May 2024

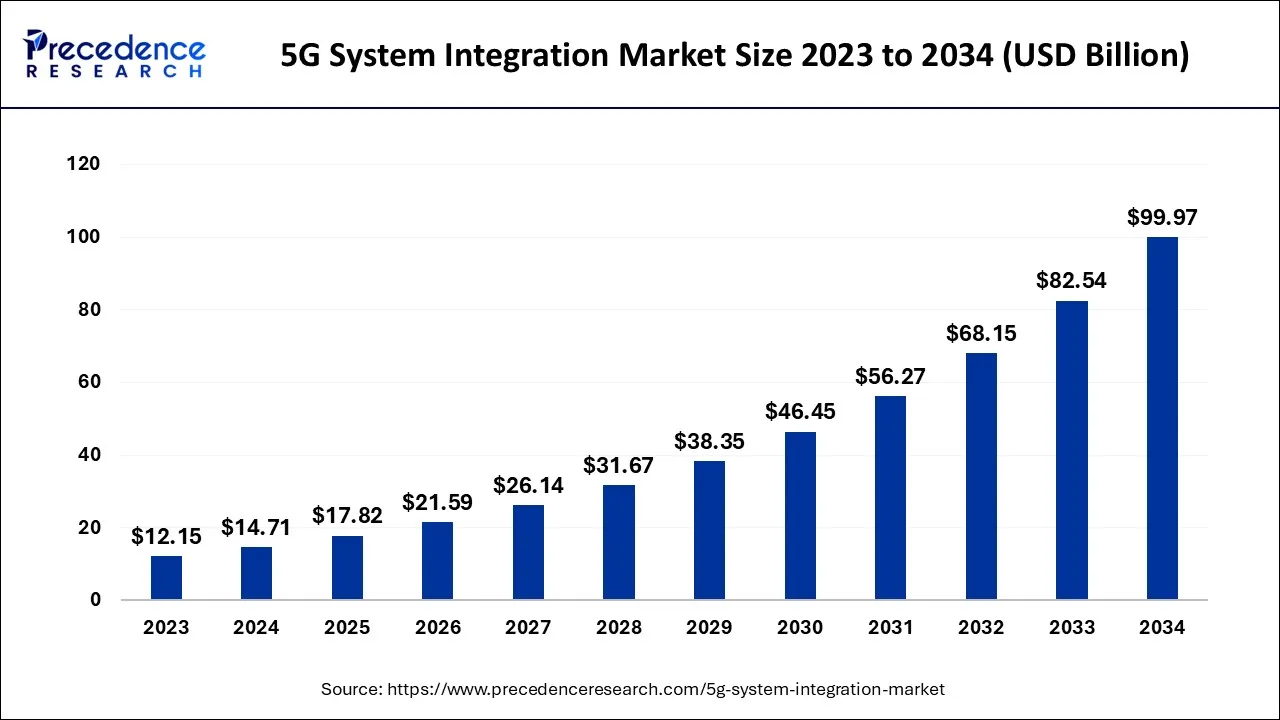

The global 5G system integration market size accounted for USD 14.71 billion in 2024, grew to USD 17.82 billion in 2025, and is expected to be worth around USD 99.97 billion by 2034, poised to grow at a CAGR of 21.12% between 2024 and 2034. The North America 5G system integration market size is predicted to increase from USD 5.15 billion in 2024 and is estimated to grow at the fastest CAGR of 21.29% during the forecast year.

The global 5G system integration market size is expected to be valued at USD 14.71 billion in 2024 and is anticipated to reach around USD 99.97 billion by 2034, expanding at a CAGR of 21.12% over the forecast period from 2024 to 2034.

