September 2024

Dairy Products Market (By Product Type: Milk, Cheese, Butter, Desserts, Yogurt, and Others; By Distribution Channel: Supermarket/Hypermarket, Specialty Stores, Convenience Stores, and Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024 - 2033

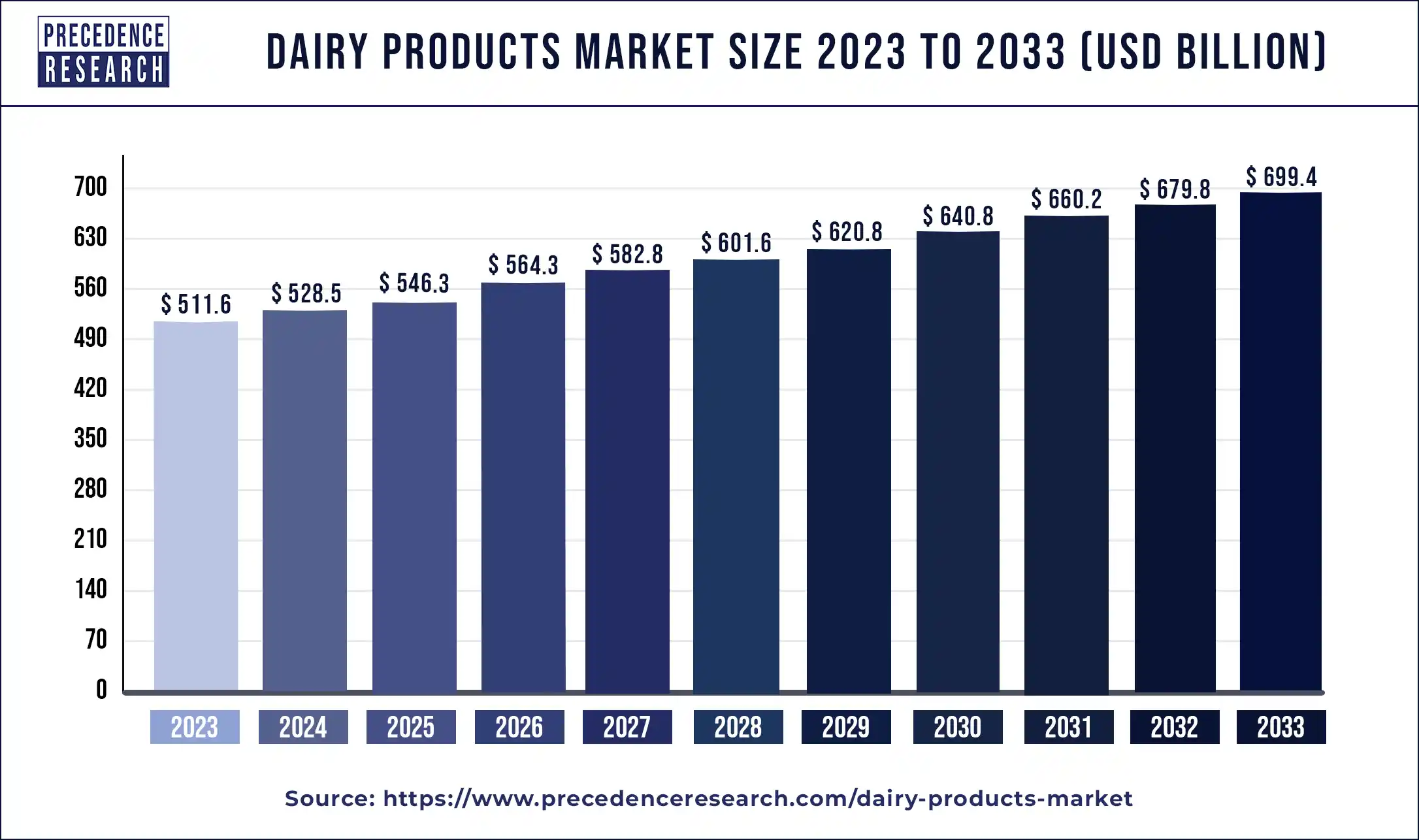

The global dairy products market size was valued at USD 511.6 billion in 2023 and is expected to hit USD 699.4 billion by 2033, poised to grow at a noteworthy compound annual growth rate (CAGR) of 3.17% from 2024 to 2033.

