August 2024

The global women wear market size is calculated at USD 1.07 trillion in 2024, grew to USD 1.10 trillion in 2025 and is projected to surpass around USD 1.49 trillion by 2034, expanding at a CAGR of 3.41% between 2024 and 2034.

The global women wear market size is estimated at USD 1.07 trillion in 2024 and is anticipated to reach around USD 1.49 trillion by 2034, growing at a CAGR of 3.41% from 2024 to 2034. The women wear market is driven by the rise of e-commerce platforms.

The Asia Pacific women wear market size accounted for USD 44 billion in 2024 and is predicted to be worth around USD 62 billion by 2034, rising at a CAGR of 3.60% from 2024 to 2034.

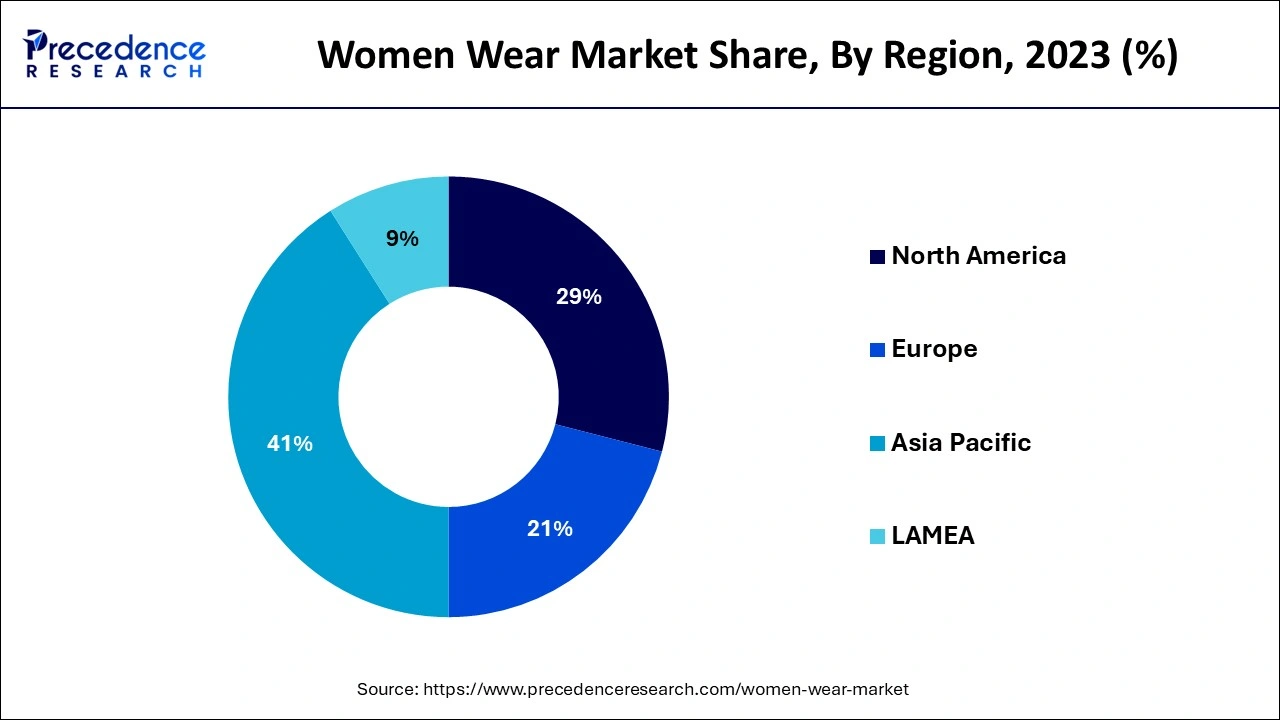

Asia- Pacific dominated women wear market in 2023. Social media's widespread use has allowed celebrities and fashion influencers in the Asia-Pacific to mold consumer tastes. Their support frequently raised demand for brands and styles. Local brands can better connect with their target audience than multinational ones because they have a deeper understanding of cultural quirks and customer preferences. The shift to online shopping is accelerating, with many brands enhancing their online presence and offering personalized shopping experiences.

There’s a blending of traditional and modern styles, reflecting local cultures while appealing to contemporary tastes. Despite the rise of sustainable practices, fast fashion remains popular, especially among younger consumers looking for trendy, affordable options. The women's wear market in Asia Pacific is poised for continued growth, driven by changing consumer preferences, technological advancements, and an increasing emphasis on sustainability. As brands adapt to these trends, they will likely capture a larger share of the market in this diverse and rapidly evolving region.