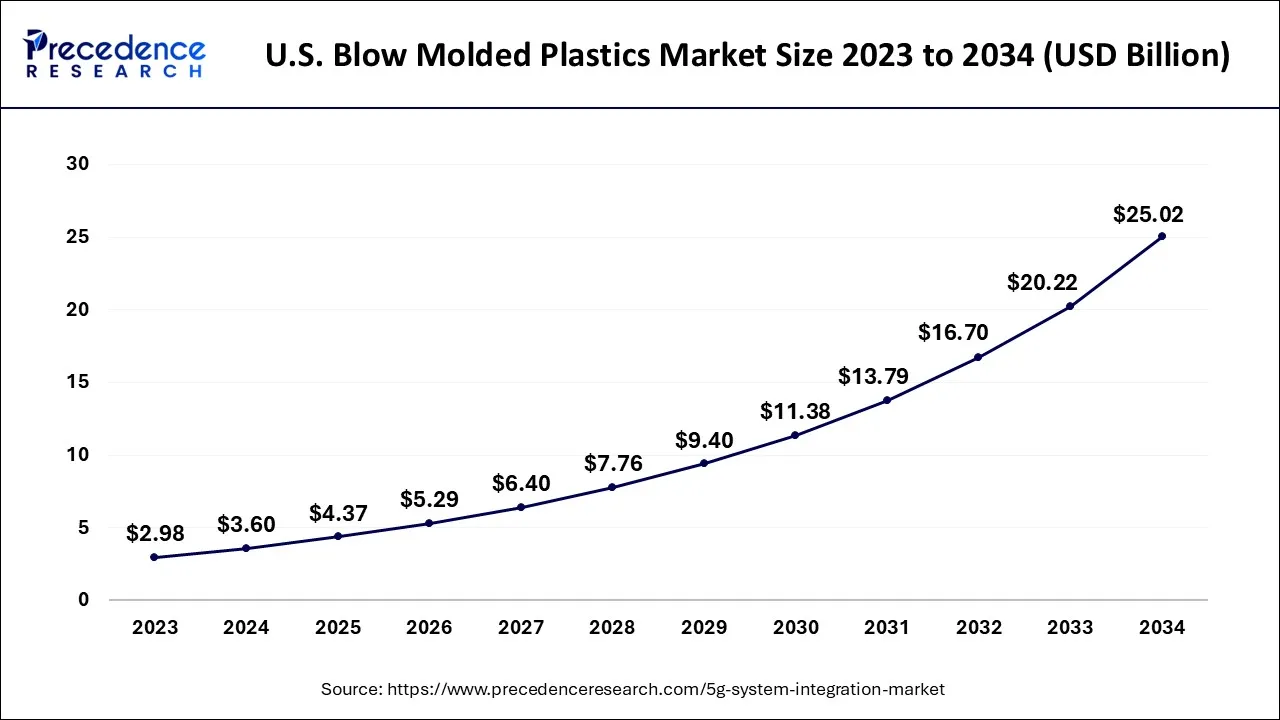

The U.S. 5G system integration market size is exhibited at USD 3.60 billion in 2024 and is projected to be worth around USD 25.02 billion by 2034, growing at a CAGR of 21.38% from 2024 to 2034.