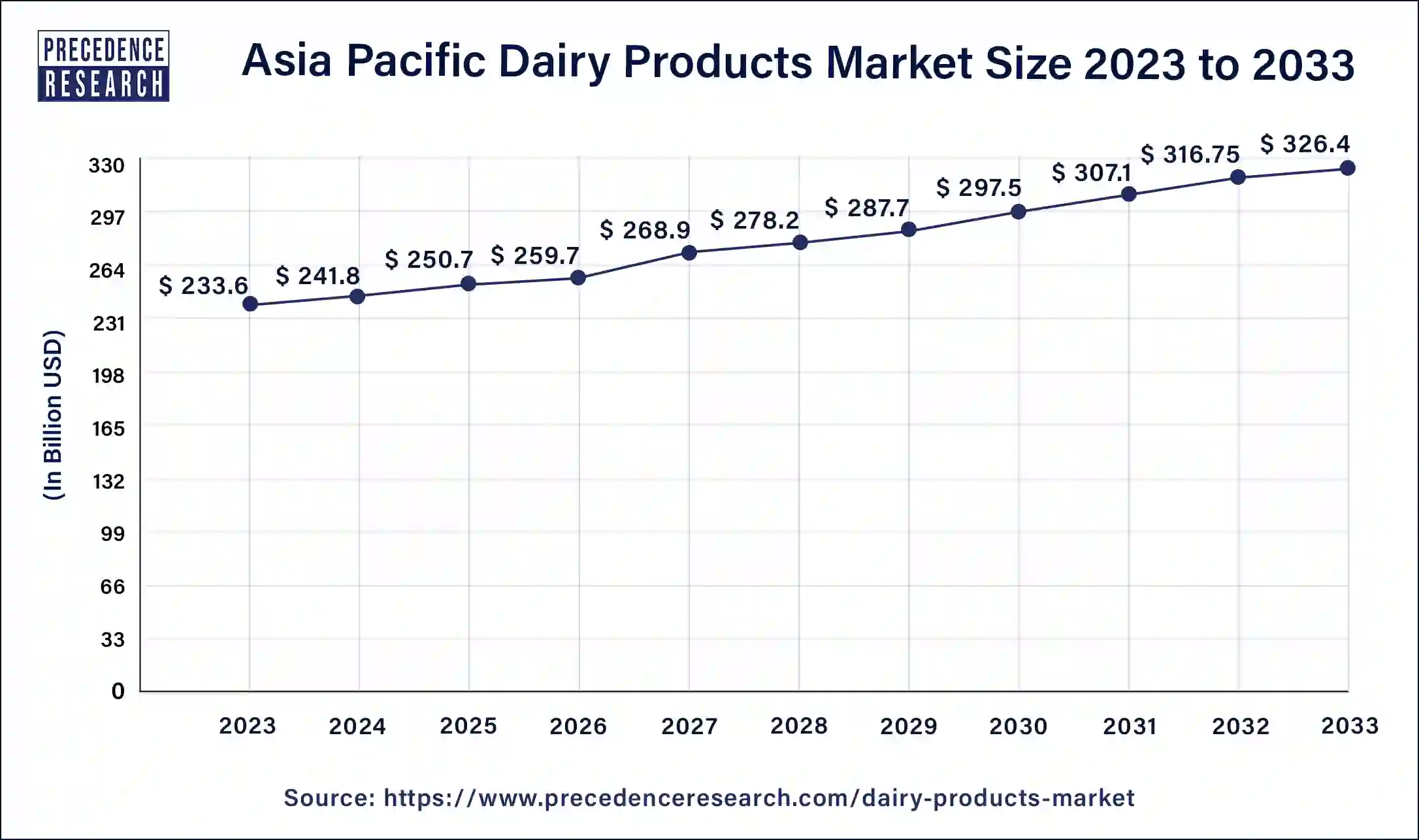

The Asia Pacific dairy products market size was estimated at USD 233.6 billion in 2023 and is projected to surpass around USD 326.4 billion by 2033 at a CAGR of 3.4% from 2024 to 2033.

