May 2024

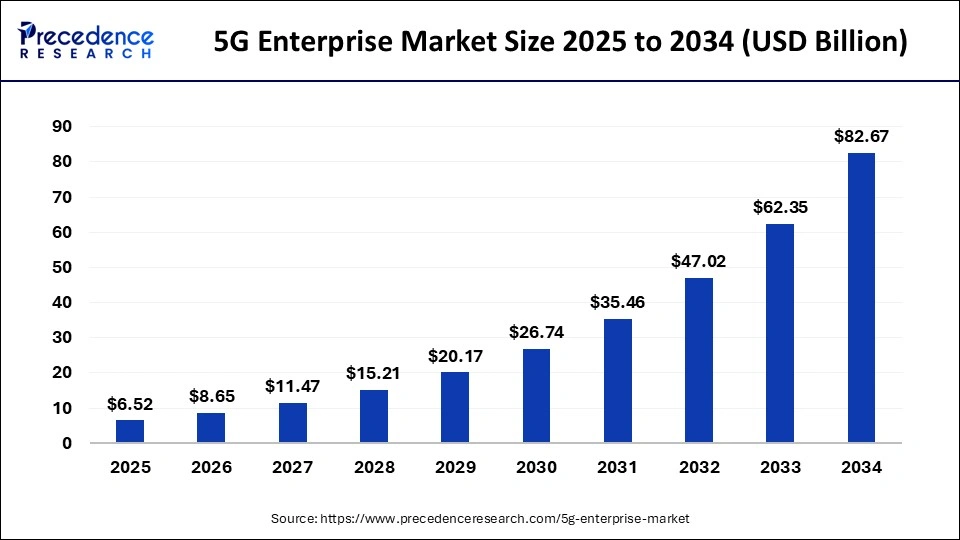

The global 5G enterprise market size accounted for USD 4.92 billion in 2024, grew to USD 6.52 billion in 2025 and is predicted to surpass around USD 82.67 billion by 2034, representing a healthy CAGR of 32.60% between 2024 and 2034.

The global 5G enterprise market size is estimated at USD 4.92 billion in 2024 and is anticipated to reach around USD 82.67 billion by 2034, expanding at a CAGR of 32.60% from 2024 to 2034.

The 5G wireless network, or 5G enterprise, is an improvement over the fourth-generation (4G) wireless network. It is accomplished by using the radio spectrum's high frequency and short-range band. Low latency and fast internet speeds are offered by 5G Enterprise. It provides more than 1Gbps of network performance, which is ten times quicker than the 4G network. With the help of the 5G enterprise technology, enterprises will be able to enable a variety of services and build up their own private wireless platform with a wide range of operational capabilities. Additionally, it makes it possible for the high-tech internet of things platform, which is crucial for the deployment of industry 4.0 and industrial automation.

Businesses all across the world have been severely affected by the global COVID-19 outbreak. Due to the global lockdown that forced employees of different industry verticals, the global pandemic has positively affected the adoption of 5G enterprise solutions in the industry vertical. Increased internet traffic is anticipated as a result of this. The adoption of the 5G enterprise has been delayed as a result of restrictions placed on the 5G spectrum auction due to the global shutdown.

However, communication service providers (CSPs) are investing quickly in the 5G enterprise in post-COVID-19 areas like Europe and North America, which is projected to accelerate the growth of the market internationally. Companies are concentrating on employing cutting-edge technology, such as augmented reality, virtual reality, and the internet of things, to undertake contactless operations in the manufacturing, energy and utility, and educational sectors in the post-COVID-19 environment. This is anticipated to fuel the worldwide 5G enterprise market.

The worldwide 5G enterprise market is expanding due to a number of factors, including the increased use of network slicing to offer various 5G services and the rise in smartphone and wearable device usage among all age groups. Additionally, the worldwide expansion of smart telecommunications infrastructure also propels the market. The market's expansion is hampered by the high start-ups and construction costs of 5G corporate solutions as well as security issues in 5G core networks.

In addition, increased demand for low latency connection and increased investment in mobile computing and communication solutions by several nations are predicted to open up attractive 5G corporate market opportunities.

The usage of cell phones in emerging nations has been rising steadily over the past ten years due to a variety of causes, including an increase in per capita income, cost affordability, the availability of several low-priced choices with significant capabilities, and others. Due to the COVID-19 pandemic and the expanding usage of work-from-home policies by many firms, cell phones are increasingly being used for social reasons. Many businesses and institutions are adopting smartphones, tablets, and other smart gadgets to connect with their staff members and students. As a result of the rising demand for high-speed internet and communication services, as well as for online mobile video streaming, the global market for the 5G enterprise is expected to grow.

