February 2025

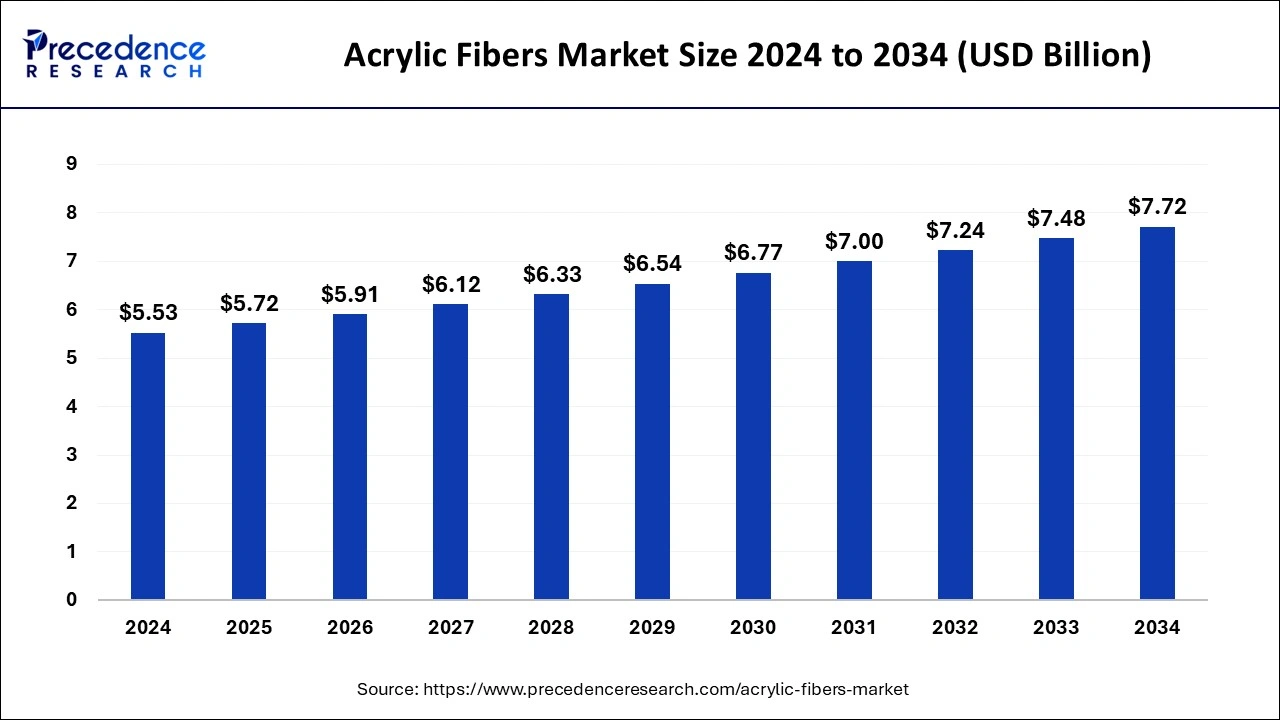

The global acrylic fibers market size is accounted at USD 5.72 billion in 2025 and is forecasted to hit around USD 7.72 billion by 2034, representing a CAGR of 3.39% from 2025 to 2034. The Asia Pacific market size was estimated at USD 3.32 billion in 2024 and is expanding at a CAGR of 3.47% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global acrylic fibers market size accounted for USD 5.53 billion in 2024 and is predicted to increase from USD 5.72 billion in 2025 to approximately USD 7.72 billion by 2034, expanding at a CAGR of 3.39% from 2025 to 2034. The market perception of acrylic fibers is largely a result of initiatives to create recycling programs, environmentally friendly manufacturing techniques, and sustainable raw material sources.

