March 2025

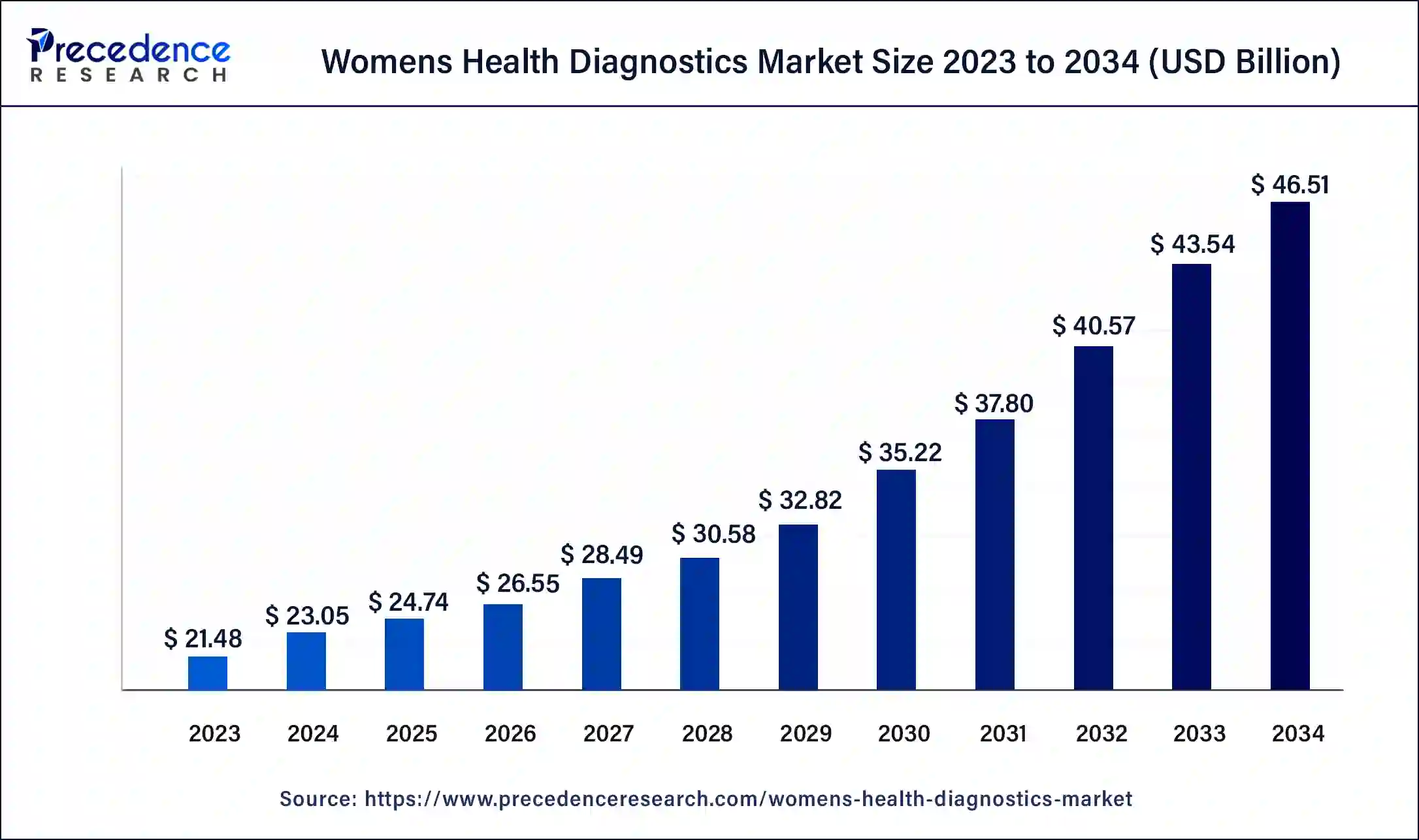

The global womens health diagnostics market size was USD 21.48 billion in 2023, estimated at USD 23.05 billion in 2024 and is anticipated to reach around USD 46.51 billion by 2034, expanding at a CAGR of 7.27% from 2024 to 2034.

