August 2024

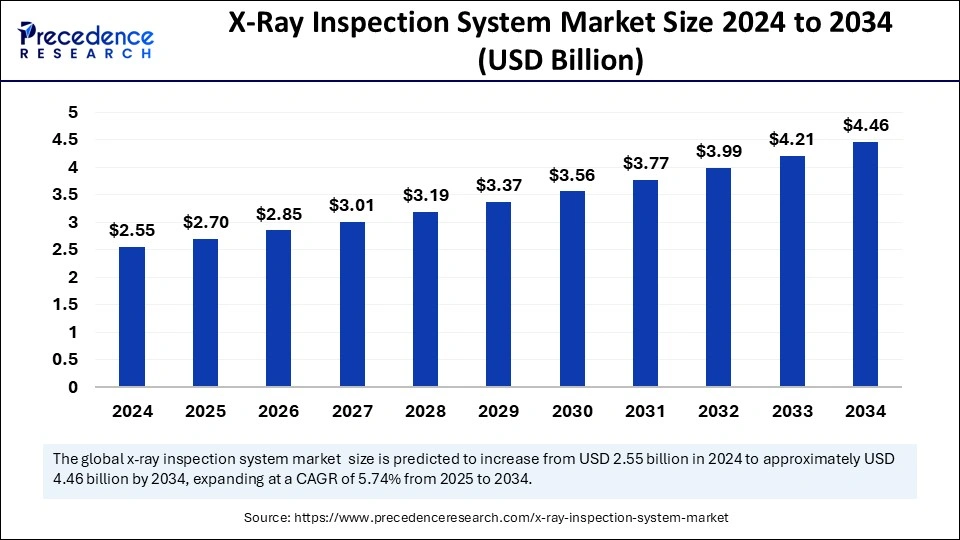

The global X-ray inspection system market size is calculated at USD 2.7 billion in 2025 and is forecasted to reach around USD 4.46 billion by 2034, accelerating at a CAGR of 5.74% from 2025 to 2034. The North America market size surpassed USD 0.94 billion in 2024 and is expanding at a CAGR of 5.92% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global X-ray inspection system market size accounted for USD 2.55 billion in 2024 and is predicted to increase from USD 2.70 billion in 2025 to approximately USD 4.46 billion by 2034, expanding at a CAGR of 5.74% from 2025 to 2034. The market is predominantly fueled by growing security concerns, prompting airports, transportation hubs, and critical infrastructure facilities to make substantial investments in advanced X-ray technologies aimed at strengthening them.

The integration of artificial intelligence (AI) is revolutionizing the X-ray inspection system market, enhancing precision, efficiency, and automation in security screening and quality control to evolve. The need for advanced inspection solutions surged, promoting industries such as aviation, manufacturing, and healthcare to embrace smart technology.

Computerized systems leverage machine learning algorithms and deep learning techniques to improve image recognition, anomaly detection, and decision-making processes. These systems can rapidly analyze vast amounts of data, identifying hidden threats, defects, or inconsistencies with greater accuracy than traditional methods. In security applications, AI enhances baggage screening at airports by reducing false alarms and improving the detection rates of prohibited items.

Additionally, the synergy between AI and radiograph inspection is poised to redefine security and quality assurance industries. As digital models become more sophisticated, they will further improve threat detection, reduce operational costs, and enhance overall system reliability.

Scanning the Future: A Deep Dive into the X-Ray Inspection System Market

The global X-ray inspection system market has emerged as a cornerstone in the quality control, security, and diagnostics sectors, driven by the rapid advancement of imaging technologies and growing integration of smart devices. These systems are widely used across industries, including healthcare, food and beverages, aerospace, electronics, and security, offering non-destructive, real-time analysis for defect detection. This capability not only streamlines production processes but also upholds regulatory compliance, minimizes risk, and enhances product reliability on a global scale.

High-tech use of products in the industry has led to the rise of digital radiography, which offers superior image quality, faster processing, and reduced radiation exposure compared to traditional film-based methods. With unmatched versatility and ability to enhance operational integrity, the market continues to expand its footprints across the globe, emerging not merely as tools but as strategic assets in achieving excellence, safety, and trust.