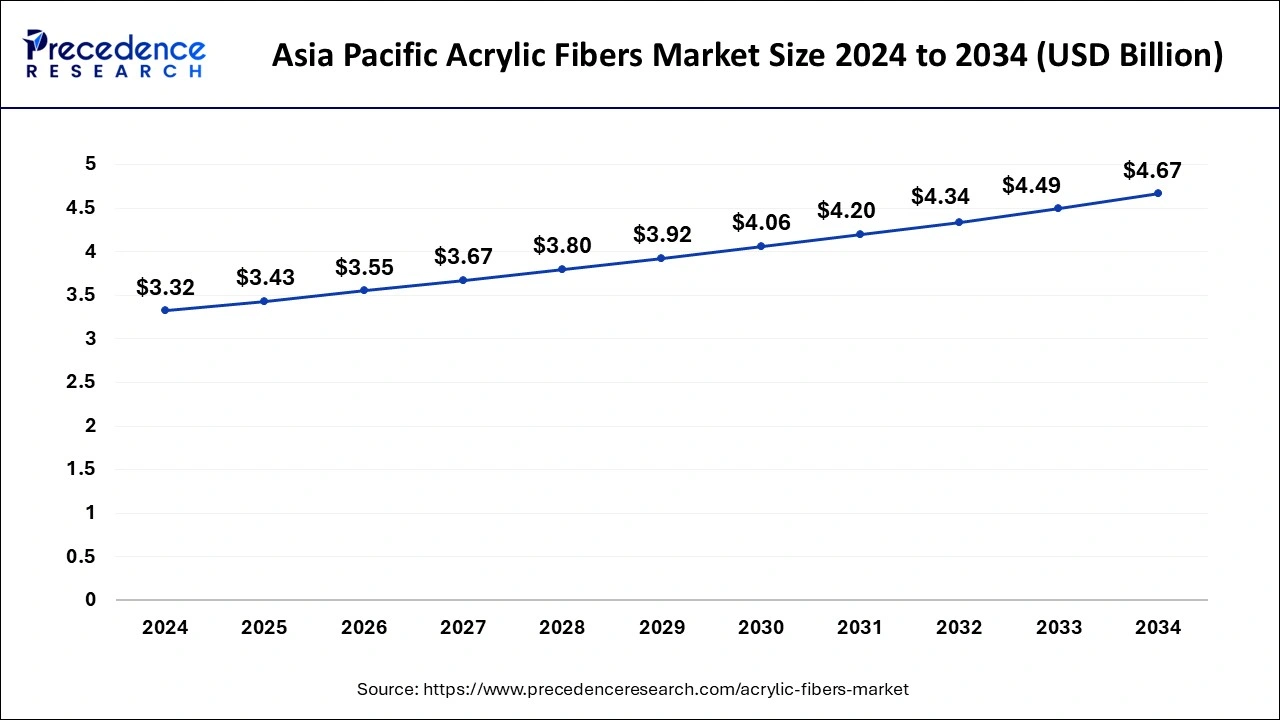

The Asia Pacific acrylic fibers market size was exhibited at USD 3.32 billion in 2024 and is projected to be worth around USD 4.67 billion by 2034, growing at a CAGR of 3.47% from 2025 to 2034.