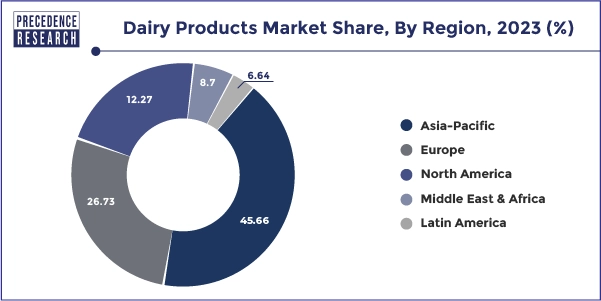

Based on the region, the Asia Pacific dominated the global dairy products market in 2023 with revenue share of 45.66% and is estimated to sustain its dominance during the forecast period. The region is expected to generate revenue of USD 297.5 billion by 2030.

The region is characterized by huge population, increased demand for milk, increasing milk production, rising government initiatives for boosting milk production, rising disposable income, and rapid urbanization. The rising consumer awareness regarding the health benefits of dairy products is fueling the market growth. Moreover, the increased usage of milk in almost every household in nation like India and China had significantly contributed towards the dairy products consumption. Therefore, the Asia Pacific region is expected to sustain its dominance throughout the forecast period.

On the other hand, North America is estimated to be the most opportunistic market during the forecast period. This is due to the increased penetration of restaurants and fast food chains such as Burger King, Pizza Hut, Domino’s, and Yum Brands. These restaurants extensively use cheese and butter in the majority of its products. Furthermore the growing popularity of yogurt and dairy desserts among the North American consumers is boosting the growth of the North America dairy products market during the forecast period. The rising consumer awareness regarding A2 milk is expected to fuel the market growth in North America.

The rising demand for the dairy products is driven by several factors such as growing population, rising personal disposable income of the consumer, rising health awareness, increasing production of milk in developing nations, and rising consumption of protein enriched food. According to the Population Reference Bureau, the global population is expected to reach around 9.9 billion by 2050. The growing population is expected to drive the demand for milk, butter, yogurt, various other dairy products owing to its extensive uses in various dishes and direct consumption. Dairy products provide high value protein and essential micronutrients to the consumers. Studies have shown that cheese is good for the heart health. The rising awareness regarding the health benefits of dairy products is further boosting the demand for the dairy products across the globe. Moreover consumers shifting preference from meat to dairy-based products for micronutrients and proteins, the demand is estimated to rise significantly in the upcoming years.

The dairy products market is expected to grow owing to the rising government schemes and initiatives regarding milk production and improving cattle productivity. For instance, National Dairy Program by the government of India, focuses on the development of cattle and milk production. The rising penetration of fast food chains is significantly boosting the consumption of dairy products such as cheese, dairy desserts, and butter. These dairy products are extensively used in various dishes like pasta, burger, pizza, and many more. The delicious taste and protein content of the dairy products is propelling the consumption of dairy products in households. Further, milk is now considered as an essential and daily use product in majority of the households. Therefore, the global dairy products market is expected to grow at a considerable rate during the forecast period.

Growing Demand for Alternatives such as Plant Protein

The demand for plant-based food alternatives is increasing among consumers, owing to growing awareness about animal welfare. Plant-based dairy products alternatives such as soy milk, almond milk, non-dairy ice-creams, cheese analogues, and whipped cream are rapidly moving into the mainstream retail market, owing to the growing perception that plant-based products are healthier and safer.

The rapidly developing dairy alternatives industry with new product innovations such as non-dairy ice-creams, cheese analogues, and whipped creams is expected to hamper the global dairy products market growth. Increasing number of people who do not consume lactose is a major restraining factor for the growth of global dairy products market. Additionally, increasing incidence of lactose intolerance such as allergies from milk or milk-based products, and a shift toward vegan diets due to potential health benefits offered by vegan diet and healthy lifestyles are also expected to restrain the market growth during the forecast period. For instance, according to the Survey conducted by National Institutes of Health (NIH) in 2020, in the U.S., Europe, and China, more than 5%, 10%, and 90% of the population are intolerant to lactose, respectively. Thus aforementioned factors are expected to restrain the market growth during the forecast period.

