April 2025

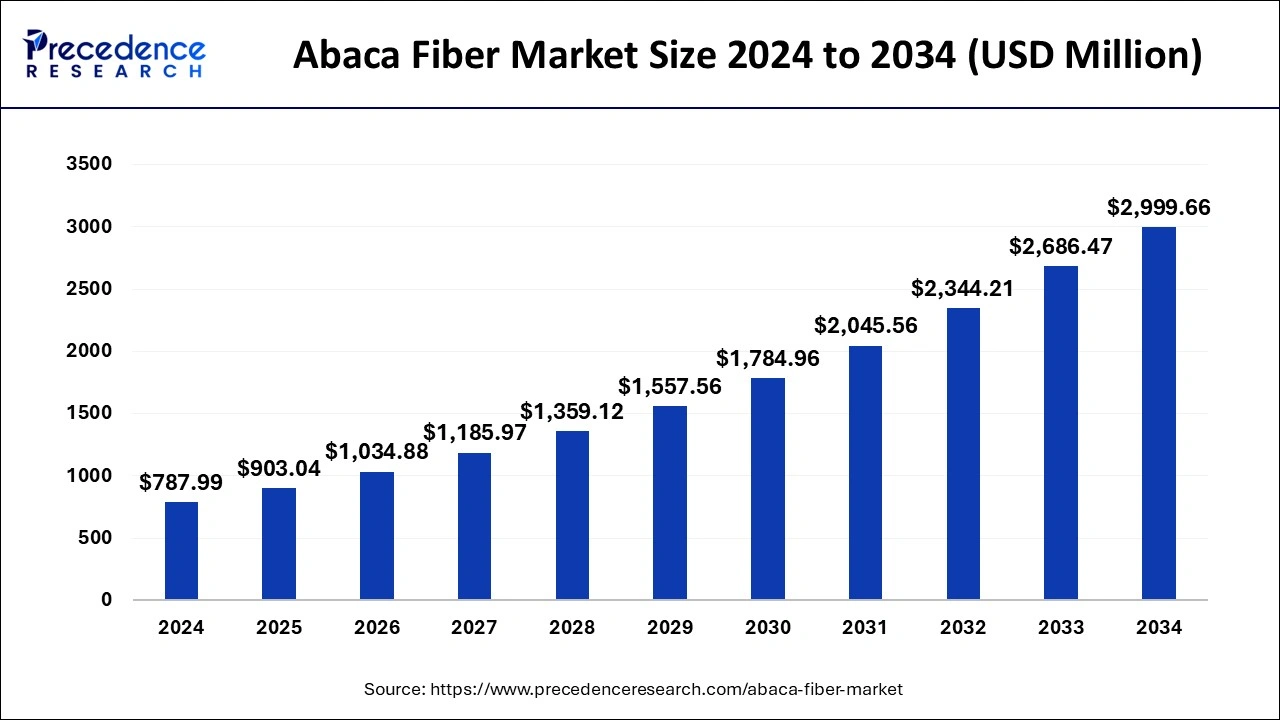

The global abaca fiber market size is calculated at USD 903.04 million in 2025 and is forecasted to reach around USD 2,999.66 million by 2034, accelerating at a CAGR of 14.30% from 2025 to 2034. The Asia Pacific abaca fiber market size surpassed USD 514.34 million in 2024 and is expanding at a CAGR of 14.53% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global abaca fiber market size was accounted for USD 787.99 million in 2024 and is anticipated to reach around USD 2,999.66 million by 2034, growing at a CAGR of 14.30% from 2025 to 2034. Sustainability is driving the growth of the abaca fiber market.

The market for abaca fiber is undergoing a change thanks to automation and artificial intelligence (AI), which are increasing manufacturing efficiency and quality control. Cutting manufacturing costs and waste, advanced AI algorithms optimize the processing of abaca fibers. Higher accuracy and consistency in pulp quality are made possible by automation in harvesting and processing facilities. Additionally, improved supply chain management is made possible by predictive analytics and data-driven decision-making, which enables businesses to react quickly to shifts in the market. It is anticipated that when the industry implements these technologies, operational efficiency will rise dramatically, which will eventually benefit market expansion and sustainability initiatives.