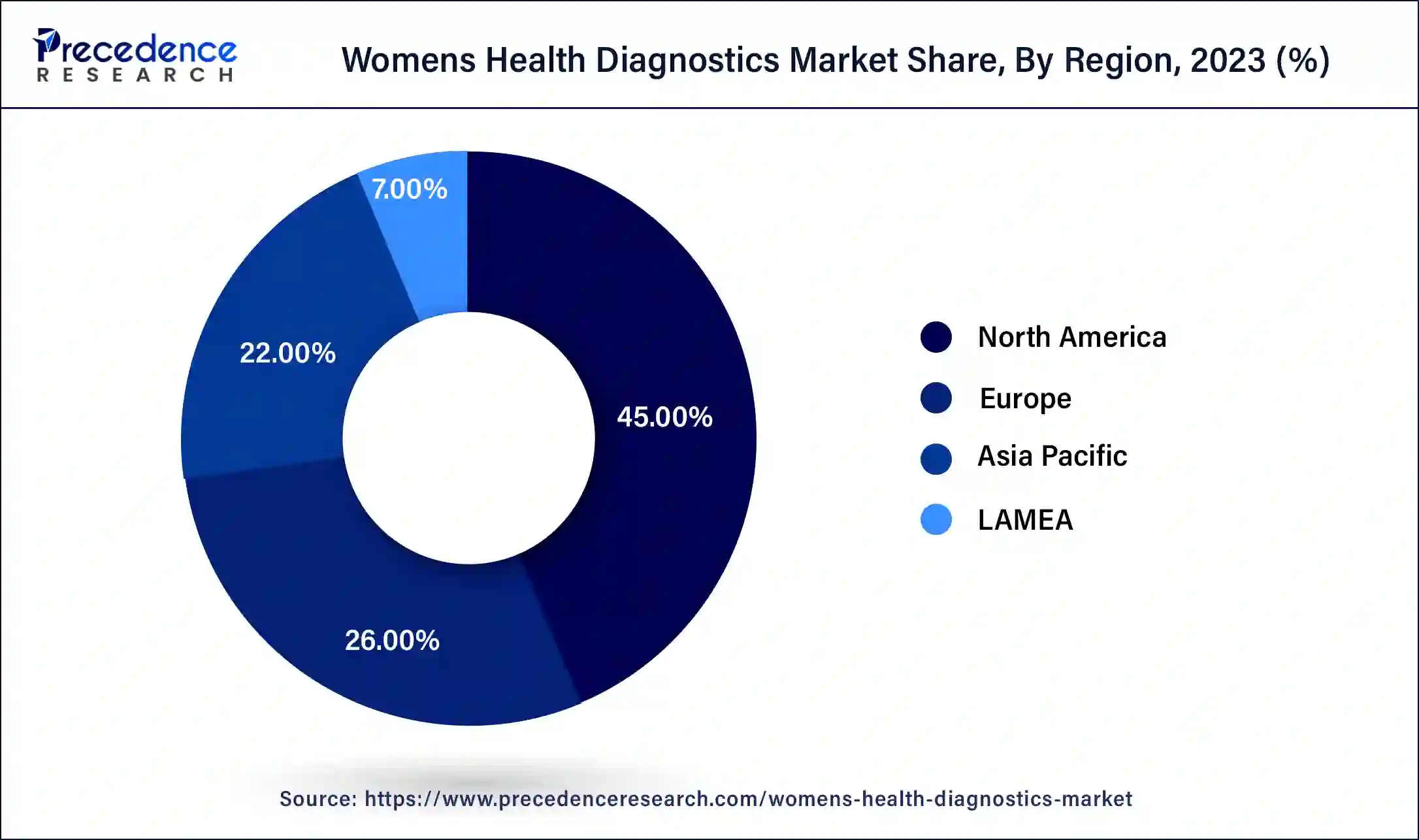

The global womens health diagnostics market size accounted for USD 23.05 billion in 2024 and is predicted to reach around USD 46.51 billion by 2034, growing at a CAGR of 7.27% from 2024 to 2034. The North America womens health diagnostics market size reached USD 9.67 billion in 2023. The increasing demand for the diagnostics of women-centric health conditions drives the growth of the market.