Additionally, dairy product manufacturers require high capital investments to install processing equipment. This processing equipment has high installation costs and requires timely maintenance, which is a costly addition affecting the operating margins of dairy product processors. Hence, high capital investment is also expected to restrain the market growth.

| Report Highlights | Details |

| Market Size | USD 699.4 Billion by 2033 |

| Growth Rate | CAGR of 3.17% From 2024 to 2033 |

| Fastest Growing Market | North America |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Distribution Channel, Region |

| Companies Mentioned | Arla Foods Amba, Danone, Fonterra, Lactalis, Nestle, Frieslandcampina, DMK Group, Dairy Farmers of America, Inc., GCMMF, Meiji Holdings Co. Ltd., The Kraft Heinz Company |

Impact Of Covid-19

The global economy has been affected by the coronavirus pandemic, as governments across the globe imposed lockdown measures to curb the movement of people. Due to these lockdowns, industrial activities halted and international travel was ceased. These measures had a significant toll on almost all industrial sectors. Factories and manufacturing facilities also faced supply chain breakdowns and labor shortages.

The COVID-19 pandemic continues to wreak havoc on the supply chain of the dairy products industry. Various countries and sub regions such as the U.S., Germany, France, China, India, Japan, and ASEAN are prominent markets, in terms of both production and consumption of dairy products. These countries are most heavily impacted by the COVID-19. The pandemic has slowed the dairy products manufacturing projects due to labor shortage and disruption in raw materials supply. Due to such interruptions to global trade, the projects under construction were delayed, resulting in higher capital expenditure (CAPEX) for such dairy product manufacturing projects, which in turn halted the supply of dairy products.

Due to the coronavirus pandemic, the world is still facing unprecedented challenges. Diary product manufacturing companies are facing problems due to supply-demand disruption and building long-term strategies has become difficult. Growing concerns for freight rates and container shortages had cumulatively worsen supply chain problems. As a result, raw material prices increased sharply and created panic situation for diary product manufacturers.

The COVID-19 pandemic has revealed the fragility of global supply chains. After the first wave of the pandemic, many dairy products manufacturing companies are exploring ‘local’ supply chains. Several dairy products manufacturing companies are enjoying a competitive edge, as they have responded with great agility to the COVID-19 pandemic and quickly started production lines.