The connected device space in the sectors that are now advancing toward the fourth industrial revolution is predicted to undergo a transformation thanks to the 5G enterprise market. Through the growth of the Internet of Things and machine-to-machine communications, Industrial Revolution 4.0 is assisting cellular connectivity across the sector.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.92 Billion |

| Market Size by 2034 | USD 82.67 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 32.60% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Developments of open-access architectures

Depending on the spectrum, the licensed segment had the majority of the 5G enterprise market share in 2023, and this trend is anticipated to continue over the next several years. Numerous benefits offered by this spectrum type, including excellent connectivity quality that reduces costs when adding additional resources, strong security, and others, are credited with the segment's expansion. But in the next years, the unlicensed/shared market is anticipated to increase at the fastest rate. Due to its independent and cost-effective operation, unlicensed infrastructure is also increasingly being adopted by end users, which significantly aids in the expansion of the 5G enterprise market.

The mmWave frequency band led the total 5G enterprise market in 2023, and this trend is anticipated to continue over the course of the forecast period. since it enables a large number of users to connect to a single access point, which is advantageous in densely populated areas of big cities. Adoption of this technology accelerates the start-up of new businesses, optimizes the value of already-existing mobile and wearable resources, and reduces data costs, all of which contribute to the market's continued expansion.

However, the sub-6Ghz frequency band is anticipated to have the fastest development in order to obtain a strategic and competitive advantage over their rivals, businesses are increasingly adopting 5G enterprise solutions. Additionally, it offers a broad coverage area and permits complete network access inside of nearby locations like homes and offices, which promotes market expansion.

Large-scale organizations now dominate the 5G enterprise market in terms of organization size, and this trend is anticipated to continue over the forecast period. The market is expanding due to both the significant investments made by big-size organizations in 5G networks and the rising demand for high-speed internet among these organizations. However, in the market in 2023, small and medium-sized businesses had the greatest growth. This expansion is attributable to a change in small and medium-sized businesses toward digitalization and the use of the internet of things in routine operations that necessitate high-speed and affordably priced internet, which fuels the global 5G enterprise market.

Given that top manufacturers are already implementing AR and VR technologies in training applications and equipment maintenance, Gabler, the manufacturing sector is anticipated to dominate the 5G enterprise market throughout the projection period. A 5G infrastructure can easily provide the 100 Mbps bandwidth requirement for a fluid AR/VR experience.

Enterprise apps that use the cloud are quite popular in North America. Since 5G enables a significantly higher internet connection, it may further improve the connectivity experience. Cloud-based solutions require internet access to operate in the hosted environment. In comparison to other areas, the region is experiencing the biggest growth in demand for cutting-edge technology including machine-to-machine communication, linked autos, and artificial intelligence. Consequently, it is predicted to present significant growth prospects for the 5G enterprise market.

Additionally, according to Ericsson, the number of 5G mobile subscribers is predicted to reach 318 million by the end of 2025 or more than 80% of all mobile subscriptions in the North American area. This might increase demand for 5G networks. Network operators in the US are investing in their networks to achieve the highest performance at the lowest cost per bit, using innovations like network function virtualization (NFV) and software-defined networking (SDN) to maximize network efficiency, in order to meet the capacity, coverage, and efficiency requirements of future 5G services.

5G-operated connected automobiles present a further potential for mobile carriers since low latency communication is increasingly essential for onboard computers in autonomous vehicles to convey their presence as well as perceive and respond to obstacles, traffic signals, and surrounding vehicles. The majority of US providers currently provide platforms for connected cars, with AT&T leading this market.

However, Asia-Pacific is anticipated to experience the strongest growth during the 5G enterprise market forecast period. This is because the region's emerging economies are experiencing rapid economic growth and the telecom industry is continuing to develop, which encourages businesses to concentrate on the deployment and implementation of 5G enterprises in order to maintain growth and boost productivity. The quick rollout of the 5G network across the nation is also being spearheaded by nations like India, China, and Japan, which propels the industry. In order to remain competitive in the market, leading companies in Asia-Pacific are also concentrating on improving their operations and raising their overall efficacy, which is anticipated to present profitable prospects for the market's growth throughout the course of the projected year.

By Spectrum

By Frequency

By Organization Size

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

November 2024

November 2024

February 2025