt release will ensure the infrastructure building for information security and encourage WLAN application in several economic domains.

Wireless network security refers to the process of designing, implementing, and ensuring safety & security on a wireless computer network. With the evolving tech world and due to the increasing adoption of the Internet of Things (IoT), many organizations are using wireless network security to protect their networks from malicious and unauthorized access. In recent times, many companies have preferred wireless communication as it is easy to set up and reduces various limitations of wired communication structure. Wireless network security is not just easily movable but is also cost-effective as compared to wired network security structures. Wireless network security also plays a key role in eliminating all the unnecessary threats that occur in the network.

The wireless network security market is experiencing high growth due to the accelerating requirement for WLAN security systems. Wireless network security systems enable high-speed data transmission in a secure environment and enhance the overall network performance. When the Service Set Identifier (SSID) is protected, it becomes tougher for attackers to find a network. Network security is very crucial for an organization's ability to provide services and products to customers and employees. From enterprise applications to online stores, protecting data and apps on the network is highly essential to improving business activities. Wireless network security prevents access to sensitive information and valuable data. When hackers or cybercriminals get access to confidential data, they can cause various problems, including stealing assets and harming reputations.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.31% |

| Market Size in 2025 | USD 33.31 Billion |

| Market Size in 2024 | USD 29.60 Billion |

| Market Size by 2034 | USD 94.55 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solutions, Services, End User, and Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Data security in different industries

In today’s tech-driven world, cybersecurity is critical for various industries. Financial services, IT, telecommunication, healthcare, retail and e-commerce, government agencies, and critical infrastructure providers are top targets for cyber threats due to the sensitive data they handle. These industries must implement robust security measures like encryption, multi-factor authentication, and intrusion detection systems to safeguard against cyber-attacks. Adherence to regulatory compliance, regular security protocol updates, and continuous staff training are also essential for maintaining a strong security posture. Financial institutions face high volumes of sensitive customer data and must also comply with regulatory requirements for security controls.

Healthcare companies store vast amounts of personal and medical data, making them prime targets for cybercriminals. Retail and e-commerce businesses hold valuable data for hackers to exploit. Government agencies and political organizations face threats to sensitive information and political processes, while critical infrastructure providers must protect against the catastrophic consequences of cyber-attacks.

Poor strength and compatibility issues

Because they offer installation flexibility and are frequently less expensive than hardwired systems, wireless security systems may be an excellent investment for the home or place of business. But be careful while selecting them; not all of them will provide trustworthy protection. It is possible for crooks to get around the system without ever setting it off due to weak signal strength and compatibility problems. Price may be appealing, but there are frequently better solutions available in the same price range that offer reliable connectivity and 24/7 service.

Wi-Fi 6

The latest generation of wireless technology is called Wi-Fi 6, or 802.11ax. Not only does Wi-Fi 6 have amazing speed, but it also adds several security enhancements. Devices can plan their network activity with Target Wake Time (TWT), which lowers power usage. The vulnerability to such assaults is lowered as a result. A new security feature called OWE is also included in Wi-Fi 6. The first connection between a device and an access point is encrypted as a result. It enhances the protectiveness of open networks.

The firewall segment dominated the market in 2024. The number of hackers, or rogue users, will rise in tandem with the expansion of trustworthy users. Protecting hosts linked to wireless networks from rogue users will become more crucial for system administrators due to worries about finances, businesses, and privacy. Firewall technology is one technique that system administrators may utilize. System administrators can establish stringent access restrictions between the reliable internal network and the unreliable external environment by using a firewall.

The encryption segment is expected to grow at the fastest rate during the forecast period. Data encryption protects remote workforces, boosts consumer confidence, and preserves data privacy, integrity, and regulatory compliance, among many other advantages. Organizations may avoid data breaches, secure sensitive information, and adhere to data protection laws by putting strong encryption mechanisms in place. Encryption solutions are very useful for AI/ML models and important datasets since they guarantee the correctness and unaltered nature of data while simultaneously protecting it from illegal access.

Furthermore, encryption assists in reducing the security risks related to working remotely, including safeguarding personal devices and securing data while it's in transit. In the end, robust data encryption shows a dedication to data security, boosting client confidence and trust in the company's management of private data.

The managed security segment dominated the wireless network security market in 2024. Small and medium-sized businesses usually employ MSPs since their own IT resources are insufficient. You may obtain networking and IT expertise without expanding your staff by using managed network services. MSPs are in charge of integration, troubleshooting, providing technical support, and establishing policies. By using this service, you can reduce the risks when experimenting with new technologies. By putting IT specialists to other uses, businesses may make greater use of their resources. Preventing IT outages is made easier with proactive MSP management. Larger companies, organizations, and governmental entities also use MSPs to supplement their own IT personnel due to budgetary and recruitment constraints.