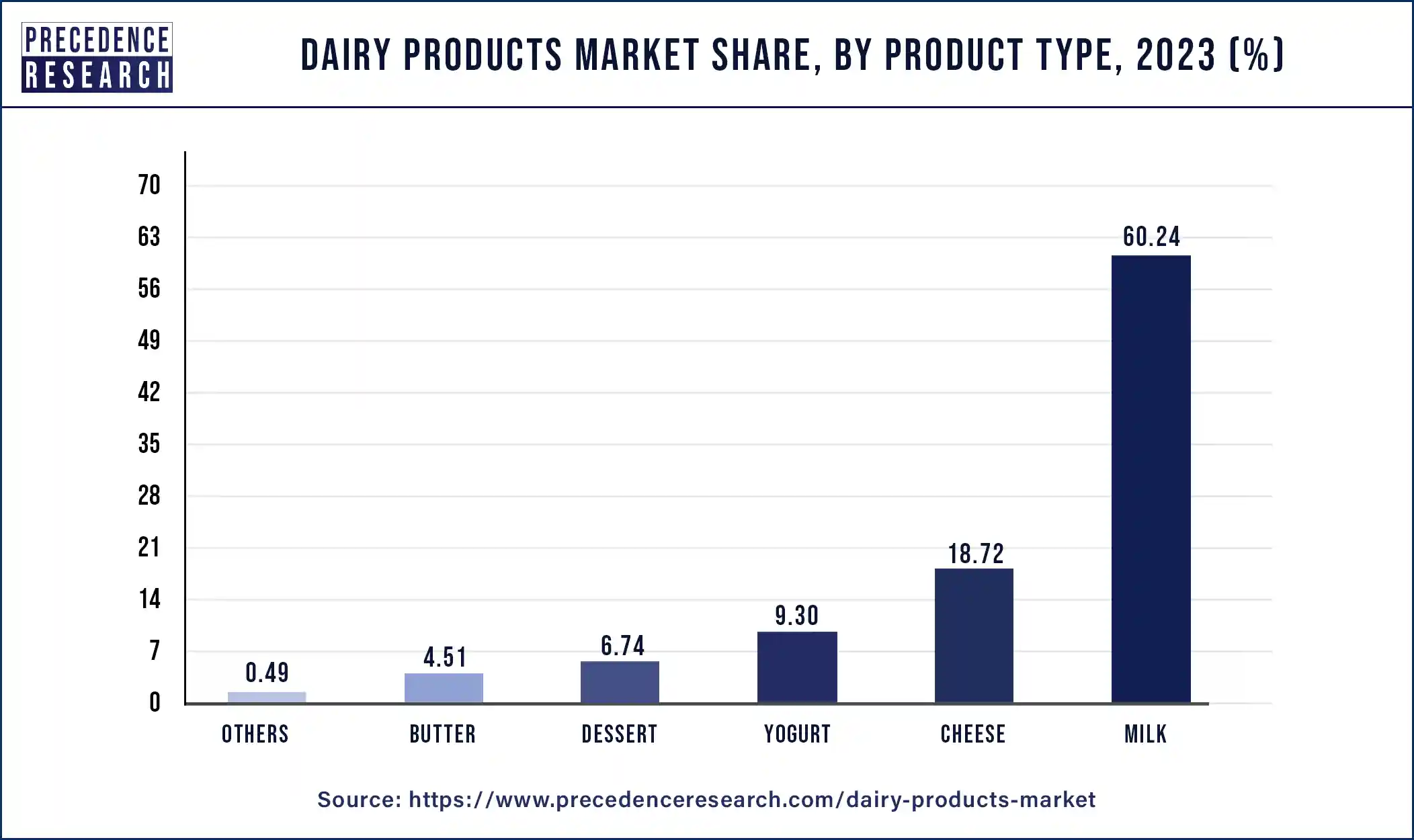

By product type, the milk segment led the global dairy products market with remarkable revenue share 60.24% in 2023 and is anticipated to retain its dominance throughout the forecast period. The dominance of milk is attributed to the increased consumption of milk in households and various commercial units all over the globe. The nutritional properties of milk and the increased awareness regarding the health benefits of milk are driving the growth of this segment across the global market.

On the other hand, yogurt segment is estimated to be the most opportunistic segment during the forecast period owing to its increased consumption. Consumers prefer to eat yogurt and include it in their regular diet in order to improve gut health and build strong immunity. Hence, rising adoption of yogurt in regular diet is estimated to propel the segment growth during the forecast period.

