January 2025

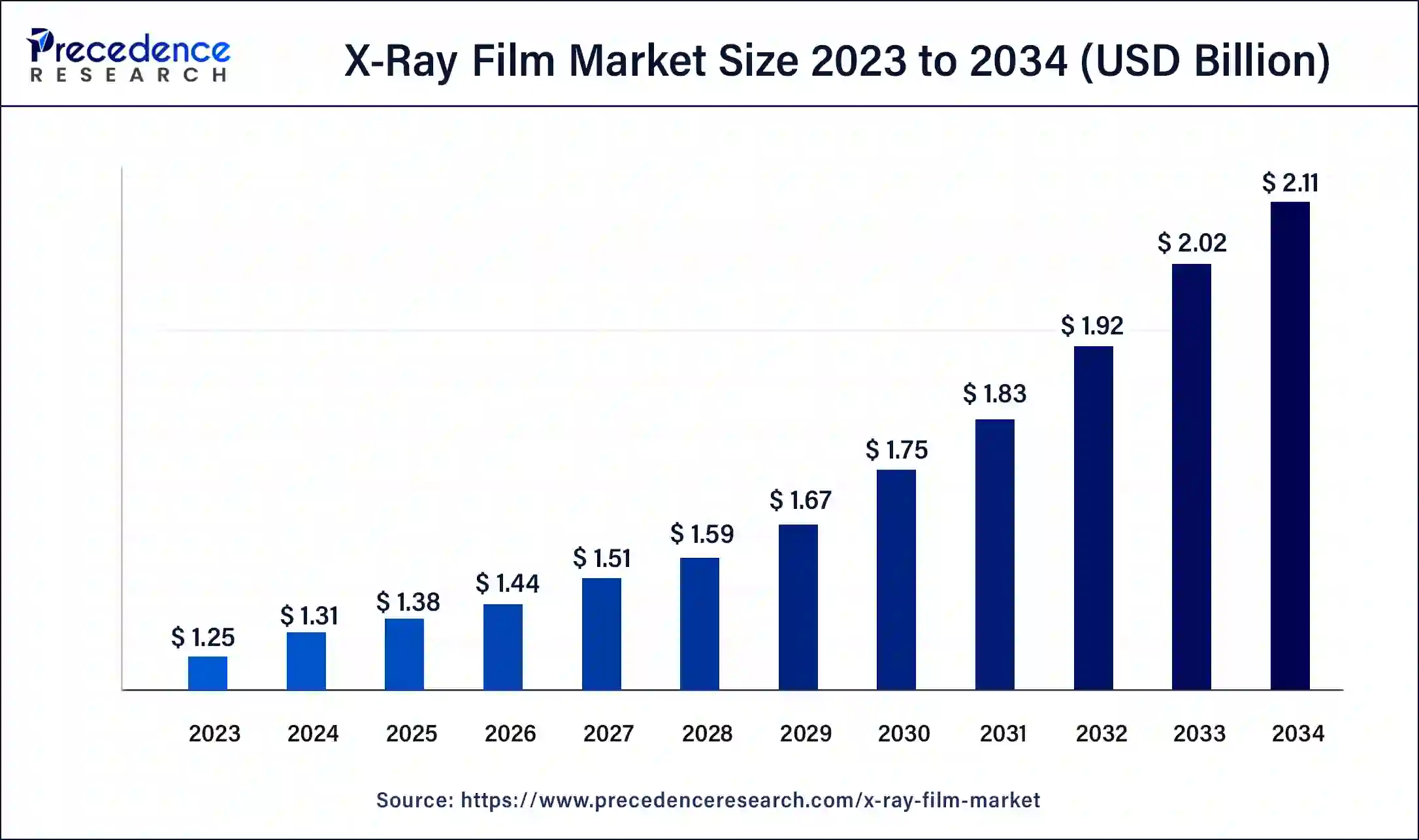

The global X-ray film market size was USD 1.25 billion in 2023, estimated at USD 1.31 billion in 2024 and is anticipated to reach around USD 2.11 billion by 2034, expanding at a CAGR of 4.90% from 2024 to 2034.

The global X-ray film market size accounted for USD 1.31 billion in 2024 and is predicted to reach around USD 2.11 billion by 2034, growing at a CAGR of 4.90% from 2024 to 2034.