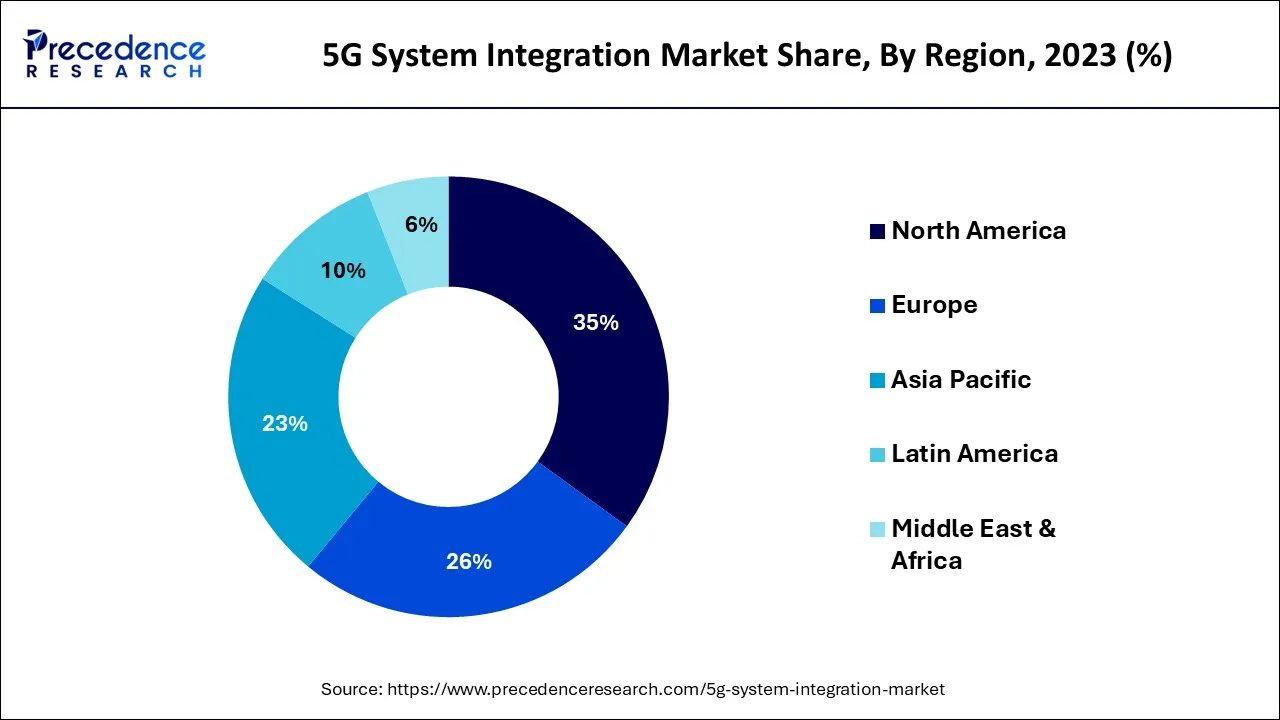

Throughout the forecast period, North America will dominate the 5G system integration market and generate for more than 35% of the revenue share in 2023. This results from increasing government spending on implementing cutting-edge solutions across numerous departments, rising industrial automation using the internet of things (IoT), growing use of energy-efficient production techniques, and rising demand for affordable products in this geographical area.

During the projected period of 2024–2034, Asia–Pacific is anticipated to experience the fastest growth because of the region's increasing internet of things (IoT) adoption in industrial automation as well as the sector's technological improvements and investment in utilized information technology systems.

Individual business variables and modifications to market regulation are also provided in the country section of the report, which affects both the market's current and future developments. Data points like technical trends, case studies, porter's five forces analysis, and downstream and upstream supply chain analyses are just a limited number of the indicators used to predict the market condition for particular countries. When supplying a forecast review of the country data, it also considers the presence and visibility of major brands, the problems they face because of significant or inadequate competition from national and local brands, the effect of domestic tariff barriers, and trade routes.

Integrating physical and virtual aspects of any enterprise with new, improved applications or systems so they can operate over the brand-new 5G network is known as 5G system integration. Due to the increasing requirement for high-speed bandwidth capacity, businesses can now install updated network infrastructure to increase operational efficiency and decrease overall process expenses.

Therefore, it is predicted that the requirement for 5G system integration services will be driven by the aggressive deployment of improved network infrastructure all over enterprises to deliver enhanced services to consumers.

Major international manufacturers want to accelerate their business processes by utilizing cutting-edge digital technologies to fuel the fourth industrial revolution (Industry 4.0). Manufacturing facilities can make a significant step toward innovative and data-driven flexible operations success can be attributed to technologies like industrial wireless cameras, big data analytics, and collaborative robots.

Additionally, several manufacturers have created and implemented the abovementioned technologies to succeed in a highly competitive market. To give these 5G technologies truly united communication, manufacturers must integrate them with next-generation networks. Supplying constant remote monitoring and connectivity also assists in reducing operational expenses and downtime.

Therefore, over the forecast period, the popularity of 5G system integration services will increase due to the widespread deployment of the industrial internet of things (IIoT) and the increasing preference for 5G services to provide genuinely united connectivity.

One of the key factors anticipated to propel the market for 5G system integration is the rising acceptance of Software-Defined Networking and Network Function Visualization among businesses. Businesses can use NFV to deploy multiple firewalls and virtual machines to achieve an effective economy of scale. On the other hand, the smart network architecture offered by SDN aims to decrease hardware limitations on the business's premises.