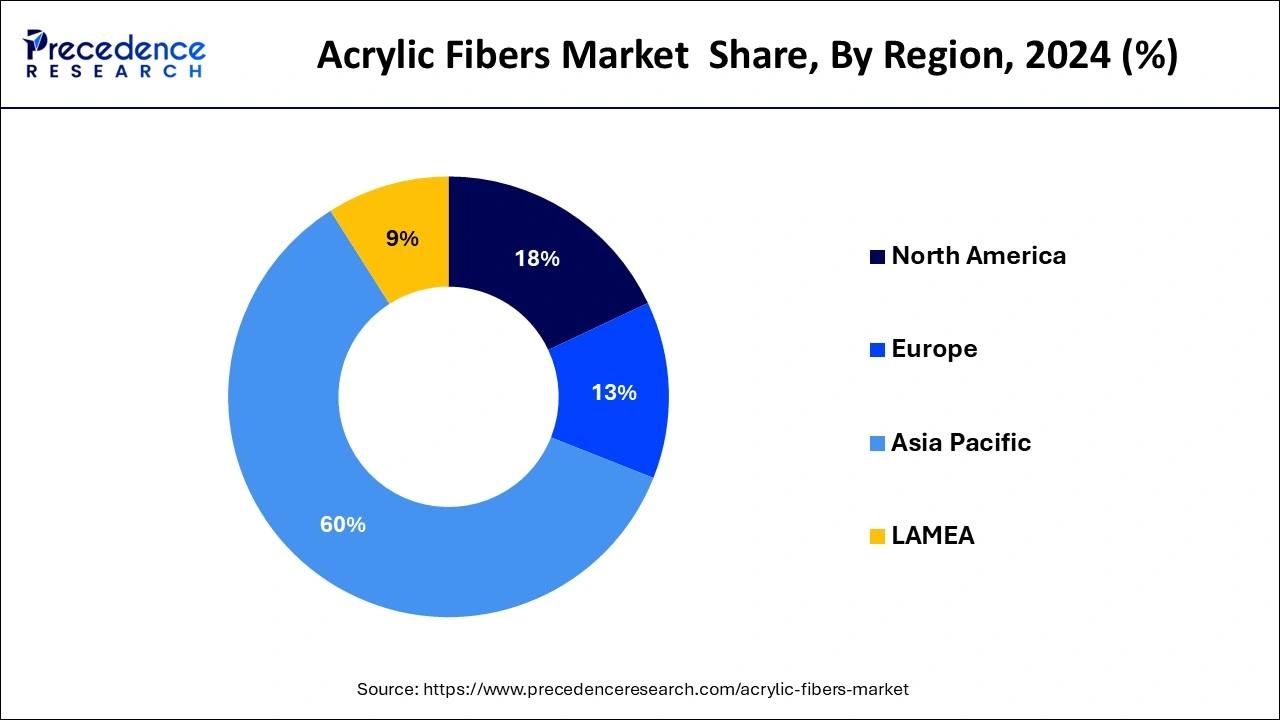

Asia Pacific held the largest share of 60% in the market in 2024. The region's acrylic fibers market has been expanding significantly, mostly due to rising demand from end-use sectors such as home furnishings, clothing, and textiles. Major contributors to this rise were nations like China, India, and Japan, whose booming industrial sectors and vast bases of textile production played a significant role.

Due to its well-known qualities of warmth, softness, and resilience to chemicals and sunshine, acrylic fibers are used in a variety of products, such as outdoor fabrics, carpets, blankets, and apparel. The need for the acrylic fibers market has been fueled by the region's expanding population, rising levels of disposable income, and evolving consumer habits.

North America is observed to grow at a notable rate in the acrylic fibers market and is expected to maintain this dominance during the forecast period. In the textile business, acrylic fibers are commonly utilized to make a wide range of goods, including blankets, carpets, furniture, and clothing. Textile makers use acrylic fibers because of their versatility and qualities, such as warmth, softness, and colorfastness. Non-woven textiles, which have uses in the filtration, automotive, building, and healthcare sectors, are also made from acrylic fibers.

As acrylic fibers are more affordable, easier to maintain, and have better performance qualities than natural fibers like wool and cotton, they are frequently employed in their place. North America's acrylic fibers market is doing well thanks to expansion in a number of end-use sectors, including clothing, home furnishings, automotive, and healthcare.

Because acrylic fibers have qualities similar to those of wool, including warmth, softness, and moisture-wicking ability, they are widely used in the clothing business. They are frequently utilized in sportswear, socks, and sweaters. Because acrylic fibers resist mildew, insects, and fading from sunshine, they are utilized in carpets, upholstery, and blankets. Also, these fibers are strong and long-lasting; they are used in industrial items, including filters, awnings, and ropes. There is a significant reach for the acrylic fibers market in these areas as well, especially for industrial and household furnishings.

The expanding textile and industrial sectors of Latin America and Africa are making these regions attractive for the acrylic fibers market players. In order to create sophisticated acrylic fibers with improved qualities like flame resistance, dyeability, and sustainability, businesses are concentrating on research and development. A growing emphasis is being placed on creating eco-friendly manufacturing processes and generating acrylic fibers from recycled resources due to growing environmental concerns.

Mergers and acquisitions are driving the acrylic fibers market consolidation as businesses look to bolster their market positions and diversify their product lines. Although acrylic fibers have some benefits, there is rising worry about their influence on the environment, especially in relation to microplastic contamination. As a result, there is more scrutiny and demand for sustainable alternatives. The market for acrylic fibers was first affected by the COVID-19 pandemic because it caused supply chain interruptions and reduced consumer expenditure on non-essential items.

| Report Coverage | Details |

| Market Size in 2025 | USD 5.72 Billion |

| Market Size in 2024 | USD 5.53 Billion |

| Market Size by 2034 | USD 7.72 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.39% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fiber Type, Application, and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Eco-friendly options

Recycling lessens the environmental impact of raw material extraction and processing while also reducing the demand for virgin materials. Bio-based acrylic fibers made from renewable resources like corn, sugarcane, or other plant-based materials are the result of research and development activities. In order to lower energy, water, and emission levels while producing acrylic fibers, several producers are putting eco-friendly production techniques into practice. Because acrylic fibers are well-known for being strong and long-lasting, they can promote sustainability by lowering the need for regular replacements and lengthening the life of products created with them.

Innovation and differentiation

Provide acrylic fibers with better performance attributes, like increased abrasion and chemical resistance, moisture-wicking capabilities, strength, and durability. Put your attention on creating environmentally friendly acrylic fibers by recycling, using sustainable sourcing techniques, and minimizing the impact of production on the environment. Be creative when it comes to color and design. Provide acrylic fibers with eye-catching hues, distinctive textures, and captivating visual effects to satisfy the demands of the interior design and fashion industries. Give customers the ability to customize the color, thickness, texture, and performance aspects of acrylic fibers to suit their unique needs. This may entail creating goods specifically for each client or customizing solutions for certain purposes.