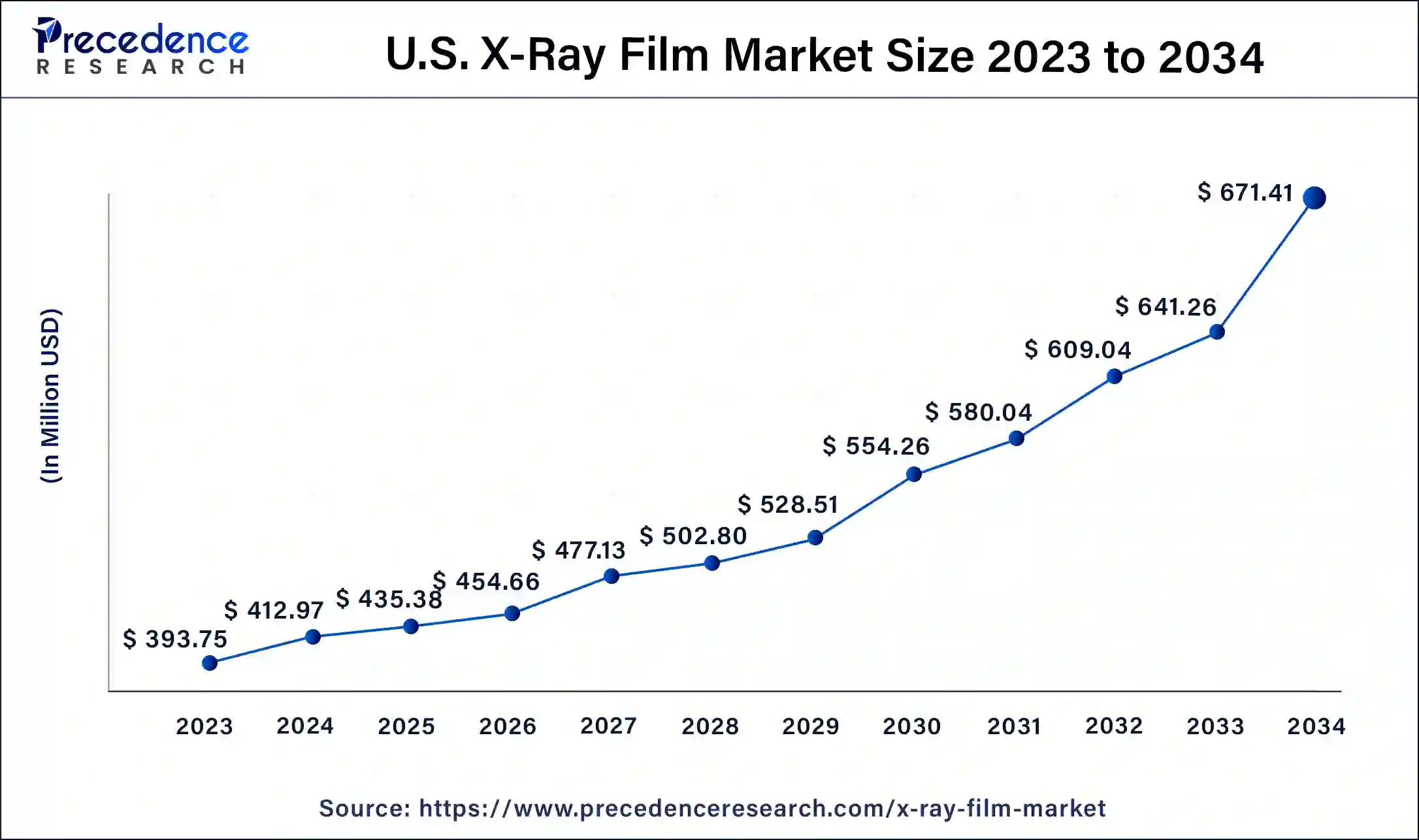

The U.S. X-ray film market size was valued at USD 393.75 million in 2023 and is expected to be worth around USD 671.41 million by 2034, at a CAGR of 4.98% from 2024 to 2034.