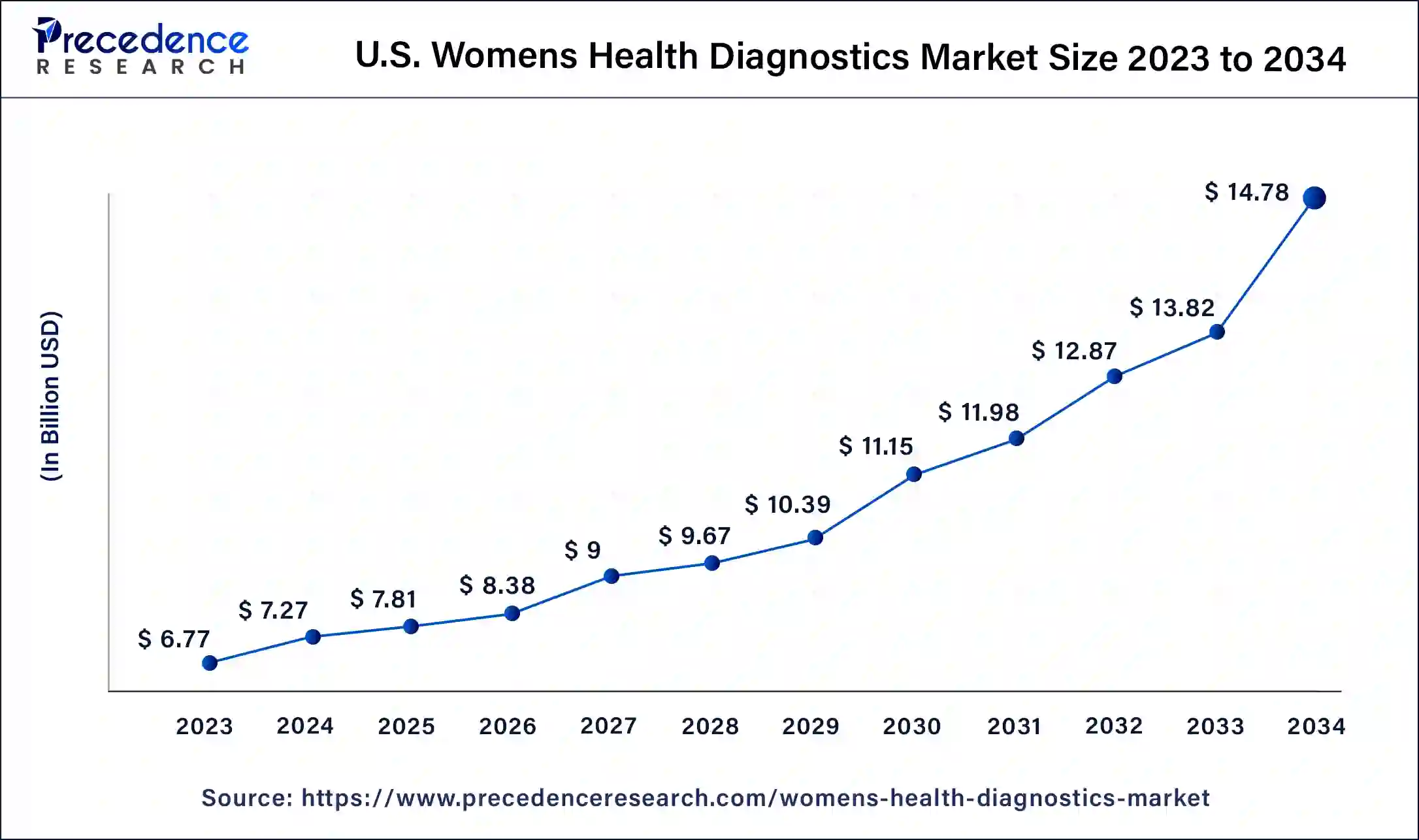

The U.S. womens health diagnostics market size was estimated at USD 7.25 billion in 2023 and is predicted to be worth around USD 14.96 billion by 2033 with a CAGR of 7.51% from 2024 to 2033.

North America led the women health diagnostics market with the largest market size in 2023. The growth of the market in the region is increasing due to the rising number of women affected by some type of diseases due to the changing lifestyle choices, accepting sedentary lifestyle, eating and sleeping habits, higher consumption of alcohol and smoking that causes the chronic illness in the women population that is contributing in the expansion of the women’s health diagnostics centers. The increasing prevalence of women-oriented cancers like breast cancer, cervical cancer, and others is highly driving the demand for the women health diagnostics market in the region.

Asia Pacific is expected to witness the fastest growth during the forecast period. The growth of the market in the region is attributed to the rising women aging population and the rising prevalence of infectious diseases among women, the modern lifestyle impacting body reproductive organ issues, and the increasing chronic illnesses such as diabetes, cardiovascular diseases, and other infectious diseases in the women is driving the demand for the women health diagnostics centers. The increasing investment by the government in the development of women-centric diagnostics centers and innovative launches associated with women's diagnostics procedures are driving the growth of the women health diagnostics market in the region.

