January 2025

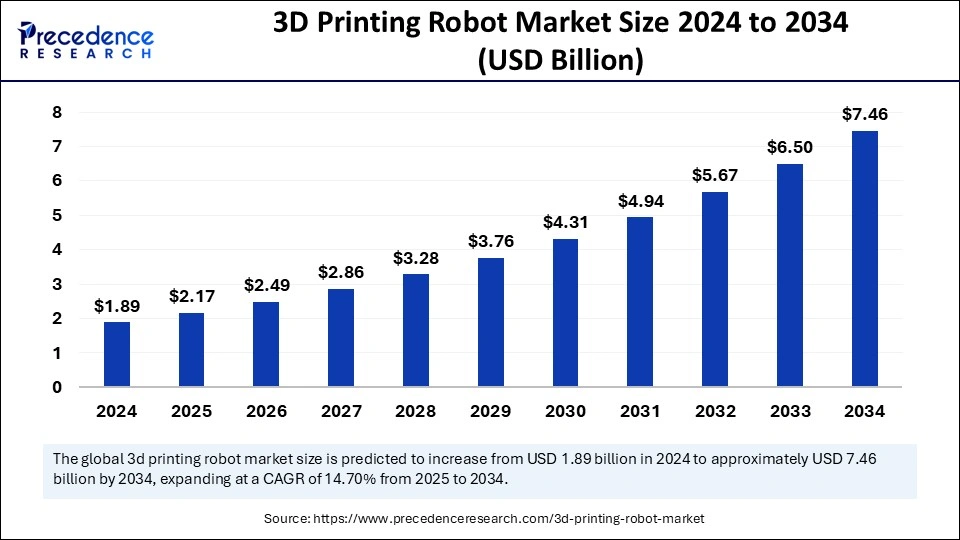

The global 3D printing robot market size is calculated at USD 2.17 billion in 2025 and is forecasted to reach around USD 7.46 billion by 2034, accelerating at a CAGR of 14.70% from 2025 to 2034. The North America market size surpassed USD 680 million in 2024 and is expanding at a CAGR of 14.86% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global 3D printing robot market size accounted for USD 1.89 billion in 2024 and is predicted to increase from USD 2.17 billion in 2025 to approximately USD 7.46 billion by 2034, expanding at a CAGR of 14.70% from 2025 to 2034. The market growth is driven by the increasing demand for robotics in the aerospace, healthcare, and construction industries.

Integrating artificial intelligence (AI) algorithms in 3D printing robots automates operations and improves efficiency. AI algorithms analyze design parameters and optimize the design of 3D-printed objects. AI also monitors 3D printing processes in real-time, ensuring consistent quality. The implementation of AI-driven 3D printing robots helps businesses optimize their design procedures while achieving higher productivity levels. Moreover, these robots reduce material losses, leading to reduced production costs.

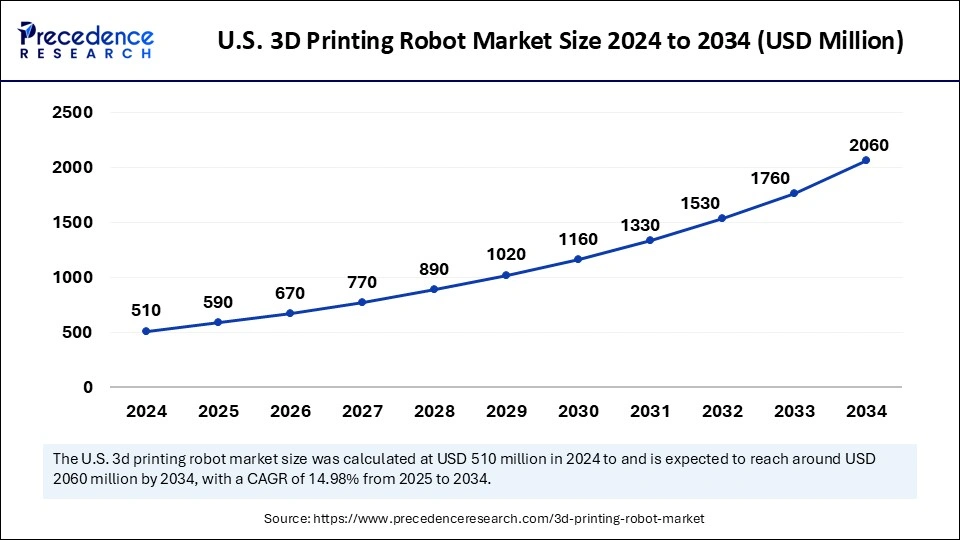

The U.S. 3D printing robot market size was exhibited at USD 510 million in 2024 and is projected to be worth around USD 2.060 million by 2034, growing at a CAGR of 14.98% from 2025 to 2034.