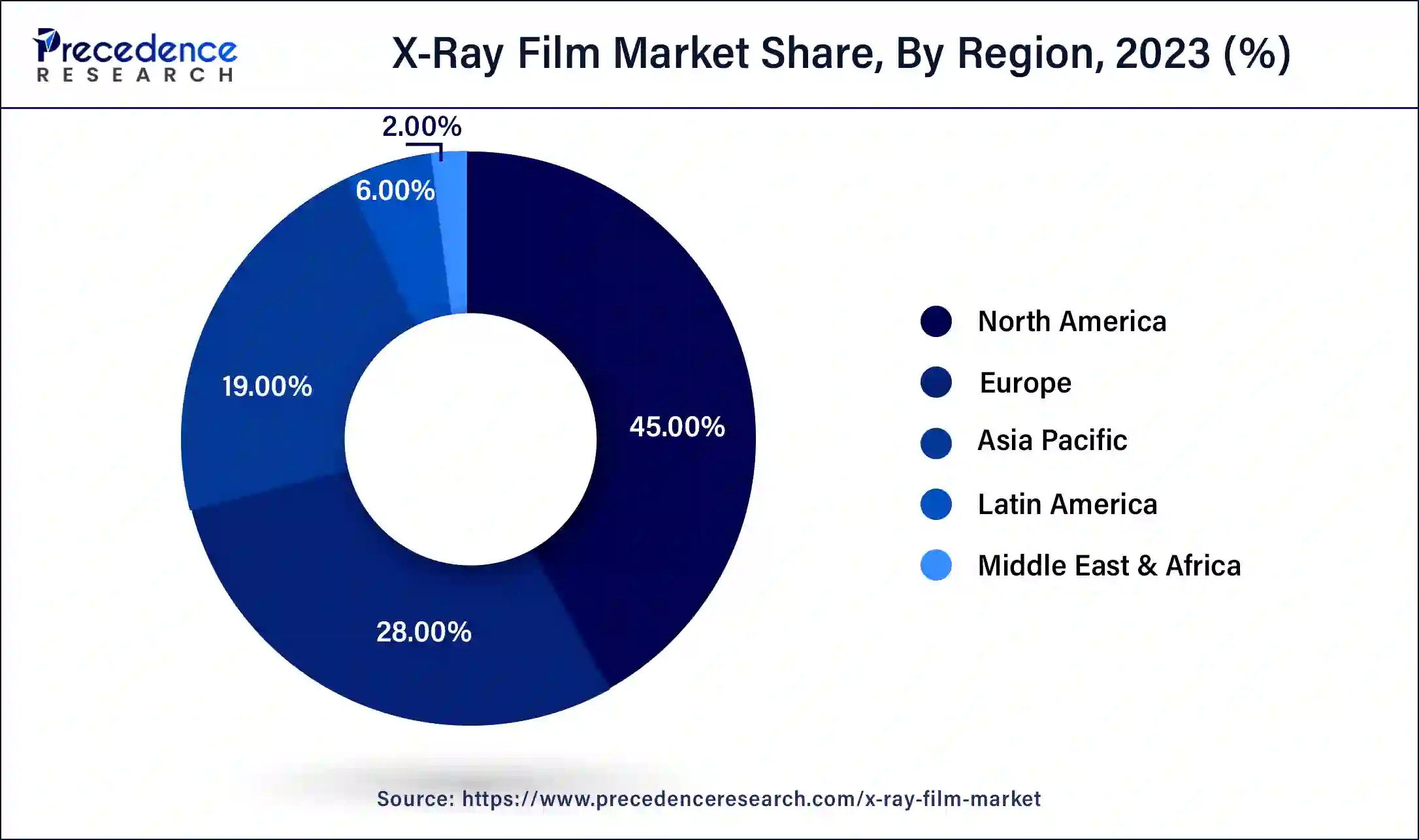

North America has held the largest revenue share of 45% in 2023. North America commands a significant share in the X-ray film market due to robust healthcare infrastructure, technological advancements, and high healthcare spending. The region's well-established medical facilities, coupled with a matured market for diagnostic imaging, contribute to the dominance. Additionally, a proactive approach to adopting advanced medical technologies, including digital radiography, fuels market growth. The presence of key market players, ongoing research and development initiatives, and a growing aging population further consolidate North America's position as a major contributor to the X-ray film market.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific dominates the X-ray film market due to a confluence of factors, including rapid technological advancements, growing healthcare infrastructure, and a substantial patient population. The region's expanding economies, particularly in countries like China and India, drive increased healthcare spending and the adoption of diagnostic imaging technologies. Moreover, a rising prevalence of chronic diseases fuels the demand for X-ray films. Additionally, the industrial sector in Asia-Pacific relies heavily on X-ray films for non-destructive testing, further contributing to the region's major share in the global X-ray film market.

X-ray film is a crucial component in medical imaging, serving as a traditional yet indispensable tool for capturing internal structures of the human body. Comprising a light-sensitive emulsion on a flexible base, typically made of polyester, these films are exposed to X-rays during medical examinations. When X-rays pass through the body and interact with different tissues, varying levels of radiation absorption occur, creating a latent image on the film. Subsequent chemical processing develops this latent image into a visible representation of the internal structures, enabling healthcare professionals to diagnose and monitor various medical conditions.

Despite advancements in digital imaging technologies, X-ray film remains relevant in certain medical settings due to its cost-effectiveness and reliability. It continues to be employed in radiography, fluoroscopy, and dental imaging, providing a tangible and easily interpretable record of a patient's anatomy. While digital alternatives offer advantages in terms of immediate access and manipulation of images, X-ray film persists as a durable and widely accessible medium in the realm of diagnostic radiology.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.25 Billion |

| Market Size in 2024 | USD 1.31 Billion |

| Market Size by 2034 | USD 1.93 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.90% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Dental imaging demand and diagnostic accuracy

The demand for X-ray films in the medical imaging market is significantly bolstered by the crucial roles they play in dental imaging and ensuring diagnostic accuracy. In dental applications, X-ray films remain a cornerstone in traditional dental radiography, offering detailed imaging of teeth and surrounding structures. Dentists rely on X-ray films to detect dental issues such as cavities, infections, and structural abnormalities, driving consistent demand for these films in dental practices.