The women health diagnostics market focuses on a specialized diagnostic process and center that helps to treat women-oriented health conditions. It includes the production of diagnostics kits and medications that help in the diagnosis process of various health issues associated with women. The increasing prevalence of chronic diseases such as diabetes, reproductive organ-related issues, breast cancer, cervical cancers, and other infectious diseases accelerates the demand for the market. The ongoing investment and research in medical science drive advancements in women's health diagnostics, which have also contributed to the growth of the market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.27% |

| Market Size in 2023 | USD 21.48 Billion |

| Market Size in 2024 | USD 23.05 Billion |

| Market Size by 2034 | USD 46.51 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of chronic diseases in women

The increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, infectious diseases, and others is accelerating the demand for specialized women’s health diagnostics centers globally. Women's health diagnostics centers work with innovative and targeted diagnostics tests to improve women's health outcomes. The rising complications in the reproductive system, heart diseases, mental health illness, sexual transmission infections, osteoarthritis, stroke, stress, and urinary tract infections in women are driving the demand for women's health diagnostics.

Heart stroke, diabetes, and heart disease are some of the common diseases that affect both men and women. Some of the diseases only affect the female organs, such as the ovaries, uterus, fallopian tubes, and vagina, and they can develop the issues like fibrosis, cysts, or cancer. The increasing prevalence of chronic diseases due to changing lifestyle habits further contributes to the growth of the women health diagnostics market.

Increased diagnostics cost

The higher cost of the diagnostics of several diseases limits the adoption of the women health diagnostics market. Hospitals in economically developing countries have less of a budget for the deployment of such technologically advanced health diagnostic devices due to the higher cost of the machines or devices that restrict the growth of the market. Underdeveloped countries lack resources and do not have large healthcare budgets, which is why they are only able to invest in highly essential resources. In the case of developed countries, due to inflation and the high cost of healthcare, people who belong to the poor class and people who live in rural areas are not able to afford basic resources.

Trends and advancements in women’s health diagnostics

The increasing investment in advancements in women's health diagnostics to improve women's health outcomes and the development of diagnostics centers are driving the opportunity for market growth. The technological integration in the diagnostic process, such as breast cancer screening, HPV, NIPT, and personalized fertility testing, enhances the early detection and treatment process. Healthcare trends like telemedicine and remote monitoring technologies in the diagnostics of diseases, especially for women in remote areas, are enhancing the health outcomes of women.

The increasing investments in the research and development activities in the innovative and more accessible, personalized, accurate diagnostics process that can fulfill the unique health requirement in women. Thus, all the technological advancements in women’s health diagnostics drive opportunities in the women health diagnostics market.

The diagnostics devices segment dominated the women health diagnostics market with the largest share in 2023. Diagnostic devices are used by professional physicians or doctors to detect, diagnose, and monitor medical conditions. Diagnostic devices help in treatment planning and monitoring, disease staging and prognosis, and guiding surgical interventions. Diagnostic medical imaging equipment, electrocardiograph (ECG) machines, spirometers, blood pressure monitors, endoscopes, self-diagnostic kits, and laboratory equipment are some of the diagnostics devices. The rising prevalence of diseases drives the demand for medical diagnostics devices for the treatment and monitoring of patients, which drives the demand for the segment.

The breast cancer segment dominated the women health diagnostics market with the highest share in 2023. The growth of the segment is attributed to the rising incidence of breast cancer in women globally, which is driving the demand for women’s health diagnostics centers. Breast cancer is one of the most common types of cancer in women globally. Breast cancer is caused by abnormal growth of the cancerous cells in the breast and becomes a tumor. Approximately 80% of breast cancers are invasive, and they spread from the breast to the other part of the body.

A maximum of women above the age of 50 are likely to be affected by breast cancer. Invasive (infiltrating) ductal carcinoma (IDC), Lobular breast cancer, Ductal carcinoma in situ (DCIS), Triple-negative breast cancer (TNBC), inflammatory breast cancer (IBC), and Paget’s disease of the breast are some of the types of breast cancer. Increased alcohol consumption, genetics, family history, smoking, radiation exposure, obesity, and hormonal replacement therapy are the major cause of breast cancer in women.

The hospital and diagnostics centers segment projected the highest growth in the market in 2023. The rising acceptance and preferences for the treatment and diagnostics of several kinds of illnesses and disorders are driving the segment's expansion. The rising investment by the public and private institutes for the development of hospital and diagnostic centers and the higher availability of professional physicians, technologically advanced medical equipment, and devices in the hospitals and diagnostics centers drive the segment's growth.

Segments Covered in the Report

By Type

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

January 2025