North America shows a significant growth in the women wear market during the forecast period. Particularly since the epidemic, there has been a growing trend toward more comfortable and adaptable apparel. Customers are looking for more casual and athleisure clothing that can be worn in social or professional contexts. Disposable earnings are increasing as the economy bounces back from the pandemic. Due to this rise, customers can now spend more on luxuries like women's clothing. Retailers are using technology to improve the shopping experience. Online shopping is now more customized and interactive due to AI-driven suggestions, augmented reality, and virtual fitting rooms.

In the fashion industry, women are the crucial buyers, and trends and retail tactics are influenced by female purchases. Due to the dynamic nature of women's fashion choices, which are impacted by culture, lifestyle, and shifting social standards, the market is always open to new ideas. Demand for ethical, eco-friendly, and sustainable fashion is rising due to consumers, especially women.

As a result, businesses have been compelled to reconsider their supply chains, opening new markets for circular fashion, fair labor standards, and sustainable textiles. Media trends, influencers, and celebrities significantly impact women's fashion. The emergence of fashion superstars and social media influencers is crucial in influencing customer behavior and increasing the need for brands or looks.

How is AI helping clothing industry?

Artificial Intelligence (AI) systems can pair women with peers, coaches, and mentors according to their issues, abilities, and career goals. These platforms use data analysis to provide personalized guidance and link women with skill-development opportunities. Women entrepreneurs and small business owners can concentrate on growth and strategy by using AI to automate chores like marketing, bookkeeping, and customer care (via chatbots). For women hoping to progress in industries like biotechnology or healthcare, it opens new avenues for development. AI advancements in women's health, like disease prediction, fertility monitoring, and customized wellness programs, enhance health outcomes and open new commercial prospects for women in these fields.

| Report Coverage | Details |

| Market Size by 2034 | USD 1.49 Trillion |

| Market Size in 2024 | USD 1.07 Trillion |

| Market Size in 2025 | USD 1.10 Trillion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.41% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Category, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Influence of social media & e-commerce

Social media platforms significantly raise engagement by facilitating real-time communication between brands and customers. Through surveys, comments, direct messages, and interactive stories, brands can communicate directly with their audience and gain insight into their target audience's preferences, needs, and trends. Instant feedback can reveal information about how collections are received. Based on past interactions, likes, or searches, social media sites use data to present users with products that match their preferences. These monitored suggestions raise the possibility of a purchase.

Supply chain disruptions

Many producers of women's clothing mainly depend on importing raw materials worldwide, including cotton, silk, wool, and synthetic fibers. Severe shortages may result from interruptions in these supply systems brought on by pandemics, natural disasters, or geopolitical wars. For instance, raw material costs increased when cotton prices rose due to export restrictions or unfavorable weather. Freight prices have also increased significantly as a result of the inconvenience. Increased delivery costs, especially in price-sensitive markets such as fast fashion, can reduce the profit margins of businesses that find it difficult to pass such expenses on to customers.

Innovation in fabrics

New developments in plant-based textiles, including Tencel (made from wood pulp), offer eco-friendly substitutes for conventional textiles like polyester and leather. These fabrics also provide distinctive finishes and textures, giving a unique value proposition for stylish women's clothing. Fabrics resistant to bacteria and odor give a clear advantage in light of growing health consciousness and hygiene. This innovation can be included in women's undergarments, loungewear, or workwear for long-lasting freshness. The most comfortable materials may adjust to the body's fluctuating temperatures, warming when cold and cooling when warm. These versatile textiles appeal to the busy modern lady by making clothing appropriate for various formal and professional settings.

The casual wear segment dominated the women wear market in 2023. Due to changing lifestyles, many ladies now value comfort over formality. Casual clothing has emerged as a popular option for daily activities, such as social gatherings and errand running, because of its comfortable fit, breathable materials, and adaptable styles. Companies emphasize inclusivity and provide casual clothing in a wider variety of sizes and designs to appeal to a broader range of consumers. This emphasis broadens the market and improves brand loyalty.

The sportswear segment shows a significant growth in the women wear market during the forecast period. A greater emphasis on health and wellness among women leads to increased engagement in exercise activities such as yoga, running, and group sports. Demand for cozy, practical sportswear that can be worn both during and outside of exercises is being driven by this change. Customers are increasingly drawn to companies prioritizing sustainability as environmental concerns gain more attention. In response, sportswear businesses favor ethical manufacturing processes, employ recycled materials, and provide eco-friendly solutions.

The mass segment dominated the women wear market in 2023. The mass market offers a range of patterns, sizes, and styles to suit various preferences and events. This inclusivity enables firms to connect with a wide range of consumers, from casual to formal clothes. Mass brands frequently use social media marketing and tailored advertising to reach a large audience. Working with celebrities and influencers can raise brand awareness and draw in younger customers.