Moreover, the inherent diagnostic accuracy of X-ray films solidifies their position in various medical settings. These films provide high-resolution images that allow healthcare professionals to identify subtle abnormalities, aiding in the precise diagnosis of a range of medical conditions. The reliability and clarity of X-ray films make them indispensable in situations where fine details are crucial, contributing to sustained market demand driven by the imperative for accurate and comprehensive diagnostic imaging across diverse medical specialties, including dentistry.

Storage and retrieval challenges

The storage and retrieval challenges associated with traditional X-ray films represent a significant restraint on the market's growth. Unlike digital imaging, which allows for electronic storage, X-ray films necessitate physical archiving space. This poses logistical difficulties for healthcare facilities, as maintaining extensive physical film libraries can be space-consuming and organizationally demanding. Retrieving specific patient records from these archives is often time-intensive, potentially impeding the efficiency of medical workflows. In an era where digital solutions offer instant access and seamless retrieval of medical images, the limitations of physical storage become increasingly apparent.

The shift towards electronic health records and Picture Archiving and Communication Systems (PACS) further accentuates the need for streamlined, digital solutions. The storage and retrieval challenges associated with X-ray films hinder the overall adaptability and efficiency of healthcare systems, contributing to a gradual decline in their preference compared to more technologically advanced alternatives.

Digital radiography conversion

The ongoing trend of digital radiography conversion is creating significant opportunities for the X-ray film market. As healthcare providers increasingly transition from traditional radiography to digital imaging systems, there arises a demand for solutions that facilitate a smooth conversion process. Companies in the X-ray film market have an opportunity to provide conversion services, allowing healthcare facilities to upgrade their existing radiography equipment to incorporate digital capabilities. This not only addresses the need for modernization but also caters to institutions that may prefer a phased approach rather than a complete overhaul of their imaging infrastructure.

Moreover, offering digital radiography conversion services aligns with the broader industry shift toward electronic health records and integrated healthcare information systems. The X-ray film market can capitalize on this opportunity by providing comprehensive solutions that bridge the gap between conventional film-based imaging and the benefits of digital radiography, ensuring a seamless transition for healthcare providers.

In 2023, the full speed blue segment had the highest market share of 42% on the basis of the type. The full-speed blue segment in the X-ray film market refers to a specialized type of X-ray film designed for high-speed imaging applications, particularly in medical diagnostics. This segment caters to the need for rapid image acquisition, allowing healthcare professionals to obtain diagnostic results quickly. The trend in the full-speed blue segment involves continuous advancements in emulsion technology and manufacturing processes to enhance the sensitivity of the film, enabling faster exposure times and improved image quality, thereby meeting the demand for swift and accurate diagnostic imaging in medical settings.

The green segment is anticipated to expand at a significant CAGR of 5.2% during the projected period. In the X-ray film market, the "green" segment refers to environmentally friendly or sustainable X-ray films. Green X-ray films are designed to minimize the environmental impact associated with traditional film processing, often featuring lead-free and recyclable components. A growing trend within this segment involves the development of X-ray films that adhere to eco-friendly practices, addressing concerns about chemical waste and energy consumption. As healthcare industries prioritize sustainability, the demand for green X-ray films is expected to rise, driving innovation towards more environmentally conscious solutions in the diagnostic imaging sector.

According to the end user, the medical segment has held 49% revenue share in 2023. In the X-ray film market, the medical segment encompasses healthcare facilities such as hospitals, diagnostic imaging centers, and clinics that utilize X-ray films for medical diagnostics. A key trend in this segment is the gradual integration of digital radiography alongside traditional X-ray films. While digital technologies continue to advance, medical end-users exhibit a dual-modality approach, leveraging the strengths of both digital and film-based imaging for a comprehensive and flexible diagnostic strategy, catering to the diverse needs of healthcare professionals.

The industrial segment is anticipated to expand fastest over the projected period. In the X-ray film market, the industrial segment refers to end-users within the manufacturing and industrial sectors employing X-ray films for non-destructive testing (NDT) applications. This includes inspecting welds, detecting structural defects, and ensuring product quality in industries such as aerospace, automotive, and manufacturing. A notable trend in the industrial segment involves the increasing adoption of digital radiography systems for NDT, offering enhanced efficiency, immediate results, and streamlined data management. While traditional X-ray films persist in industrial settings, the market is witnessing a gradual shift towards digital solutions for improved precision and workflow integration.

Segments Covered in the Report

By Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025