Additionally, SDN enables these businesses to effectively manage the utilization of their interactions through an Application Programming Interface (API). Thus, the market growth is expected to be further boosted by the rapid adoption of SDN and NFV technologies to reduce overall network infrastructure prices.

Moreover, as the amount of data being stored in the cloud proliferates and the demand for cloud-based application integration rises, customers are becoming more concerned about security, which could limit the growth of the 5G system integration market in the future.

| Report Coverage | Details |

| Market Size in 2024 | USD 14.71 Billion |

| Market Size by 2034 | USD 99.97 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 21.12% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Services, By Vertical and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for network infrastructure and increasing industrial automation

The 5G system integration market has expanded due to the growing use of industrial automation technologies, especially in advanced nations. There are now more battery manufacturing facilities due to the rising demand for hybrid and electric vehicles. Therefore, growing industrial automation demand is anticipated to drive the 5G system integration market forward.

Industries have substantially reduced process expenses and enhanced efficiency and productivity by upgrading their network infrastructure due to the rising need for high-speed bandwidth capacity. By implementing a robust, updated network infrastructure, companies can offer better customer service, which will spur market expansion.

The market for 5G system integration may be affected by various restraints, including:

The market for 5G system integration may present several opportunities, including:

The infrastructure integration segment, which had a market share of more than 39% in 2023 in revenue, held the largest market share for 5G system integration. From 2024 to 2034, this segment is anticipated to grow at the fastest CAGR. The rapid growth of the fusion of current and next-generation network infrastructure is to blame.

Therefore, integrating legacy infrastructure allows customers to utilize the same hardware with improved features, decreasing the hardware price. Additionally, building management, network integration, and data center infrastructure management are included in the infrastructure system integration services.

During the forecast period, the consulting segment is anticipated to grow at a CAGR of 31.40%. Business enterprises first turn to system integrators to create updated network architecture for their organizations due to the rapidly increasing demand for 5G technologies, such as networking devices. These businesses will be able to expand business output overall in less time compared to this architecture. Additionally, it is anticipated that the requirement for application integration services will increase throughout the projected timeframe due to the spiraling demand for multi-vendor cloud-based applications all over enterprises.

The IT and telecom segment dominated the 5G system integration market in terms of value in 2023, with a share of 26%; from 2024 to 2034, a significant CAGR is expected to be recorded. This is explained by the rising demand for 5G integration services from IT and telecom firms to support New Radio (NR) waves. The requirement for 5G system integration facilities in the IT and telecom sector is expected to increase due to increasing preference for incorporating enterprise network infrastructure and data center network hardware. In addition, 5G network services are anticipated to experience significant enterprise implementation over the forecast period due to increased emphasis on delivering seamless connectivity during a virtual meeting to cut down on a consultant or specialist's overall travel time.

Manufacturing companies continuously automate their production lines to increase overall production efficiency as digitalization gains popularity in the industry. This has led to the requirement for seamless wireless communication among industrial robots, sensors, actuators, and other devices mounted in production facilities. Due to the increasing demand for system integration facilities to integrate the entire facility with 5G carriers' supporting network, the manufacturing sector is predicted to expand faster throughout the projected period.

The home and office broadband segment held the largest market share in revenue in 2023, with a market share of 24%; from 2024 to 2034, it is anticipated to grow at a significant CAGR. This is due to the increasing demand for 5G system integration facilities to connect customers and businesses to improved mobile broadband. The requirement for 5G system integration services to create such systems adaptable with next-generation network services is also anticipated to increase due to the significant rise in IoT devices across fast-developing smart cities worldwide. From 2024 to 2034, it is predicted that this factor will further accelerate the expansion of the smart city segment during the forecast period.

Globally, there has been a significant increase in the use of connected sensors and collaborative robots in industry applications. Establishing seamless connectivity is anticipated to increase the requirement for next-generation data services, fuelling the segment's expansion during the forecast period. A flawless communication setup among smart grids to automate and monitor power distribution and storage operations is another factor expected to contribute to the intelligent power distribution processes market segment experiencing a significant rise

By Services

By Vertical

By Application

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

January 2025

February 2025

October 2024