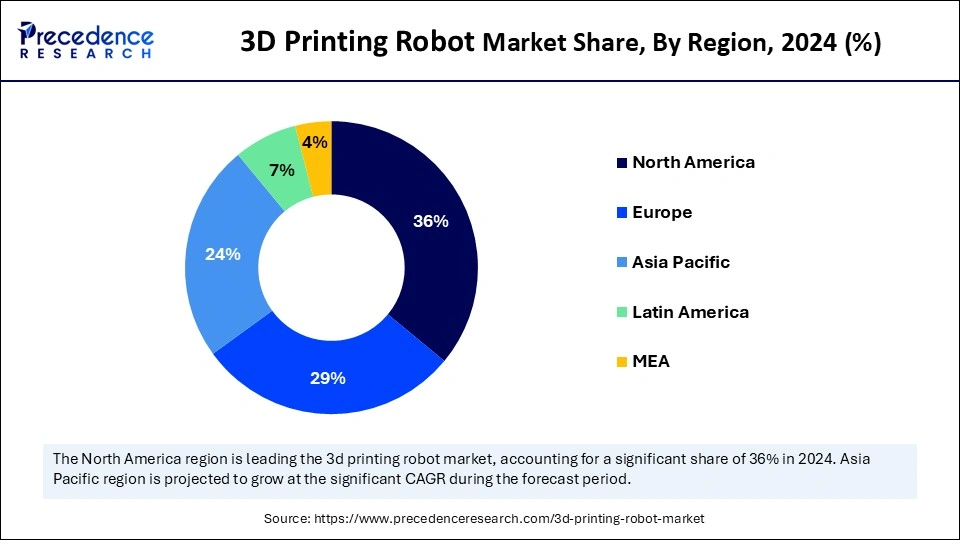

North America led the 3D printing robot market by capturing the largest share in 2024. This is mainly due to its strong industrial base, with various industries investing heavily in additive manufacturing. The region boasts some of the leading aircraft and spacecraft manufacturing companies that are investing heavily in 3D printing to accelerate development cycles. Furthermore, the region is an early adopter of 3D printing and robotics, which bolstered the market growth in the region.

The U.S. is a major contributor to the market growth. The U.S. government is actively promoting innovations in manufacturing technologies. There is a strong emphasis on industrial automation, with automotive, construction, and manufacturing industries investing in advanced automation solutions, supporting market growth.

Asia Pacific is projected to witness the fastest growth in the market during the forecast period. The rising focus on industrial automation and improving manufacturing capabilities are expected to boost the growth of the market in the region. Governments around the region are promoting the use of advanced technologies to support industrial automation. The rapid industrialization further supports regional market growth. China stands out as a major player in the market. According to the Ministry of Industry and Information Technology (MIIT), for August 2024, China remained the global leader in industrial robot markets for the 11th consecutive year. China surpassed 430,000 industrial robot units in terms of production in 2023, while robots installed during that year captured half of the overall market volume. China demonstrates its strong dedication to implementing robotic 3D printing into massive manufacturing operations focused on the automotive and consumer electronics industries.

Europe is expected to witness notable growth in the coming years. The European 3D printing robot market growth is attributed to the rising demand for additive manufacturing among industries for creating sustainable production, lightweight materials, and customized solutions. In September 2024, the European Space Agency (ESA) reached an important feat when it completed the launch of Metal 3D Printer to the International Space Station (ISS). The technological breakthrough offers improved capabilities for production within space exploration missions while enabling developments for lunar infrastructure. There is a heightened adoption of robotics and 3D printing in the automotive sector. The German automotive industry heavily uses 3D printing robots to design sophisticated cars and improve production efficiency. Furthermore, the dedication of European entities toward integrating robotic 3D printing in every sector supports market growth.

The 3D printing robot market is witnessing significant growth due to the rising government initiatives to promote additive manufacturing to create innovative products. 3D printing robots are integrated with robotic arms and printing technology, which help build complex structures automatically. These robots find applications in various industries, such as automotive, construction, and aerospace. They help with prototyping, tooling, and final production. The rising adoption of 3D printing robots in the defense industry to accelerate the development of equipment further supports market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.46 Billion |

| Market Size in 2025 | USD 2.17 Billion |

| Market Size in 2024 | USD 1.89 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.70% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Robot Type, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing Adoption in Aerospace and Defense

The increasing adoption of 3D printing robots in the aerospace sector is driving the growth of the 3D printing robot market. 3D printing enables the creation of complex and lightweight components with intricate designs, reducing the overall weight of aircraft and spacecraft. It also allows for rapid prototyping, reducing the time required for production cycles. 3D printing robots enable the on-demand manufacturing of spare parts with stronger structural designs. In addition, there is a high adoption of additive manufacturing in the defense sector to develop military aircraft, driving the growth of the market. In March 2025, Tom Enders, a Former CEO of Airbus, urged Europe to shift attention from major arms projects to nimble new technologies like robotic drones, a crucial part of the military. The industry-wide acceptance of 3D printing robots for making complex, lightweight structural components with exceptional strength represents a widespread shift to improve operational efficiency in both the aerospace and defense industries.