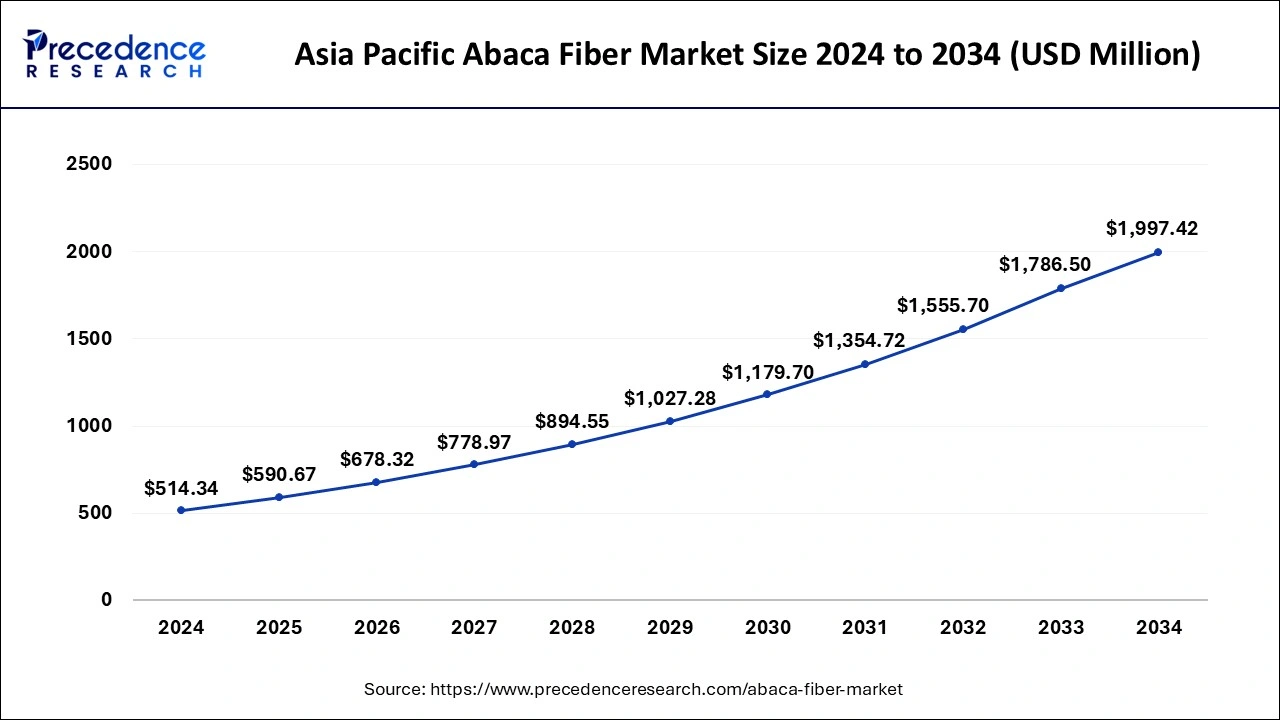

The Asia Pacific abaca fiber market size was exhibited at USD 514.34 million in 2024 and is projected to be worth around USD 1,997.42 million by 2034, growing at a CAGR of 14.53% from 2025 to 2034.