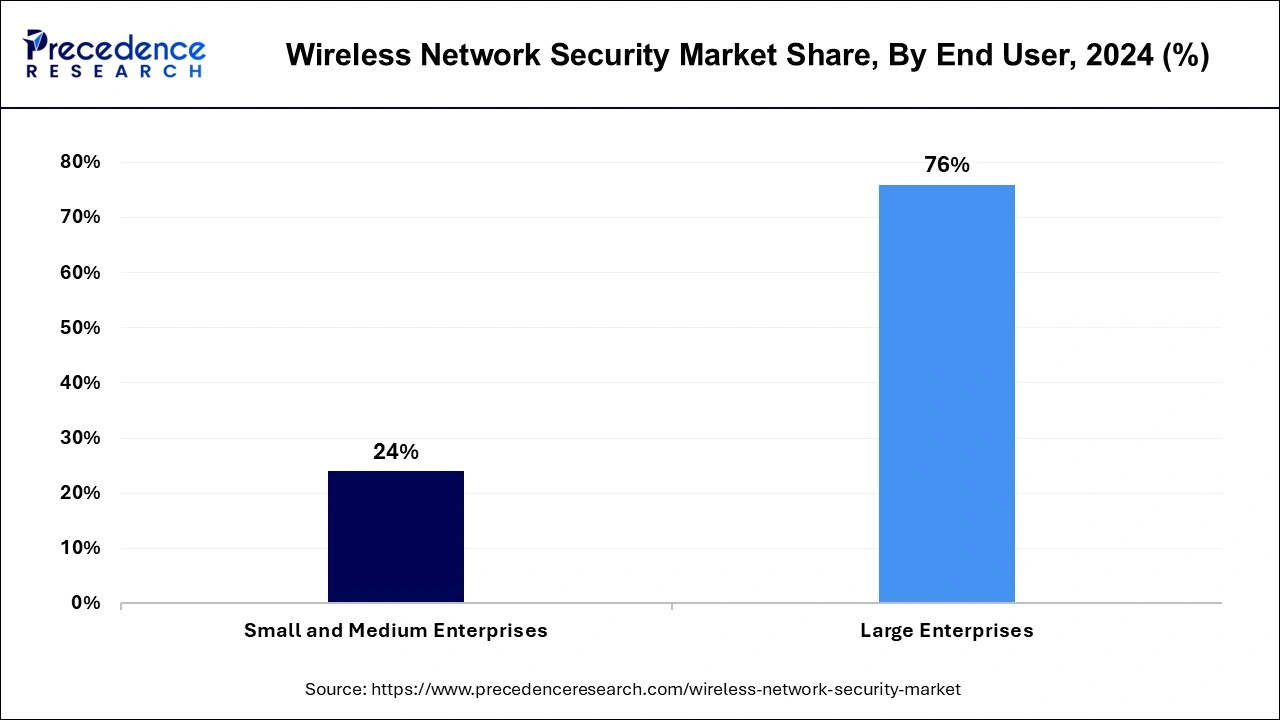

The large enterprises segment dominated the wireless network security market in 2023. Large enterprises are prone to large data theft. Companies have a lot of data that is handled on a daily basis, which can be stolen and used for the wrong purposes. Such data is not only a threat to the main company but is also disadvantageous for companies to which they provide services. Government organizations also need high-end security for national security reasons. Therefore, wireless network security is largely used in large enterprises.

The small & medium segment is expected to grow at the fastest rate during the forecast period. Small & medium enterprises do not have as large data as large enterprises, but their data is more prone to cyber-attacks due to weak security. The companies have realized the importance of better security, and hence, they have started using wireless network security. Recently, a rise has been seen in small and medium enterprises, which has also increased the use of network security.

The BSFI segment dominated the wireless network security market in 2024. Hackers have made the BFSI industry their top target, using cunning methods to steal user credentials, tax returns, insurance information, and bank account and credit/debit details. Information obtained through cyberspace and staff computers can be used fraudulently to submit false tax returns, fund high-value transactions, commit insurance fraud, and make cryptocurrency investments. Hence very strong security of network is needed.

The IT & telecommunications segment is expected to grow at the fastest rate during the forecast period. Due to the susceptibility of wireless transmissions to unwanted access, wireless network security is crucial in IT and telecommunications. Secure wireless connections are essential for protecting against dangers like malware, illegal access, and data eavesdropping because of the increasing use of mobile devices and distant work. Strong authentication and encryption procedures must be put in place in order to guard against data breaches and guarantee adherence to industry rules. Strong wireless network security measures are also essential due to the necessity to safeguard secret data and preserve sensitive information.

By Solutions

By Services

By End User

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

October 2024

August 2024