The luxury segment is observed to be the fastest growing in the women wear market during the forecast period. Luxury companies that offer exceptional craftsmanship, distinctive designs, and premium materials are becoming increasingly popular as modern customers place a higher value on quality than quantity. Luxury brands use influencers and celebrities to increase brand awareness and create aspirational value. This tactic is especially appealing to younger customers who respect relatability and genuineness. To improve consumer experiences, luxury firms are implementing cutting-edge technology such as artificial intelligence (AI) and augmented reality (AR). Personalized shopping recommendations and virtual try-ons are becoming commonplace.

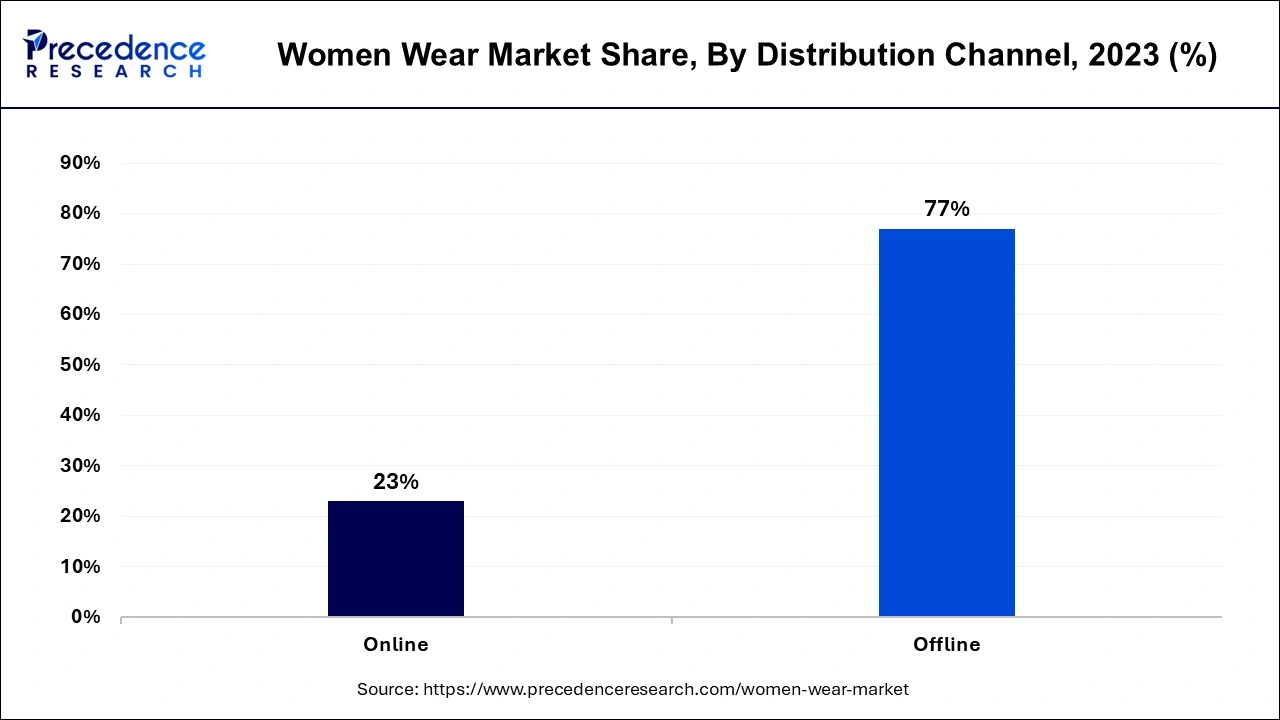

The offline segment dominated the women wear market in 2023. Many customers can easily visit offline retail stores because they are frequently positioned in shopping districts, malls, and metropolitan areas. Women typically visit stores with friends or family because they love shopping as a social activity. This social dynamic promotes purchases and improves the shopping experience. Customers can enjoy individualized attention, eye-catching displays, and carefully chosen collections in an immersive shopping environment offered by retailers. This sensory experience raises customer happiness and brand loyalty.

The online segment is observed to be the fastest growing in the women wear market during the forecast period. Customers can browse and buy products from the comfort of their homes with the unmatched convenience of online shopping. The popularity of user-friendly websites and mobile shopping apps has sped up this change. Many consumers had to adjust to online purchasing due to the pandemic's lockdowns and social distancing efforts. Shopping patterns have changed permanently due to this trend; even after physical stores reopen, many customers still choose to shop online.

Segments Covered in the Report

By Type

By Category

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

July 2024