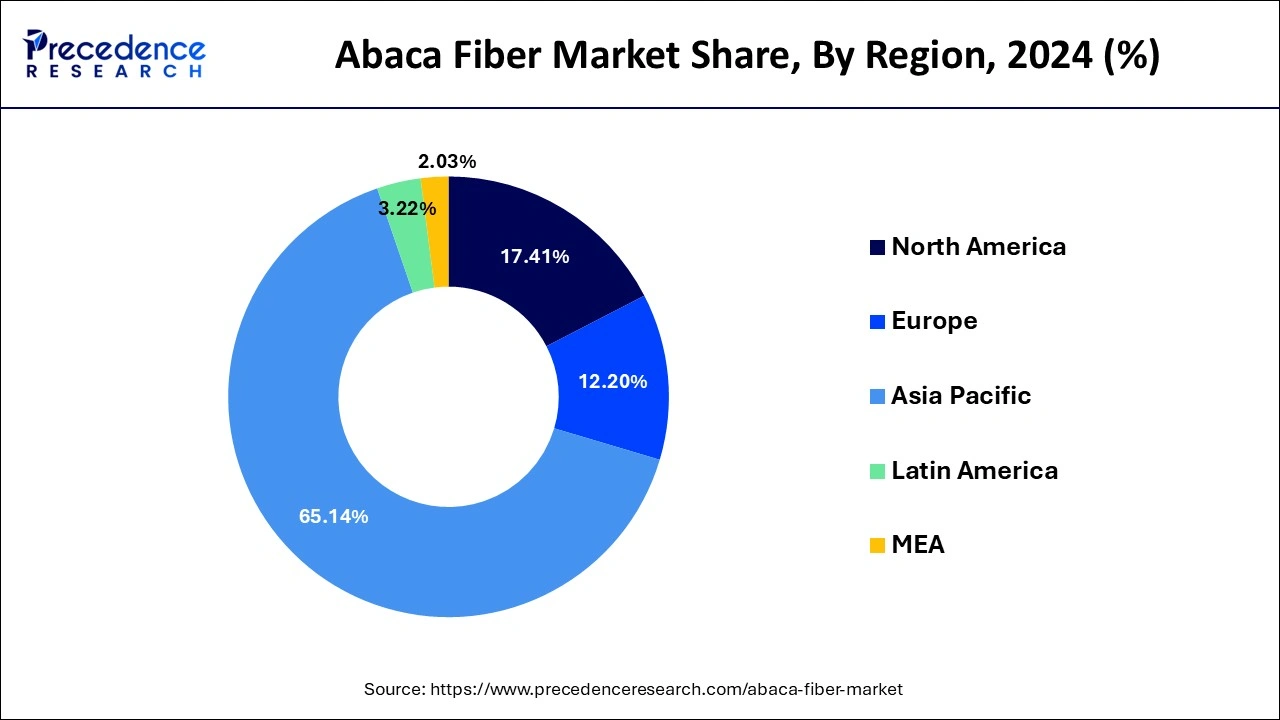

Due to the increasing use of these fibers in a variety of end-use industries, automotive, specialty paper, including healthcare, handicraft, and textile, as well as their strong mechanical properties, long length, durability, and sustainability, Asia Pacific dominated the industry and accounted for the highest revenue share of around 65.14% in 2024.

With the Philippines holding a market share of more than 85% worldwide, the region is the most significant worldwide supplier of abaca fibers. Public spending in Japan and the Philippines to support abaca cultivation practices and boost fiber manufacturing capacity is also anticipated to positively impact market expansion in the future.

Due to the increasing use of fibers in numerous application industries, such as automotive, beverages and food, and specialty papers, due to their high mechanical strength, flexibility, durability, and long length, the market in Europe is anticipated to experience a remarkable revenue-based CAGR of 14.9% from 2024 to 2033.

Additionally, it is anticipated that the expansion of the fiber market will be aided by the European nations' beneficial trade policies for importing abaca and other natural fibers. Major German auto manufacturers are using abaca fibers for automotive parts like headliners, trunk components, rear cargo shelves, and thermal insulation to lighten the weight of the entire vehicle and improve fuel economy.

The market is anticipated to be driven by the quickly expanding use of abaca fiber in the expanding pulp and paper industry for products like disposable tea and coffee bags, disposable medical and food papers, and cigarette filter papers.

Because of the product's superior high mechanical strength and long fiber length resistance to salt-water damage, there has been a rise in the need for it in recent years in the manufacture of curtains, paper, clothing, screens, and furnishings. This requirement is anticipated to continue driving market growth. In addition, the market is expected to expand as more people worldwide adopt products.

As natural fibers are increasingly used in the production of cars, the use of abaca fibers, mainly in the automotive industry, is also expanding. In the automotive industry, these fibers are used in various applications, such as filler material for bolster and exterior semi-structure components and interior trip parts to replace glass fiber in reinforced plastic elements.

Because abaca fibers are becoming more widely used in various industries, including medical fabric, automotive, paper, and handicraft industries, demand for them has increased globally in recent years. Low productivity, though, has been present in the market and hasn't been sufficient to meet demand.

Over the projected period, the pulp and paper sector is predicted to dominate all other application segments. Abaca fiber specialty papers are thin and have high tensile strength. Abaca fibers are preferred by businesses in the paper and pulp industry for uses like tea bags, currency, large sausage casings, security papers, and cigarette and filter papers because of these qualities.

Due to the growing demand for natural fibers, the abaca fiber industry is anticipated to grow in importance over the forecast period. Throughout the forecast period, consumers' demand for abaca fiber will be driven by superior quality and strength.

| Report Coverage | Details |

| Market Size in 2025 | USD 903.04 Million |

| Market Size by 2034 | USD 2,999.66 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.30% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The growth and demand for abaca fiber in various applications are being fueled by several market factors. Among some of the key factors are:

Various industries and applications comprise a broad range of market drivers for abaca fiber. The demand for strong, long-lasting, and distinctive materials is expected to increase as consumers and businesses emphasize sustainability and eco-friendliness. The abaca fiber market is predicted to grow and prosper.

The market opportunities for abaca fiber are wide-ranging and cover a variety of sectors and uses. Abaca fiber is poised to take a more significant role in the global fiber market as more businesses and consumers look for eco-friendly and sustainable alternatives to synthetic materials.

The paper and pulp product segment dominated the industry with more than 83% revenue growth in 2023. This explains the increased need for non-wood fibers as raw materials for specialty paper applications. The superior strength-to-weight ratio of specialty paper made with abaca fiber makes it highly functional for making money, tea bags, and security papers.

To properly understand the yield of pulp, the characteristics of pulping, and the quality of abaca fibers, development activities, and active research are taking place. The findings from the study results can provide an accurate depiction of the potential and uses of abaca fibers for the manufacture of paper and pulp.

Due to the growing popularity of advanced biomaterials in fashion textiles, the textile product segment is also anticipated to experience a substantial operating income CAGR of 12.3% over the projected period. The most recent fashion in interior decorating techniques for commercial and residential spaces is also anticipated to increase the requirement for abaca fiber in the textile industry.

Environmental issues have compelled several industry executives to concentrate on creating "green" products over the last few years. Industries now use biomaterials in their production technologies to achieve sustainability goals. Abaca fibers are expected to see growth opportunities in the textile industry because of the growing need for advanced, sustainable fibers.

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

September 2024

January 2025