Innovations in acrylic fiber technology

The goal of innovations in the production of acrylic fibers has been to increase the fibers' comfort and softness, which makes them more desirable for usage in clothing items like sportswear, socks, and sweaters. These developments extend the lifespan of acrylic fibers and improve their appropriateness for a variety of end applications, including upholstery, carpets, and industrial settings. Acrylic fibers are now more resistant to abrasion, stretching, and tearing. The exceptional color retention and fade resistance of acrylic fibers have been further improved by advancements in dyeing methods and additives. Innovations in acrylic fiber technology have also focused on lessening the production processes' environmental impact, which is in line with the growing emphasis on sustainability.

The staple fiber segment held the largest position in the acrylic fibers market share in 2023 and is expected to continue doing so during the forecast period. In the acrylic fiber industry, acrylic fibers manufactured in short lengths—typically a few millimeters to several inches—are referred to as staple fiber. These fibers are frequently used to make a wide range of textiles, including blankets, carpets, furniture, and clothes. Acrylic staple fibers are soft, warm, long-lasting, and resistant to moths, mildew, and fading, among other benefits. Wet spinning, also known as dry spinning, is the method used to create staple fibers. Acrylic polymer is dissolved in a solvent and then extruded through spinnerets to make fibers. Staple fibers are then created by cutting these strands into short lengths.

The two dyed fibers segment is expected to grow at a steady pace during the forecast period. Numerous factors, including consumer tastes, fashion trends, industrial applications, and scientific breakthroughs in dying processes, have an impact on the market for dyed acrylic fibers. Because acrylic fibers are soft, strong, and have good color retention, they are widely used in textiles. Acrylic fiber coloring has become more effective and ecologically friendly because of developments in dying technology.

The advantages of various techniques, including space dyeing, dope dyeing, and solution dyeing, vary with regard to cost-effectiveness, sustainability, and color fastness. In the textile sector, sustainability is becoming more and more significant. In an effort to reduce their influence on the environment, manufacturers are looking into eco-friendly dyeing techniques and employing natural or low-impact dyes.

The apparel segment dominated the acrylic fibers market in 2024. Because of its qualities and adaptability, acrylic fibers have found widespread use in the apparel industry. Benefits of acrylic fibers include warmth, softness, resilience to chemicals and sunlight, and durability. Because acrylic fibers are warm and fuzzy and have a similar feel to wool but at a lower cost, they are frequently utilized in cardigans and sweaters.

A lot of the time, acrylic fibers are combined with other materials to make sturdy and cozy stockings and socks. Their ability to wick away moisture and offer warmth makes them perfect for daily wear. Because acrylic fibers stretch and wick away moisture, they are used in sportswear and athletic gear. When exercising, they keep the wearer comfortable and dry.

The home textiles segment is expected to gain a significant market share during the forecast period. Acrylic fibers are used extensively in the home textile industry because of their qualities, such as softness, durability, and resistance to chemicals and sunshine. Many home textile products, including blankets, carpets, rugs, upholstery textiles, and curtains, include acrylic fibers. Because acrylic fibers can imitate the look and feel of wool at a lesser cost, they are frequently utilized in carpets and rugs. Because of their strong stain, fade, and mildew resistance, they are appropriate for high-traffic areas of homes. Upholstery fabrics are sometimes made by blending acrylic fibers with other fibers, such as cotton or polyester. These materials were picked because they are long-lasting, wrinkle-resistant, and low maintenance.

The textile industry segment dominates the global acrylic fibers market. The acrylic fibers market is significantly influenced by the textile sector. Synthetic fibers made of polymers generated from petroleum products are known as acrylic fibers. Their softness, warmth, and resistance to chemicals and sunshine make them attractive for use in a variety of textile applications. Acrylic fibers are used in industrial textiles in addition to clothing and home textiles. Because of their strength and resistance to chemicals, they are utilized in items such as protective garments, ropes, and filtration materials. A few examples of the variables that affect the textile industry's demand for acrylic fibers are consumer preferences, fashion trends, and economic conditions. Market demand is also impacted by advancements in acrylic fiber technology, such as the creation of softer and more environmentally friendly varieties.

The automotive industry segment is also expected to show a notable presence during the forecast years. Although the usage of acrylic fibers in cars isn't as widespread as it is in other industries, such as textiles or outdoor uses, there are still some specialized markets for them. Because acrylic fibers are long-lasting and resistant to weathering and sunshine, they are occasionally utilized in car upholstery. They can be mixed with other materials, such as nylon or polyester, to make fabrics that work well for door panels, headliners, and vehicle seats. Convertible tops occasionally use acrylic fibers because of their UV resistance and long-lasting color retention. Both softtop and hardtop convertible tops are available with them.

By Fiber Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

November 2024

October 2024

July 2024