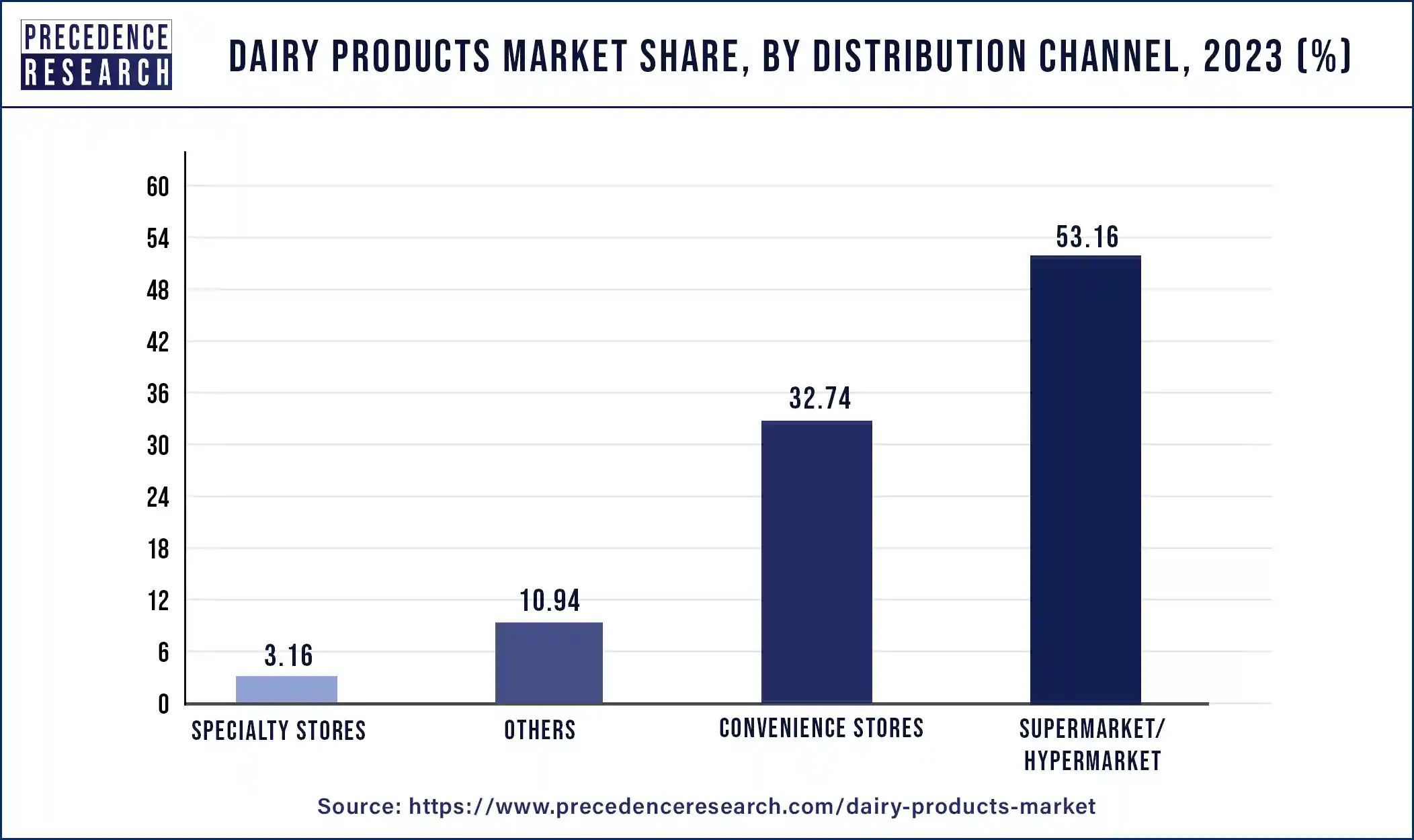

By distribution channel, the supermarket/hypermarket stores segment led the global dairy products market with remarkable revenue share 53.16% in 2023 and is anticipated to retain its dominance throughout the forecast period. The segment was valued USD 256.1 billion in 2021 and is projected to grow at a CAGR of 3.3% during the forecast period.

The supermarkets attract a huge customer base due to the availability of wide variety of food and beverages products and household groceries. Therefore, consumers prefer to buy household essentials and groceries on weekly or monthly basis. Further, the supermarkets are located in urban and easy accessible areas.This sales channel generates a regular revenue stream for the dairy products manufacturers.

On the other hand, the others segment is expected to be the fastest-growing segment due to the rising adoption of food delivery platforms among the consumers. The rapid growth of the online food and grocery delivery platforms in the global market has boosted the sales of the dairy products and is expected to grow rapidly in the forthcoming years.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improvedproducts. Moreover, they are also focusing on maintaining competitive pricing.

In March 2019, Danone launched Australian style yogurt named Wallaby. It is a no sugar added yogurt introduced to serve the health conscious consumers. It was launched in the US in three flavors.

In August 2019, Arla Foods entered into a partnership with Walki, for providing sustainable and recyclable packaging solution in order to contribute towards the mission of reducing carbon footprint.

These developmental strategies adopted by the top market players are expected to boost the growth of the dairy products market in the foreseeable future and provide lucrative growth opportunities.

Segments Covered in the Report

By Product Type

By Distribution Channel

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

October 2023

May 2022

December 2024