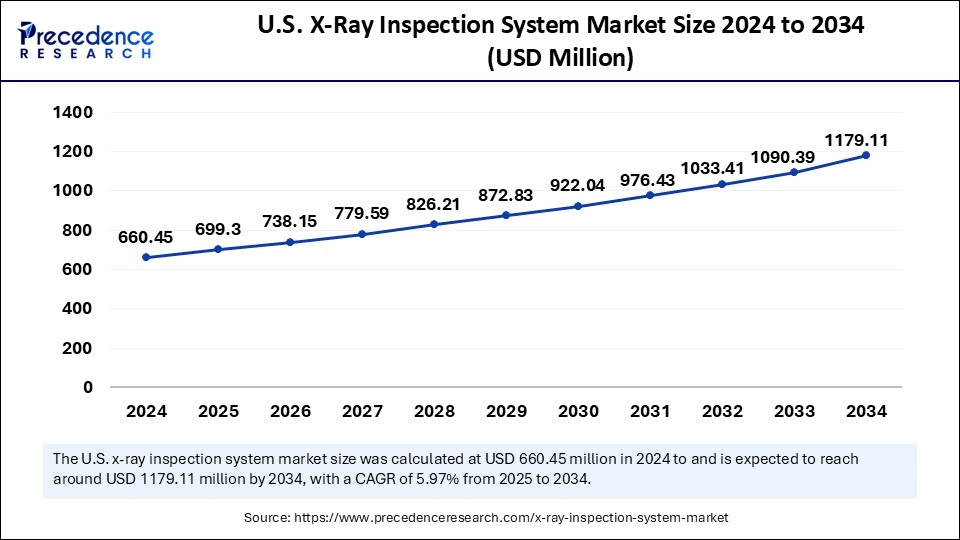

The U.S. X-ray inspection system market size was exhibited at USD 660.45 million in 2024 and is projected to be worth around USD 1179.11 million by 2034, growing at a CAGR of 5.97% from 2025 to 2034.

Is North America Setting the Inspection Standard?

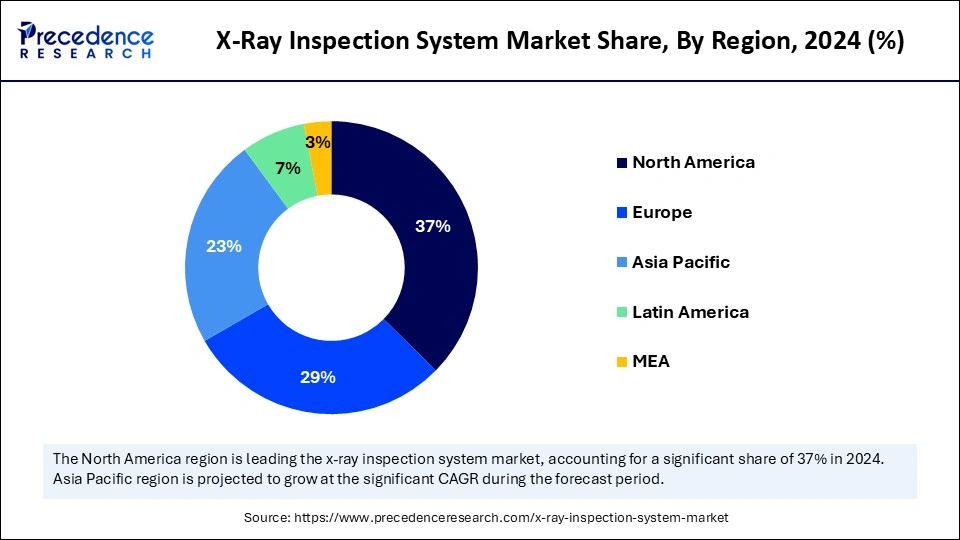

North America dominated the X-ray inspection system market in the year 2024. The growth of the region is due to a strong industrial base, advanced healthcare infrastructure, and consistent technological innovation. The region benefits from the early adoption of cutting-edge inspection technologies, stringent regulatory standards, and a high concentration of key market players across sectors such as defense, electronics, and medical imaging. The key market player in this region U.S., remains the primary contributor, backed by its advanced industrial infrastructure and strong focus on technological innovation.

Is the future of X-Ray Inspection Made in Asia Pacific?

Asia Pacific is estimated to expand the fastest CAGR in the X-ray inspection system market between 2025 and 2034, driven by rapid industrialization, expanding manufacturing capabilities, and increasing investment in quality control and safety standards. Countries like China, Japan, South Korea, and India are at the forefront of this growth, leveraging inspection systems across self-propelled, electronics, food processing, and pharmaceutical industries. It has been recently observed that some strong government initiatives made in China policy were booming the electronics sector and further accelerating the growth of the market.

Europe Growing at a Notable Pace

Europe has been witnessing notable growth in the global X-ray inspection system market but is considered a developing region compared to North America and Asia-Pacific. Germany, France, and the UK are key contributors, with an emphasis on automotive, aerospace, and food safety applications. Europe is also actively investing in sustainability and energy-efficient technologies, impacting the development of innovative x-ray systems. Emphasis on automation, sustainability, and quality assurance, combined with supportive government policies and a focus on research and development, continues to propel the region’s market forward. Some leading companies in this region are leading companies include Bosello High Technology srl, YXLON International, and Smiths Detection.