High Initial Investment

The high costs of 3D printing robots are expected to hinder the growth of the 3D printing robot market. 3D printing robots require additional hardware and software for their optimized functionality, which adds to the overall cost. Multiple financial resources are required to procure and start 3D printing robot operations, creating challenges for SMEs. Moreover, operating and maintaining 3D printing robots requires comprehensive knowledge. Thus, the limited availability of skilled workforce limits the adoption of 3D printing robots, restraining market growth.

Focus on Industrial Automation

A strong emphasis on industrial automation creates immense opportunities for the 3D printing robot market. 3D printing robots automate various mundane tasks, freeing up workers for other complex tasks. Moreover, these robots minimize defects in manufacturing operations, enhancing overall productivity. Governments around the world are also promoting the usage of advanced automation technologies, encouraging businesses to invest heavily in industrial automation solutions, including robotics. The rising government investments in the industrial sector further propels market growth. Industrial funding makes it easy for industries to deploy 3D printing robots in production lines, as it removes manual work while controlling production expenses.

The robot arms segment dominated the 3D printing robot market with the largest share in 2024. This is mainly due to their versatility and precise execution of additive manufacturing processes. The freedom of robotic arms extends to the creation of intricate shapes with the capacity to print items extending beyond one meter in dimensions. The 3D printing heads use five or six directional movements on an axis to draw complex shapes, which produce detailed components without supplemental support systems. Furthermore, large-scale 3D printing production received transformational development through robotic arms designed to layer concrete materials during print. Robotic arms have the ability to adapt to various tasks, making them ideal tools in manufacturing.

The software segment is expected to grow at the fastest rate in the coming years. The market benefits from advanced software that makes 3D printing robots work harmoniously with production systems through real-time process control capabilities. Advanced features built into software include path-planning automation with error detection and optimization features that improve 3D printing operational efficiency. Furthermore, as industries continue implementing 3d printing technology, the need for advanced software solutions is expected to grow. Software delivers consistent results, reduces operational costs, and enhances the overall efficiency of manufacturing processes.

The articulated robots segment held the largest share of the 3D printing robot market in 2024. This is mainly due to their versatility and precision in additive manufacturing processes. The multiple rotary joints in articulated robots enhance maneuverability, which allows users to create complex designs larger than one meter across all dimensions. The five- or six-axis movements let the articulated robots follow complicated paths, which enables the creation of intricate components needing no extra support structures. Furthermore, the automotive and aerospace industries heavily use articulated robots to produce intricate designs and maximize production efficiency.

The SCARA robots segment is projected to grow at a significant CAGR over the studied years. SCARA robots offer a parallel-axis joint placement design that gives them X-Y compliance with Z-axis rigidity that enables precise, delicate assembly operations. The four-axis SCARA robot utilizes two parallel arm sections that move together in one plane, while its fourth axis enables the rotational motion of the end-effector to fulfill multiple 3D printing tasks. These robots function with printers to print complex designs and operate automated post-processing systems for support removal and inspection work while advancing the printing scale using multi-material capabilities.

The prototyping segment dominated the 3D printing robot market in 2024. The segment growth is driven by the rise in the need for rapid prototyping. It accelerates product development across various industries. 3D printing robots enable manufacturers to create complex prototypes, which facilitate fast design evaluation through numerous iterations. Rapid prototyping enables companies to accelerate production cycles and launch new products promptly with increased production volumes.

The functional part manufacturing segment is projected to expand rapidly in the coming years. The segment growth can be attributed to the ongoing advances in materials and simultaneous printing innovations. Many industries now depend on automated 3D printing machines that create functional parts with unusual designs that conventional production techniques find difficult to replicate. Furthermore, the manufacturing industry relies on functional part production to complete the production cycles. The rising demand for high-strength components and customized 3D printed parts in aerospace and automotive industries further support segmental growth.

The aerospace & defense segment held the largest share of the 3D printing robot market in 2024. This is mainly due to the rise in the demand for components that are lightweight and feature complex geometries and exceptional performance. The aerospace and defense industries heavily use 3D printing and robotic solutions to develop efficient aircraft structures and durable defense equipment. 3D printing enables aircraft manufacturers to develop intricate and customized components that enhance the overall performance of aircraft. It reduces tooling requirements and cuts down both production expenses and material waste. The rise in defense expenditure to improve infrastructure further bolstered the segment.

The construction segment is projected to grow at a notable rate in the near future. Robots are significantly gaining traction in the construction sector owing to the rising need for automation in construction operations. The construction industry adopts 3D printing robots for building affordable structures with stronger materials while minimizing dependence on human labor. 3D printing robots can quickly produce a building without human intervention. In March 2025, Australia’s first 3D-printed multistory house is being built using robotic cranes.

By Component

By Robot Type

By Application

By End-user

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025