Worldwide Product Highlights

| Country | Company | Product |

| United Kingdom | Smith’s Detection | Unveiled their latest HI-SCAN 6040 CTX with AI-powered threat recognition in 2024 |

| America | Varex Imaging | Launched an AI-integrated digital X-ray flat-panel detector for industrial inspection in 2023 |

| China | Nuctech | Deployed enhanced cargo inspection systems at Sanghai port in 2023. |

| Germany | YXLON international | Introduced the cheetah EVO plus for semiconductors in 2024 |

| Japan | Canon Medical | Released a next-generation 3D imagining on healthcare and precision diagnostics in 2024 |

| Report Coverage | Details |

| Market Size by 2034 | USD 4.46 Billion |

| Market Size in 2025 | USD 2.7 Billion |

| Market Size in 2024 | USD 2.55 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.74% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Dimension, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

High-end security needs

The growing need for high-end security solutions across airports, border controls, and public spaces is a major driver of the X-ray inspection system market. With rising global security threats and an increase in contraband smuggling, governments and private sectors are investing in advanced X-ray systems to enhance security screening. The aviation industry has seen a surge in the adoption of digitally hi-tech scanners, with the U.S. Transportation Security Administration and European civil aviation conference implementing stricter regulations.

High investment costs and maintenance challenges

Despite the growing demand, the market faces challenges due to the high upfront costs associated with purchasing and installing advanced X-ray inspection systems. Additionally, the cost of regular maintenance, software updates, and skilled personnel for system operation can be a significant financial burden, especially for developing economies. Moreover, industries like food and pharmaceuticals require stringent compliance with safety regulations, further increasing operational costs.

The machine sector is witnessing rapid growth, driven by technological advancements and increasing adoption in industrial and medical applications. The integration of AI-powered automated detection has significantly improved accuracy and reduced manual screening efforts, making X-ray inspection more efficient.

The digital imaging segment held the largest X-ray inspection system market share in 2024. It is witnessing growth due to its high resolution, faster processing time, and ease of data storage and sharing. Industries such as aerospace, automotive, and healthcare have rapidly shifted towards digital solutions for real-time, precise inspection. Recently, next-gen digital flat-panel detectors have been introduced in the market, offering improved image clarity and higher inspection speeds, gaining traction in industrial applications. Precision and speed are the key factors that are keeping this segment in supremacy.

On the other hand, the film-based imaging segment is anticipated to grow at a remarkable CAGR between 2025 and 2034 due to its remaining relevance in regions with limited digital infrastructure and for specific legacy applications. The key factors contributing to constant market growth include cost-effectiveness, simplicity, and continued demand in emerging economies and traditional applications. Recently, some oil and gas companies in remote areas continue to utilize film-based systems, although they are gradually transitioning to alphanumeric substitutes.

The 2D X-ray segment held the largest X-ray inspection system market share in 2024. It is witnessing growth due to proven reliability, faster processing capabilities, and cost-effective deployment. Widely adopted across industries such as automotive, electronics, food processing, and manufacturing systems. This segment offers efficient defect detection and quality control with minimal complexity. Their ability to deliver high-resolution flat images in real time without requiring advanced computational infrastructure makes them a preferable choice for routine inspection.

However, the 3D X-ray segment is anticipated to grow at a remarkable CAGR between 2025 and 2034 due to demand for in-depth inspections in aerospace, electronics, and medical applications. It provides comprehensive visualization, improving fault detection and quality assurance. This segment offers depth perception and layered visualization, which significantly enhances accuracy in identifying hidden defects, voids, or misalignments, especially in critical applications such as aerospace, automotive, and electronics manufacturing. As industries increasingly adopt advanced quality assurance standards and advanced devices, the demand for 3D imaging systems is increasing.

The manufacturing segment held the largest X-ray inspection system market share in 2024. It is witnessing growth due to its extensive reliance on non-destructive testing for quality assurance, defect detection, and process optimization. Industries such as automotive, electronics, and food and beverages heavily rely on tomographic solutions to maintain production standards and regulatory compliance, solidifying manufacturing's dominate market position. For instance, GE measurement and control introduced advanced X-ray systems for robotic inspection on manufacturing lines, improving quality control in 2024.

Meanwhile, the aerospace segment is anticipated to grow at a remarkable CAGR between 2025 and 2034 due to the increasing need for the precision inspection of high-value components, complex assemblies, and composite materials. As global aviation demand rises and safety regulations become more stringent, the adoption of advanced inspection technologies in aerospace is accelerating rapidly, marking it as a key growth frontier in the market. For instance, in 2024, Nikon Metrology unveiled its latest CT scan system, optimized for inspecting turbine blades and aerospace composites, boosting safety and performance standards.

By Technology

By Dimension

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

October 2024

January 2025

January 2025